PET Scanners Market Outlook:

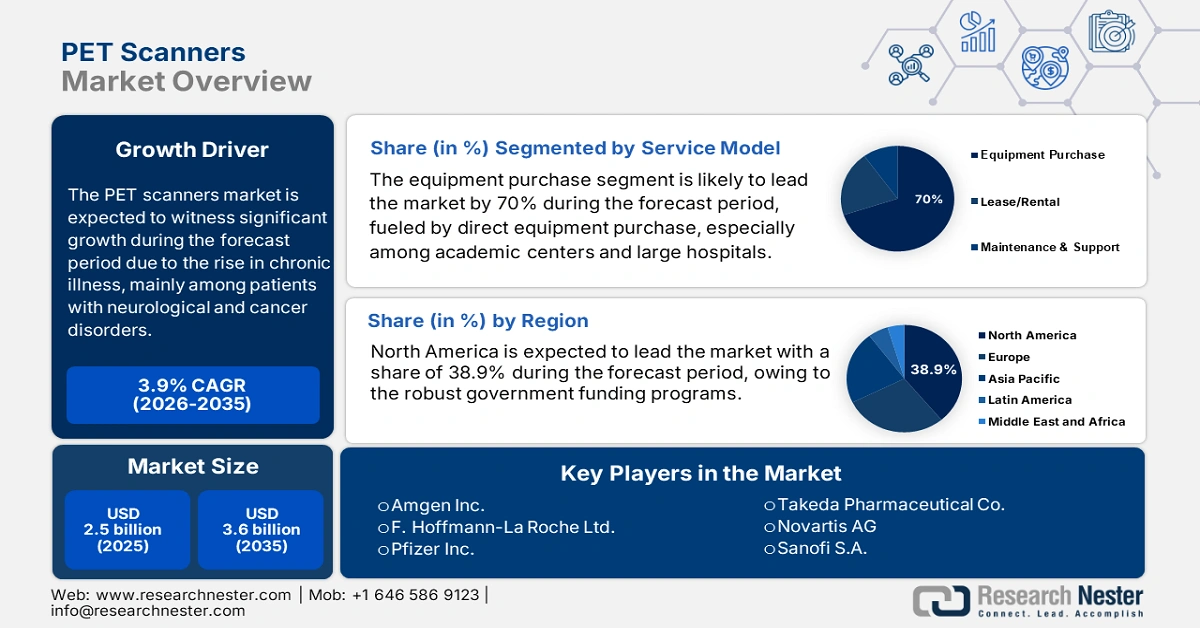

PET Scanners Market size was valued at USD 2.5 billion in 2025 and is projected to reach USD 3.6 billion by the end of 2035, rising at a CAGR of 3.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of PET scanners is assessed at USD 2.6 billion.

The global PET scanners market is expanding due to the rising burden of chronic illness, mainly among patients with neurological and cancer disorders. According to the WHO February 2024 report, 1 in 5 people develop cancer, with nearly 1 in 9 men and 1 in 12 women dying from cancer, which is a vital driver for advanced imaging systems, including PET scanners. Further, Alzheimer's disease is also an important diagnosis requiring PET scanners. As per the NLM report published in May 2024, above 6.9 million patients in the U.S. are affected by Alzheimer's disease in 2024, which is expected to double in the upcoming years. This rise in patient volume is impacting the procurement rates for PET scanners in major diagnostic centers and healthcare systems.

On the supply chain side, the manufacturing of PET scanners is driven by both radiopharmaceutical tracer logistics and medical device components. Nuclear materials used in PET tracers are subject to regulatory control, according to the U.S. Energy Information Administration and the FDA, and delays in isotope manufacturing, such as molybdenum-99, in 2023 affected diagnostic scheduling. As per the FDA report in 2023, nearly 21 PET drugs are approved by the FDA in the U.S., and more than 50 new PET drugs are in development as companion imaging agents for theranostic agents. These values highlight the growth and demand for the market.

Key PET Scanners Market Insights Summary:

Regional Highlights:

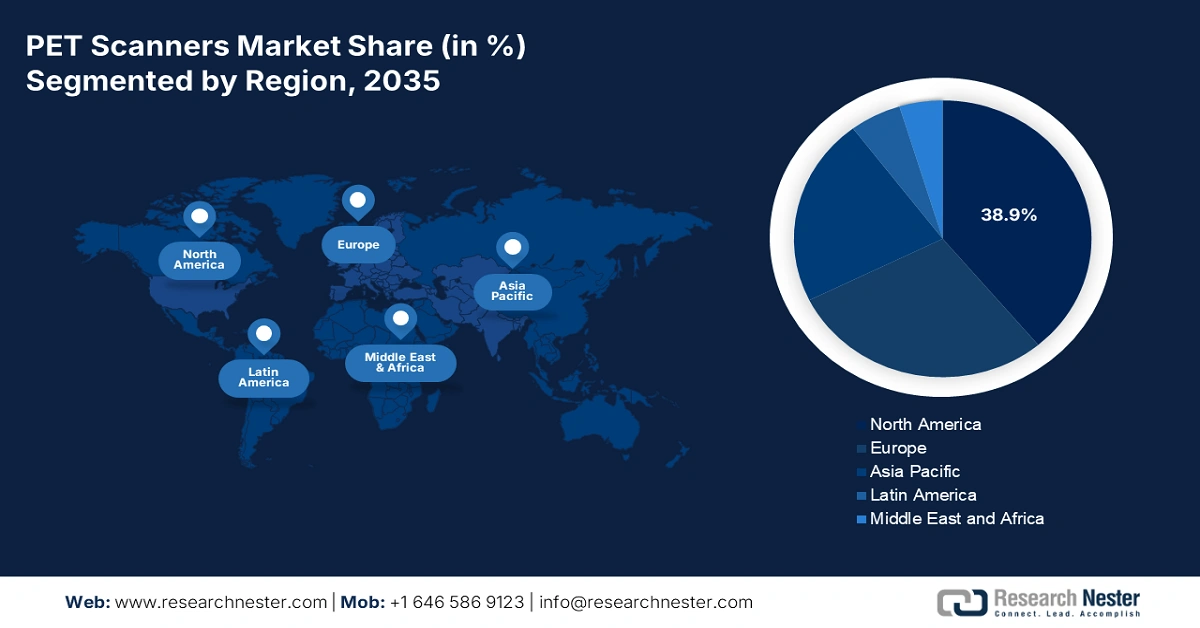

- North America is projected to secure a 38.9% share of the PET scanners market by 2035, upheld by a rising ageing population and strong government-backed imaging investments.

- Asia-Pacific is expected to capture the largest share by 2035, supported by escalating cancer incidence and expanding diagnostic infrastructure.

Segment Insights:

- By 2035, the equipment purchase segment in the PET scanners market is poised to attain a 70% share, propelled by direct procurement across major hospitals and academic centers.

- The oncology sub-segment is expected to retain a dominant share by 2035, reinforced by its high sensitivity in cancer staging.

Key Growth Trends:

- Rising patient pool with chronic diseases

- Hybrid imaging and advancements in technology

Major Challenges:

- Affordability criteria in the developing country

Key Players: Siemens Healthineers AG, GE HealthCare Technologies Inc., Canon Medical Systems Corporation, Philips Healthcare, Shimadzu Corporation, United Imaging Healthcare, Positron Corporation, Neusoft Medical Systems, Mediso Medical Imaging Systems, Cubresa Inc., Molecubes, Spectrum Dynamics Medical, Nuctech Company Ltd., iSOTOPE LLC, Adani Medical Technologies, INUMAC, ScintCare Medical, Medha Servo Drives Pvt. Ltd., Cyclomedica, DGIST (Daegu Gyeongbuk Institute of Science & Tech).

Global PET Scanners Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.5 billion

- 2026 Market Size: USD 2.6 billion

- Projected Market Size: USD 3.6 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Italy, Australia

Last updated on : 25 September, 2025

PET Scanners Market - Growth Drivers and Challenges

Growth Drivers

- Rising patient pool with chronic diseases: neurodegenerative and cancer diseases are driving the PET demand. In the U.S., nearly 2,041,910 new cases are registered in 2025, requiring PET scans, based on the NCI report in May 2025. Further in Europe, the aging population affected by Alzheimer’s disease has increased. This rising patient pool has increased the adoption of PET scanners for treatment planning and early diagnosis, mainly in the neurology and oncology sectors. Moreover, the reimbursement in these cases from Medicare and European national health systems has surged the installation of advanced scanners across hospitals and diagnostic centers.

- Hybrid imaging and advancements in technology: Companies are advancing their PET scans with AI-enabled image analysis, and digital PET or CT analysis to improve the diagnostic precision. Companies like Siemens Healthineers’ Biograph Vision Quadra in 2023 have provided scan results faster with 10 times higher effective sensitivity and lower radiation. Companies are nowadays actively investing in AI and hybrid systems to dominate the market. These innovations are improving the patient throughput and expanding the PET application in infectious diseases and cardiology sectors. Manufacturers are making strategic collaborations with AI developers and research institutions to drive precision medicine initiatives and personalized diagnostics.

- Strong government spending and reimbursement guidelines: Government funding for Medicare and Medicaid is propelling the PET scanner adoption. Medicare expenditure in 2023 on PET scans has grown, affecting the increasing demand for diagnostics. FDA has widened the approvals for PET in neurology and oncology increases the reimbursement. The CMS announcement in 2022 to cover amyloid PET scans for Alzheimer's has increased access. In addition, nations such as Germany and Japan have amplified the public expenditure on advanced imaging. Further, to improve the market penetration, the manufacturers are concentrating on harmonizing with the reimbursement policies.

Leading Cancer Sites in 2022

|

Rank |

Males – Leading Cancer Sites |

% Share |

Females – Leading Cancer Sites |

% Share |

|

1 |

Lung |

10.6% |

Breast |

28.8% |

|

2 |

Mouth |

8.4% |

Cervix |

10.6% |

|

3 |

Prostate |

6.1% |

Ovary |

6.2% |

|

4 |

Tongue |

5.9% |

Corpus Uteri |

3.7% |

|

5 |

Stomach |

4.8% |

Lung |

3.7% |

Source: NLM, March 2023

Cancer Death Rate by Type in 2021

|

Type |

Death Rate |

|

Lung, trachea and bronchus |

25.6 |

|

Colon and rectum |

13.2 |

|

Stomach |

12.1 |

|

Breast |

8.5 |

|

Esophageal |

6.8 |

|

Pancreas |

6.4 |

Source: Our World in Data, 2021

Challenges

- Affordability criteria in the developing country: In India, limited hospitals have PET scanners, as they are too expensive. United Imaging introduced a system that captures most of the market share. Limited insurance coverage and high out-of-pocket costs limit patient access to advanced diagnostics. Public-private partnerships are being considered for subsidizing scan prices and expanding infrastructure. As domestic production scales, the affordability is expected to rise, hence unlocking growth opportunities in tier-2 and tier-3 cities.

PET Scanners Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 2.5 billion |

|

Forecast Year Market Size (2035) |

USD 3.6 billion |

|

Regional Scope |

|

PET Scanners Market Segmentation:

Service Model Segment Analysis

Equipment purchase leads the segment and is poised to hold the share value of 70% by 2035. The segment is driven by direct equipment purchase, mainly in large hospitals and academic centers. The U.S. Department of Veterans Affairs and Health Resources and Services Administration continue to invest in diagnostic equipment, including PET scan systems, under the federal modernization programs. Further, the direct ownership benefits in reducing the operational costs and enables a seamless integration in IT systems and radio pharmacies. As PET imaging is vital for multi-disciplinary care, institutions prefer open purchase to ensure the availability for long-term, control maintenance charges, and eligibility for depreciation-related tax incentives under the U.S. federal guidelines.

Application Segment Analysis

The oncology sub-segment dominates and is expected to hold a significant share value by 2035. The segment is driven due to the modality’s high sensitivity in cancer staging. As per the WHO report in February 2024, 77% of cancer cases are expected to rise in the upcoming years, highlighting the growing demand. PET imaging is significant in managing breast, colorectal, lung, and lymphoma cases. According to Centers for Medicare and Medicaid Services data, multiple PET scan procedures are performed for oncology-related CPT codes, enhancing outpatient and hospital access. Further, the clinical and policy trends freeze the oncology leadership from continuing the use of the PET scanners application globally.

End user Segment Analysis

Hospitals lead the end user segment and are poised to hold the considerable share value by 2035. The segment is driven due to their process in accessing capital budgets and comprehensive patient care. As per the AHRQ report, the integration of PET-CT has expanded across the U.S. hospital systems for neurology and oncology diagnosis. Further, the MOHFW report depicts that the government intends to build 200 Day Care Cancer Centers by 2025 to 2026 in all district hospitals throughout in the next three years. These institutions address the accreditation standards for enhancing the imaging reimbursement and enabling consistent patient throughput.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Detector Technology |

|

|

Application |

|

|

End user |

|

|

Service Model |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

PET Scanners Market - Regional Analysis

North America Market Insights

North America is the dominating region in the PET scanners market and is expected to hold a share of 38.9% at a CAGR of 6.3% by 2035. The region is driven by a rising ageing population, growing chronic disease burden, and robust government funding programs. The U.S. retains and adopts advanced radiology infrastructure, Medicare/Medicaid reimbursements, and NIH-funded research on imaging. Canada supports this growth via robust provincial healthcare funding and centralized public hospital procurement in high-capacity sectors. Both countries are also benefiting from local PET radiotracer manufacturing and investment in digital PET technologies. Also, public-private partnerships between research institutions and medical universities are driving the adoption of AI-enabled PET systems in oncology and neurology.

The PET scanners market in the U.S. is expanding due to the strong diagnostic imaging infrastructure and strong government support. As per the NIH report in 2025, the National Institutes of Health (NIH) allocated approximately USD 440.6 million in fiscal year 2025 to the National Institute of Biomedical Imaging and Bioengineering, which primarily funds biomedical imaging research, including advanced medical imaging technologies. Medicare expenditure on PET scans increased between 2020 and 2024, after the eligibility was widened for oncology and neurodegenerative diagnostics. The American Medical Association and PhRMA increased collaboration between drug developers and device makers to enable PET-based diagnostics. These trends are supported by the aging population and Alzheimer's cases, with PET becoming a key for early intervention.

Rising Cost of Cancer in the U.S.

|

Year |

Cost |

|

2015 |

USD 183 billion |

|

2025 |

USD 222 billion |

|

2030 |

USD 246 billion |

Source: NIHCM, December 2024

APAC Market Insights

The Asia-Pacific is the fastest-growing market for PET scanners and is likely to command a largest share in 2035. The region is fueled by rising cancer incidence, neurodegenerative disease burden, and expanding health infrastructure. Japan and China together command the largest regional revenue share, along with high government support. Moreover, a July 2024 NLM report says that 319 institutes in China conduct PET examinations, with 314 PET/CT scanners in 30 provinces. Key trends in the region are focusing on digital PET technology and localizing the supply of radiotracer, and changes in reimbursement to improve access.

Japan is dominating the PET scanners market in the Asia Pacific region. The NLM report in April 2024 depicted that nearly 389 PET scans were performed in 2022 which is later increased to 412. The Japan Agency for Medical Research and Development (AMED) has also co-funded PET-MRI development projects to promote early Alzheimer's and cancer detection among aging populations. The rise in investment has made Japan a leading center for PET development and clinical research in Asia. Ongoing government-industry cooperation should continue to boost availability and diagnostic precision nationwide.

Europe Market Insights

The PET scanners market in Europe is expanding rapidly and is fueled by rising aging populations, high incidence of cancer rates, and growing demand for accurate diagnostics. Technological advancements such as digital PET and hybrid PET/MRI systems are further fueling market growth. Further, the EU Commission has allocated over €810 million for health digitalization projects, which includes €280 million under the EU4Health Programme and additional funding via the Digital Europe Programme, Connecting Europe Facility, and Horizon Europe, based on European Commission data published in September 2025. PET scanners are vital to oncology and neurology imaging programs, which are funded via national budgets and EU-wide plans for health modernization.

Germany is the largest shareholder in the PET scanners market in Europe. The country is driven by the rising cancer cases in YoY. The Federal Ministry of Health has stated that the country has spent a considerable amount on PET infrastructure in 2024, with new machines installed under public-private partnership models. The German Medical Association highlights PET’s vital role in national cancer care guidelines, mainly for breast and prostate cancer detection. The integration of Germany’s PET diagnostics in primary care hospitals surges the dominance in regional market.

Key PET Scanners Market Players:

- Siemens Healthineers AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE HealthCare Technologies Inc.

- Canon Medical Systems Corporation

- Philips Healthcare

- Shimadzu Corporation

- United Imaging Healthcare

- Positron Corporation

- Neusoft Medical Systems

- Mediso Medical Imaging Systems

- Cubresa Inc.

- Molecubes

- Spectrum Dynamics Medical

- Nuctech Company Ltd.

- iSOTOPE LLC

- Adani Medical Technologies

- INUMAC

- ScintCare Medical

- Medha Servo Drives Pvt. Ltd.

- Cyclomedica

- DGIST (Daegu Gyeongbuk Institute of Science & Tech)

The global PET scanners market is dominated by the leading players such as Siemens Healthineers and GE HealthCare, which together capture the one-third of the market share via advanced PET/CT innovation and strong distribution around the globe. Japan and Europe firms are highly investing in AI-enabled and digital PET systems. Companies undergo strategic initiative such as joint ventures, rising R&D investment and geographic expansion in hybrid imaging. Regional players and startups in India, Malaysia, and South Korea are aiming on low cost effective and modular design to aid the underserved markets. Further, the U.S. NIH grants and EU-funded public private partnerships surge the innovation across the globe.

Here is a list of key players operating in the market:

Recent Developments

- In June 2025, Scotland’s first total-body PET scanner is launched and used in various hospitals, now benefiting patients to speed up diagnosis, treatment, and clinical trials across the UK. While comparing with other machines, the newly launched machine is 40 times more sensitive, 10 times faster, and can scan 50% of patients per day.

- In May 2025, GE HealthCare developed and launched Omni Legend, which is the advanced PET-CT scanner using artificial intelligence to detect tumors as small as 1.4 millimeters, which was introduced in Gurugram.

- In April 2024, CDL Nuclear Technologies introduced the latest innovation, the Mobile dedicated cardiac PET/CT trailer, which is used to transform cardiac care by directly providing state-of-the-art cardiac PET/CT imaging services to medical facilities on their schedule.

- Report ID: 203

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

PET Scanners Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.