Portable Ultrasound Devices Market Outlook:

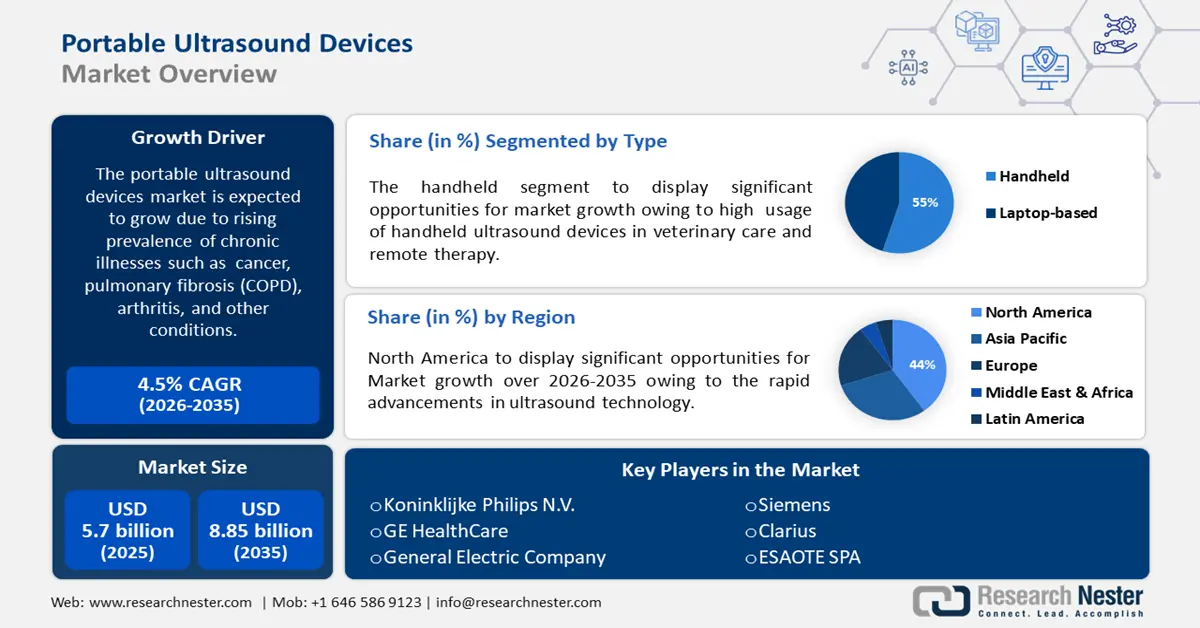

Portable Ultrasound Devices Market size was over USD 5.7 billion in 2025 and is poised to exceed USD 8.85 billion by 2035, witnessing over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of portable ultrasound devices is estimated at USD 5.93 billion.

The growth of the portable ultrasound devices market can be attributed to the increasing number of chronic illnesses like cancer, pulmonary fibrosis (COPD), arthritis, and other conditions across the globe. According to estimates from the American Cancer Society for 2022, stomach cancer accounts for around 1.5% of all newly diagnosed malignancies in the U.S. annually. The prevalence of these diseases over the years has resulted in a growing need for surgical interventions, including ultrasound devices for early detection and diagnosis.

Several businesses, including GE Healthcare, Philips, MinXray, and others, are adopting strategic alliances such as partnerships, joint ventures, mergers and acquisitions, and product launches to enhance their product base and maintain their dominance in the market. In November 2023, MinXray introduced a cordless handheld ultrasound gadget. Doctors found this gadget useful for a variety of tasks, including obstetrics examinations, mass evaluations, home health screenings, and blood flow velocity measurements.

Key Portable Ultrasound Devices Market Insights Summary:

Regional Highlights:

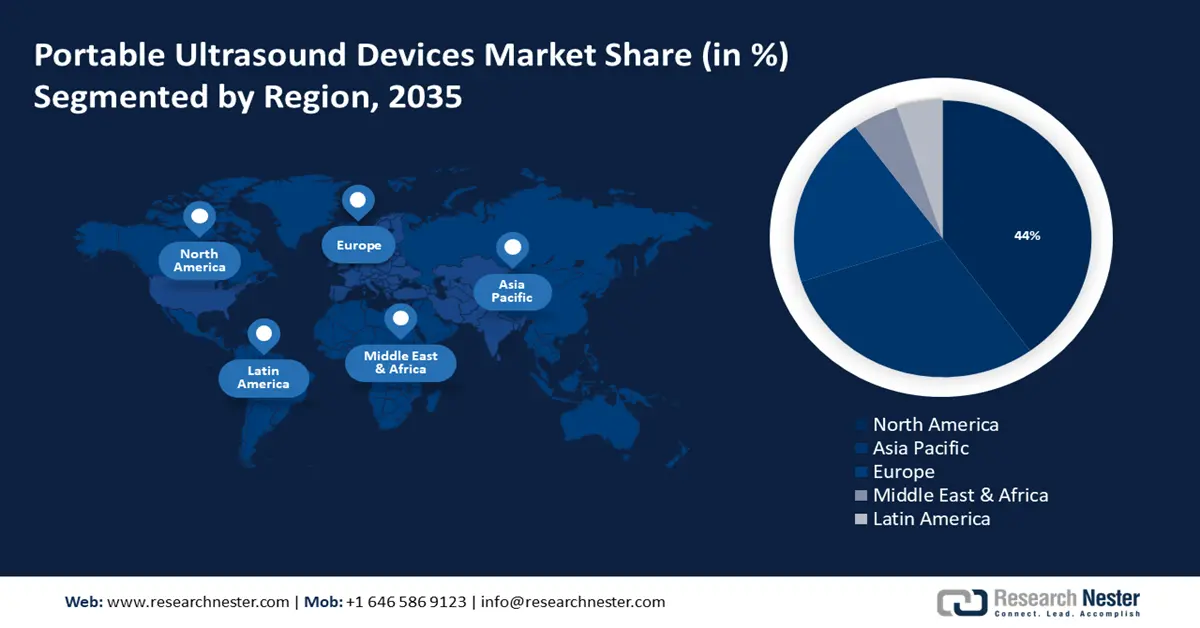

- The North America portable ultrasound devices market will secure over 44% share by 2035, driven by rising demand for precise diagnostic imaging and chronic illness prevalence.

Segment Insights:

- The handheld portable ultrasound devices segment in the portable ultrasound devices market is projected to secure a 55% share by 2035, fueled by the increase in chronic illnesses and demand for portable diagnostic equipment.

- The obstetrics/gynecology segment in the portable ultrasound devices market is poised for substantial growth till 2035, driven by the global increase in procedures to deliver babies and government efforts in women’s health.

Key Growth Trends:

- Rising prevalence of accidents

- New product launches

Major Challenges:

- Issues with regulatory reform in conjunction with limited compensation

- Delay in product approvals and shortage of sonographers

Key Players: GE HealthCare, General Electric Company, Siemens, Clarius, Shenzhen Mindray Bio-medical Electronics Co., Ltd., BenQ, ESAOTE SPA, Butterfly Network, Inc.

Global Portable Ultrasound Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.7 billion

- 2026 Market Size: USD 5.93 billion

- Projected Market Size: USD 8.85 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Portable Ultrasound Devices Market Growth Drivers and Challenges:

Growth Drivers

- Rising prevalence of accidents: Road accident cases are significantly increasing owing to reckless driving and over speeding. In the year 2023, the World Health Organization (WHO) estimated that globally 1.19 million people will lose their lives in traffic accidents each year and about 20-50 million people will suffer from non-fatal injuries brought on by accidents. The demand for portable ultrasound devices is increasing due to the rising number of emergency operations.

- New product launches: The introduction of new products into the market is one of the key elements anticipated to propel market growth over the forecast period. In recent years, there has been an increase in product launches to cater to rising need for technologically advanced and handy ultrasound devices. In July 2023, Konica Minolta Healthcare Americas, Inc. announced the launch of PocketPro H2, a handheld wireless device for general imaging for point-of-care settings.

Challenges

- Issues with regulatory reform in conjunction with limited compensation: The restricted reimbursement for medical imaging is one of the restraints that is anticipated to restrict the growth of the global market during the forecast period. For example, reimbursement for operations involving portable ultrasonography is only given if the usage satisfies all standards specified by that specific payer. Additionally, as medical ultrasonography is a relatively new technique, it is sometimes classified as investigative and is not covered by the CPT code list.

- Delay in product approvals and shortage of sonographers: The market for portable ultrasound devices is anticipated to grow steadily due to the non-approval of medical products including ultrasound systems. Moreover, severe shortage of laboratory and medical experts due to poor pay and rising workloads in many developing economies is expected to hamper overall market growth during the forecast period.

Portable Ultrasound Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 5.7 billion |

|

Forecast Year Market Size (2035) |

USD 8.85 billion |

|

Regional Scope |

|

Portable Ultrasound Devices Market Segmentation:

Type Segment Analysis

The handheld segment is poised to capture about 55% portable ultrasound devices market share in the year 2035. The increase in chronic illnesses and the expanding use of portable diagnostic equipment, including ultrasound devices are the main factors driving this segment’s growth. In the US, an estimated 129 million people suffer from at least one serious chronic illness. The increased awareness of veterinary care and remote therapy has propelled the development of handheld ultrasound equipment. The segment is booming due to the improved image quality carried by ongoing technological advancements.

Application Segment Analysis

The obstetrics/gynecology segment in the portable ultrasound devices market is expected to account for 45% share in the forecast period owing to the global increase in the number of procedures performed to deliver babies. The need for portable ultrasound equipment has grown due to an increase in hysterectomies, ovarian cyst removal, and uterine infection cases. For instance, in 2021, research conducted by Centers for Disease Control and Prevention (CDC) stated that 2.8% of women between the age of 18 and 44 had hysterectomy. This number increased to 22.1% for women in the 45-64 age group, 35.0% for women in the 65-74 age group, and 41.8% for women in the 75+ age group.

Furthermore, as laparoscopy is used more often in gynecologic procedures, there is a greater need for portable ultrasonography equipment. The segment’s expansion is due to the increasing government efforts in women's health and child care. In October 2021, the Ministry of Health and Social Services received 16 portable ultrasound machines valued at USD 503.94 from WHO, with assistance from the Japanese government.

Our in-depth analysis of the portable ultrasound devices market includes the following segments:

|

Type |

|

|

Application |

|

|

Technology |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Portable Ultrasound Devices Market Regional Analysis:

North America Market Insights

North America industry is expected to account for largest revenue share of 44% by 2035. The increased use of portable ultrasounds, which are equipped with cutting-edge technology, is one of the contributing factors to the large market share. The ongoing need for precise medical imaging due to the rising incidence of serious diseases and malignancies is another important factor boosting market growth in this region. The Global Cancer Observatory (GLOBOCAN) projected that 2,281,658 new cases of cancer would be reported in the U.S. in 2020.

The market’s growth in U.S. can be attributed to presence of strong healthcare system, developments in diagnostic technology, and increasing chronic illnesses. Moreover, over 40% of adults in the U.S have a chronic illness, and over 23% of these patients require hospitalization. The expansion of the regional market is attributed to the presence of a substantial number of competitors.

APAC Market Insights

Asia Pacific will also encounter huge growth in the portable ultrasound devices market during the forecast period. The market is expected to grow due to an increasing prevalence of accidents and a rising number of target diseases, including cardiovascular disease and cancer. A study conducted by the Asia Pacific Cohort Studies Collaboration (APCSC) found that the number of CVD patients in Asian nations has increased by an estimated 60.0%.

The number of patients in China is rising as a result of changing lifestyle choices and an expanding population. For example, the World Population Ageing 2019 study projects that China's population over 65 will grow from 164.48 million in 2019 to 246.98 million by 2030. Due to region's high population, more market potential, and less production costs, medical device companies from all over the world are expanding their operations.

The market for portable ultrasound equipment is expanding in South Korea due to the rise in cosmetic procedures and surgeries. In South Korea, there are 13.5 cosmetic treatments performed for every 1000 people in 2021, according to ISAPS. According to estimates, one in three South Korean women in the 19-29 age range have undergone plastic surgery. South Korea tops the world in the number of plastic procedures performed per person and is referred to be the cosmetic surgery capital of the world.

Portable Ultrasound Devices Market Players:

- Koninklijke Philips N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE HealthCare

- General Electric Company

- Siemens

- Clarius

- Shenzhen Mindray Bio-medical Electronics Co., Ltd.

- BenQ

- ESAOTE SPA

- Butterfly Network, Inc.

The top corporations are trying to expand their product line by improving their offerings, working together extensively, and looking into mergers and government approvals to grow their customer base and market share. To improve their market position, they are also implementing tactics including alliances, joint ventures, collaborations, agreements, product and service launches, mergers and acquisitions, and expansions. Here is a list of key players operating in the global market:

Recent Developments

- In August 2023, GE HealthCare introduced Vscan Air SL, a wireless handheld ultrasound equipment to expedite the imaging procedure during cardiac and vascular disorders. For better imaging performance and quality, this equipment includes GE HealthCare's exclusive XDclear and SignalMax technologies.

- In February 2022, Philips announced the launch of Lumify, a portable point-of-care ultrasound device equipped with Pulse Wave Doppler. This enables clinicians to measure blood flow in a range of point-of-care diagnostic and therapeutic applications, including vascular, cardiology, urology, abdominal, obstetrics, and gynecology.

- Report ID: 6326

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Portable Ultrasound Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.