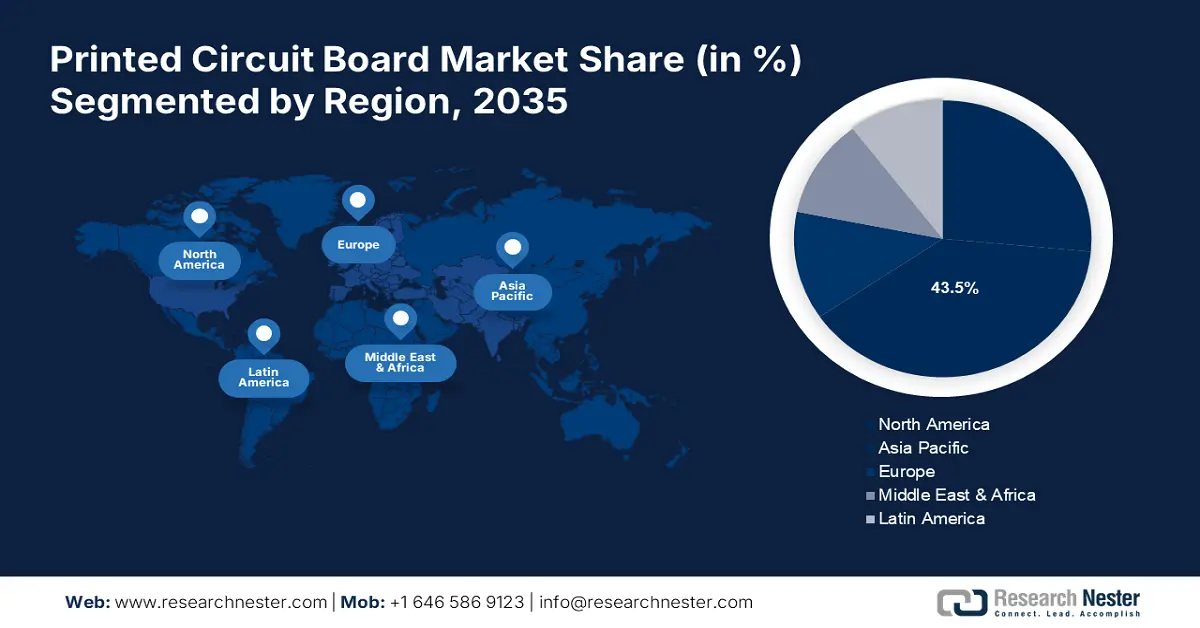

Printed Circuit Board Market Regional Analysis:

North America Market Insights

North America’s printed circuit board market is anticipated to exhibit a moderate growth rate during the forecast period, attributed to increasing demand from the aerospace and defense industries. There is a strong demand for highly reliable PCBs in the region, which focus on military equipment, satellite communications, and commercial aviation amid an emphasis on technological innovation. Similarly, the rapid development of electric vehicles as well as 5G infrastructure, have significantly enhanced its progress. The integration of 5G technology into electric vehicles has made possible advanced functions such as live navigation, better battery management, and uninterrupted connection which are important for the wider deployment of EVs in North America.

Policy changes made in the recent past are restructuring electronic circuit board manufacture in the United States. According to the U.S. Department of Commerce Bureau of Industry and Security Office of Technology Evaluation report, there has been a 15% increase in domestic production capacity for PCBs in late 2023 compared to 2021, when new policies were enforced. For instance, in Canada, there are untapped opportunities for PCB manufacturers to concentrate on high value-added niche specialty PCBs within a strong aerospace and telecommunications sector. The Canadian aerospace industry is known for its innovation and high-quality production capabilities. As such, developing advanced avionics systems, satellite technology, and unmanned aerial vehicles (UAVs) are some of the areas that Canadian companies have increasingly been focusing on where specialized PCBs that can withstand harsh environments and offer reliable performance are needed.

Asia Pacific Market Insights

Asia Pacific industry is set to account for largest revenue share of 43% by 2035. This growth could be attributed to a strong and large base of manufacturing companies domiciled in China, Japan, and Taiwan. With high production volumes of consumer electronics and steadily growing markets in countries like India, this region currently leads globally in demand for PCBs across all applications. Furthermore, the outlook also shifts to 5G technology, IoT devices, and electric vehicles, further accelerating PCB market growth in the region.

China’s PCB production capabilities are still the strongest in Asia-Pacific. This sector is dominated by corporations, including Wus Printed Circuit and Shennan Circuits. In May 2024, exports of China's PCBs reached USD 1,670 million, and imports accounted for USD 574 million, resulting in a trade surplus of USD 1.1 billion. From May 2023 to May 2024, the exports of printed circuit boards manufactured in China increased by USD 269 million (19.2%), reaching USD 1.67 billion from USD 1.4 billion.

India’s printed circuit board market is growing steadily due to the make in India campaign by the Government of India and its booming domestic electronics industry. In turn, this has resulted in domestic electronics industries being built up through investment hence giving rise to a strong ecosystem that supports PCB production for different applications including consumer electronics, automotive, and telecommunications.

Also, in Japan the PCB manufacturers are more geared toward high value segments and products such as automotive and industrial Printed Circuit Boards which require quality and technical leadership. For instance, Meiko Electronics has announced a major investment in its Vietnam operations to boost automotive PCB capacity by 2023 for Japanese automakers expanding EV production. Given enhanced Vietnam production capabilities, Meiko is likely to tap into the opportunity and take advantage of the increasing adoption trend of EVs and become one of the prominent leaders in Japan’s PCB market.