Power Monitoring Market Outlook:

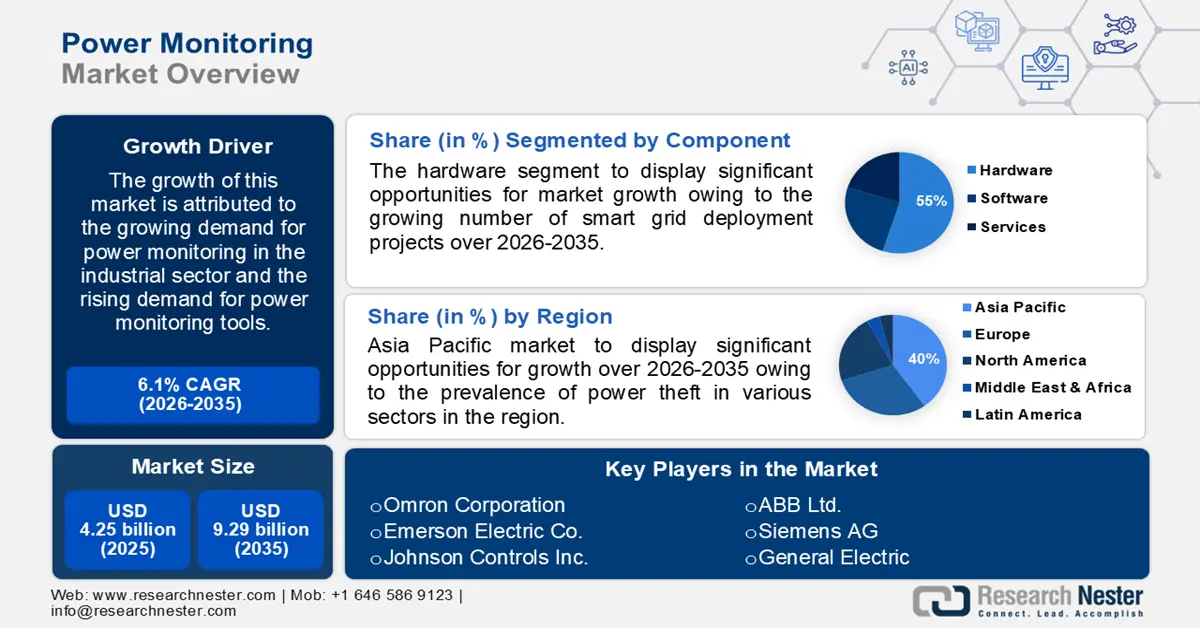

Power Monitoring Market size was valued at USD 5.14 billion in 2025 and is expected to reach USD 9.29 billion by 2035, expanding at around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of power monitoring is evaluated at USD 5.42 billion.

The growth of this market is attributed to the growing demand for power monitoring in the industrial sector and the rising demand for power monitoring tools. Rapid expansion in the manufacturing industry and also the significant need for power reliability in the industrial atmosphere are factors driving the growth of this market. According to statics, power dependability is the top issue for 75% of industrial clients, and 85% said that power outages would significantly affect their business operations.

Additionally, the power monitoring system is also used to trace the actual power utilized in installed devices in industrial and commercial buildings, particularly in data centers and manufacturing sectors in order to grow energy efficiency. They have a flexible power distribution system and attain mileage grade, which are the two advantages of a power monitoring system in the end-user sector. Additionally, power supply through UPS, growing digitalization, and cloud computing are factors driving the growth of this market. As per the financial data, the global digital transformation held a market revenue of USD 500 billion in 2020.

Key Power Monitoring Market Insights Summary:

Regional Highlights:

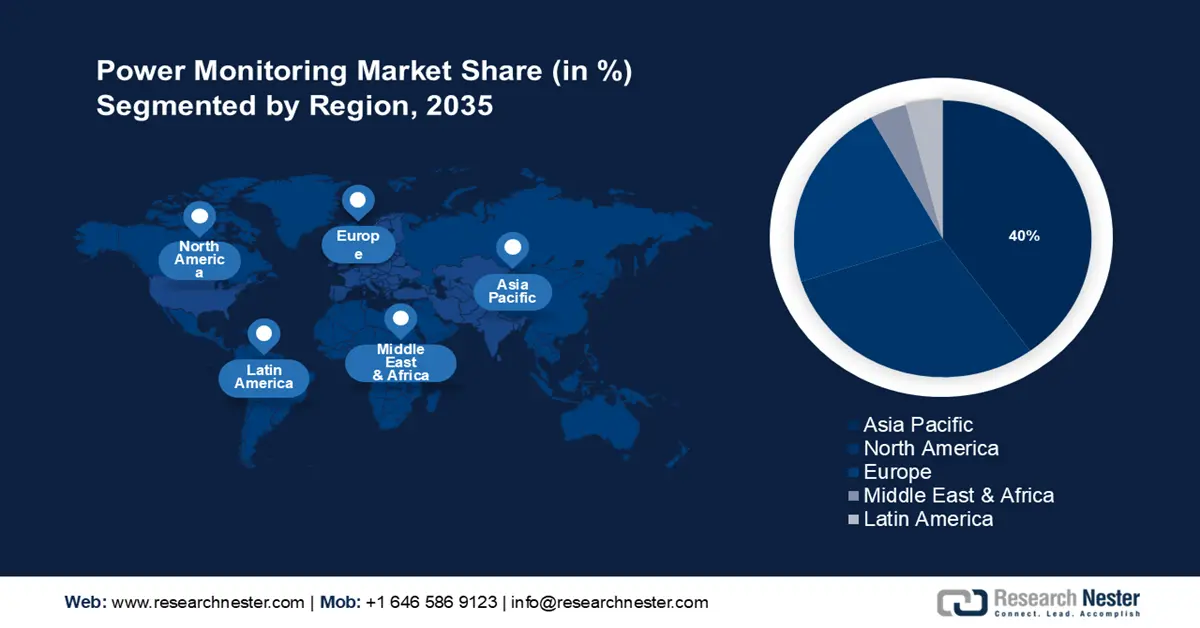

- Asia Pacific power monitoring market will dominate over 40% share by 2035, attributed to rising power demand and urbanization across key countries.

- North America market demonstrates significant growth during the forecast timeline, driven by infrastructure upgrades and growing smart meter adoption.

Segment Insights:

- The hardware segment in the power monitoring market is expected to secure the largest share by 2035, driven by the growing number of smart grid deployment projects and investments.

- The manufacturing industry segment in the power monitoring market is forecasted to grow significantly by 2035, driven by increasing digitalization, cloud computing, and energy efficiency initiatives.

Key Growth Trends:

- Growing Adoption ofSmart Grids and Smart Meters

- Enhanced Power Quality with Power Monitoring Systems

Major Challenges:

- High Initial Investment in the Market

- Disturbance in the Supply Chain Owing to COVID-19 Lockdown

Key Players: Yokogawa Electric Corporation, Omron Corporation, Emerson Electric Co., Johnson Controls Inc., Silver Springs Networks, ABB Ltd., Siemens AG, General Electric, Schneider Electric SE, Eaton Corporation plc.

Global Power Monitoring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.14 billion

- 2026 Market Size: USD 5.42 billion

- Projected Market Size: USD 9.29 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 9 September, 2025

Power Monitoring Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Adoption of Smart Grids and Smart Meters – In terms of renewable energy sources and utilities, smart grids, and smart meters are the primary factor expected to drive the industry growth. As per a report by U.S. Energy Information Administration, in 2020 around 103 million AMIs were installed in the United States.

-

Enhanced Power Quality with Power Monitoring Systems – Power monitoring systems are designed to measure and monitor power quality parameters, including voltage, current, frequency, power factor, and harmonic distortion, among others. A power monitoring system improves power quality. Therefore, it is expected to fuel the growth of this market in the forecast period. The U.S. Department of Energy estimates that the implementation of power monitoring and control systems can result in energy savings of 5% to 15%, with some companies reporting improvement in the power quality to 30.

-

Increasing Commercial and Industrial Sector – A power monitoring system plays a vital role industrial and commercial sector for various power related purposes such as energy saving, power reliability, power quality and others. Growing commercial and industrial sector gives rise to the demand for better power monitoring system. According to the U.S. Department of Energy, the commercial and industrial sectors use close to 50% of the nation's total energy, which presents a sizable opportunity for energy savings through the installation of power monitoring systems.

-

Growing Renewable Energy Sources - As the need for electricity is growing across the globe, countries are focusing on establishing more power generating capacity. Therefore, plants need better power monitoring system to process the better. The establishment of renewable energy sources is growing which instead is leading to growth of the power monitoring system all over the globe. As per International Energy Agency report, renewable energy sources will hold 95% hike in global power capacity by 2026.

Challenges

-

High Initial Investment in the Market – The power monitoring system market includes high initial costs this factor can hamper the market in the forecast period.

-

Disturbance in the Supply Chain Owing to COVID-19 Lockdown

Power Monitoring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 5.14 billion |

|

Forecast Year Market Size (2035) |

USD 9.29 billion |

|

Regional Scope |

|

Power Monitoring Market Segmentation:

Component Segment Analysis

The market is segmented and analyzed for demand and supply by component software, services, and others. Out of this, the hardware segment is expected to account for the largest market share by the end of 2035. This can be attributed to the growing number of smart grid deployment projects. The government authorities of various countries are focusing on bringing smart meters in order to reduce carbon emissions. Therefore, they are encouraging installation of smart meters. Also, growing investment by government & market players in smart grids is driving the growth of this segment. By the end of 2019, around 100 million smart electricity meters were deployed in United States, while smart meters in Great Britain reached around 23 million units in 2021.

End-user Segment Analysis

The global power monitoring market is segmented and analyzed for demand and supply by end users into the manufacturing industry, utilities & renewables, public infrastructure, EV charging solutions, and others. Out of this, the manufacturing industry is anticipated to hold the market share in the forecast period. Power monitoring is highly used in the manufacturing industry in industrial facilities and data center facilities in order to enhance energy efficiency. This can be used to track the power drawn by installed devices in these sectors. Growing digitalization and cloud computing, along with variation in power supply with the help of UPS are a few factors driving the growth of this segment in the forecast period. As per data, global digital industrialization held a market revenue of USD 122 billion in 2021.

Our in-depth analysis of the global market includes the following segments:

|

By Deployment Board |

|

|

By Component |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power Monitoring Market Regional Analysis:

APAC Market Insight

The market share in Asia Pacific industry is estimated to dominate majority revenue share of 40% by 2035. This can be attributed to high power demand, the prevalence of power theft in various sectors, and the growing population in the region. Furthermore, the region's developing urbanization and industrialisation makes power monitoring systems even more essential in the region. Over the projected period, it is anticipated that sales of power monitoring in China and Japan will rise by up to 8% and 4%, respectively. Additionally, government of the countries, including, India, Singapore, and China focusing on the decentralization of the electricity grid, which is further expected to boost the market growth. As per the statistics of the ministry of power, India is the largest producer and consumer of electricity in 2022.

Europe Market Insight

Europe region is likely to register significant growth till 2035. This can be attributed to the upsurging investments made in electric vehicles (EVs) by the UK, Germany, and Italy are anticipated to help the regional growth. Additionally, digitalization of the power sector, adoption of renewable energy, and high awareness amongst the population regarding energy conservation are expected the fuel the market growth. For instance, in 2021, renewable energy represented 21.8 % of the energy consumed in the Europe, down from 22.1% in 2020.

North American Market Insight

The market in the North American region is expected to have a significant growth by the end of 2035. The outdated power infrastructure in the area has been greatly improved owing to the market for power monitoring. With growing expenditures in smart meters to advance the country's intelligent infrastructure, the United States has seen an increase in demand for power monitoring systems compared to other countries in the region. The focus of the governments of the North American nations on replacing and upgrading their aging infrastructure, allowing smarter power networks, and enhancing grid dependability has significantly raised the market for power monitoring systems. Some of the main factors propelling the power monitoring market in the region include outdated electric transmission infrastructure and sizable expenditures made by a number of private organizations to update the network's existing equipment for better control of the electrical supply.

Power Monitoring Market Players:

- Yokogawa Electric Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Omron Corporation

- Emerson Electric Co.

- Johnson Controls Inc.

- Silver Springs Networks

- ABB Ltd.

- Siemens AG

- General Electric

- Schneider Electric SE

- Eaton Corporation plc

Recent Developments

- Schneider Electric announced the opening of its First Smart Distribution Center in Mumbai, India.

- Siemens AG launched a precise power measuring device SIRIUS 3UG546 DC load monitoring relay for DC applications

- Report ID: 3674

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power Monitoring Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.