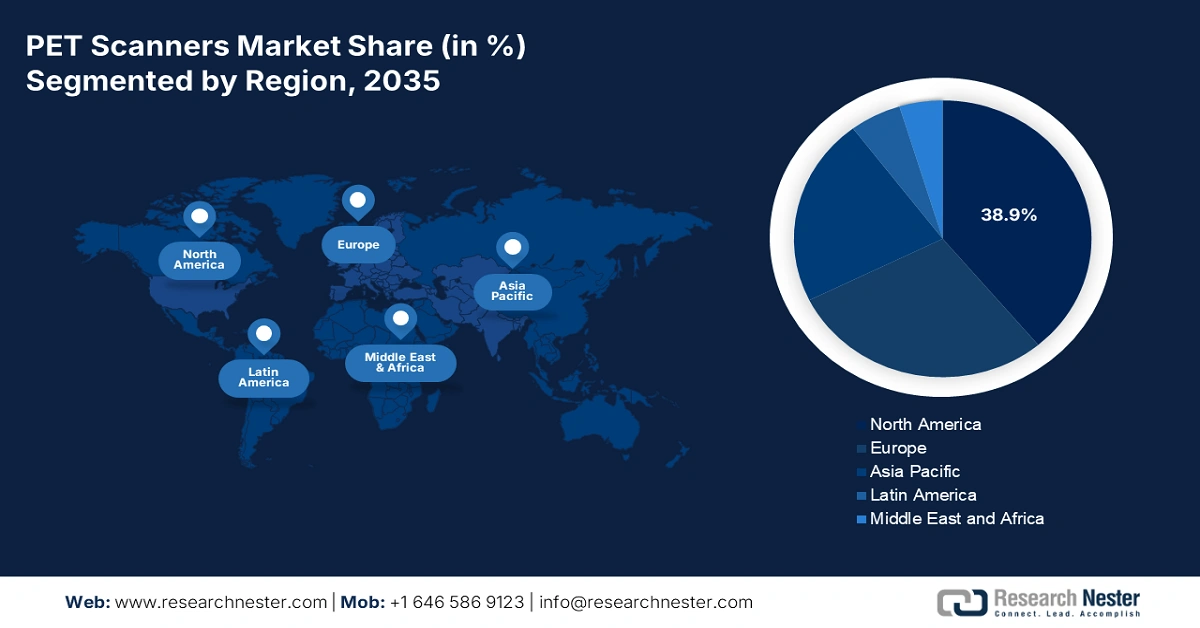

PET Scanners Market - Regional Analysis

North America Market Insights

North America is the dominating region in the PET scanners market and is expected to hold a share of 38.9% at a CAGR of 6.3% by 2035. The region is driven by a rising ageing population, growing chronic disease burden, and robust government funding programs. The U.S. retains and adopts advanced radiology infrastructure, Medicare/Medicaid reimbursements, and NIH-funded research on imaging. Canada supports this growth via robust provincial healthcare funding and centralized public hospital procurement in high-capacity sectors. Both countries are also benefiting from local PET radiotracer manufacturing and investment in digital PET technologies. Also, public-private partnerships between research institutions and medical universities are driving the adoption of AI-enabled PET systems in oncology and neurology.

The PET scanners market in the U.S. is expanding due to the strong diagnostic imaging infrastructure and strong government support. As per the NIH report in 2025, the National Institutes of Health (NIH) allocated approximately USD 440.6 million in fiscal year 2025 to the National Institute of Biomedical Imaging and Bioengineering, which primarily funds biomedical imaging research, including advanced medical imaging technologies. Medicare expenditure on PET scans increased between 2020 and 2024, after the eligibility was widened for oncology and neurodegenerative diagnostics. The American Medical Association and PhRMA increased collaboration between drug developers and device makers to enable PET-based diagnostics. These trends are supported by the aging population and Alzheimer's cases, with PET becoming a key for early intervention.

Rising Cost of Cancer in the U.S.

|

Year |

Cost |

|

2015 |

USD 183 billion |

|

2025 |

USD 222 billion |

|

2030 |

USD 246 billion |

Source: NIHCM, December 2024

APAC Market Insights

The Asia-Pacific is the fastest-growing market for PET scanners and is likely to command a largest share in 2035. The region is fueled by rising cancer incidence, neurodegenerative disease burden, and expanding health infrastructure. Japan and China together command the largest regional revenue share, along with high government support. Moreover, a July 2024 NLM report says that 319 institutes in China conduct PET examinations, with 314 PET/CT scanners in 30 provinces. Key trends in the region are focusing on digital PET technology and localizing the supply of radiotracer, and changes in reimbursement to improve access.

Japan is dominating the PET scanners market in the Asia Pacific region. The NLM report in April 2024 depicted that nearly 389 PET scans were performed in 2022 which is later increased to 412. The Japan Agency for Medical Research and Development (AMED) has also co-funded PET-MRI development projects to promote early Alzheimer's and cancer detection among aging populations. The rise in investment has made Japan a leading center for PET development and clinical research in Asia. Ongoing government-industry cooperation should continue to boost availability and diagnostic precision nationwide.

Europe Market Insights

The PET scanners market in Europe is expanding rapidly and is fueled by rising aging populations, high incidence of cancer rates, and growing demand for accurate diagnostics. Technological advancements such as digital PET and hybrid PET/MRI systems are further fueling market growth. Further, the EU Commission has allocated over €810 million for health digitalization projects, which includes €280 million under the EU4Health Programme and additional funding via the Digital Europe Programme, Connecting Europe Facility, and Horizon Europe, based on European Commission data published in September 2025. PET scanners are vital to oncology and neurology imaging programs, which are funded via national budgets and EU-wide plans for health modernization.

Germany is the largest shareholder in the PET scanners market in Europe. The country is driven by the rising cancer cases in YoY. The Federal Ministry of Health has stated that the country has spent a considerable amount on PET infrastructure in 2024, with new machines installed under public-private partnership models. The German Medical Association highlights PET’s vital role in national cancer care guidelines, mainly for breast and prostate cancer detection. The integration of Germany’s PET diagnostics in primary care hospitals surges the dominance in regional market.