Potassium-Sparing Diuretics Market Outlook:

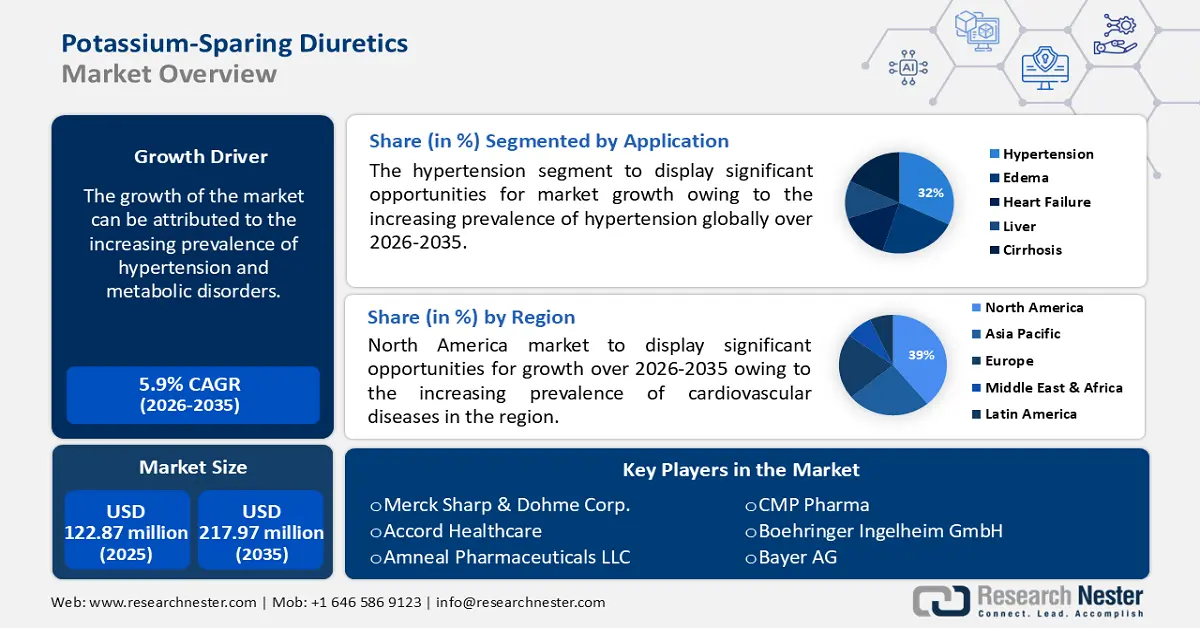

Potassium-Sparing Diuretics Market size was valued at USD 122.87 million in 2025 and is likely to cross USD 217.97 million by 2035, registering more than 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of potassium-sparing diuretics is estimated at USD 129.39 million.

The growth of the market can be attributed to the increasing prevalence of hypertension and metabolic disorders. According to WHO statistics, nearly 1.28 billion adults aged 30–79 worldwide suffer from hypertension, the majority (80%) living in low- and middle-income countries. According to the CDC, nearly half of Americans (46 percent, or 116 million) suffer from hypertension, which is defined as a systolic blood pressure over 130 mmHg or a diastolic blood pressure over 80 mmHg or are taking hypertension medications. Potassium-sparing diuretics help to reduce blood pressure by increasing the amount of potassium in the body. This helps to reduce the levels of sodium in the bloodstream, which in turn reduces the amount of fluid in the body and thus the pressure of the blood on the walls of the blood vessels.

In addition to these, factors that are believed to fuel the market growth of potassium-sparing diuretics include the increasing demand for better healthcare and innovations in the drug delivery system. Moreover, the growing number of investments in the healthcare sector and increased awareness of the availability and importance of these medications are also expected to contribute to market growth. The United States spent more than 17 percent of its GDP on healthcare in 2021. Nearly USD 28 billion was invested in the Indian healthcare sector between April 2000 and December 2021. Governments around the world are investing heavily in healthcare infrastructure and services, which is contributing to increased awareness of health and wellness, and in turn, driving the demand for potassium-sparing diuretics for a variety of ailments.

Key Potassium-Sparing Diuretics Market Insights Summary:

Regional Highlights:

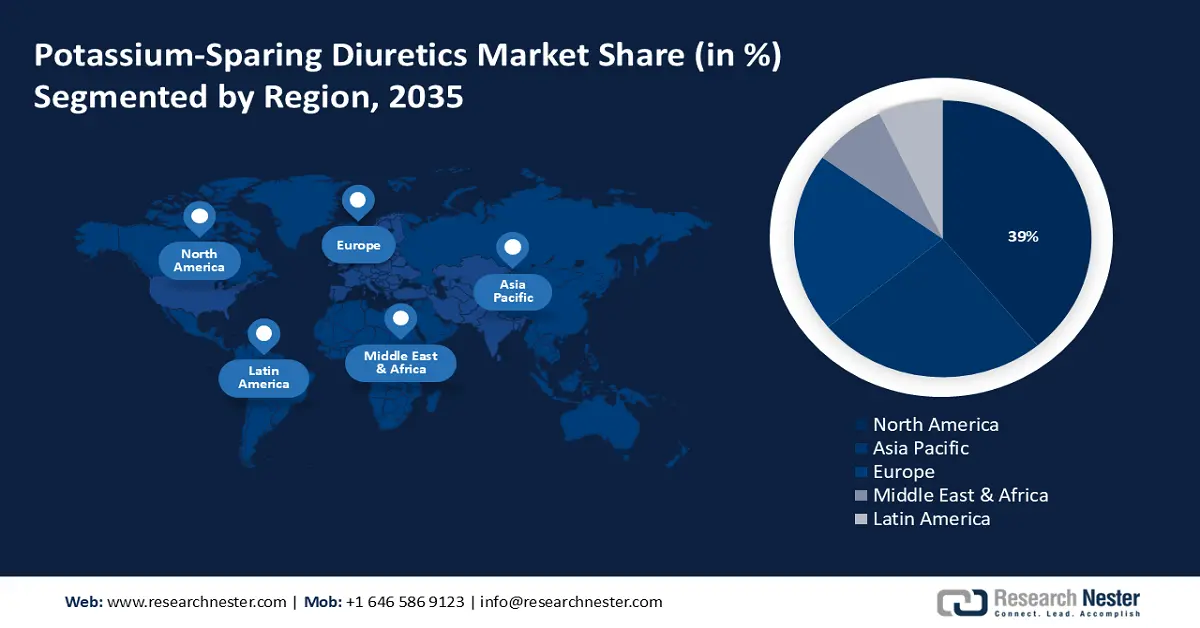

- By 2035, North America is anticipated to capture a 39% share of the potassium-sparing diuretics market, stemming from the increasing prevalence of cardiovascular diseases and the rising demand for safe and effective medicines.

- By 2035, the Asia Pacific region is expected to secure about 25% share, arising from the increasing populace of geriatrics suffering from chronic kidney diseases as well as hypertension and other cardiovascular diseases.

Segment Insights:

- By 2035, the hypertension segment in the potassium-sparing diuretics market is projected to command about 32% share, supported by the increasing prevalence of hypertension globally owing to rising obesity and unhealthy and sedentary lifestyle habits.

- By 2035, the hospital pharmacies segment is anticipated to hold nearly 29% share, bolstered by the increasing demand for generic drugs in hospitals, rising number of surgeries, and increasing spending capacity on healthcare in developing countries.

Key Growth Trends:

- Higher Rates of Obesity Among Adults

- Huge Number of People Suffering from Chronic Diseases

Major Challenges:

- Availability of generic alternatives

- High cost of potassium sparing diuretics

Key Players: Pfizer Inc., Merck Sharp & Dohme Corp., Accord Healthcare, Amneal Pharmaceuticals LLC, Centaur Pharmaceuticals Pvt. Ltd., Validus Pharmaceuticals LLC, Teva Pharmaceutical Industries Ltd., CMP Pharma, Boehringer Ingelheim GmbH, Bayer AG.

Global Potassium-Sparing Diuretics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 122.87 million

- 2026 Market Size: USD 129.39 million

- Projected Market Size: USD 217.97 million by 2035

- Growth Forecasts: 5.9%

Key Regional Dynamics:

- Largest Region: North America (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 19 November, 2025

Potassium-Sparing Diuretics Market - Growth Drivers and Challenges

Growth Drivers

- Higher Rates of Obesity Among Adults - There are approximately 1 in 11 adults (9.2%) who have severe obesity in the United States. There is a greater proportion of overweight men (34.1%) than overweight women (27.5%). With an increase in obesity, there is an increase in the risk of developing high blood pressure and heart disease which results in an increase in the need for medications like potassium-sparing diuretics. These medications work to lower the levels of sodium and water in the body, which can help reduce the risk of associated health problems.

- Huge Number of People Suffering from Chronic Diseases - According to estimates, 6 out of 10 Americans have a chronic disease. There are about 40 million Americans who are limited in their normal activities owing to chronic health issues. Potassium-sparing diuretics are medications used to treat high blood pressure, fluid retention, and other conditions caused by water retention. Their use is increasing owing to the rising prevalence of chronic diseases such as diabetes, hypertension, and heart failure, which increase the risk of fluid retention.

- A Growing Awareness Of Edema And Pulmonary Edema Prevalence - The prevalence of pulmonary edema among patients with heart failure is estimated to be 75000-83,000 cases per 100,000 individuals worldwide. Edema is swelling in the body caused by excess fluid trapped within the tissues. As more people become aware of edema, they are increasingly seeking treatments, such as diuretics, to reduce the excess fluid. Doctors are also becoming more aware of the condition, leading to earlier detection and better treatments.

- Increasing Incidence of Cirrhosis Among Adults - Cirrhosis is a chronic liver disease which is characterized by fibrosis and the formation of scar tissue. This causes the liver to not be able to function properly and can lead to a buildup of potassium in the body, which can be dangerous. Potassium-sparing diuretics help to flush out the excess potassium and can help to reduce the symptoms of cirrhosis. It is estimated that about one in four hundred adults in the United States have cirrhosis. The prevalence of cirrhosis is higher in adults between the ages of 45 and 54. Cirrhosis affects about one in every 200 Americans aged 45 to 54.

- A Rise In The Number Of Heart Failure Cases - The Centers for Disease Control and Prevention estimates that approximately 6.2 million Americans have heart failure. According to death certificates, heart failure contributed to 379,800 deaths in 2018 (13.4%). Potassium-sparing diuretics are used to treat congestive heart failure and other cardiac-related conditions as they help the body to eliminate excess fluid and sodium while preserving potassium. This helps to reduce the strain on the heart, which in turn can help to improve symptoms and increase quality of life.

Challenges

- Availability of generic alternatives - Generic drugs tend to be significantly cheaper than their brand-name counterparts, and since potassium-sparing diuretics are already relatively inexpensive, the presence of generics reduces the incentive for people to purchase the more expensive brand-name drugs. This results in a decrease in market growth for potassium-sparing diuretics.

- High cost of potassium-sparing diuretics

- Stringent regulations imposed by governments to control the usage of these drugs

Potassium-Sparing Diuretics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 122.87 million |

|

Forecast Year Market Size (2035) |

USD 217.97 million |

|

Regional Scope |

|

Potassium-Sparing Diuretics Market Segmentation:

Application Segment Analysis

The global potassium-sparing diuretics market is segmented and analyzed for demand and supply by application in edema, hypertension, heart failure, liver cirrhosis and others. Out of these, the hypertension segment is estimated to gain the largest market share of about 32% in the year 2035. The growth of the segment can be attributed to the increasing prevalence of hypertension globally owing to rising obesity and unhealthy and sedentary lifestyle habits. Approximately 60% of U.S. adults do not participate in the recommended amount of physical activity. It is estimated that 25 percent of U.S. adults are not physically active at all. Unhealthy lifestyle habits such as lack of physical activity, unhealthy dietary habits, smoking and alcohol consumption have been associated with increasing levels of obesity, which in turn increases the risk of hypertension. Additionally, increasing government initiatives for preventative healthcare and awareness about hypertension and its risk factors are also expected to contribute to the growth of this segment.

Distribution Channel Segment Analysis

The global potassium-sparing diuretics market is segmented and analyzed for demand and supply by distribution channel into hospital pharmacies, retail pharmacies, online pharmacies and others. Out of these, the hospital pharmacies segment is estimated to gain a significant market share of about 29% in the year 2035. The hospital pharmacies segment is expected to grow at a rapid pace owing to the increasing demand for generic drugs in hospitals, rising number of surgeries, and increasing spending capacity on healthcare in developing countries. Moreover, hospital pharmacies have access to more specialized equipment and a wider range of medications than regular pharmacies, which allows them to provide more tailored medication to their patients, resulting in a growing number of hospitals with specialty pharmacies. It was observed that more than 21% of hospitals have specialty pharmacies in 2018, up from less than 8% in 2016. Furthermore, rising investments in healthcare infrastructure and the presence of a large number of hospitals in urban and rural areas are also expected to drive the growth of the segment.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Potassium-Sparing Diuretics Market - Regional Analysis

North American Market Insights

North America industry is poised to dominate majority revenue share of 39% by 2035, The growth of the market can be attributed primarily to the increasing prevalence of cardiovascular diseases and the increasing demand for safe and effective medicines. The increasing acceptance of new technologies and the growing number of clinical trials for the development of new drugs and treatments as well as the growing investments in research and development activities by pharmaceutical and biotechnological companies, are also expected to aid in the growth of the market. A total of USD 83 billion was spent on R&D by the pharmaceutical industry in 2019 in the United States. Also, from 2010 to 2019, 59 novel drugs were approved for sale, a 60 percent increase over the previous decade. Companies are investing in research and development activities in order to develop newer and more effective potassium-sparing diuretics that can help those suffering from illnesses such as hypertension, congestive heart failure, and edema. Furthermore, the rising number of initiatives taken by governments and private organizations to create awareness about cardiovascular diagnostics and their treatments, are expected to fuel regional market growth.

APAC Market Insights

The Asia Pacific potassium-sparing diuretics market is estimated to be the second largest, registering a share of about 25% by the end of 2035. The growth of the market can be attributed majorly to the increasing populace of geriatrics suffering from chronic kidney diseases as well as hypertension and other cardiovascular diseases. The study indicated that the overall self-reported prevalence of diagnosed CVDs was 30% for older adults aged 45 and above in India. Also, as per WHO, China's population is ageing at the fastest rate in the world. Chinese citizens over 60 are expected to reach 28% by 2040. As people age, they often develop hypertension and other conditions that require diuretics to manage water retention. Potassium-sparing diuretics are preferred for elderly individuals as they are gentler on the kidneys and help retain potassium levels, which are important for proper functioning of the heart and other organs. In addition, increasing health awareness and initiatives by governments to control the prevalence of diabetes and hypertension, and the growing focus on preventive healthcare are expected to contribute to the growth of the Asia Pacific potassium-sparing diuretics market in the near future.

Europe Market Insights

Further, the potassium-sparing diuretics market in the Europe, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of this market can be attributed to the rising prevalence of lifestyle diseases such as hypertension and diabetes. A growing awareness of early diagnosis and treatment options among regional populations is expected to boost demand for potassium-sparing diuretics. As people become more aware of the early signs of kidney disease, they are more likely to seek medical attention and treatment. Potassium-sparing diuretics are becoming increasingly popular as they help to reduce the risk of developing kidney disease.

Potassium-Sparing Diuretics Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck Sharp & Dohme Corp.

- Accord Healthcare

- Amneal Pharmaceuticals LLC

- Centaur Pharmaceuticals Pvt. Ltd.

- Validus Pharmaceuticals LLC

- Teva Pharmaceutical Industries Ltd.

- CMP Pharma

- Boehringer Ingelheim GmbH

- Bayer AG

Recent Developments

-

A new FDA approval for Merck & Co., Inc., VERQUVO® (vericiguat) has been announced. heart failure (HF) hospitalization risk reduction with VERQUVO in adults with symptomatic chronic heart failure and a low ejection fraction (45%) after heart failure hospitalization or need for intravenous (IV) diuretics in adults.

-

In a joint announcement today, Boehringer Ingelheim GmbH and Eli Lilly and Company announced that Jadix® (empagliflozin) 10 mg has been approved by the U.S. Food and Drug Administration for the reduction of cardiovascular death and hospitalization associated with heart failure in adults with heart failure with reduced ejection fractions (HFrEF).

- Report ID: 3292

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Potassium-Sparing Diuretics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.