Printed and Flexible Sensors Market Outlook:

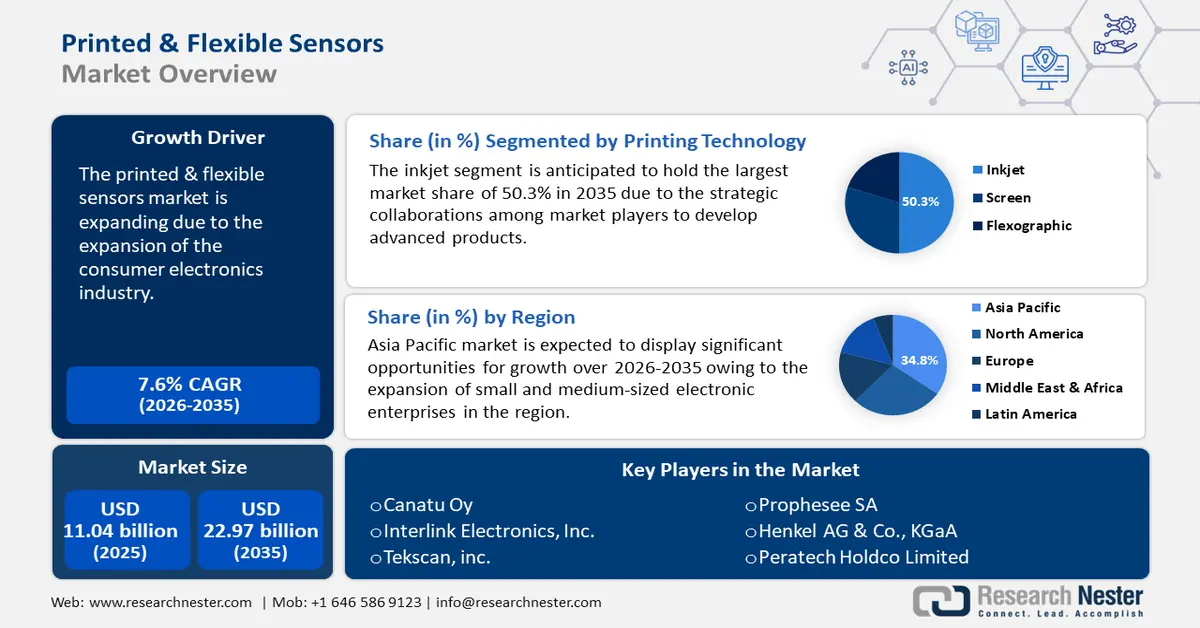

Printed and Flexible Sensors Market size was valued at USD 11.04 billion in 2025 and is set to exceed USD 22.97 billion by 2035, expanding at over 7.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of printed and flexible sensors is estimated at USD 11.8 billion.

The flexible and printed electronics market continues to showcase steady growth attributed to its widespread applications and new technological approaches in product manufacturing. They offer vital energy and resource optimization along the value chain. Simple production processes, novel form factors such as stretchable, ultra-thin, flexible product range, and inexpensive mass production have facilitated the development of a new class of highly integrated digital and analog electronics, with promising applications in packaging, consumer electronics, and pharmaceuticals. In the consumer electronics segment, the printed and flexible sensors market has a key use case in smartphones, laptops, and tablets. World Economic Forum stated that in 2022, there were more than 8.58 billion active mobile subscribers globally, out of a total population of 7.95 billion. Electronic device innovations and technological breakthroughs will soon be upending customer demand and preference.

Key Printed and Flexible Sensors Market Insights Summary:

Regional Highlights:

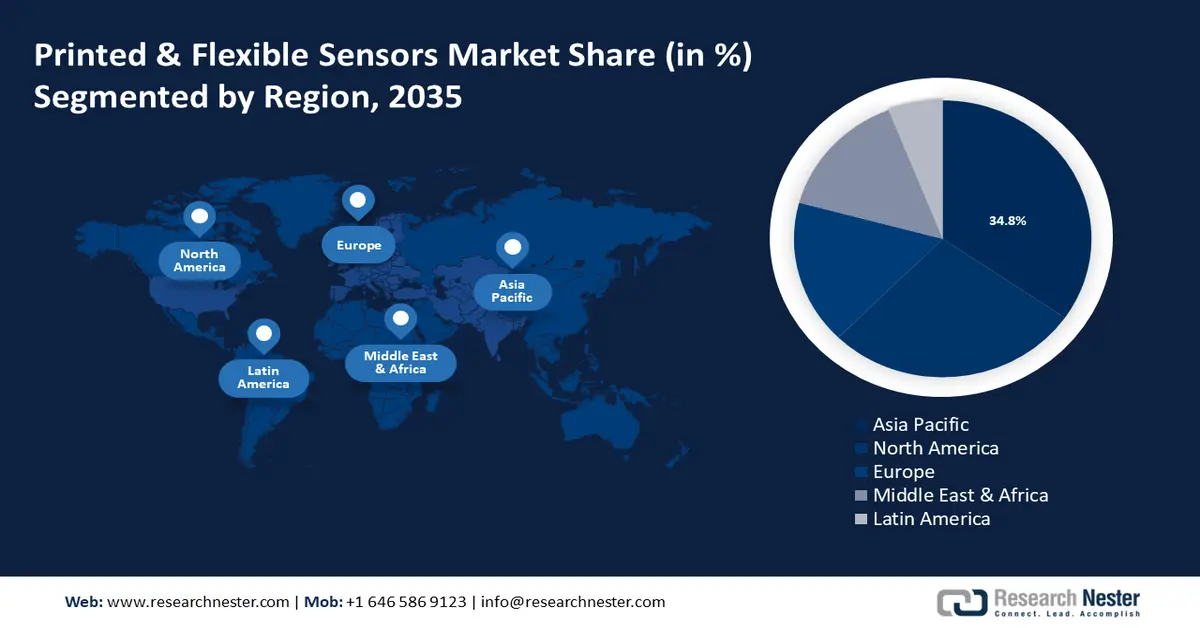

- Asia Pacific printed and flexible sensors market is anticipated to capture 34.80% share by 2035, driven by key players, growing technological advancements, and expanding small and medium electronic enterprises.

Segment Insights:

- The inkjet segment in the printed and flexible sensors market is projected to hold a 50.30% share by 2035, fueled by growing advancements in inkjet printing and rising demand across industries.

- The biosensors segment in the printed and flexible sensors market is projected to hold a notable revenue share by 2035, driven by the burgeoning demand for glucose test strips for diabetes monitoring.

Key Growth Trends:

- Aerogel and gas sensor R&D to enhance pollutant detection

- Growing use in biomedical applications

Major Challenges:

- Intense competition from alternatives

- High costs

Key Players: Nippon Telegraph and Telephone Corporation (NTT), Mitsufuji Corporation, Fujifilm Holding Corporation.

Global Printed and Flexible Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.04 billion

- 2026 Market Size: USD 11.8 billion

- Projected Market Size: USD 22.97 billion by 2035

- Growth Forecasts: 7.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 18 September, 2025

Printed and Flexible Sensors Market Growth Drivers and Challenges:

Growth Drivers

- Aerogel and gas sensor R&D to enhance pollutant detection: Printed electrical gas sensors are an affordable, low-power, lightweight, and potentially disposable alternative to their counterparts produced using conventional methods including etching, photolithography, and chemical vapor deposition. Present-day research on printed electrical gas sensors comprises the study of materials, fabrication methodologies, and applications in monitoring air quality, diagnosis of diseases, food quality, and detection of hazardous gases. Additionally, the growing interest in smart homes, IoT, wearable devices, and point-of-need sensors has further fueled R&D in this segment. Polyethylene-2,6-naphthalate (PEN), polyimide (PI), and polydimethylsiloxane (PDMS) are the most common flexible substrates being researched for the fabrication of gas sensors.

A Global Action Plan report mentions that in the UK, particularly in London, Birmingham, and the Home County households face dangerous levels of indoor air pollution. 45% of homes had volatile organic compounds (VOCs) that surpassed healthy levels and 17% reported concerning levels of VOCs. In this perspective, researchers at the University of Cambridge developed a sensor in February 2024, made from aerogels or frozen smoke that detects formaldehyde as low as eight parts per billion concentration using AI techniques.to in real time at concentrations as low as, far beyond the sensitivity of most indoor air quality sensors. The aerogel incorporates 3D-printed lines of a graphene paste and tiny semiconductors called quantum dots to enhance formaldehyde sensitivity. - Growing use in biomedical applications: Flexible sensors have been used daily, leading to significant advancements, especially in biomedical applications, as they can be used for curved surfaces and adapt to complex geometries due to their flexibility and stretchability. Blood gas analyzers, pregnancy tests, blood glucose monitors, and cholesterol tastings are among the devices that use medical biosensors. Biosensors identify and quantify biological materials, such as proteins, nucleic acids, enzymes, and antibodies.

According to the National Institutes of Health, it is predicted that around 552 million people will have diabetes worldwide by 2030. Therefore, novel glucose biosensor technologies, such as POC devices, CGMS, and noninvasive glucose monitoring systems, have been created in recent decades due to the rising prevalence of diabetes. These sensors enable improved healthcare results by offering comfortable and non-invasive monitoring options. Therefore, biosensors with printed and flexible formats are acceptable, flexible, and reasonably priced for use in wearable and point-of-care applications, which is escalating the market growth. - Increased technological advancements: The development of printing technologies like roll-to-roll, inkjet, and screen printing makes it possible to fabricate printed and flexible sensors with greater accuracy and resolution. These developments lead to increased cost-effectiveness, scalability, and sensor performance. For instance, in February 2024, Tekscan released a new pressure mapping sensor to handle the difficulties associated with sensing interface pressure in battery manufacture and research. By spotting possible issues with battery design, this method provides our customers with practical insights that could result in improved, safer, and more dependable energy storage.

The use of printed and flexible sensors is growing across a range of industries due to the growing demand for technologically sophisticated sensors that are flexible and simple to integrate. - Increased adoption for producing sustainable energy: Various new systems and technologies are introduced in the energy business. Many research organizations have succeeded in developing flexible instruments and equipment that can be used in the renewable energy sector. These devices are nimble and agile because they use printable and flexible sensors. Flexible sensors have utility in other industrial settings as well. These sensors are more beneficial to the final user and need very little space.

Challenges

- Intense competition from alternatives: Because conductive ink is inexpensive and easy to use, it limits industry improvements. As a result, the printed and flexible sensors market growth rate for flexible sensors will be challenged.

- High costs: The main issue impeding the growth of flexible and printable sensors in the coming years is their expensive cost in comparison to rigid sensors and their significant handling danger.

Printed and Flexible Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 11.04 billion |

|

Forecast Year Market Size (2035) |

USD 22.97 billion |

|

Regional Scope |

|

Printed and Flexible Sensors Market Segmentation:

Printing Technology Segment Analysis

Inkjet segment is expected to capture around 50.3% printed and flexible sensors market share by the end of 2035. The segment growth can be attributed to the growing advancements in inkjet printing and a surge in demand across various industries. For instance, in July 2024, Hi-Print and Ventec Giga Solutions, the value-added PCB equipment business of Ventec, collaborated to introduce the most advanced inkjet printer for solder mask technology in the printed and flexible sensors market. The Hi-Print SD11 Inkjet printer, with its first-ever fully adjustable three-color ink supply system and up to ten cutting-edge printheads, is a versatile, scalable, modular, and reconfigurable system made for PCB fabrication that will not go out of demand. Furthermore, inkjet printing offers various benefits- it can produce intricate patterns, works well with numerous materials, and has a high resolution.

Type Segment Analysis

The biosensors segment in flexible sensors market is poised to garner a notable share during the forecast period. The segment growth can be attributed to the burgeoning demand for glucose test strips for diabetes monitoring. Nowadays, diabetes is among the most prevalent illnesses worldwide. The government has been compelled to take various measures to manage the disease due to its concerning rate of rise. For instance, in the U.S., key DPP elements, such as changing one's diet and increasing physical activity, are used by the CDC's National Diabetes Prevention Program to stop or postpone the onset of type 2 diabetes. The program can reduce a person's risk of type 2 diabetes by 58% (or 71% if they are over 60).

Our in-depth analysis of the global printed and flexible sensors market includes the following segments:

|

Printing Technology |

|

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Printed and Flexible Sensors Market Regional Analysis:

APAC Market Insights

Asia Pacific printed and flexible sensors market is poised to hold revenue share of over 34.8% by the end of 2035. The market growth in the region is expected on account of the presence of key players and growing technological advancements. Additionally, the increasing use of printed electronics technology in consumer electronics, automotive, and medical fields, as well as the expansion of small and medium-sized electronic enterprises in the region are stimulating printed and flexible sensors market growth.

China is a leading player in the Internet of Things (IoT) business and is the largest consumer electronics market globally. According to the Shanghai Municipal People’s Government consumer electronics market witnessed a 4% increase in total retail sales in 2023, reaching USD 305 billion. By 2024, the growth rate is likely to reach 5%. Therefore, the incorporation of these sensors into wearables, tablets, smartphones, smart home appliances, and other consumer electronics products is driving the printed and flexible sensors market.

India is known for its digitalization and automation which has increased the adoption of printed and flexible sensors in automotive and healthcare industries. According to Invest India, as of October 2023, there were over 888 million broadband customers in India.

In South Korea, a rise in technological developments and research and development (R&D) is boosting the printed and flexible sensors market growth. The medical and automotive industries are witnessing an upsurge in the use of printed and flexible sensor technologies, which is driving the market.

North America Market Insights

The printed and flexible sensors market in North America is poised to hold a notable share in 2035. The market is growing in the region owing to the robust demand for wearable medical technology, medical patches, and remote patient monitoring in addition to an established healthcare infrastructure. According to the Health Information National Trends Survey, approximately 30% of Americans track their fitness and health using wearable technology, including bands or smartwatches.

In the U.S., the printed and flexible sensors market is expanding due to factors such as the growing use of wearable technology, IoT applications, healthcare monitoring systems, and automotive improvements. For instance, approximately 54 million Americans over 65 were living in 2021. By 2050, this figure is anticipated to rise to 85.7 million, which will consequently increase the demand for healthcare monitoring systems in the region. Also, the region's early acceptance of emerging technologies and significant emphasis on technological innovation and support printed and flexible sensors market expansion. In Canada, technological innovations including improved printing capabilities, and efficient and enhanced data sensing capabilities, will present several growth prospects for the industry.

Printed and Flexible Sensors Market Players:

- Canatu Oy

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Interlink Electronics, Inc.

- Tekscan, Inc.

- Prophesee SA

- Henkel AG & Co., KGaA

- Peratech Holdco Limited

- KWJ Engineering

- T+Ink, Inc.

- Thin Film Electronics ASA

- Renesas Electronics Corporation

The global printed and flexible sensors market is very competitive, providing both fresh startup companies and well-established manufacturers with opportunities. Rapid changes in consumer preferences and the speed at which technology is developing across a range of industries have given market participants a fantastic opportunity to seize as much of a foothold as possible.

Recent Developments

- In October 2023, Prophesee SA, the developer of the world's most powerful neuromorphic vision systems, today released the GenX320 Event-based Metavision sensor, the industry's first event-based vision sensor designed exclusively for incorporation into ultra-low-power Edge AI vision devices.

- In February 2023, Henkel, a pioneer in material technologies worldwide, introduced a unique sensor experience kit designed for IOT engineering in many industries. Four distinct printed electronics technologies are available in the innovative Henkel Qhesive Solutions Sensor INKxperience Kit, which comes pre-configured with hardware and software for engineering ideation and prototype.

- Report ID: 6427

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Printed and Flexible Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.