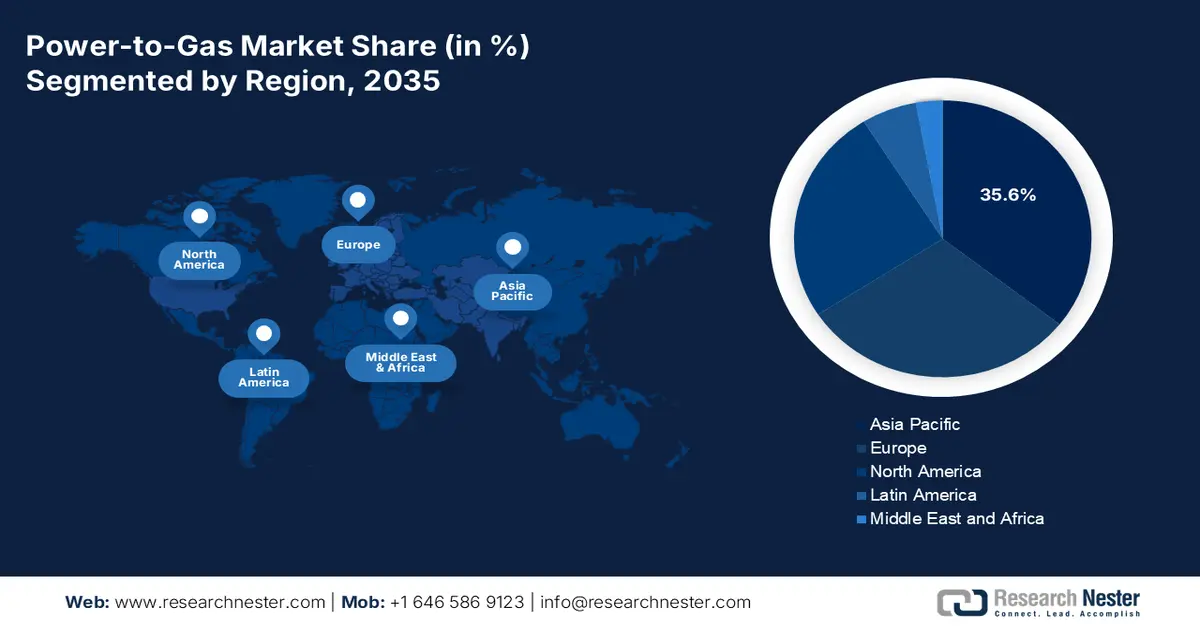

Power-to-Gas Market - Regional Analysis

APAC Market Insights

Asia Pacific market is anticipated to garner the largest share of 35.6% by the end of 2035. The market’s upliftment is highly attributed to an increase in the energy demand, robust national hydrogen strategies, and energy security imperatives. The overall region comprises mature economies, such as South Korea and Japan, both of which have focused on hydrogen imports and exports, with the intention of effectively decarbonizing. Likewise, resource-based nations, including Australia, have aimed to emerge as the green hydrogen export superpower. In addition, the PtG integration with massive renewable energy projects, especially wind in Australia and solar in India, is also a regional trend for the market’s growth. According to an article published by ARENA in October 2023, the government in Australia invested USD 2.0 billion in the latest Hydrogen Headstart Program to successfully fund large-scale hydrogen projects.

2023 Hydrogen Export and Import in Asia

|

Countries |

Export (USD) |

Import (USD) |

|

China |

1.9 billion |

2.1 billion |

|

Malaysia |

748 million |

394 million |

|

Japan |

443 million |

1.4 billion |

|

Singapore |

93.9 million |

261 million |

|

South Korea |

92.8 million |

605 million |

|

Thailand |

20.7 million |

139 million |

|

India |

16 million |

486 million |

|

Vietnam |

277 million |

1.1 billion |

Source: OEC

China in the power-to-gas market is growing significantly, owing to the top-down national strategy, which is executed with effective state-based investment, huge domestic need for hydrogen in its chemical and refining sectors, and unparalleled scale of manufacturing. Besides, the Ministry of Industry and Information Technology (MIIT) and the National Development and Reform Commission (NDRC) have readily prioritized green hydrogen, which has resulted in the rapid deployment of gigawatt-scale electrolyzer projects. As per an article published by the CSIS Organization in February 2022, the country is considered the highest producer of hydrogen, with 25 million tons. The majority of the volume is produced from fossil fuels, denoting 60% from coal, and 25% from natural gas, which is positively impacting the overall market.

India market is also growing due to the urgent demand for energy import substitution, a highly proactive government strategy, and abundant low-cost renewable energy potential. As per a data report published by the PIB Government in July 2024, the Union Cabinet accepted the National Green Hydrogen Mission in January 2023, amounting to ₹19,744 crore. In addition, the objective of the Mission is to make the country an international center for production, export, and usage of Green Hydrogen, along with its derivatives, by effectively targeting the 5 MMT production per annum by the end of 2030. Besides, the Mission has an outlay, amounting to ₹600 crore as of 2024, and meanwhile, the Green Hydrogen production capacity has been significantly envisaged and is projected to leverage more than ₹8 lakh crore, which readily contributes to the market’s upliftment.

North America Market Insights

North America market is expected to emerge as the fastest-growing region during the predicted period. The market’s development in the region is highly fueled by a rapid transition from pilot-scale projects to commercial-scale and integrated deployments, especially with a focus on renewable energy storage and green hydrogen production for industrial decarbonization. As per an article published by the Green House Innovation Center in 2023, the U.S. is considered the second-biggest consumer and producer of hydrogen after China, catering to 13% of the international demand. In addition, the country is focused on initiating carbon reduction targets, denoting a 50% reduction of greenhouse gas pollution by 2030, followed by ensuring 1 100% carbon pollution-free electricity industry by 2035, which is positively impacting the overall market in the region.

The U.S. in the power-to-gas market is gaining increased traction, owing to the existence of the Inflation Reduction Act (IRA) as the primary funding mechanism, the presence of funding programs, along with the Environmental Protection Agency (EPA), and chemical safety. For instance, as stated in the October 2023 Biden White House Government article, 7 domestic clean hydrogen centers have been selected to receive USD 7.0 billion in Bipartisan Infrastructure Law funding for escalating the demand for clean and low-cost hydrogen. Additionally, these projects catalyzed over USD 40 billion in private investment and developed standard employment opportunities. This brought the overall private and public investment in hydrogen centers to almost USD 50 billion, thereby denoting an optimistic outlook for rapid expansion of the market in the country.

Canada in the power-to-gas market is also developing due to international partnerships, strategic export ambition, federal fiscal incentives mirroring the U.S. policy, low-cost and abundant renewable feedstock, and decarbonization of domestic heavy industry. According to an article published by PBO Canada in February 2024, the Clean Hydrogen Investment Tax Credit (ITC) has been declared in the 2022 Fall Economic Statement, wherein it provided 15% to 40% refundable tax credit for investments in clean hydrogen projects. The tax credit is 40% for carbon intensity (CI), which is less than 0.7 kg, 25% for CI more than 0.7 kg and less than 2 kg, and 15% for over 2 kg and less than 4 kg. Additionally, the tax credit was also expanded by 15% with the intention of converting hydrogen into ammonia for transportation purposes, which is creating an optimistic outlook for the overall market.

Europe Market Insights

Europe market is projected to grow steadily by the end of the forecast period. The market’s exposure in the region is highly fueled by the REPowerEU Plan, along with the Green Deal approach, which collectively aim to gain climate neutrality by the end of 2050 and diminish reliance on fossil fuels. According to the 2025 Europe Commission article, hydrogen accounted for less than 2% of the region’s energy consumption, and it has been primarily utilized to produce chemical products, including fertilizers and plastics. Moreover, 96% of this hydrogen has been produced with natural gas, leading to significant carbon dioxide emissions. Besides, the 2022 REPowerEU Strategy has set out the objective to produce 10 million tons as well as import 10 million tons by the end of 2030. Furthermore, renewable hydrogen is projected to cover nearly 10% of regional energy demands for decarbonizing the energy-intensive transport sector and industrial processes.

The power-to-gas market in Germany is gaining increased exposure, owing to the huge industrial base, unparalleled government financial commitment, and a tactical focus on supplying and producing green hydrogen to provide energy transition success. Besides, as mentioned in an article published by the World Nuclear Association Organization in May 2024, the country’s national hydrogen approach has approved almost €7 billion to ensure electrolyzer capacity of 5 GW by the end of 2030 for 14 TWh of green hydrogen, demanding 20 TWh of renewable electricity. Additionally, the approach has also offered €2 billion for projects internationally since there is a huge demand for hydrogen imports. Besides, the German Chemical Industry Association has readily recognized that cost-effective hydrogen is crucial for the market’s competitiveness and survival in a decarbonized world.

The power-to-gas market in the UK is also growing due to the existence of its advanced business model, which is significantly focused on a flexible regulatory framework and industrial clusters. In addition, the Department for Energy Security & Net Zero's (DESNZ) cluster-based sequencing process is also another driver, which successfully de-risks investment by co-locating offtake, storage, and production. According to an article published by the UK Government in April 2025, the government declared that it has provided £21.7 billion as a generous fund to carbon capture, usage, and storage (CCUS)-based projects in the country. Moreover, the government also initiated a commitment of £21.7 billion for more than 25 years to support CCUS clusters in the North East and North West of England. Meanwhile, the nation’s Low Carbon Hydrogen Agreement policy, along with the upcoming Hydrogen Production Business Model, are also ensuring long-lasting revenue support for the market’s growth.