- An outline of the Global Private 5G Network Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Opportunities

- Growth Drivers

- Major Roadblocks

- Trends

- Government Regulation

- Comparative Analysis of the Current Technology Trends

- Up-Coming Technologies

- Growth Outlook

- Risk Analysis

- Analysis on the Parts/Components Utilized in Manufacturing of Humanoid Robots

- Pricing Benchmarking

- SWOT

- Patent Analysis

- Supply Chain

- Root Cause Analysis

- Regional Demand

- Recent News

- Strategic Initiatives

- Customer Requirements

- Value Chain Analysis

- Parts/Components and Their Future Trends

- Factors Enhancing the Potential of the Private 5G Network Market

- Verification of Change Points – Market

- Required Technology Hypotheses

- Verification of Change Points – Technology

- Technology Trends

- Current Applications of Humanoid Robots with a Focus on Factory Automation

- Customized Analysis: Opportunities for Expansion into the Private 5G Network Market

- Strategic Recommendation Analysis for Panasonic in the Humanoid Robots Market

- Integration of Latest Technology in Private 5G Network Market

- Industry Vertical Analysis

- Comparative Positioning

- Competitive Landscape

- Competitive Model

- Market Share of Major Companies Profiled, 2023

- Business Profile of Key Enterprise

- Advanced Info Service PLC

- Maxis Bhd.

- Singtel

- Telekom Malaysia Berhad

- Verizon

- PT Telekomunikasi Selular

- Viettel High Tech

- Axiata Group Berhad

- Market Share of Major Companies Profiled, 2023

- Global Private 5G Network Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion) and Compound Annual Growth Rate (CAGR)

- Global Private 5G Network Market Segmentation Analysis (2024-2037)

39.1.1 By Component

- Hardware, Market Value (USD Billion), and CAGR, 2024-2037F

- Core Network Infrastructure, Market Value (USD Billion), and CAGR, 2024-2037F

- Radio Access Network, Market Value (USD Billion), and CAGR, 2024-2037F

- Edge Devices, Market Value (USD Billion), and CAGR, 2024-2037F

- Software, Market Value (USD Billion), and CAGR, 2024-2037F

- By Deployment Model

- On-Premise, Market Value (USD Billion), and CAGR, 2024-2037F

- Cloud-Based, Market Value (USD Billion), and CAGR, 2024-2037F

- Frequency Band

- Below 1 GHz

- Between 1-6 GHz

- Above 24 GHz

39.1.4 Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

39.1.5 By Application

- Industrial Automation

- Remote Operations

- Logistics & Supply Chain

- Public Safety & Security

- Others

39.1.6 End use

- Government & Public Sectors

- Defense & Military

- Smart Cities

- Emergency Response Management

- Education

- Others

- Private Sectors

- Manufacturing

- Healthcare

- Energy Utilities

- Transportation

- Retail

- Telecommunications

- Finance

- Others

39.1.4 By Region

- North America, Market Value (USD Billion), and CAGR, 2024-2037F

- Europe Market Value (USD Billion) and CAGR, 2024-2037F

- Asia Pacific Market Value (USD Billion) and CAGR, 2024-2037F

- Latin America Market Value (USD Billion) and CAGR, 2024-2037F

- Middle East and Africa Market Value (USD Billion) and CAGR, 2024-2037F

39.1.5 Cross Analysis of Component W.R.T. Application (USD Billion), 2024-2037

40) North America Private 5G Network Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion) and Compound Annual Growth Rate (CAGR)

- Predictions and Trend Analysis for Humanoid Robots

- Regional Competitors and Market Positioning

- North America Private 5G Network Market Segmentation Analysis (2024-2037)

40.1.1 By Component

- Hardware, Market Value (USD Billion), and CAGR, 2024-2037F

- Core Network Infrastructure, Market Value (USD Billion), and CAGR, 2024-2037F

- Radio Access Network, Market Value (USD Billion), and CAGR, 2024-2037F

- Edge Devices, Market Value (USD Billion), and CAGR, 2024-2037F

- Software, Market Value (USD Billion), and CAGR, 2024-2037F

- By Deployment Model

- On-Premise, Market Value (USD Billion), and CAGR, 2024-2037F

- Cloud-Based, Market Value (USD Billion), and CAGR, 2024-2037F

- Frequency Band

- Below 1 GHz

- Between 1-6 GHz

- Above 24 GHz

40.1.4 Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

40.1.5 By Application

- Industrial Automation

- Remote Operations

- Logistics & Supply Chain

- Public Safety & Security

- Others

40.1.6 End use

- Government & Public Sectors

- Defense & Military

- Smart Cities

- Emergency Response Management

- Education

- Others

- Private Sectors

- Manufacturing

- Healthcare

- Energy Utilities

- Transportation

- Retail

- Telecommunications

- Finance

- Others

40.1.7 By Country

- US, Market Value (USD Billion), and CAGR, 2024-2037F

- Canada Market Value (USD Billion) and CAGR, 2024-2037F

40.1.8 Cross Analysis of Component W.R.T. Application (USD Billion), 2024-2037

41) Europe Private 5G Network Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion) and Compound Annual Growth Rate (CAGR)

- Predictions and Trend Analysis for Humanoid Robots

- Regional Competitors and Market Positioning

- Europe Private 5G Network Market Segmentation Analysis (2024-2037)

41.1.1 By Component

- Hardware, Market Value (USD Billion), and CAGR, 2024-2037F

- Core Network Infrastructure, Market Value (USD Billion), and CAGR, 2024-2037F

- Radio Access Network, Market Value (USD Billion), and CAGR, 2024-2037F

- Edge Devices, Market Value (USD Billion), and CAGR, 2024-2037F

- Software, Market Value (USD Billion), and CAGR, 2024-2037F

- By Deployment Model

- On-Premise, Market Value (USD Billion), and CAGR, 2024-2037F

- Cloud-Based, Market Value (USD Billion), and CAGR, 2024-2037F

- Frequency Band

- Below 1 GHz

- Between 1-6 GHz

- Above 24 GHz

41.1.4 Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

41.1.5 By Application

- Industrial Automation

- Remote Operations

- Logistics & Supply Chain

- Public Safety & Security

- Others

41.1.6 End use

- Government & Public Sectors

- Defense & Military

- Smart Cities

- Emergency Response Management

- Education

- Others

- Private Sectors

- Manufacturing

- Healthcare

- Energy Utilities

- Transportation

- Retail

- Telecommunications

- Finance

- Others

41.1.7 By Country

- UK, Market Value (USD Billion) and CAGR, 2024-2037F

- Germany, Market Value (USD Billion) and CAGR, 2024-2037F

- France, Market Value (USD Billion) and CAGR, 2024-2037F

- Italy, Market Value (USD Billion) and CAGR, 2024-2037F

- Spain, Market Value (USD Billion) and CAGR, 2024-2037F

- BENELUX , Market Value (USD Billion) and CAGR, 2024-2037F

- Poland, Market Value (USD Billion) and CAGR, 2024-2037F

- Russia, Market Value (USD Billion) and CAGR, 2024-2037F

- Rest of Europe, Market Value (USD Billion) and CAGR, 2024-2037F

41.1.8 Cross Analysis of Component W.R.T. Application (USD Billion), 2024-2037

42) Asia Pacific Private 5G Network Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion) and Compound Annual Growth Rate (CAGR)

- Predictions and Trend Analysis for Humanoid Robots

- Regional Competitors and Market Positioning

- Asia Pacific Private 5G Network Market Segmentation Analysis (2024-2037)

42.1.1 By Component

- Hardware, Market Value (USD Billion), and CAGR, 2024-2037F

- Core Network Infrastructure, Market Value (USD Billion), and CAGR, 2024-2037F

- Radio Access Network, Market Value (USD Billion), and CAGR, 2024-2037F

- Edge Devices, Market Value (USD Billion), and CAGR, 2024-2037F

- Software, Market Value (USD Billion), and CAGR, 2024-2037F

- Consulting & Integration Services

- Maintenance & Support

- Data Services

- By Deployment Model

- On-Premise, Market Value (USD Billion), and CAGR, 2024-2037F

- Cloud-Based, Market Value (USD Billion), and CAGR, 2024-2037F

- Frequency Band

- Below 1 GHz

- Between 1-6 GHz

- Above 24 GHz

42.1.4 Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

42.1.5 By Application

- Industrial Automation

- Remote Operations

- Logistics & Supply Chain

- Public Safety & Security

- Others

- End use

- Government & Public Sectors

- Defense & Military

- Smart Cities

- Emergency Response Management

- Education

- Others

- Private Sectors

- Manufacturing

- Healthcare

- Energy Utilities

- Transportation

- Retail

- Telecommunications

- Finance

- Others

42.1.7 By Country

- China, Market Value (USD Billion) and CAGR, 2024-2037F

- India, Market Value (USD Billion) and CAGR, 2024-2037F

- Indonesia, Market Value (USD Billion) and CAGR, 2024-2037F

- South Korea, Market Value (USD Billion) and CAGR, 2024-2037F

- Malaysia, Market Value (USD Billion) and CAGR, 2024-2037F

- Australia, Market Value (USD Billion) and CAGR, 2024-2037F

- Singapore, Market Value (USD Billion) and CAGR, 2024-2037F

- Vietnam, Market Value (USD Billion) and CAGR, 2024-2037F

- Thailand, Market Value (USD Billion) and CAGR, 2024-2037F

- New Zealand, Market Value (USD Billion) and CAGR, 2024-2037F

- Rest of Asia Pacific excluding Japan, Market Value (USD Billion), and CAGR, 2024-2037F

42.1.8 Cross Analysis of Component W.R.T. Application (USD Billion), 2024-2037

44) Latin America Private 5G Network Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion) and Compound Annual Growth Rate (CAGR)

- Predictions and Trend Analysis for Humanoid Robots

- Regional Competitors and Market Positioning

- Latin America Private 5G Network Market Segmentation Analysis (2024-2037)

44.1.1 By Component

- Hardware, Market Value (USD Billion), and CAGR, 2024-2037F

- Core Network Infrastructure, Market Value (USD Billion), and CAGR, 2024-2037F

- Radio Access Network, Market Value (USD Billion), and CAGR, 2024-2037F

- Edge Devices, Market Value (USD Billion), and CAGR, 2024-2037F

- Software, Market Value (USD Billion), and CAGR, 2024-2037F

- Consulting & Integration Services

- Maintenance & Support

- Data Services

- By Deployment Model

- On-Premise, Market Value (USD Billion), and CAGR, 2024-2037F

- Cloud-Based, Market Value (USD Billion), and CAGR, 2024-2037F

- Frequency Band

- Below 1 GHz

- Between 1-6 GHz

- Above 24 GHz

44.1.4 Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

44.1.5 By Application

- Industrial Automation

- Remote Operations

- Logistics & Supply Chain

- Public Safety & Security

- Others

44.1.6 End use

- Government & Public Sectors

- Defense & Military

- Smart Cities

- Emergency Response Management

- Education

- Others

- Private Sectors

- Manufacturing

- Healthcare

- Energy Utilities

- Transportation

- Retail

- Telecommunications

- Finance

- Others

44.1.7 By Country

- Brazil, Market Value (USD Billion) and CAGR, 2024-2037F

- Argentina, Market Value (USD Billion) and CAGR, 2024-2037F

- Mexico, Market Value (USD Billion) and CAGR, 2024-2037F

- Rest of Latin America, Market Value (USD Billion) and CAGR, 2024-2037F

44.1.8 Cross Analysis of Component W.R.T. Application (USD Billion), 2024-2037

45) Middle East & Africa Private 5G Network Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion) and Compound Annual Growth Rate (CAGR)

- Predictions and Trend Analysis for Humanoid Robots

- Regional Competitors and Market Positioning

- Middle East & Africa Private 5G Network Market Segmentation Analysis (2024-2037)

45.1.1 By Component

- Hardware, Market Value (USD Billion), and CAGR, 2024-2037F

- Core Network Infrastructure, Market Value (USD Billion), and CAGR, 2024-2037F

- Radio Access Network, Market Value (USD Billion), and CAGR, 2024-2037F

- Edge Devices, Market Value (USD Billion), and CAGR, 2024-2037F

- Software, Market Value (USD Billion), and CAGR, 2024-2037F

- Consulting & Integration Services

- Maintenance & Support

- Data Services

- By Deployment Model

- On-Premise, Market Value (USD Billion), and CAGR, 2024-2037F

- Cloud-Based, Market Value (USD Billion), and CAGR, 2024-2037F

- Frequency Band

- Below 1 GHz

- Between 1-6 GHz

- Above 24 GHz

45.1.4 Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

45.1.5 By Application

- Industrial Automation

- Remote Operations

- Logistics & Supply Chain

- Public Safety & Security

- Others

45.1.6 End use

- Government & Public Sectors

- Defense & Military

- Smart Cities

- Emergency Response Management

- Education

- Others

- Private Sectors

- Manufacturing

- Healthcare

- Energy Utilities

- Transportation

- Retail

- Telecommunications

- Finance

- Others

45.1.7 By Country

- GCC, Market Value (USD Billion) and CAGR, 2024-2037F

- Israel, Market Value (USD Billion) and CAGR, 2024-2037F

- South Africa, Market Value (USD Billion) and CAGR, 2024-2037F

- Rest of Middle East & Africa, Market Value (USD Billion) and CAGR, 2024-2037F

45.1.8 Cross Analysis of Component W.R.T. Application (USD Billion), 2024-2037

46 Global Economic Scenario

47 About Research Nester

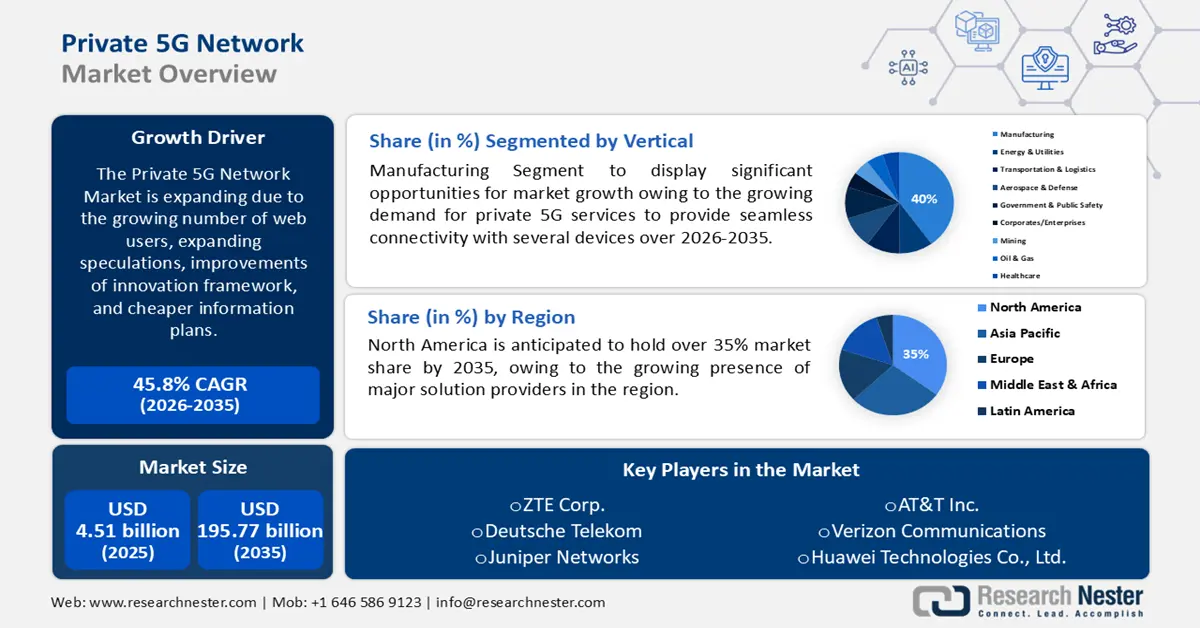

Private 5G Network Market Outlook:

Private 5G Network Market size was over USD 4.51 billion in 2025 and is poised to exceed USD 195.77 billion by 2035, witnessing over 45.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of private 5G network is estimated at USD 6.37 billion.

One of the key factors expected to fuel private 5g network market growth during the forecast period is the rising need for secure and reliable connectivity across several industries. Enterprises, especially in sectors such as healthcare, defense, IT, telecommunications, and finance require highly secure communication networks as many traditional wi-fi networks often lack the robustness and security services that private 5G networks provide. Private 5G networks operate in a dedicated spectrum and ensure minimal interference and higher reliability compared to shared networks or public 5G. According to the latest survey, the number of private 5G network deployments was over 4000 in 2022 and is expected to reach 60,000 by 2028. This has encouraged network providers to develop novel and advanced private 5G networks and solutions.

For instance, in September 2024, Ericsson announced the launch of its enterprise 5G portfolio with the launch of private 5G and neutral host solutions for several sectors. The portfolio includes 3 solutions, Ericsson Private 5G with industry and licensed spectrum support, an Ericsson Private 5G Compact for robust connectivity in low Wi-Fi environments, and Ericsson Enterprise 5G Coverage certified by all major U.S. carries with a simplified and scalable architecture compared to other networks.

Key Private 5G Network Market Insights Summary:

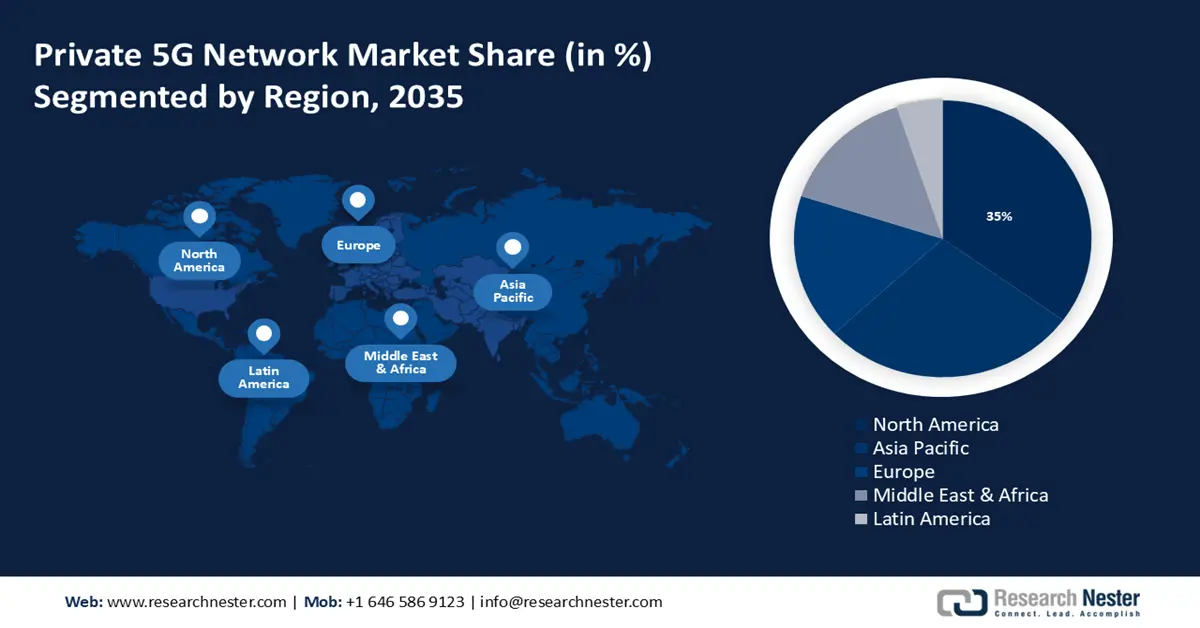

Regional Highlights:

- North America private 5G network market is expected to capture 35% share, driven by rapid technological advancements in 5G networking, forecast period 2026–2035.

- Asia Pacific market will register rapid CAGR, fueled by high usage of private 5G in smart cities, automation, and manufacturing, forecast period 2026–2035.

Segment Insights:

- The cloud segment in the private 5g network market is projected to hold the largest share by 2035, driven by growing adoption of digital transformation and cloud-based solutions.

- The private sectors segment in the private 5g network market is projected to experience robust growth over 2026-2035, driven by rising demand for secure and reliable connectivity across various industries.

Key Growth Trends:

- Rapid expansion of Industrial IoT (IIoT)

- Government support for deploying 5G networks

Major Challenges:

- Rapid expansion of Industrial IoT (IIoT)

- Government support for deploying 5G networks

Key Players: Nokia Corporation, Samsung Electronics Co., Ltd., ZTE Corporation, Deutsche Telekom Group, AT&T Inc., Juniper Networks, Inc., Verizon Communications, Altiostar, HUAWEI TECHNOLOGIES CO., LTD., Mavenir, T-Systems International GmbH, Cisco Systems, Inc., Vodafone Group Plc, BT Group.

Global Private 5G Network Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.51 billion

- 2026 Market Size: USD 6.37 billion

- Projected Market Size: USD 195.77 billion by 2035

- Growth Forecasts: 45.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Private 5G Network Market Growth Drivers and Challenges:

Growth Drivers

- Rapid expansion of Industrial IoT (IIoT): The increasing adoption of smart factories, autonomous machinery and IoT-enabled systems in logistics, energy, and manufacturing sectors has resulted in the need for ultra-reliable and low-latency networks. The private 5G network in smart manufacturing for instance helps in real-time data transfer between machines, allowing predictive maintenance and reducing downtime. Several companies are investing in developing secure 5G private solutions for industrial 4.0. For instance, In November 2024, Celona launched Aerloc, a new suite of security capabilities, providing next-generation private 5G wireless network security for Industry 4.0.

- Government support for deploying 5G networks: Governments across the globe are actively supporting private 5G networking with spectrum allocation, regulatory frameworks and financial incentives to accelerate industrial innovation and digital transformation. They are allocating specific spectrum bands for private 5G networks so that industries can deploy their networks without relying on public operators. The government in India for instance has launched a production-linked incentive (PLI) scheme for telecom and networking products to boost local manufacturing of 5G equipment and support the development of private network infrastructure.

Challenges

- High initial investments: Though 5G private networks are rapidly gaining popularity across various sectors, deploying private 5G requires significant investment in hardware, software, and spectrum licenses. In addition, it requires suitable infrastructure for smooth deployment and operations. Certain small and medium enterprises may lack sufficient funds to deploy these advanced products and services. This can limit the adoption of private 5G networks to a certain extent, hampering global private 5g network market growth during the stipulated timeframe.

- Limited spectrum availability and issues with interoperability: 5G network spectrum is uneven globally, as many countries offer limited options at high prices. In such regions with an unclear spectrum allocation, enterprises are forced to rely on public 5G networks which may compromise overall network performance. In addition, integrating private 5G with existing enterprise systems may pose significant challenges, leading to disruptions or reduced efficiency. These factors are expected to hamper overall private 5g network market growth during the forecast period.

Private 5G Network Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

45.8% |

|

Base Year Market Size (2025) |

USD 4.51 billion |

|

Forecast Year Market Size (2035) |

USD 195.77 billion |

|

Regional Scope |

|

Private 5G Network Market Segmentation:

Deployment Segment Analysis

Based on deployment, the cloud segment in private 5G network market is expected to account for largest revenue share during the forecast period owing to the growing adoption of digital transformation, high preference for cloud-based products to enhance network performance, flexibility, and scalability, expanding applications of cloud 5G networks, and increasing investments in deploying cloud-based solutions in smart manufacturing, healthcare, logistics and warehousing, automobiles, media and entertainment. The cloud-based solutions are rapidly gaining traction owing to high demand for low-latency connectivity, scalability, and enhanced security. One of the recent developments in cloud solutions is HPE Aruba’s Cloud Native Private 5G network equipped with 4G/5G small cell radios launched in June 2024. Advancements like these are expected to fuel segment growth going ahead.

End use Segment Analysis

The private sectors segment in private 5G network market is expected to register robust revenue growth between 2026 and 2035. This growth can be attributed to rising demand for secure and reliable connectivity across the manufacturing, healthcare, energy utilities, transportation, retail, telecommunications, and finance sectors for securing sensitive data, rising adoption of industrial IoT and automation in these industries, and rising need for operational efficiency.

Among the private sectors, the manufacturing industry is expected to contribute the highest to segment growth due to the increasing adoption of Industry 4.0 and smart manufacturing, rising usage of 5G private networks for mission-critical applications such as robotic arms, quality control systems, or autonomous guided vehicles. Moreover, it offers enhanced network reliability and security, defect detection, and flexibility and scalability in production in the manufacturing units.

Our in-depth analysis of the global private 5g network market includes the following segments:

|

Component |

|

|

Deployment |

|

|

Frequency Band |

|

|

Enterprise Size |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Private 5G Network Market Regional Analysis:

North America Market Insights

In North America, the private 5G network market is expected to account for a robust revenue share during the forecast period owing to rapid technological advancements in 5G networking, the presence of leading telecom operators, network equipment providers, and IT companies, and rising investments in developing advanced private 5G networks. In addition, government support and investments to promote the deployment of private 5G networks and increasing collaboration with telecom operators and tech providers are expected to fuel private 5g network market growth in this region going ahead.

In the U.S. the adoption of 5G networks has significantly increased over recent years. Sectors such as manufacturing, healthcare, and logistics are rapidly deploying private 5G for IoT integration, real-time data analytics, and automation. The Federal Communications Commission’s allocation of the Citizens Broadband Radio Service (CBRS) has enabled enterprises in the U.S. to deploy private 5G networks with enhanced flexibility. Through this initiative, the commission has already deployed private 5G network solutions across the country and the number is expected to increase during the forecast period.

The government in Canada has heavily invested in 5G research partnerships, ensuring private network expansion. Many companies are also expanding their presence in the country. For instance, in January 2024, Ericsson partnered with Telus to launch and deploy its 5G standalone network from coast to coast. Through this partnership, Ericsson’s 5G Core technologies will be delivered through a cloud-native Ericsson dual-mode 5G Core solution, enabling Telus to offer the most advanced services to its customers. The private 5g network market is also supported by the rising adoption of private 5G networks across mining, oil, and gas sectors and smart city projects in Canada.

private 5G networks across mining, oil, and gas sectors and smart city projects in Canada.

Asia Pacific Market Insights

The Asia Pacific private 5G network market is expected to register a rapid revenue CAGR throughout the forecast period owing to increasing investments in 5G network infrastructure, automation, and technology upgrades across several industries, presence of some industry giants, and high usage of private 5G networks in smart city projects and manufacturing plants. Countries such as China, Japan, India, and South Korea are leading with substantial expenditures on the 5G spectrum.

China is one of the global leaders in 5G deployment, with a strong focus on private network deployments. The local government is investing in infrastructure development and integrating private 5G in critical sectors such as mining, logistics, and energy. In addition, leading companies in China are focused on providing end-to-end solutions and investing in R&D activities to cater to the rising demand.

In India, the private 5g network market is expected to expand at a robust pace owing to high usage of private 5G networks in different industries for automation, predictive maintenance, and IoT integration. In addition, telecom companies in India like Reliance Jio and Airtel are partnering with enterprises to deploy private 5G networking solutions.

Private 5G Network Market Players:

- Telefonaktiebolaget LM Ericsson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- ZTE Corporation

- Deutsche Telekom Group

- AT&T Inc.

- Juniper Networks, Inc.

- Verizon Communications

- Altiostar

- HUAWEI TECHNOLOGIES CO., LTD.

- Mavenir

- T-Systems International GmbH

- Cisco Systems, Inc.

- Vodafone Group Plc

- BT Group

The global private 5G network market is rapidly expanding driven by industries seeking enhanced connectivity, low latency, and secure digital-transformation communication. The competitive landscape of the market consists of several leading and emerging telecom operators, network equipment providers, and IT companies offering customized solutions and services. The key players in the market are focused on innovation, strategic alliances such as mergers and acquisitions, partnerships, and joint ventures to expand market reach and gain a competitive edge. Here is a list of key players operating in the global private 5g network market:

Recent Developments

- In October 2024, NEC Corporation announced its partnership with Cisco to launch a new end-to-end private 5G network for its customers. Through this partnership, the companies plan to use Cisco 5G SA core and cloud control along with NEC’s validated radio network and systems integration services.

- In June 2024, HPE launched Aruba Networking Enterprise Private 5G to simplify the deployment of private cellular networks. This system provides a holistic solution that helps eliminate the complexity of managing, deploying, and purchasing private 5G cellular networks.

- In August 2021, NTT announced the launch of the first globally available private 5G network-as-a-service platform.

- Report ID: 5654

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Private 5G Network Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.