Power Factor Correction Market Outlook:

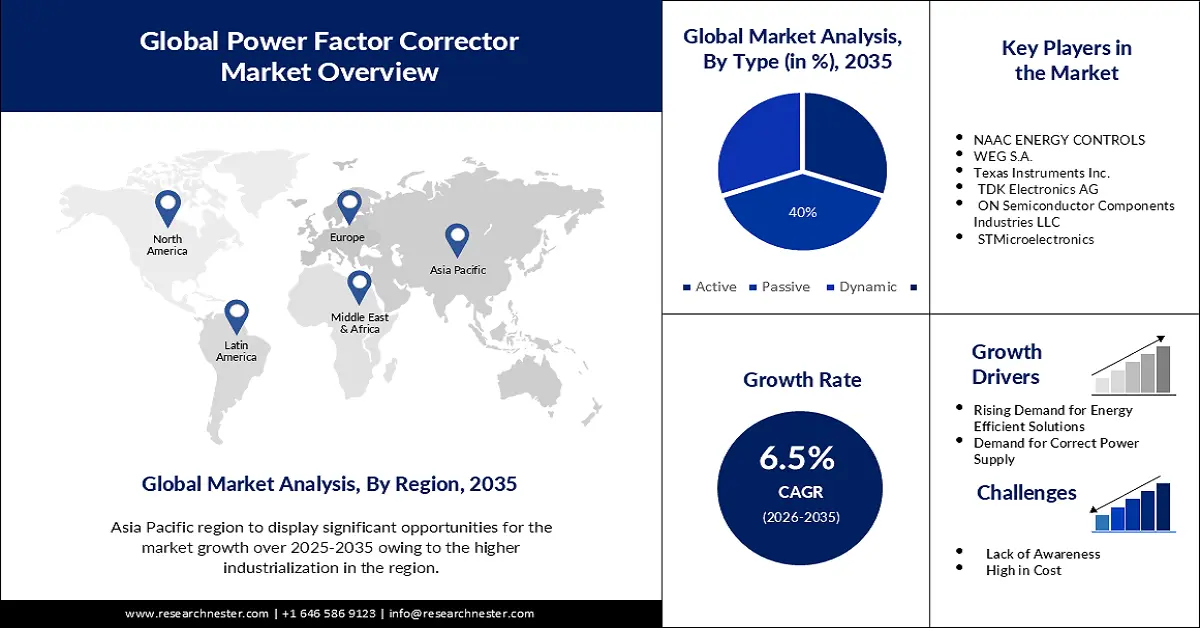

Power Factor Correction Market size was over USD 2.31 billion in 2025 and is poised to exceed USD 4.34 billion by 2035, witnessing over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of power factor correction is evaluated at USD 2.45 billion.

The growth of the market can be attributed to the growing need for correct power supply amongst the end users, such as data centers, manufacturing, and other industries, This is mostly due to the growing adoption of loT in recent years, and the increase in spending in loT, the number of connected devices and other computer-based systems has grown significantly. The projected spending on loT by the end of 2024 is expected to reach around USD 1 Trillion. Moreover, in the year 2021, the spending on IT data centers were estimated to be close to USD 240 Billion.

Moreover, in the end user industries, there has been a surge in demand for power factor correction as these devices improve the reactive power and reduce harmonics in the equipment. Besides this, with the introduction of PFC integrated circuits (ICs), these correctors are now being utilized widely in commercial, enterprises, and for military purposes, due to the lack of reliable power management systems.

Key Power Factor Correction Market Insights Summary:

Regional Highlights:

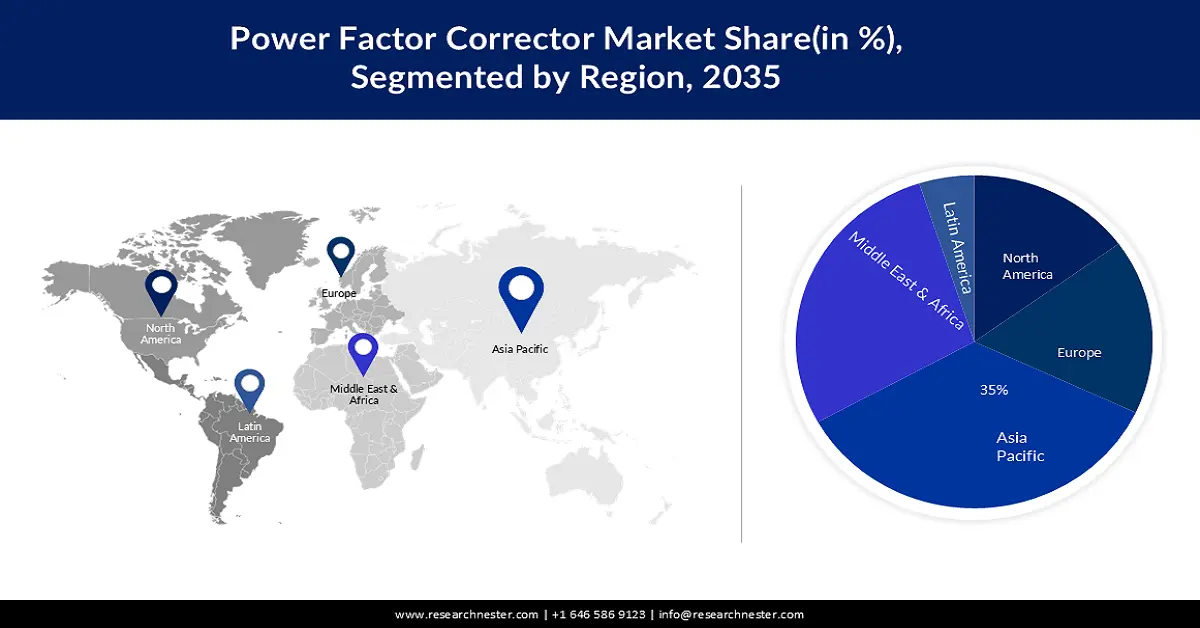

- Asia Pacific power factor correction market will dominate over 35% share by 2035, driven by growing demand for electricity, industrialization, and urbanization, alongside increasing infrastructure upgrades in the region.

- Middle East & Africa market will secure significant revenue share by 2035, driven by government initiatives to improve electricity infrastructure and increasing electricity demand due to population growth in MEA.

Segment Insights:

- The passive segment in the power factor correction market is projected to capture a 40% share by 2035, driven by the cost-effectiveness and simplicity of passive systems for residential and small commercial applications.

- The commercial segment in the power factor correction market is forecasted to exhibit the fastest growth over 2026-2035, driven by the increasing use of electronic systems and modernization in commercial facilities.

Key Growth Trends:

- Escalating Energy Cost and Penalties for Low Power Facto

- Increasing Demand for Energy Efficient Solutions

Major Challenges:

- Escalating Energy Cost and Penalties for Low Power Facto

- Increasing Demand for Energy Efficient Solutions

Key Players: of NAAC ENERGY CONTROLS, WEG S.A., Texas Instruments Inc., TDK Electronics AG, ON Semiconductor Components Industries LLC, STMicroelectronics.

Global Power Factor Correction Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.31 billion

- 2026 Market Size: USD 2.45 billion

- Projected Market Size: USD 4.34 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Power Factor Correction Market Growth Drivers and Challenges:

Growth Driver

-

Escalating Energy Cost and Penalties for Low Power Factor - Many countries have implemented regulations or policies that penalize businesses that operate with low power factors, which can lead to higher energy costs. This has prompted businesses to invest in power factor correction systems to reduce energy bills and avoid fines. Such as, in the United States, utilities can impose penalties on industrial and commercial customers with low power factors.

-

Increasing Demand for Energy Efficient Solutions - With growing concerns about climate change and energy security, there is an increasing focus on energy efficiency across all sectors. Power factor correction systems can improve energy efficiency by reducing the amount of reactive power generated, which can result in significant energy savings. Therefore, many companies are investing in power factor correction systems as part of their energy-saving initiatives. Furthermore, the application of energy efficiency norms and standards to develop public electricity and lighting systems is also expected to increase the demand for power factor correction devices in the near future times.

- Stringent Government Regulations being Implemented- Stricter rules and energy efficiency requirements are being imposed by governments and utility companies to promote the use of power factor correction technologies. Furthermore, producers and customers alike are growing more aware of sustainability and carbon footprints. Additionally, by enhancing power quality, these devices encourage the use of extra incentives. The expansion and development of the power factor correction market are being accelerated by all of these variables.

Challenges

-

High Initial Investment Cost - Installing a power factor correction system can be expensive, especially for small and medium-sized businesses. Equipment, installation, and maintenance costs may deter some companies from investing in power factor correction systems, especially if they do not incur low power factor penalties.

-

Lack of Awareness is Expected to Pose Limitations on the Power Factor Correction Market Growth in the Projected Period

- Shortage of Skilled Labor is Predicted to Hamper the Market Expansion in the Upcoming Period.

Power Factor Correction Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 2.31 billion |

|

Forecast Year Market Size (2035) |

USD 4.34 billion |

|

Regional Scope |

|

Power Factor Correction Market Segmentation:

Type Segment Analysis

Based on type, the passive segment is estimated to hold 40% share of the global power factor correction market during the forecast period. Passive systems are widely used due to their cost-effectiveness and simple design, making them easy to install and maintain. They are especially suitable for low-power consumption applications, such as residential and small commercial buildings. This is why growing residential and small commercial building construction raises the segment growth in the forecast period. The forecast for new US residential construction occurring in 2023 is USD 817 billion.

Application Segment Analysis

The fastest-growing segment in the application segmentation of the power factor correction market is anticipated to be the commercial sector. Commercial facilities, including offices, retail spaces, hospitals, and educational institutions, are increasingly aware of the importance of power factor correction in their operations. With the increasing use of electrical appliances, lighting systems, and electronics, commercial buildings often have poor power factors and face higher electricity costs. The commercial sector is witnessing a wave of modernization and automation. This consists of deploying sophisticated lighting systems, HVAC equipment, and electronic devices. While these advancements offer operational benefits, they often have low power utilization, protect equipment from harmonic distortion, and extend lifespans.

Our in-depth analysis of the global power factor correction market includes the following segments:

|

Material |

|

|

Type |

|

|

Approach |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power Factor Correction Market Regional Analysis:

APAC Market Insights

The power factor correction market in the Asia Pacific region is estimated to hold the highest share of 35% by the end of 2035. The growth of the market in the region can be attributed to the growing demand for electricity in the region, followed by the increasing industrialization, and rapid urbanization in several countries, such as China, India, Malaysia, and others. According to the statistics by the International Energy Agency (IEA), electricity consumption in the Asia Pacific grew from 3842.1 TWh in 2000 to 11614.4 TWh in 2028. Many Asia Pacific countries are undergoing significant infrastructure upgrades and modernization initiatives. This includes revamping aging power grids, which demands the integration of energy-efficient solutions such as power factor correction to reduce transmission losses and enhance grid stability. Furthermore, ongoing advancements in power factor correction technologies in the region are making them more efficient, cost-effective, and compact. This opens up new application areas and makes them accessible to a wider user base. This is set to drive the growth in this region during the studied period.

Middle East and Africa Market Insights

The power factor correction market in the Middle East and Africa region is anticipated to grow significantly by the end of the forecast period. Growth in the region is due to increasing government initiatives to improve electricity infrastructure and energy efficiency, especially in countries such as the United Arab Emirates and Saudi Arabia. Growing demand for electricity due to population growth is also driving the need for power factor correction systems in the region. Many MEA countries are experiencing rapid economic growth and investing heavily in infrastructure development. This comprises of expanding power grids constructing new industrial facilities, and building modern urban centers. All of these developments require efficient and reliable power supply where power factor correction play a significant role in minimizing energy losses and ensuring grid stability. This is predicted to drive the growth of the power factor correction market in the Middle East and Africa region during the projected period.

Power Factor Correction Market Players:

- Abb Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eaton Corporation

- Schneider Electric

- General Electric

- NAAC ENERGY CONTROLS

- WEG S.A.

- Texas Instruments Inc.

- TDK Electronics AG

- ON Semiconductor Components Industries LLC

- STMicroelectronics

Recent Developments

- In March 2021, Schneider Electric announced the launch of the new AccuSine PCSn active harmonic filter for low voltage applications, designed to help customers improve power quality, reduce energy waste and reduce operating costs.

- In May 2021, ABB introduced the new PQF800-T reactive power compensation module, designed to help improve power quality and reduce energy consumption in industrial and commercial applications.

- Report ID: 3305

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power Factor Correction Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.