Power Grid System Market Outlook:

Power Grid System Market size was over USD 10.98 billion in 2025 and is projected to reach USD 24.37 billion by 2035, growing at around 8.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of power grid system is evaluated at USD 11.8 billion.

The power grid system market is influenced by various factors, such as the growing need for electrification in transportation, the increasing demand for electricity due to urbanization and industrialization, the rising use of renewable energy sources, government initiatives to modernize and upgrade aging power grid infrastructure, the growing emphasis on grid reliability and resilience, and expanding investments in smart grid technology. In 2023, the International Energy Agency (IEA) reported that global power demand increased by 2.2%, which was smaller than the 2.4% growth recorded in 2022. Over the following three years, the electricity demand is predicted to increase more quickly worldwide, averaging 3.4% per year until 2026.

The depletion of onshore fossil fuel supplies, the economic viability of offshore operations, and remarkable technology advancements are all pushing operators to engage in deepwater exploration and development. This is due to the discovery of offshore petroleum deposit accounts, such as those found in the Kutch Valley in India, the Liza ground in Guyana, and the Tupi offshore oil pipeline in Brazil, suggests the possibility of additional offshore petroleum products.

Key Power Grid System Market Insights Summary:

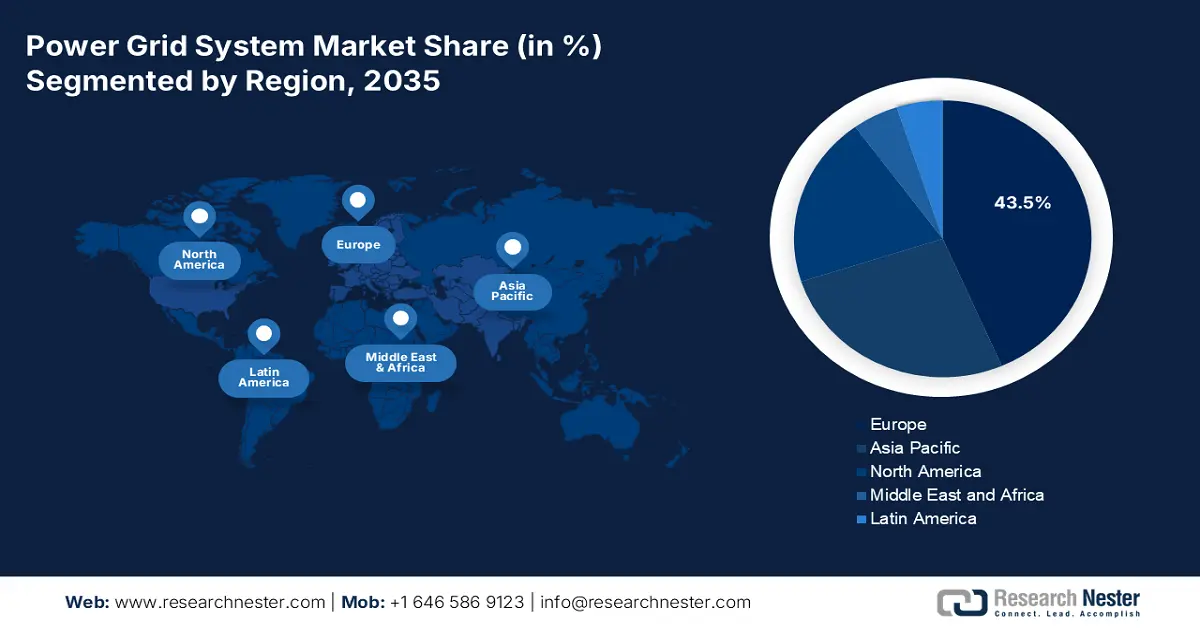

Regional Highlights:

- Europe commands a 43.5% share in the Power Grid System Market, fueled by advantageous government policies and strong adoption of renewable energy sources, enhancing growth prospects through 2035.

Segment Insights:

- The variable speed drives segment is expected to capture over 25.5% share by 2035 in the power grid system market, propelled by growing demand for energy-efficient solutions and grid modernization.

Key Growth Trends:

- Data privacy and cybersecurity issues

- Growing availability and affordability of wind farm technologies

Major Challenges:

- Low-cost onshore generation of electricity

- Intricate regulatory framework

- Key Players: ABB, Aker Solutions ASA, Apar Industries, Baker Hughes, Hartek Group Power System, Deep C, DEME, General Electric, Intertek Group.

Global Power Grid System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.98 billion

- 2026 Market Size: USD 11.8 billion

- Projected Market Size: USD 24.37 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (43.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, China, United States, France, United Kingdom

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Power Grid System Market Growth Drivers and Challenges:

Growth Drivers

-

Data privacy and cybersecurity issues: The escalating concerns over data privacy and cybersecurity are significantly influencing the power grid system market, particularly with the integration of smart technologies. The increasing digitization and connectivity of power grids have heightened their vulnerability to cyber threats, prompting substantial investments in cybersecurity measures. In 2024, U.S. utilities experienced a 7% surge in cyberattacks compared to the same period in 2023, averaging 1,162 attacks through August, up from 689 the previous year. This trend underscores the growing threats to critical infrastructure as power grids become more digitalized.

Governments worldwide are implementing stringent cybersecurity standards to protect power grids. For instance, the North American Electric Reliability Corporation’s Critical Infrastructure Protection (NERC-CIP) standards mandate comprehensive cybersecurity measures for power grid operators. In response to rising threats, regulatory bodies are enhancing oversight and requiring utilities to adopt robust cybersecurity practices to safeguard critical infrastructure. - Growing availability and affordability of wind farm technologies: Power grids must update to accept variable renewable energy (VRE) sources as wind power becomes more affordable and popular in order to maintain stability, effectiveness, and resilience. The global average levelized cost of electricity (LCOE) for onshore wind energy decreased 69% from USD 107/MWh to USD 33/MWh between 2010 and 2022. Onshore wind energy costs have fallen to USD 30-USD 50 per MWh, while offshore wind is projected to reach USD 50-USD 80 per MWh by 2030. Wind farms are increasingly competitive with fossil fuel-based power generation, driving investments in grid expansion and upgrades.

As wind farm technologies become affordable and more widely available, the demand for advanced power grid systems is rising. Grid operators and utilities must invest in smart grids, energy storage, and digital solutions to manage the growing share of wind energy efficiently. The transition to renewable-powered future is accelerating, making power gris modernization a top priority for energy security and sustainability.

Challenges

-

Low-cost onshore generation of electricity: Even in the absence of financial support and with oil prices declining, the cost of producing electricity from offshore wind farms, geothermal and hydroelectric facilities, and biomass energy facilities is on par with or less expensive than producing energy from gas, coal, and gasoline engine facilities. Furthermore, the price of electricity produced by solar and wind power has dropped, making it more economical to use these resources than certain other renewable energy sources globally. Additionally, producing power at oil and gas production facilities on the sea is far more expensive than producing energy using traditional energy sources like coal, gas, and petroleum.

-

Intricate regulatory framework: The electricity grid system must abide by many regulatory frameworks as it encompasses multiple nations and regions. Jurisdictions differ greatly in their rules regarding the transmission, distribution, and connection of renewable energy facilities. Grid operators face an additional operational burden in ensuring adherence to local regulations. They must smoothly coordinate transmission across borders while navigating an uneven regulatory environment. Project timescales are prolonged by the need for numerous clearances for upgrades to existing infrastructure. Clean energy integration and grid technology innovation are hampered by this complicated regulatory framework.

Power Grid System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 10.98 billion |

|

Forecast Year Market Size (2035) |

USD 24.37 billion |

|

Regional Scope |

|

Power Grid System Market Segmentation:

Component (Cables, Variable Speed Drives, Transformers, Switchgears)

In power grid system market, variable speed drives segment is set to dominate revenue share of over 25.5% by 2035, owing to lower energy consumption and increased energy efficiency by regulating the power and speed of electric motors. Better process control, lower maintenance costs, and longer equipment lifespans are all made possible by this technology. Variable speed drives have gained popularity in sectors including manufacturing, oil and gas, and mining due to the growing need for energy-efficient solutions.

With increasing grid modernization projects and the push for smart energy management, VSDs are set to be a key component in the expansion of the power grid system market. Investments in industrial automation and energy efficiency are expected to further accelerate this growth. The value of private equity investment in the worldwide industrial automation industry so far in 2024 has surpassed the full-year total for 2023 and is approaching the sector's record capital deployment in 2021.Through September 20, private equity and venture capital companies invested USD 14.87 billion, compared to USD 7.17 billion in the full fiscal year 2023.

Application (Captive Generation, Wind Power)

Based on the application, the captive generation segment in power grid system market is likely to hold a notable share by the end of 2035 due to distributed energy systems and self-generation becoming popular. The production of electricity for a particular entity's consumption, such as commercial or industrial facilities, is referred to as captive generation. It gives businesses more control over the energy supply, lessens their reliance on the grid, and enables them to fulfill their energy needs more affordably. The market for power grid systems is predicted to remain dominated by the captive generation segment due to the growing demand for clean and dependable energy.

Our in-depth analysis of the global power grid system market includes the following segments:

|

Component |

|

|

Application |

|

|

Depth |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power Grid System Market Regional Analysis:

Europe Market Analysis

In power grid system market, Europe region is predicted to capture over 43.5% revenue share by 2035, owing to the advantageous government policies and the strong need for renewable energy sources. The growth of renewable energy resources is the main focus of most countries in Europe. Countries like the UK, Norway, the Netherlands, Germany, and others are at the forefront of increasing their capacity for renewable energy. The growth of the subsea sector is being aided by the European Winds Initiatives (EWI), a renewable electricity research and development organization established to promote the wind industry in Europe.

For instance, in 2023, 24.5% of the total energy used in the European Union came from renewable sources. According to estimates, the share has grown by one percentage point since 2022, with the robust expansion in the supply of renewable electricity continuing to be the main driver. Additionally, a slight decrease in non-renewable energy use in 2023 increases the percentage. It will be necessary to double the rates of renewables deployment observed during the last ten years and undergo a more thorough overhaul of the European energy system to meet the new minimum EU objective of 42.5% for 2030.

As electric vehicles become more integrated into the grid environment, there is a growing demand for sophisticated charging infrastructure and vehicle-to-grid (V2G) solutions in the UK. In the UK, programs that support peer-to-peer energy trading and community energy projects can help local energy producers and decentralized power grid solutions. As the UK power grid system market welcomes the transition to a low-carbon energy system, significant investment is being made in grid-scale energy storage and demand response technology.

Germany's grid infrastructure is well-established, modern, and heavily invested in renewable energy sources like solar and wind. Wind energy accounted for the highest portion of Germany's electricity output in 2023, surpassing brown coal and other energy sources. They accounted for over 32% (net) of Germany's total electricity generation in 2023. The expansion of the power grid system market in Germany has also been aided by favorable laws and regulations, strict energy efficiency requirements, and rising electricity demand in industries like heating and transportation.

Asia Pacific Market Analysis

Asia Pacific in power grid system market is expected to experience a stable CAGR during the forecast period. In developing countries like China, India, and Southeast Asia, power consumption has risen steeply due to rapid industry, urbanization, and wealth growth. Utility companies are under pressure to update and grow their networks as aging transmission infrastructure cannot keep up. There is a huge potential for companies that export grid technology and offer services. For instance, China, the parent firm of Energy Monitor, is making more investments in transmission grids than all other nations combined. China spent USD 166 billion on its transmission infrastructure in 2022, and other nations invested a total of USD 118 billion.

The massive investments in China's electric grid industry are fueled by ultra-high-voltage transmission infrastructure, which permits long-distance power transmission with minimal losses. China's power system can now execute predictive maintenance by combining artificial intelligence and big data analytics, which lowers operational costs and downtime. Rapid urbanization in China is driving up demand for power grid solutions, which presents opportunities for businesses offering demand-side management and grid optimization technologies.

The power grid system market in South Korea benefits from significant government investment in smart grid technology, which creates a robust and efficient energy distribution network.

In addition to opening up possibilities for power grid solutions, the use of renewable energy sources like wind and solar power enhances the electrical system's resilience and sustainability in South Korea. South Korea's power grid system market, which prioritizes energy security, has cutting-edge grid monitoring and control systems that guarantee reliability and minimize downtime.

Key Power Grid System Market Players:

- Nexans

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB

- Aker Solutions ASA

- Apar Industries

- Baker Hughes

- Hartek Group Power System

- Deep C

- DEME

- General Electric

- Intertek Group

Major competitors in the fiercely competitive power grid system market are concentrating on innovation, strategic alliances, and mergers to hold onto their market share. The market is dominated by major firms that provide a wide range of grid solutions and cutting-edge technologies. These businesses offer end-to-end solutions, ranging from transmission and distribution to smart grid technologies, by utilizing their vast experience in grid infrastructure and technology development.

Here are some leading players in the power grid system market:

Recent Developments

- In January 2025, Hartek Group's Power system business unit in Gujarat was awarded a USD 13.45 million project by the Power Grid Corporation of India Limited (PGCIL), the largest power distribution company in India. A 765kv AIS substation extension and 400/220kV substation work are part of the project.

- In January 2025, Nexans, a world leader in the design and production of cable systems and services, won the project agreement for LanWin 2, which is worth one billion euros under the TenneT frame agreement granted in May 2023. In this project, 250 km of 525 kV High-Voltage Direct Current, Cross-Linked Polyethylene (HVDC, XLPE) onshore and offshore export cable systems are being designed, procured, built, and installed (EPCI). In the German North Sea, the project is a component of TenneT's 2 GW offshore grid connection effort. The project is anticipated to be put into service in 2030.

- Report ID: 7140

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power Grid System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.