Practice Management System Market Outlook:

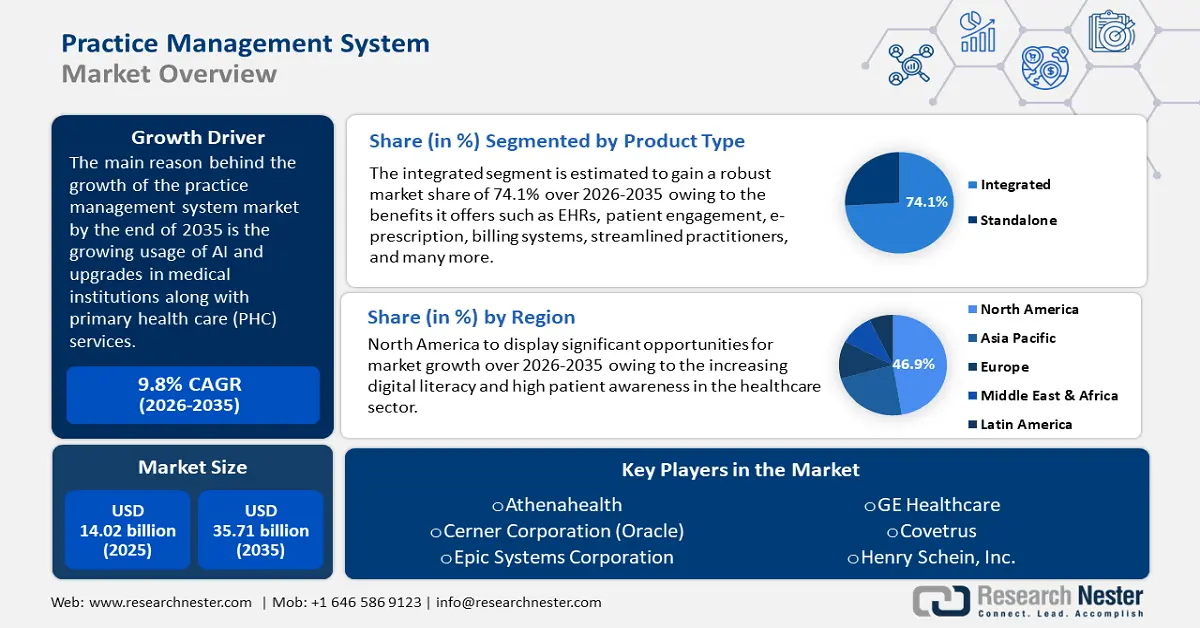

Practice Management System Market size was over USD 14.02 billion in 2025 and is anticipated to cross USD 35.71 billion by 2035, growing at more than 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of practice management system is assessed at USD 15.26 billion.

Practice management software (PMS) is being increasingly integrated with AI. National Institute of Health predicted in March 2020, that 5% of adults were affected by outpatient environments along with 17% of diagnostic errors resulting in adverse events in hospital settings.

This demands an upgrade in current medical institutions and various practices such as primary health care (PHC) services. Several practice management automators (PMAs) such as Medicodio, Aiwyn, and XBert have gained immense popularity. XBert an AI-powered work intelligence, is a PMA that helps in report analytics, client portals, and workflow automation. In addition, electronic data in healthcare IT has been massively produced since the advent of PMS to cater to patient care, regulatory compliance, and record-keeping. This necessitates the usage of a PMS as it saves resources, and time while providing a high ROI in processes such as administrative tasks and billing.

Key Practice Management System Market Insights Summary:

Regional Highlights:

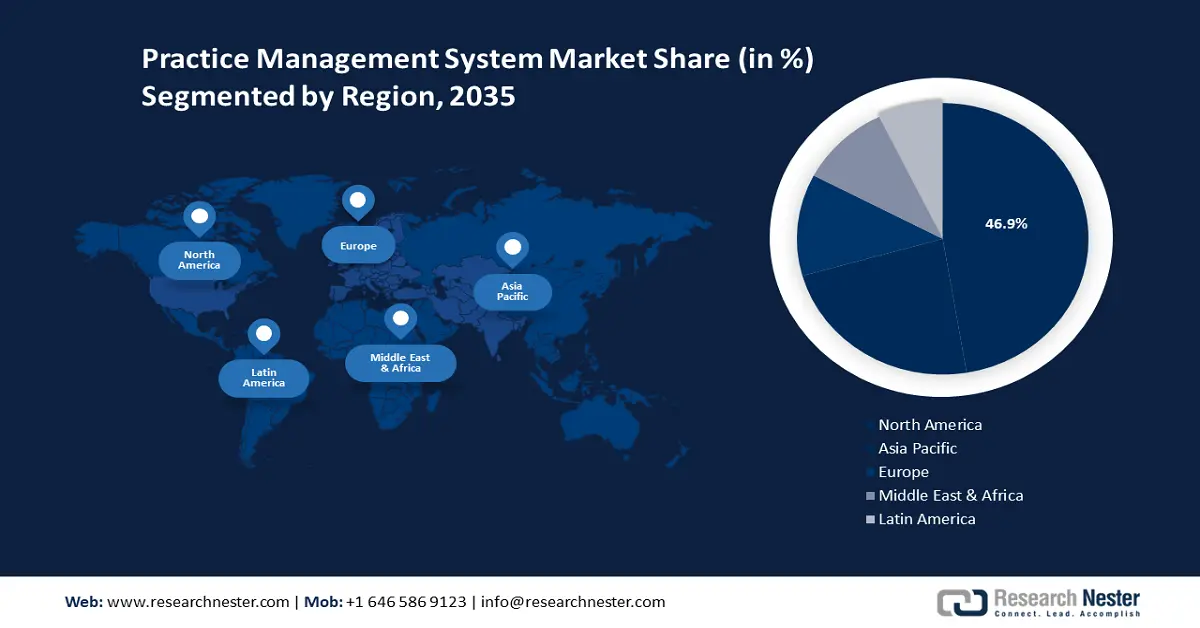

- The North America practice management system market is anticipated to capture 47% share by 2035, driven by surging digital literacy and technological advancements in healthcare.

Segment Insights:

- The integrated segment in the practice management system market is projected to hold a 74.10% share by 2035, driven by the benefits of integrated systems, such as EHRs and patient engagement, which streamline healthcare operations and improve patient care.

- The integrated segment in the practice management system market is projected to hold a 74.10% share by 2035, driven by the benefits of integrated systems, such as EHRs and patient engagement, which streamline healthcare operations and improve patient care.

Key Growth Trends:

- Shift to electronic health records (EHR)

- Demand for seamless integration of telehealth

Major Challenges:

- Data vulnerability along with privacy concerns

- High initial implementation and recurring maintenance costs

Key Players: Allscripts Healthcare, LLC, AdvantEdge Healthcare Solutions, Athenahealth, Cerner Corporation (Oracle), Epic Systems Corporation, GE Healthcare, Covetrus, Henry Schein, Inc..

Global Practice Management System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.02 billion

- 2026 Market Size: USD 15.26 billion

- Projected Market Size: USD 35.71 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Practice Management System Market Growth Drivers and Challenges:

Growth Drivers

-

Shift to electronic health records (EHR): The need for PMS has increased credited to the transition in EHR from paper-based records. This software handles data about patients, medical billing, administrative duties, and appointments effectively. Nearly 96% of non-federal acute care hospitals and 4 out of 5 office-based physicians had implemented certified EHRs by 2021. Additionally, 28% of hospitals and 34% of physicians have adopted an EHR, this has been a substantial 10-year progress by 2021, based on the data provided by the Office of the National Coordinator for Health IT 2021. During the digital revolution in healthcare, it is estimated to be crucial for contemporary practices to optimize operations and enhance patient care.

-

Demand for seamless integration of telehealth: Mobile phones, tablets, smartphones, and related devices are expected to be used frequently in healthcare applications. Medical practitioners provide patient care remotely attributed to the seamless integration of telehealth with practice management software. Robust remote access capabilities enable effective management of administrative tasks, guaranteeing continuous patient care while upholding safety procedures and preserving operational effectiveness.

The National Library of Medicine in 2022 stated that healthcare is highly integrated with advanced technologies such as Babylon and Microsoft. For instance, Microsoft acquired Nuance in April 2021 for about USD 19.7 billion. This made Microsoft offer industry-specific services such as cloud-based ambient clinical intelligence and conversational AI for healthcare providers. In addition, Microsoft also announced Microsoft Cloud for Healthcare to address the substantial needs of a growing and transforming healthcare industry. The virtual care & healthcare delivery share has increased, augmented by the rising adoption and usage of practice management systems in the healthcare sector.

Challenges

-

Data vulnerability along with privacy concerns: Data protection has become difficult driven by the preference of digital medicine over traditional one. It is expected that many institutes hesitate to implement EMRs and PMSs due to privacy concerns. Software for medical practices that raises security issues can cause an issue as it makes healthcare providers hesitant about patient data being vulnerable. It is necessary to have strong cybersecurity measures in place as cyber threats become more frequent and complicated.

-

High initial implementation and recurring maintenance costs: Practice management software's recurring maintenance costs and high initial implementation discourage healthcare providers from making investments, which restricts market expansion. Furthermore, as budgets become stretched over time, people may become reluctant to upgrade or implement new systems, which will negatively impact their ability to innovate and compete in the market demand.

Practice Management System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 14.02 billion |

|

Forecast Year Market Size (2035) |

USD 35.71 billion |

|

Regional Scope |

|

Practice Management System Market Segmentation:

Product Type Segment Analysis

The integrated segment in the practice management system market is poised to capture a share of 74.1% in the coming years. Significant growth in the revenue share is anticipated as a result of the benefits it offers such as EHRs, patient engagement, e-prescription, billing systems, and streamlined practitioners. For instance, in May 2023, MEDITECH Software announced an agreement to integrate with Canada Health Infoway's "PrescribeIT" e-prescribing service. Through this agreement, Canadian prescribers could electronically send a prescription to the patient's preferred pharmacy straight from MEDITECH's Expanse EHR. Furthermore, the healthcare industry's centralization and the complexity of patient care and payment will also drive the segment growth.

Component Segment Analysis

By 2035, software segment in the practice management system market is estimated to account for significant revenue. This growth is propelled by their easy installation which allows professionals to effectively manage financial administrative, as well as clinical workflows. Hospitals, medical providers, and health systems use them to improve patient satisfaction and care quality. Software is also used by small and medium-sized medical offices to automate and streamline business-related processes. Additionally, in July 2024, the Agency for Healthcare Research and Quality (AHRQ) stated that whether or not a patient's expectations for a medical interaction were fulfilled determines patient satisfaction. Patient satisfaction is taken into consideration in various value-based care compensation models, such as the Inpatient Prospective Payment System (IPPS).

Our in-depth analysis of the practice management system market includes the following segments:

|

Product Type |

|

|

Component |

|

|

Mode of Delivery |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Practice Management System Market Regional Analysis:

North America Market Insights

North America industry is poised to dominate majority revenue share of 47% by 2035. The surging digital literacy and high patient awareness, coupled with technological advancements in the healthcare sector drive the growth of PMS in this region. According to a report by Research Nester in 2022, in the U.S., 74% of consumers said they would use telemedicine. This will demand for proper management and storage of their data and demands PMS in the forecast period.

Government funding in Canada will change the adoption of medical practice management by healthcare providers. For instance, Canadian Medica Association Journal 2023, stated that with USD 46.2 billion in additional funding to increase health care budget by USD 196.1 billion over the next ten years.

In the U.S., practice management systems help manage insurance information, appointment scheduling, patient records, and other aspects of the healthcare industry. In a recent report published by Research Nester in 2021, about 61% of respondents wish to have access to their medical records via an online patient portal or mobile apps from their EHR providers.

Asia Pacific Market Insights

Asia Pacific will also encounter huge growth in the practice management system market share during the forecast period with a notable size. This region will account for the second position in this landscape owing to the demand for PMS to effectively manage patient data as chronic diseases such as cardiovascular diseases (CVD), and gastrointestinal disorders are at a surge. American College of Cardiology in 2021 stated that Asia witnessed an increase in CVD mortality from 5.6 million to 10.8 million in 2019. Nearly 39% of these deaths from CVD occurred in people under the age of 70, compared to the U.S., where the percentage of premature CVD deaths was 23%.

There is a high demand for high-quality healthcare in China owing to the increasing geriatric population. The National Institute of Health 2023 estimated that health expenditures constitute about 6.5% of China’s GDP, while the number of hospitals in China witnessed a growth rate of 193.4% by 2021.

In Japan, the demand for healthcare IT companies is increasing led by the growing economic conditions in this country. International Trade Administration 2022, predicted that by 2025, the telemedicine market in Japan is observed to grow from USD 243 to 404.5 million between 2020 and 2025.

Practice Management System Market Players:

- Accumedic Computer Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Allscripts Healthcare, LLC

- AdvantEdge Healthcare Solutions

- Athenahealth

- Cerner Corporation (Oracle)

- Epic Systems Corporation

- GE Healthcare

- Covetrus

- Henry Schein, Inc.

Practice management system market expansion is predicted to witness a lucrative share during the forecast period. The competitive environment is attributed to the tremendous spike in the usage of AI in PMS coupled with the shift to EHR globally. More companies are entering this sector owing to the potential growth opportunities. In the forecast period, the market will observe emerging competitors and a growing demand for practice management systems around the world.

Some of the key players include:

Recent Developments

- In August 2022, Henry Schein, Inc. the largest global provider of healthcare solutions to office-based dental and medical practitioners, has acquired Midway Dental Supply, a full-service dental distributor that supplies products to dental offices and dental labs throughout the Midwestern region of the United States.

- In May 2022, Covetrus launched Ascend, a highly effective cloud-based PMS, to support veterinary clinics in the UK, Europe, the Middle East, Africa, and Asia Pacific.

- Report ID: 6344

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Practice Management System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.