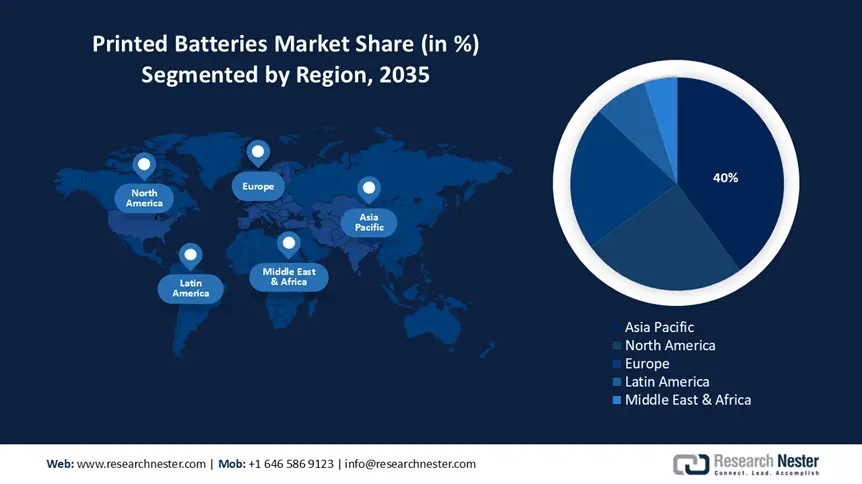

Printed Batteries Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific printed batteries market is projected to account for over 40% of the global revenue during the forecast period. This is ascribed to EV adoption and IoT growth in China, Japan, and India. In terms of battery development, China dominates the world, whereas Japan’s METI funded ¥617 billion in 2021 for advanced semiconductors. China contributed to over 80% of the overall battery cell production, with 90% of the cathode and 97% of the anode material capacity.

India is set to dominate the Asia Pacific printed batteries market and exhibit a staggering CAGR in the assessed period. The Government of India is initiating initiatives, including Manthan Platform, NRF, to optimize battery R&D infrastructure through incentives, funding, and partnership efforts. State governments are issuing research grants and are establishing Centers of Excellence (CoE) under their specific EV policies to promote industry-led collaborations. India has showcased noteworthy potential in specific segments of the battery supply chain and is relevant for countries seeking to diversify their supply chains away from China. India already generates numerous ancillary raw materials as well as precursor materials for battery production. However, the country still faces some challenges, like limited resources of nickel, lithium, and cobalt. To propagate India's battery supply chain in the global landscape, India and the international community are increasingly collaborating on trade, financing, and research.

India Raw and Precursor Material Production and Proved Reserves, 2021-2022

|

Raw Material |

Production |

Proved Reserves |

|

Bauxite |

22,493,947 metric tons |

560,865,000 metric tons |

|

Copper ore |

3,569,632 metric tons |

128,267,000 metric tons |

|

Natural graphite |

57,264 metric tons |

4,386,467 metric tons |

|

Synthetic graphite |

>30,000 metric tons |

NA |

|

Fluorspar |

1.237 metric tons |

228,393 metric tons |

|

Phosphate rock |

1,395,079 metric tons |

27,103,158 metric tons |

|

Iron ore |

253,974,000 metric tons |

4,631,786,000 metric tons |

|

Lithium |

0 |

5,900,000 metric tons |

|

Nickel |

0 |

189,000,000 metric tons |

|

Cobalt |

0 |

44,910,000 metric tons |

|

Manganese |

2,695,991 metric tons |

61,510,000 metric tons |

Source: ORF America

North America Market Insights

The North American printed batteries market is expected to hold a share of over 25% during the assessment period. The growth scenario is ascribed to high demand for IoT, wearables, and EVs in the region. U.S. adoption of industry products is credited to a prominent end user share of consumer electronics, leading to a shifting preference to locally produce a high volume of flexible batteries. The battery manufacturing capacity in the U.S. has doubled since 2022, with the incorporation of tax credits for producers and surpassed 200 GWh in 2024. The IEA in its March 2025 report stated that 700 GWh of surplus production capacity is pipelined, and 40% of present capacity is collaboratively operated by established battery makers and automakers. Strategically deploying automation, supporting innovation, and digitization has a pivotal role to play in generating sufficient yields to decouple from dependency on China's companies and allow diversification of supplies.

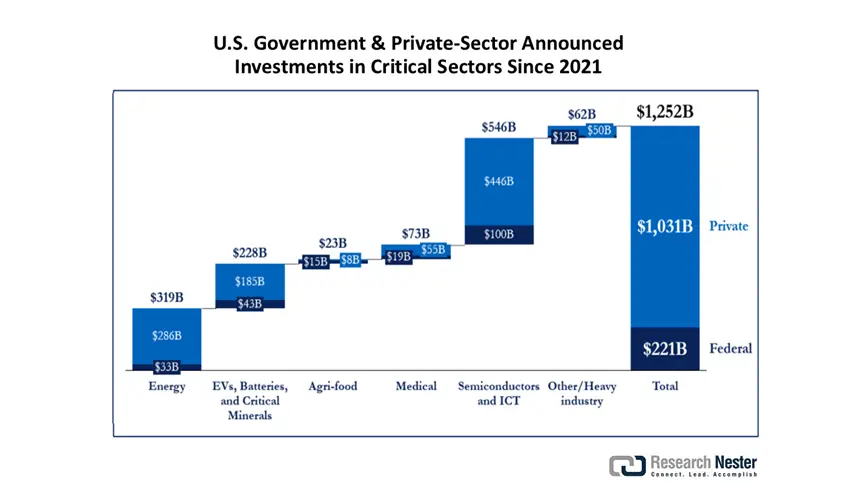

The U.S. printed batteries market is driven by a growing emphasis on domestic batteries. Over the past few years, the government has strategically allocated resources from federal investments, major legislation, comprising grants, loans, procurements, tax credits, and other mechanisms, primarily aided by the IRA, BIL, and the CHIPS and Science Act, that sanctioned USD 1 trillion in clean energy and manufacturing for the private sector since 2021. USD 796 billion of this fund was allocated for new American production capabilities. For instance, the CHIPS and Science Act announced an influx of USD 53 billion in the country’s semiconductor segment, R&D, and workforce development, leading to USD 446 billion in planned private investment. As part of it, Ultium Cells launched a battery cell manufacturing plant in Warren, Ohio, employing 2,200 employees and has delivered 100 million battery cells as of December 2024, according to the Quadrennial Supply Chain Review.

U.S. Government & Private-Sector Announced Investments in Critical Sectors Since 2021

Source: Trade.gov

Europe Market Insights

The European printed batteries market is projected to hold a lion's share in the forthcoming years. The region's regulatory protocols have shaped the battery manufacturing and deployment chain over the past several years it highlighting the procurement and usage of sustainable materials. For example, the REGULATION (EU) 2023/1542 issued by the parliament stressed heavily on recycling and the second life of batteries to help transition to a climate-neutral and circular economy. The Communication of the Commission introduced the Circular Economy Action Plan in March 2020 to streamline the recycling rates of batteries.

Germany is projected to capture the largest share by 2034, due to a robust battery storage scenario and IoT production. The country's thriving automotive sector is a potential end user of printed and flexible batteries for its small electronic devices. Battery storage is being deployed at a massive scale, and the IEA stated that the capacity reached 16 GW by the end of 2021, wherein 6 GW of grid-scale battery storage was added alone in 2021. The high-capacity factor in Germany is fueling the growth of the printed batteries market. Moreover, the emerging policies like the ETSI EN 303 645 released in June 2020 are supporting IoT devices innovation, which in turn, is aiding printed battery demand.