Private Electric Vehicle Charging Station Market Outlook:

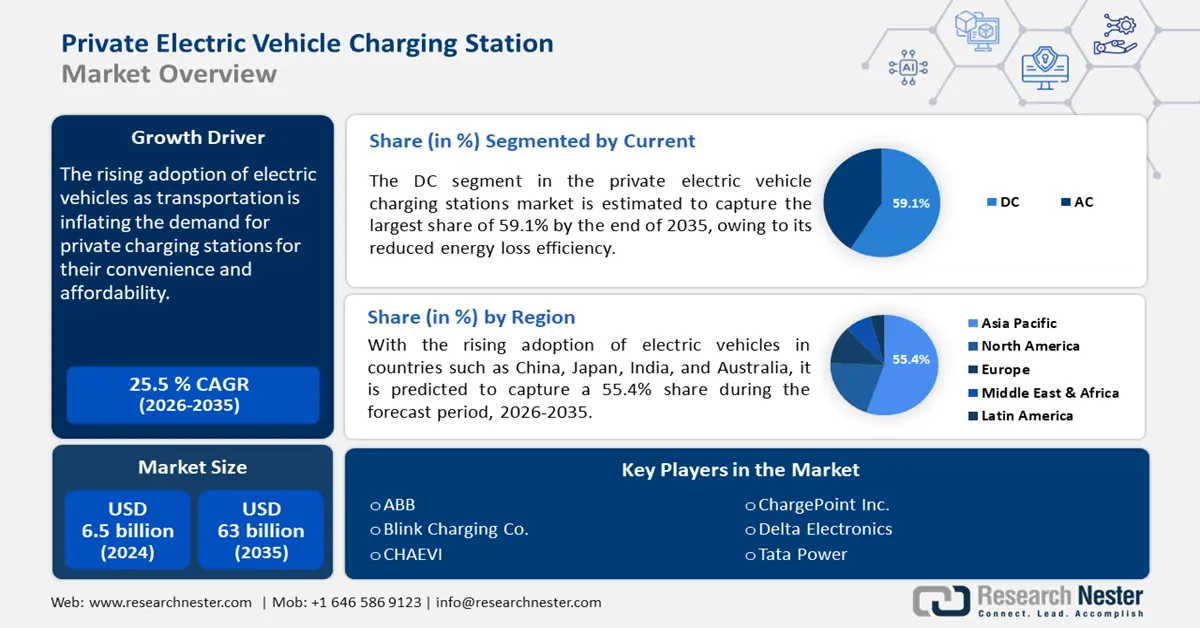

Private Electric Vehicle Charging Station Market size was valued at USD 6.5 billion in 2025 and is set to exceed USD 63 billion by 2035, registering over 25.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of private electric vehicle charging station is estimated at USD 7.99 billion.

The rising adoption of electric vehicles for transportation is inflating the demand for suitable charging stations. Car owners with private parking spaces prefer home charging systems for convenience and affordability. Establishments are integrating non-public EV chargers for their employees and customers. Many commercial electric vehicle drivers are also utilizing the advantage of the easy overnight charging system to get it fueled for the next business day.

According to a report published by IEM, in 2024, home charging solutions for EVs are in high demand these days. Around 93% of EV owners in the U.S. have access to equipped home charging systems. The demand for chargers rose due to improvement in the interoperability of charging infrastructure. Technologies such as smart charging, time-of-use tariffs, and electric road systems are attracting more private investments in development. More fast and efficient charging systems are now surged by both electric HDV and LDV drivers for remote usage. The regional automotive industries are expanding their product portfolio by incorporating electric vehicles and related supplies, including EV charging. Reputed brands are consolidating their private EV charging station market grip by introducing world-class quality in their after-sale services for EVSEs.

Key Private Electric Vehicle Charging Station Market Insights Summary:

Regional Highlights:

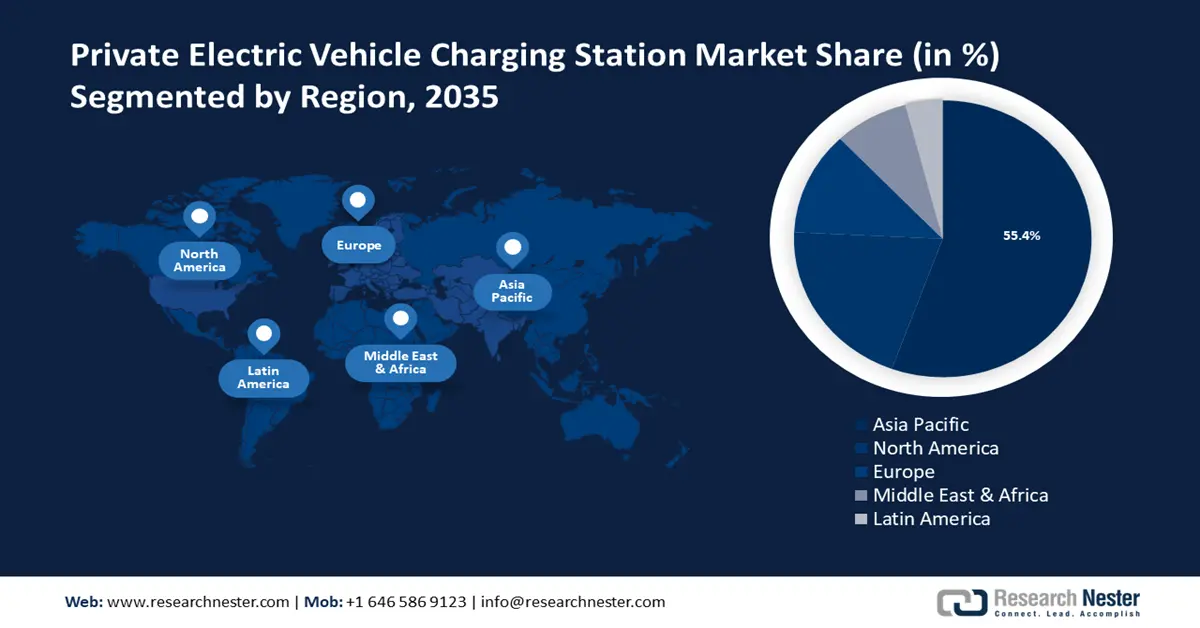

- Asia Pacific commands a 55.4% share in the private EV charging station market, fueled by government policies and incentives promoting green energy targets and the development of charging infrastructure, driving growth through 2026–2035.

Segment Insights:

- The DC Segment of the Private Electric Vehicle Charging Station Market is projected to hold a 59.1% share by 2035, driven by higher power levels, fast charging capabilities, and greater efficiency without AC-to-DC conversion.

Key Growth Trends:

- Advancing technologies in EVs

- Government support

Major Challenges:

- Expensive installation and maintenance

- Limitations in charging infrastructure

- Key Players: ABB, Blink Charging Co, CHAEVI, ChargePoint Inc, Delta Electronics, Inc, Eaton, Tata Power, Elli, EVBox, Leviton Manufacturing Co., Inc, Schneider Electric, Siemens, SK Signet, Volta, Zunder.

Global Private Electric Vehicle Charging Station Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.5 billion

- 2026 Market Size: USD 7.99 billion

- Projected Market Size: USD 63 billion by 2035

- Growth Forecasts: 25.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (55.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, South Korea, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Private Electric Vehicle Charging Station Market Growth Drivers and Challenges:

Growth Drivers

-

Advancing technologies in EVs: Regions with high-voltage power grids (220V or above) allow overnight charging through high-power domestic sockets. Lower power grid-enabled countries are also developing new technologies for fast-pace charging, by installing dedicated chargers. Innovative EVSE supplies such as battery swapping are now changing the private EV charging station market dynamics of developing countries. In December 2023, Ample partnered with Stellantis to empower its Free2move’s care sharing fleet with battery swapping technology. This partnership will allow Stellantis to avail a system to enable fully charged battery in less than five minutes. Further offering faster option for Fiat 500e’s users in their private charging stations. V2G technologies are contributing to grid stability while allowing EVs to return energy to the grid. The latest wireless charging solutions offer a convenient charging experience to consumers. Such inductive systems are promising opportunities in both the home and public electric vehicle charging station market.

-

Government support: Integration of EV charging systems along with renewable energy sources complies with the target of achieving zero-emission. In support, governing bodies are financing small to large-scale EV charger installations. In 2023, the UK government allocated funding of around USD 1 billion for UK-registered businesses. Favorable regulations promote the streamlining of the permit process for charging stations. Further encouraging homeowners and businesses to set up sufficient charging points. Standardization of charging infrastructure allows companies to offer various reliable options to EV drivers. For instance, in December 2023, SAE International announced to set SAE J3400 to be the NACS standard, developed by Tesla. New governmental projects are being sanctioned to integrate charging ports with renewable energy sources.

Challenges

-

Expensive installation and maintenance: The initial cost of installing dedicated EV charging stations in private properties can be costly for most owners. Many drivers lack adequate parking spaces at home to insert such charging connectors. The installation may require electrical and space modification to retain sufficient energy flow. Further, becoming a hurdle for maximum adoption. The maintenance cost of charging systems is no less, which can discourage users from investing in private charging stations. Integration with renewable energy also requires additional investments and management, hindering the path of extensive use.

-

Limitations in charging infrastructure: Lower power grid areas may lack efficient electrical infrastructure to support the load of chargers. A grid upgrade is needed to accommodate multiple charging connectors. A majority of the home EV charging units are slow compared to other available fueling systems in the private EV charging station market. Further being inconvenient for faster turnaround times. Variable charging connectors can create compatibility issues between different EVs and charging stations. Users who live in rental properties often fail to install charging equipment due to non-reliable power sources.

Private Electric Vehicle Charging Station Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

25.5% |

|

Base Year Market Size (2025) |

USD 6.5 billion |

|

Forecast Year Market Size (2035) |

USD 63 billion |

|

Regional Scope |

|

Private Electric Vehicle Charging Station Market Segmentation:

Current (AC, DC)

Based on the current, the DC segment is anticipated to account for more than 59.1% private electric vehicle charging stations market share by the end of 2035. The segment growth is owed to its reduced energy loss efficiency, as they do not require an AC-to-DC converter. Higher power levels and fast charging capabilities are preferred for private use. In September 2024, NREL published a report stating, that the number of installed DC fast EV charging ports in the U.S. has increased by 8.2%. Ongoing developments aim to make these devices more compact and accessible for remote use. Furthermore, it influences the private EV charging station market to grow with greater investment opportunities.

Our in-depth analysis of the global market includes the following segments:

|

Current |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Private Electric Vehicle Charging Station Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is expected to account for largest revenue share of 55.4% by 2035. Countries including China, Japan, India, and Australia promote growth by implementing policies and incentives. Their green energy targets are offering subsidies to develop the charging infrastructure. In August 2024, the government in Australia doubled the 2022 EV charging infrastructure investment to make the funding of USD 0.5 billion with an additional USD 0.3 billion grant. Such initiatives are boosting the demand for home EV charging solutions. Rapid urbanization in this region is also encouraging companies to participate in the robust production of charging portals.

India private EV charging market is presenting a lucrative investment opportunity due to the rising demand for fast and convenient charging solutions. Government bodies are involving their full-fledged efforts to promote emission-free transportation. Central and state councils are collaborating to increase the number of installations by assigning projects for private properties. Projects such as FAME are encouraging infrastructure manufacturers to invest in development. According to a report published by the World Bank, in September 2024, the FAME -II program has allocated USD 0.1 billion. This investment is intended to bring innovation in the EV charging industry across the country. Market leaders such as Tata Power are investing in more numbers of EV charging port installations. The PPRC report published in September 2024 states, that Tata Power has a 40% share in the home and fleet charging verticals.

China is also emerging to be one of the fastest-growing countries in this region’s private electric vehicle charging station market. According to an IEA report published in 2024, China is leading the industry with the world’s 85% fast and 60% slow EV charger installation. The country is also focusing on developing the charging infrastructure by issuing guidelines upon future goals. In June 2023, the State Council released its guiding opinions to build a high-quality charging infrastructure system across the country by 2030. Private transportation companies are now investing to install charging stations for heavy-duty electric vehicles such as trucks. In June 2023, CATL launched heavy-duty battery swapping technology, QIJI. The vehicle battery separation business model can reduce the operational cost. This efficient solution will promote the electrification of the truck transportation in private industries.

North America Market Analysis

Rapid urbanization and advancing technology in this region are the major driving factors of the growth of the North America private electric vehicle charging station market. Both residential and commercial installations are increasing in number, further expanding the market. A majority of this region’s population owns private cars, who are looking for an environment-friendly option. Such consumer awareness about sustainable energy supply contributes to EV adoption for zero carbon emission. Fast-charging solutions are encouraging users to incorporate remote charging ports for more convenience. The increased popularity of smart homes has also influenced the growth through EV charger implementation.

The U.S. private electric vehicle charging station market is predicted to generate remarkable revenue during the forecast period. The inflated number of EV users on-road driving demand for home and private charging solutions. According to the IEA 2024 report, 83% of EV owners in the United States are using home charging solutions. As per the private charging station count till September 2024 by the U.S. DOE, 16,587 private charging ports and 4,042 private charging stations are in operation. However, the satisfaction ratio in EV users for remote charging stations has lowered due to the country’s low-voltage power grid. Companies and authorities are investing in improving the functionality of private EV charging stations and subsequently, creating developmental scope in this sector.

Canada is also leading toward massive growth in the EV charging industry. Besides the U.S., Canada is also one of the countries with the highest remotely installed charging stations. According to a report published by the Government of Canada, in August 2023, 80% of the country’s EV owners charge at home. The authorities are also promoting energy-saving charging systems in business use for customers and employees fleet. Guidelines upon licensing and tax incentives have encouraged more users to invest in private electrical vehicle charging stations.

Key Private Electric Vehicle Charging Station Market Players:

- ABB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Blink Charging Co.

- CHAEVI

- ChargePoint Inc.

- Delta Electronics, Inc.

- Eaton

- Tata Power

- Elli

- EVBox

- Leviton Manufacturing Co., Inc.

- Schneider Electric

- Siemens

- SK Signet

- Volta

- Zunder

Market players are expanding their product range to satisfy consumer needs for efficient charging systems. Technologies such as supercharger networks are catering to vehicle-specific needs. Further bolstering brand loyalty for in-home charging solutions. For wide recognition, leading companies are now promoting the electrification of maximum HDVs through MCS adoption. In May 2024, Kempower introduced its MCS (Megawatt Charging System) for electric truck charging at the ACT Expo. Such technologies are helping to revolutionize the process of a complete transition to electrification of transportation. Superfast DC chargers for EVs are also gathering focus for future development, further expanding the market. Key players in this sector include:

Recent Developments

- In June 2024, Plugable launched UK pilot, an EV charger sharing platform in the North West. This platform will allow all EV drivers, including those in rented homes or face absence of driveways. This charger sharing community will help in help to increase EV adoption in this region.

- In August 2024, Exicom acquired Tritium to outstretch its global footprint with advancement in DC fast EV charging systems. This acquisition will benefit Exicom with its world-class manufacturing facility and its presence as a DC charging leader in 47 countries.

- Report ID: 6548

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Private Electric Vehicle Charging Station Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.