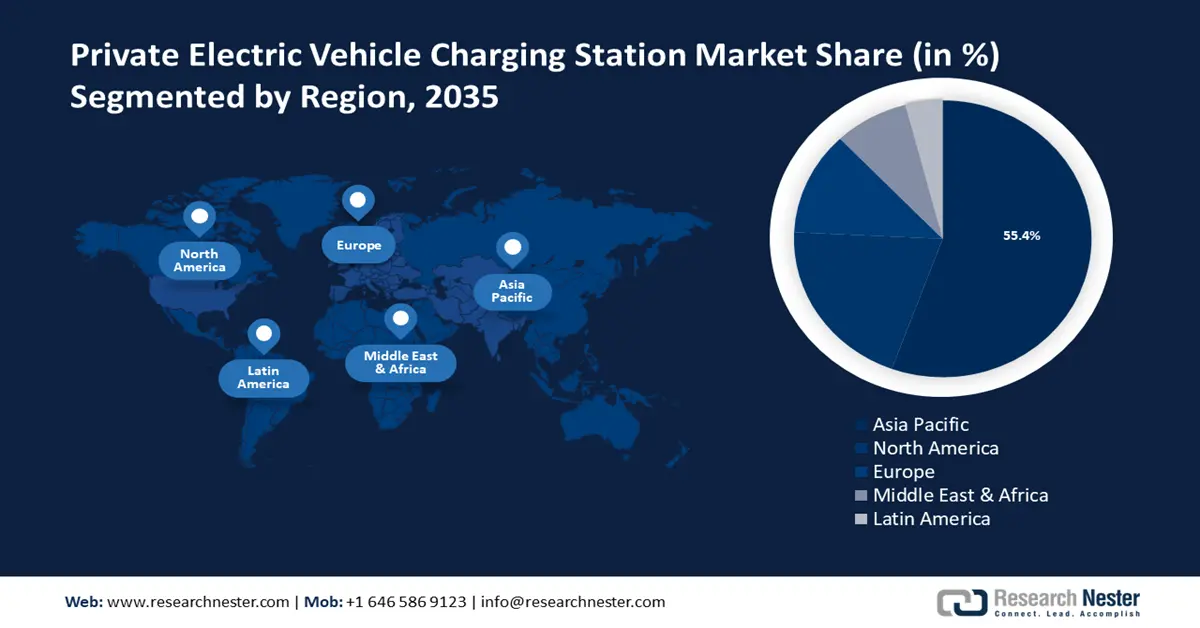

Private Electric Vehicle Charging Station Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is expected to account for largest revenue share of 55.4% by 2035. Countries including China, Japan, India, and Australia promote growth by implementing policies and incentives. Their green energy targets are offering subsidies to develop the charging infrastructure. In August 2024, the government in Australia doubled the 2022 EV charging infrastructure investment to make the funding of USD 0.5 billion with an additional USD 0.3 billion grant. Such initiatives are boosting the demand for home EV charging solutions. Rapid urbanization in this region is also encouraging companies to participate in the robust production of charging portals.

India private EV charging market is presenting a lucrative investment opportunity due to the rising demand for fast and convenient charging solutions. Government bodies are involving their full-fledged efforts to promote emission-free transportation. Central and state councils are collaborating to increase the number of installations by assigning projects for private properties. Projects such as FAME are encouraging infrastructure manufacturers to invest in development. According to a report published by the World Bank, in September 2024, the FAME -II program has allocated USD 0.1 billion. This investment is intended to bring innovation in the EV charging industry across the country. Market leaders such as Tata Power are investing in more numbers of EV charging port installations. The PPRC report published in September 2024 states, that Tata Power has a 40% share in the home and fleet charging verticals.

China is also emerging to be one of the fastest-growing countries in this region’s private electric vehicle charging station market. According to an IEA report published in 2024, China is leading the industry with the world’s 85% fast and 60% slow EV charger installation. The country is also focusing on developing the charging infrastructure by issuing guidelines upon future goals. In June 2023, the State Council released its guiding opinions to build a high-quality charging infrastructure system across the country by 2030. Private transportation companies are now investing to install charging stations for heavy-duty electric vehicles such as trucks. In June 2023, CATL launched heavy-duty battery swapping technology, QIJI. The vehicle battery separation business model can reduce the operational cost. This efficient solution will promote the electrification of the truck transportation in private industries.

North America Market Analysis

Rapid urbanization and advancing technology in this region are the major driving factors of the growth of the North America private electric vehicle charging station market. Both residential and commercial installations are increasing in number, further expanding the market. A majority of this region’s population owns private cars, who are looking for an environment-friendly option. Such consumer awareness about sustainable energy supply contributes to EV adoption for zero carbon emission. Fast-charging solutions are encouraging users to incorporate remote charging ports for more convenience. The increased popularity of smart homes has also influenced the growth through EV charger implementation.

The U.S. private electric vehicle charging station market is predicted to generate remarkable revenue during the forecast period. The inflated number of EV users on-road driving demand for home and private charging solutions. According to the IEA 2024 report, 83% of EV owners in the United States are using home charging solutions. As per the private charging station count till September 2024 by the U.S. DOE, 16,587 private charging ports and 4,042 private charging stations are in operation. However, the satisfaction ratio in EV users for remote charging stations has lowered due to the country’s low-voltage power grid. Companies and authorities are investing in improving the functionality of private EV charging stations and subsequently, creating developmental scope in this sector.

Canada is also leading toward massive growth in the EV charging industry. Besides the U.S., Canada is also one of the countries with the highest remotely installed charging stations. According to a report published by the Government of Canada, in August 2023, 80% of the country’s EV owners charge at home. The authorities are also promoting energy-saving charging systems in business use for customers and employees fleet. Guidelines upon licensing and tax incentives have encouraged more users to invest in private electrical vehicle charging stations.