Power Transistors Market Outlook:

Power Transistors Market size was valued at USD 15.69 billion in 2025 and is expected to reach USD 32.34 billion by 2035, registering around 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of power transistors is assessed at USD 16.75 billion.

The rise of electric vehicles (EVs) is a major driver for the power transistors market. EVs rely on these components for power conversion and efficient energy management within battery systems and motor drives. Power transistors enhance vehicle performance, battery life, and energy efficiency, making them essential in EV powertrains. With global initiatives to reduce carbon emissions, the EV market is set to expand, thereby boosting demand for power transistors in automotive applications. According to NZE, in order to attain Net Zero by 2050, the number of EVs worldwide must reach 790 million by 2035, and EV sales must increase to 95% of all vehicle sales by that year.

Moreover, the shift towards industrial automation drives demand for power transistors, especially in advanced manufacturing and robotics. Power transistors enable efficient power regulation and conversion in automated machinery, helping to maintain operational efficiency and reduce energy costs. A PWC analysis estimates that by 2030, automation in three major industries, including manufacturing, will boost the world economy by USD 15 trillion. As industries increasingly adopt automation technologies, the need for reliable power management solutions grows, with power transistors providing essential support for precise and durable power handling.

Key Power Transistors Market Market Insights Summary:

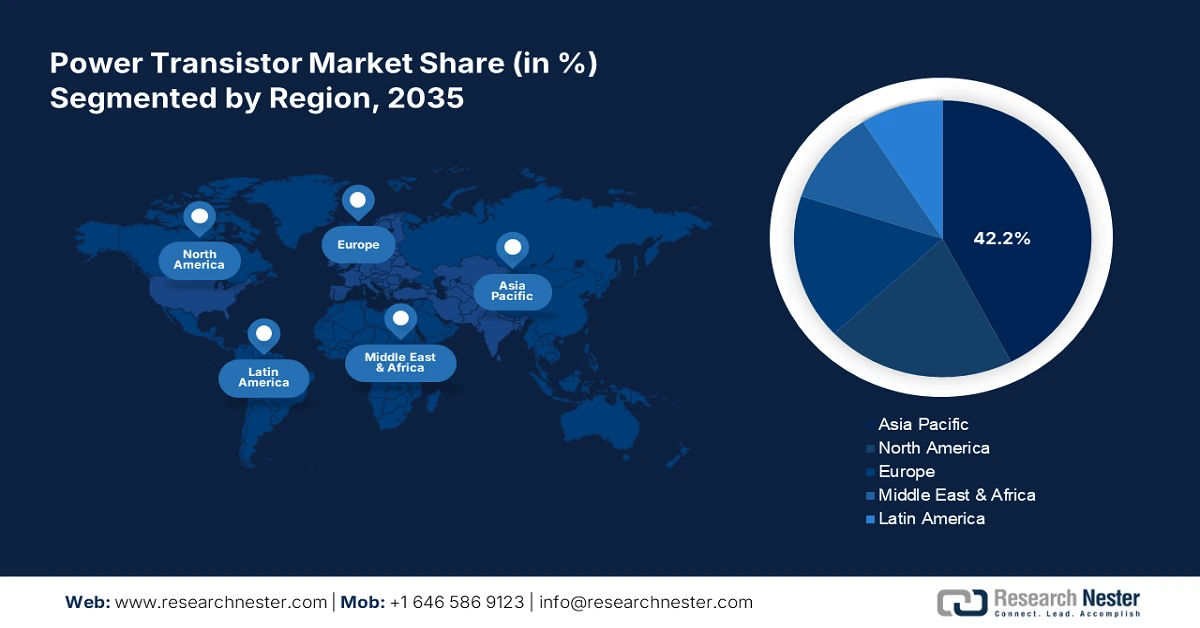

Regional Highlights:

- Asia Pacific dominates the Power Transistors Market with a 42.4% share, supported by its role as a major hub for consumer electronics manufacturing through 2026–2035.

- North America's power transistors market is expected to see lucrative growth through 2035, attributed to the rollout of 5G networks and growing EV adoption.

Segment Insights:

- The Automotive segment of the Power Transistors Market is forecasted to achieve a 32.20% share by 2035, propelled by the expanding electric vehicle market and increasing integration of power electronics.

Key Growth Trends:

- Renewable energy expansion

- Consumer electronics demand

Major Challenges:

- High production cost

- Heat management issues

- Key Players: Infineon Technologies, NXP Semiconductors, Renesas Electronics Corporation, Linear Integrated Systems Inc., Broadcom Inc..

Global Power Transistors Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.69 billion

- 2026 Market Size: USD 16.75 billion

- Projected Market Size: USD 32.34 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, South Korea, Germany

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 14 August, 2025

Power Transistors Market Growth Drivers and Challenges:

Growth Drivers

- Renewable energy expansion: Renewable energy systems, such a solar and wind power, require efficient power management, which is where power transistors play a critical role. They help handle high voltages and currents, ensuring reliable energy conversion and distribution. As countries increase their focus on green energy initiatives, demand for transistors used in inverters and converters for renewable systems grows, supporting a robust power transistors market aligned with sustainability efforts. According to the International Energy Agency's analysis, over 90% of the growth in power worldwide over the next five years will come from renewable sources.

- Consumer electronics demand: The consumer electronics industry’s rapid growth, particularly in portable and smart devices, is a key driver for power transistors. These transistors are essential in managing power efficiently within small, high-performance devices like smartphones, tablets, and wearables. It is anticipated that the consumer electronics industry will reach 9,007.0 million units by 2029. In addition, a 1.6% volume gain is projected for 2025. As consumers seek faster, longer-lasting devices, manufacturers integrate advanced power transistors to meet these demands. The consumer electronic market’s expansion supports sustained growth in power transistors adoption for compact and energy-efficient device development.

Challenges

- High production cost: Manufacturing power transistors, particularly advanced versions like silicon carbide (SiC) and gallium nitride (GaN) transistors, involves expansive materials and sophisticated production processes. These high costs can limit widespread adoption, especially in cost-sensitive power transistors markets. Additionally, the specialized equipment and clean-room facilities required further drive-up production expenses, making it challenging for manufacturers to balance affordability with technological advances.

- Heat management issues: Power transistors handle high currents and voltages, often generating significant heat. Managing this heat effectively without compromising device performance or lifespan is a major challenge, especially in compact applications like consumer electronics and EVs. Poor thermal management can lead to overheating, device failure, and reduced efficiency, making incorporating reliable heat dissipation solutions essential, which adds complexity and cost.

Power Transistors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 15.69 billion |

|

Forecast Year Market Size (2035) |

USD 32.34 billion |

|

Regional Scope |

|

Power Transistors Market Segmentation:

Application (Automotive, Consumer electronics, Industrial, IT, Telecommunication)

Based on Application, the automotive segment is projected to account for power transistors market share of around 32.2% by 2035. The segment’s growth is due to the rapid expansion of electric vehicles (EVs) and advancements in automotive electronics. In 2021, 6.6 million electric vehicles were sold worldwide, a record number representing a startling 98% increase over 2020. As EVs rely heavily on efficient power management, power transistors are essential for controlling battery usage and electric motor performance.

Additionally, modern vehicles incorporate increasingly complex infotainment, safety, and driver-assistance systems, which require effective power conversion and distribution. This demand for high-efficiency, high-power transistors is further propelled by trends toward smaller, lighter, and more energy-efficient automotive designs, making power transistors critical for meeting performance and sustainability goals in the evolving automotive Industry.

Type (Bipolar junction transistor, Metal oxide semiconductor field effect transistor, Insulated gate bipolar transistor)

As per type, the metal oxide semiconductor field effect transistor segment is expected to hold the largest revenue share in the global power transistors market. MOSFETs are highly efficient for switching applications and offer low power loss, making them ideal for industries like automotive, consumer electronics, and renewable energy, where energy efficiency is crucial. Their fast-switching speed and high-frequency capabilities are advantageous in electric vehicles (EVs), advanced computing, and industrial applications, which demand rapid, precise power control.

By 2028, the metal-oxide-semiconductor field-effect transistor (MOSFET) market is projected to grow to USD 10.8 billion globally. Additionally, ongoing advancements in MOSFET technology enhance durability and thermal performance, making them a preferred choice for high-demand power management, securing their lead in the power transistors market. The segment is hence anticipated to register considerable growth in the upcoming years.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power Transistors Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is expected to account for largest revenue share of 42.4% by 2035, The region is a major hub for consumer electronics manufacturing, including smartphones, laptops, and appliances. Power transistors are critical for efficient power management within these devices, and as demand for electronics rises, so does the need for high-performance power transistors. In 2024, the Asian consumer electronics market will earn USD 425 billion in revenue.

China emerges as one of the prominent power transistors markets due to rapid advancements in electric vehicles (EVs), renewable energy, and consumer electronics manufacturing. In 2022, 13.1 million new EVs were sold in China, accounting for 4% of all vehicle sales. China’s strong push for EV adoption and extensive renewable energy projects, including solar and wind power, rely on power transistors for efficient energy management and conversion. Additionally, the country’s dominance in consumer electronics production and government-backed support for the domestic semiconductor industry is further fueling demand, driving significant growth in China’s power transistors market.

India shifting toward smart manufacturing and automation in sectors like automotive, manufacturing, and agriculture is boosting the demand for advanced power electronics. By 2025–2026, India's manufacturing sector is expected to surpass USD 1 trillion. Power transistors enable precise power control in industrial machinery and automation systems, which are increasingly used to enhance productivity and reduce costs.

North America Market Analysis

North America is projected to capture a lucrative power transistors market share over the forecast period. The rollout of 5G networks in North America is creating demand for advanced transistors that can handle high frequencies and power requirements. 5G accounts for 59% of smartphone subscriptions in North America. Power transistors are essential for 5G infrastructure, supporting signal amplification and energy efficiency, as telecom providers rapidly build out new infrastructure.

The U.S. power transistors market is growing due to advancements in electric vehicles (EVs), 5G technology, and renewable energy projects. As EV adoption rises, so does the demand for power transistors to manage battery and motor systems efficiently. In 2023, there were 1.4 million new electric car registrations in the US, a more than 40% increase from 2022. Additionally, the rapid deployment of 5G networks requires transistors that support high frequencies and power, driving growth in telecommunications. Combined with growth in industrial automation and the defense sector, these factors are propelling the U.S. power transistors market forward.

With Canada industries increasingly adopting automation and IoT technologies, demand for power transistors is rising. By 2024, the Industrial IoT market in Canada is expected to generate USD 2.7 billion in sales. These devices enable efficient power control and distribution in connected equipment, helping industries optimize energy use, streamline operations, and reduce costs. Investment in renewable energy and smart grid infrastructure also increases demand, as power transistors are essential for efficient energy conversion and storage.

Key Power Transistors Market Players:

- Diodes Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Infineon Technologies

- NXP Semiconductors

- Renesas Electronics Corporation

- Linear Integrated Systems Inc.

- Broadcom Inc.

- Analog Devices Inc.

- STMicroelectronics N.V.

- Vishay Intertechnology, Inc.

- WOLFSPEED, INC.

Some of the key players driving innovation in the power transistors market are advancing transistor technologies like SiC (silicon carbide) and GaN(gallium nitride) to enhance energy efficiency and performance in applications such as EVs, renewable energy systems, and industrial automation. Recent developments include Infineon's launch of energy-efficient SiC MOSFETs and Toshiba's focus on compact, high-power GaN transistors, which are shaping the future of power electronics.

Recent Developments

- In June 2024, Infineon Technologies AG launched the CoolGaN Transistor 700 V G4 product family, offering high efficiency for power conversion up to 700 V. With a 20 percent performance improvement over other GaN products, these transistors enhance efficiency and reduce power losses, suitable for chargers, power supplies, and renewable energy applications.

- In January 2024, Renesas Electronics Corporation acquired all outstanding shares of Transphorm, Inc. for USD 5.10 per share, valuing the transaction at approximately USD 339 million. This acquisition provides Renesas with in-house gallium nitride technology, enhancing its reach in electric vehicles, computing, renewable energy, and industrial power conversion markets.

- Report ID: 6719

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power Transistors Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.