Potash Fertilizers Market Outlook:

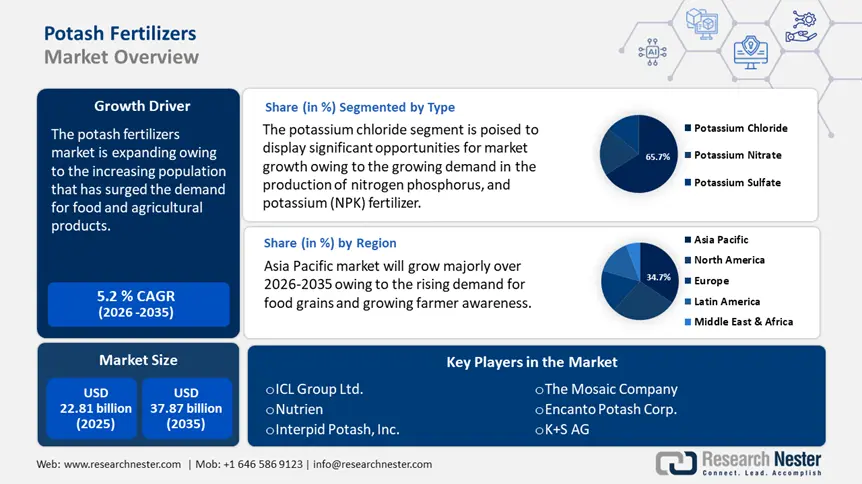

Potash Fertilizers Market size was valued at USD 22.81 billion in 2025 and is set to exceed USD 37.87 billion by 2035, expanding at over 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of potash fertilizers is estimated at USD 23.88 billion.

The global potash fertilizers market is witnessing a significant boom owing to the increasing population, which has surged the demand for food and agricultural products. To accommodate this demand, farmers boost crop yields and agricultural productivity. The Food and Agriculture Organization reported that the world's primary crop production increased by 54% between 2000 and 2021, reaching 9.5 billion tons in 2021, which were utilized as food, feed, or inputs to be converted into products including biofuels and cosmetics.

Potash is crucial for giving crops the nutrients they require to flourish. It improves nutrient absorption, root formation, and general plant growth. Additionally, the increased applicability of potash fertilizer and the growing demand for high-performance fertilizers contribute to an overall improvement in plant quality. It increases shelf life, which is another important reason propelling the potash fertilizers market.

Furthermore, the increasing global trade of agricultural products is substantially driving the potash fertilizers market, as countries strive to improve crop yields and maintain soil fertility to meet global food demand. With rising cross-border trade in staples like grains, fruits, and vegetables, farmers are under pressure to maximize production efficiency, leading to higher demand for potash fertilizers, which are essential for improving plant health, drought resistance, and crop quality.

Below is a graph representing the export and import of agricultural products:

The World Trade Organization (WTO) reports that agriculture product imports in 2022 were USD 1,550.15 billion, compared to USD 1191.4 billion in 2020, while exports were USD 1,488.14 billion, compared to USD 1160.9 billion in 2020.

Key Potash Fertilizer Market Insights Summary:

Regional Highlights:

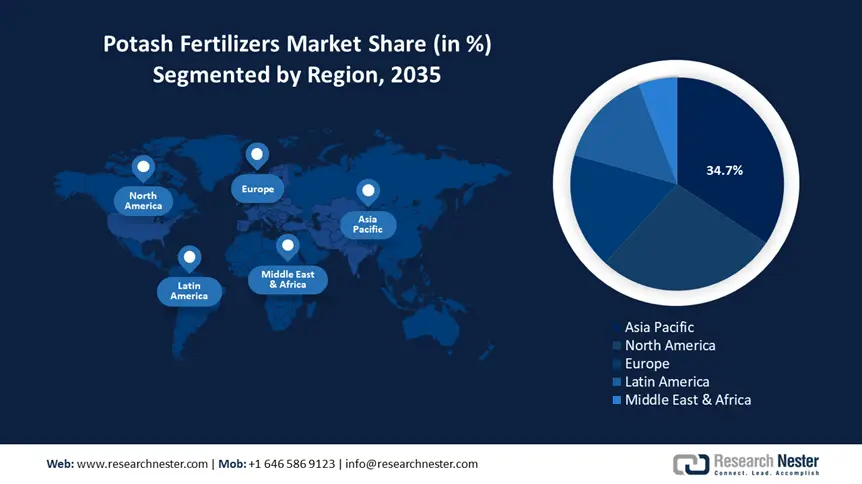

- Asia Pacific commands a 34.7% share of the Potash Fertilizers Market, driven by robust government initiatives and rising consumption of vegetable crops, positioning it as a key agricultural hub through 2026–2035.

- North America's Potash Fertilizers Market is set for significant growth through 2026–2035, fueled by precision agriculture, biofuel production, and balanced fertilization initiatives.

Segment Insights:

- Broadcasting segment is forecasted to hold a significant share by 2035, driven by its cost-effectiveness for large-scale farming applications.

- Potassium Chloride segment is anticipated to hold around a 65.7% share by 2035, driven by increased agricultural activity and demand for food.

Key Growth Trends:

- Emergence of advanced farming techniques

- Increased production of potash

Major Challenges:

- Challenges during large-scale manufacturing

- Fluctuating price of potash

- Key Players: ICL Group Ltd., Nutrien, Intrepid Potash, Inc., The Mosaic Company, Chambal Fertilisers and Chemicals Ltd., Encanto Potash Corp., EuroChem Group AG, Emmerson PLC, K+S AG, Acron Group..

Global Potash Fertilizer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.81 billion

- 2026 Market Size: USD 23.88 billion

- Projected Market Size: USD 37.87 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Canada, Russia, China, United States, Germany

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 12 August, 2025

Potash Fertilizers Market Growth Drivers and Challenges:

Growth Drivers

-

Emergence of advanced farming techniques: The necessity of cutting-edge technology such as artificial intelligence (AI) and the Internet of Things (IoT) in the agricultural industry is highlighted by smart farming systems. Using sensors and processors to boost speed and efficiency ensures that automation is achieved. Analysis of soil nutrients is a notable use of AI. This entails making fertilizer recommendations using soil NPK sensors and data stored in a cloud environment. AI can determine the soil's levels of potassium, phosphorus, and nitrogen and can indicate a specific fertilizer. It can also recommend the right amount of fertilizer and when to use it, which can help farmers save money on additional fertilizer and the associated labor. Mining is a crucial stage in the extraction of potash as it is mostly discovered deep within the earth's surface.

Additionally, advancements in controlled-release potash fertilizers and fertigation systems further enhance nutrient availability, driving their adoption among modern farmers. As agriculture becomes highly advanced, the demand for high-quality potash fertilizers continues to rise, supporting global food production and sustainability goals. Potash fertilizers ensure that plants can access potassium by replenishing it in the soil. Reduced yields can result from nutrient-depleted soils, and potash fertilizers promote soil fertility and nutrient balance, which supports sustainable food production. - Increased production of potash: As leading producers accelerate mining and processing capabilities, increased availability of potash fertilizers helps meet the global need for high-yield farming. Small quantities are also used in producing potassium-bearing chemicals including detergents, ceramics, pharmaceuticals, water conditioners, and alternatives to de-icing salt. The growth and maintenance of tissues, muscles, and organs as well as the electrical activity of the heart depend on potassium, which is a necessary component of the human diet. Potassium is an essential nutrient for people, animals, and plants that cannot be replaced. Also, expanding potash reserves and new mining projects in key regions reduce dependency on limited suppliers, fostering market competitiveness and price affordability.

Natural Resources Canada revealed that an estimated 67.5 million tons of potash were produced worldwide in 2023.

The table below shows the global production capacity of potash in 2023:

|

Ranking |

Country |

Production Capacity (thousand tons) |

Share (%) |

|

1 |

Canada |

21,875 |

32.4 |

|

2 |

Russia |

12,547 |

18.6 |

|

3 |

Belarus |

10,093 |

14.9 |

|

4 |

China |

6,267 |

9.3 |

|

5 |

Israel |

3,626 |

5.4 |

|

- |

Other Countries |

13,134 |

19.4 |

|

Total |

|

67,543 |

100.0% |

Source: Natural Resources Canada

Challenges

-

Challenges during large-scale manufacturing: Potash fertilizer is made in two ways: pelletization and compaction granulation. Attrition is a problem in the compaction granulation method because of the uneven surfaces and sharp edges that cause the granules to collide, changing their size and shape and producing a lot of unwanted potash fines and material waste. The main challenge in the pelletization method is maintaining the ideal moisture level throughout processing; moisture levels should be monitored during potash conditioning, pelletizing, and drying. The growing demand for organic farming, which restricts the use of mineral fertilizers, is another significant obstacle to the potash fertilizers market expansion.

- Fluctuating price of potash: The fluctuating prices of potash due to factors such as weather conditions, geopolitical influences, production costs, and downstream industries are impeding the growth of the potash fertilizers market. The Natural Resources Canada reported that potash prices fell between 2013 and 2016 and were low until 2020. Due to robust worldwide demand, prices increased significantly in 2021, reaching USD 807 per ton. Driven by the Russian invasion of Ukraine and geopolitical concerns, the spike persisted into 2022, reaching a peak of USD 1,202 a ton in April. Later in the year, prices leveled out but remained higher than historical averages. As concerns about global supplies diminished, prices dropped to USD 328 per ton by June 2023.

Potash Fertilizers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 22.81 billion |

|

Forecast Year Market Size (2035) |

USD 37.87 billion |

|

Regional Scope |

|

Potash Fertilizers Market Segmentation:

Type (Potassium Nitrate, Potassium Chloride, Potassium Sulfate)

Potassium chloride segment is poised to capture around 65.7% potash fertilizers market share by the end of 2035. The increase in agricultural activity is to blame for this. Commonly referred to as muriate of potash (MOP), potassium chloride is primarily utilized as a source of potassium and as a raw material for industrial applications in the production of nitrogen, phosphorus, and potassium (NPK) fertilizer. Global population growth creates a significant demand for food, which in turn boosts food production. As a result, the agricultural industry is increasingly relying on potash products to increase crop yields.

Global potash fertilizers market demand is significantly influenced by nations such as China and India. Protein, vitamin C, solid soluble sugars in fruits, and starch in grains and tubers are all enhanced by potassium. Additionally, it increases fruit size, reduces the frequency of pests and diseases, enhances fruit color and flavor, and improves storage and transportation quality.

Application (Foliar, Fertigation, Broadcasting)

The broadcasting segment in potash fertilizers market is poised to garner a significant share during the assessed period. One of the main factors driving the growth of the broadcasting sector is the fact that broadcasting applications use a lot less fertilizer than other methods, making them an inexpensive alternative for large-scale agricultural growers. The simplest way to apply potash fertilizer is by broadcasting. It involves evenly distributing liquid or dry potash across the soil's surface, usually before planting. Although this method is generally useful, it performs best at high application rates and rapid operations.

Our in-depth analysis of the global potash fertilizers market includes the following segments:

|

Type |

|

|

Form |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Potash Fertilizers Market Regional Analysis:

APAC Market Statistics

Asia Pacific in potash fertilizers market is projected to hold over 34.7% revenue share by the end of 2035. The market growth can be attributed to robust government initiatives, existing projects, and rising consumption of vegetable crops that require potash fertilizers to preserve their potassium content. The potash fertilizers market in this region is further driven by these factors, as well as rising demand for food grains and growing farmer awareness of the effective use of fertilizers to use land efficiently.

Furthermore, the potash fertilizers market is expanding in China owing to the country’s large-scale agricultural sector, government initiatives promoting balanced fertilization, and increasing demand for high-yield crops. As the world’s largest consumer of fertilizers, the nation relies heavily on potash to improve soil fertility and boost crop productivity, particularly for staple grains, fruits, and cash crops. Around 75% of China's cultivated area is used for food crops, with rice, maize, and wheat being the three main crops that account for more than 90% of China's total food production. Despite only 7% of the planet's arable land, China feeds 1.3 billion people or 19% of the world's population.

Additionally, China has been expanding its domestic potash production while maintaining significant import volumes to secure a stable supply. Moreover, the government’s support for sustainable farming practices, including reducing excessive nitrogen fertilizer use and promoting potassium-based alternatives, further accelerated demand.

Similarly, India's economy depends heavily on agriculture, but crop productivity is impacted by declining soil fertility. Appropriate fertilizer application is essential to improving soil fertility and productivity as well as reversing potassium depletion. The global potash fertilizers market is predicted to grow annually to address these issues. Additionally, the government’s push for self-sufficiency in food production, along with subsidies and import policies, has made potash fertilizers more accessible to farmers. Furthermore, the Indian Bureau of Mines revealed the potash resources in 2020 were 23,091 million tons, all of which fall under the category of remaining resources. About 89% of the total resources come from Rajasthan alone, with Madhya Pradesh coming in second with 5% and Uttar Pradesh with 4%.

Additionally, with unpredictable monsoons and climate change affecting traditional farming, there is a growing shift towards precision agriculture and protected cultivation, further driving demand for potash-based fertilizers.

North America Market Analysis

The North America potash fertilizers market is expected to grow at a significant rate during the projected period. The North American market is primarily driven by the U.S. and Canada, whose agricultural industries are sizable and serve a wide variety of crops. The production of major crops such as corn, soybeans, wheat, and canola are essential to the region's demand, and the adoption of precision agriculture and cutting-edge farming methods further increases the need for potash in North America.

The Government of the U.S. initiatives promoting balanced fertilization and technological advancements in fertilizer application, such as controlled-release formulations and fertigation systems, are driving market growth. While the U.S. produced potash domestically, it also depends on imports from Canada, ensuring a stable supply. Furthermore, the market is growing in the nation owing to the country’s large-scale commercial farming, increasing crop yields, and expanding biofuel production. The U.S. Energy Information Administration reported that the nation's capacity to generate biofuels grew by 7% in 2023, reaching 24 billion gallons annually (gal/y) by the beginning of 2024. This growth was driven by a 44% increase in a category we refer to as renewable diesel and other biofuels.

Correspondingly, Canada is the world’s largest producer and exporter of potash, supported by vast reserves in Saskatchewan. Natural Resources Canada indicated that with an estimated 22.8 million tons shipped in 2023—more than 41% of global exports—Canada leads the world in potash exports. The U.S. accounted for 46% of Canadian potash exports, followed by Brazil (19%) and China (8%). Additionally, the nation benefits from advanced mining technologies and sustainable extraction practices, ensuring a stable supply of potash fertilizers.

Key Potash Fertilizers Market Players:

- ICL Group Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nutrien

- Intrepid Potash, Inc.

- The Mosaic Company

- Chambal Fertilisers and Chemicals Ltd.

- Encanto Potash Corp.

- EuroChem Group AG

- Emmerson PLC

- K+S AG

- Acron Group

The potash fertilizers market is expected to continue to grow as a result of major industry changes, such as new product releases, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Potash fertilizers industry competitors must offer affordable products to grow and stay in a market that is becoming highly competitive. Leading market players are investing in research and development to expand their product portfolios.

Some major players leading the potash fertilizers market include:

Recent Developments

- In August 2024, ICL, a leading worldwide specialty minerals company, signed a five-year agreement with AMP Holdings Group Co. Ltd., one of China's largest agricultural distribution organizations. The agreement, valued at approximately USD 170 million, will last until 2028 and advances ICL's stated goal of expanding its Growing Solutions product offerings and positioning the company for future growth in major end markets.

- In June 2022, Nutrien announced that it intends to increase fertilizer production capacity in response to structural changes in the global energy, agriculture, and fertilizer markets. In response to supply concerns from Eastern Europe, Nutrien is ramping up its annual potash production potential to 18 million tonnes by 2025, which is more than 5 million tonnes (40 percent) more than we produced in 2020.

- Report ID: 7343

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Potash Fertilizer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.