Portable SSD Market Outlook:

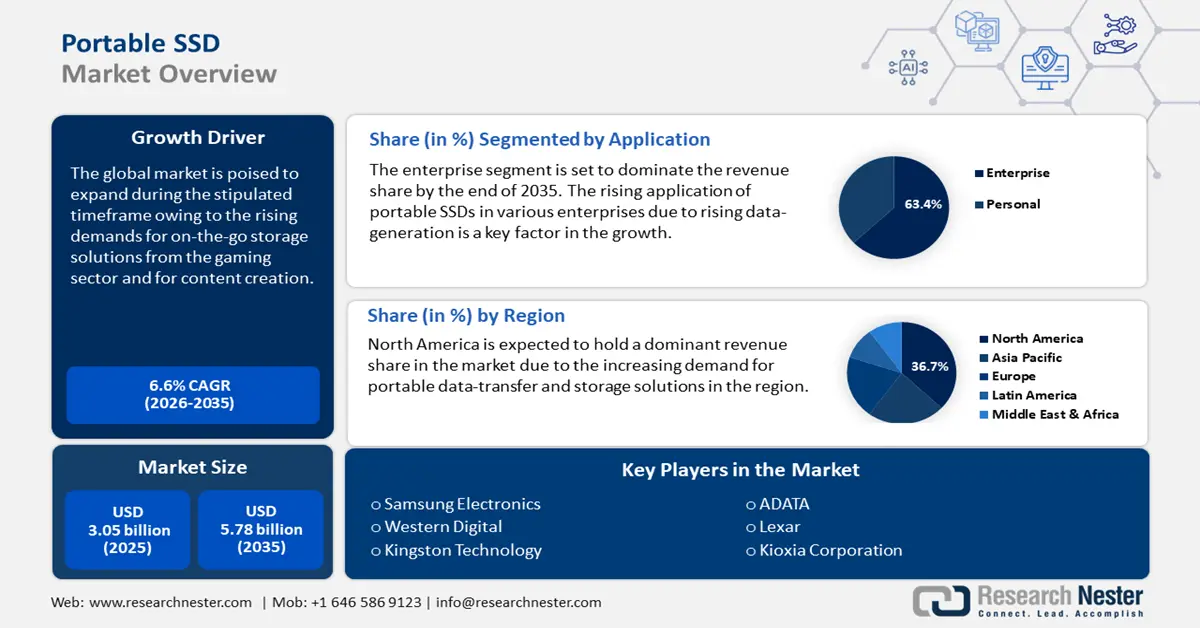

Portable SSD Market size was over USD 3.05 billion in 2025 and is projected to reach USD 5.78 billion by 2035, growing at around 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of portable SSD is evaluated at USD 3.23 billion.

The growth in demand for high-performance and reliable storage solutions across enterprise, consumer, and industrial applications is a significant driver of the sector’s expansion. The surge in data-intensive workflows has led to a shift from traditional hard disk drives (HDDs) to solid-state drives (SSDs). SSDs offer superior read/write speeds and energy efficiency which impacts the increase in demand. Moreover, the rising requirement for storage due to AI applications has boosted sales and demand for robust GPU platforms. The table below highlights the financial growth of the major companies offering GPU, and the revenue expansion remains a key macroeconomic trend bolstering the expansion of the portable SSD market.

Annual Revenue Figures of GPU Companies in 2024

|

Name of the Company |

Revenue Report |

|

Nvidia |

USD 35.1 billion quarterly revenue in Q3. 17% increase from Q2 and a 94% increase from the previous year |

|

Intel |

USD 14.3 billion in the fourth quarter |

|

AMD |

USD 6.8 billion in the third quarter |

Beyond consumer electronics, the portable SSD market benefits from the scaling up of adoption in enterprises and industries. The calls for low latency and rugged storage solutions are critical to boosting adoption rates. Moreover, professionals requiring on-the-go storage with minimal bottlenecks prefer SSD solutions. Additionally, the integration with USB 3.2, Thunderbolt, and PCIe interfaces enables faster transmission which is beneficial for the sector’s growth. Moreover, companies that can offer faster data transmission solutions for portable SSDs are poised to exhibit a competitive advantage within the sector.

Furthermore, the digital transformation initiatives worldwide, bolstered by major investments facilitated by governments have led to encryption technologies and data securities becoming key differentiators in the portable SSD market. Trends indicate that individual customers and businesses prioritize SSDs with AES hardware encryption, and firmware-based security features to safeguard sensitive data. This has led to rising investments in self-encrypting drives (SEDs) reinforcing the market’s trajectory towards more secure, high-speed, and high-capacity portable storage solutions. For instance, in June 2024, Kanguru released a new self-encrypting, internal hardware-encrypted SSDs to help organizations assist organizations in securing data. Such releases highlight the potential of businesses to release secure SSD solutions, in line with portable SSD market trends, to benefit from the lucrative opportunities within the sector.

Key Portable SSD Market Insights Summary:

Regional Highlights:

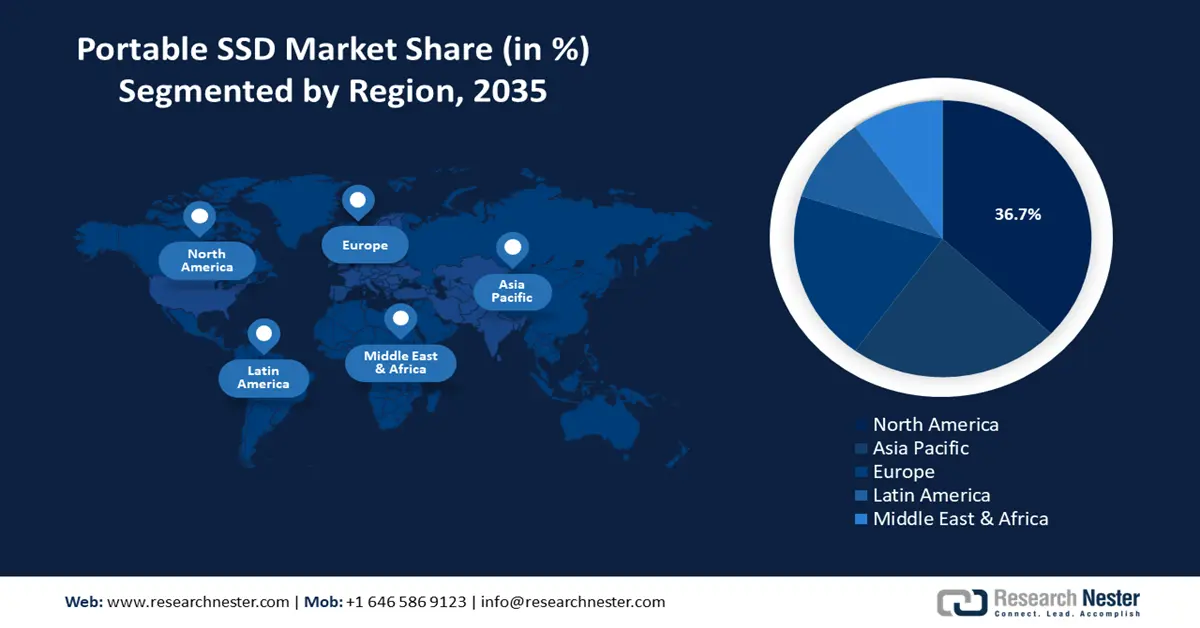

- North America holds a 36.7% share in the Portable SSD Market, driven by widespread digitalization and demand for high-speed storage solutions, fostering significant growth through 2026–2035.

- The Asia Pacific Portable SSD Market is poised for rapid growth by 2035, fueled by digital transformation initiatives and growing data mobility needs.

Segment Insights:

- The Personal segment is anticipated to expand its revenue share during 2026-2035, driven by increasing disposable income and the rise of leisure activities like gaming.

- The Enterprise segment is projected to hold a 63.4% share by 2035, driven by rising use in data centers for critical file handling operations.

Key Growth Trends:

- Proliferation of high-performance gaming & eSports

- Cost optimization & advancements in NAND Flash technology

Major Challenges:

- Supply chain disruptions

- Limitations in lifespan

- Key Players: Samsung Electronics, Western Digital, Kingston Technology, Seagate Technology, Micron, Toshiba, ADATA, Lexar, Transcend Information Inc., Kioxia Corporation.

Global Portable SSD Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.05 billion

- 2026 Market Size: USD 3.23 billion

- Projected Market Size: USD 5.78 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.7% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 13 August, 2025

Portable SSD Market Growth Drivers and Challenges:

Growth Drivers

-

Proliferation of high-performance gaming & eSports: A major end user of portable SSD solutions is the gaming industry. The growth of gaming and eSports has propelled the demand for portable SSD solutions to ensure seamless gameplay, faster load times, and efficient data transfer. Modern gaming titles feature large file sizes with high-resolution textures which traditional HDDs may not be able to support in high-performance gaming setups. Moreover, the gaming market is extremely competitive and manufacturers offering powerful storage solutions are expected to benefit from the rising sales. The most recent release in the segment is the Lenovo Legion Go (8.8”, 2) with up to 2TB of SSD storage and a 74Wh battery unveiled in January 2025.

Furthermore, eSports has gained considerable viewership and sponsorships over the years, with popular titles such as Call of Duty and League of Legends attracting significant prize pools. The rise of eSports, game streaming, and cross-platform gaming ecosystems has further accelerated the adoption of NVMe-based external SSDs with lower latency. Opportunities for major players arise in long-term partnerships, such as Samsung’s Partnership with the World Cyber Games in 2019, to provide cutting-edge SSD solutions and gain significant eyes on the product due to the large viewership numbers. -

Cost optimization & advancements in NAND Flash technology: The rapid technological advancements is a key facet of the portable SSD market. Continuous innovations in 3D NAND, Quad-Level Cell (QLC), and Penta-Level Cell (PLC) are reshaping the sector by increasing storage density. The advancements are allowing manufacturers to scale up production at lower costs, improving the profit margins, while making the solutions more accessible across various end users. In November 2024, Kioxia, a major player in the portable SSD market, forecasted a 2.7% increase in demand for NAND memory which has the potential to impact portable SSD pricing. In response, Kioxia has bolstered construction activities to expand production by the end of 2025.

-

Rise of high-resolution content creation: The growth in demand for 4K, 8K, and 360-degree video content is driving the requirement for high-speed and high-capacity portable storage solutions. The proliferation of social media platforms has created a burgeoning content creation industry worldwide, which has shifted the consumer demand in electronics. Moreover, video-editing and post-production workflows are applications boosting demand for high-performance portable SSDs. Moreover, an emerging application impacted by social media is the demand for portable SSD solutions for wedding photography.

The macro trends highlight multiple factors that have expanded the scope of application for portable SSDs, which bodes well for the manufacturers. Companies that are able to provide all-in-one solutions catering to varied end users are expected to expand their revenue shares. Additionally, opportunities have arisen in targeted solutions. For instance, in August 2024, IGadgets and Lexar announced a collaboration to release the Professional Go Portable SSD with Hub, specifically designed for professional photographers and videographers.

Challenges

-

Supply chain disruptions: The portable SSD market can face supply chain disruptions as production is highly dependent on NAND flash memory production. Disruptions in the supply chain can cause price volatility and production delays. This challenge requires manufacturers to ensure alternative modes of supply and invest in supply chain reliability, which can add to costs.

-

Limitations in lifespan: A constraint of portable SSDs is their limited lifespan due to performance degradation over time. In comparison, traditional HDDs tend to last longer. Moreover, portable SSDs have a finite number of write cycles, and frequent data writes accelerate cell wear. Concerns regarding long-term reliability are a major constraint in the portable SSD market.

Portable SSD Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 3.05 billion |

|

Forecast Year Market Size (2035) |

USD 5.78 billion |

|

Regional Scope |

|

Portable SSD Market Segmentation:

Application (Enterprise, Personal)

Enterprise segment is expected to capture around 63.4% portable SSD market share by the end of 2035. The rising application in data centers and business-critical environments to manage heavy workloads while providing simultaneous access for multiple applications remains a key factor of the segment’s profitability. Moreover, enterprises in sectors such as healthcare and media production are driving the demand for portable SSDs to ensure the handling of large files. Additionally, fields such as finance and legal services require robust storage solutions to manage sensitive data. The trend analysis of the portable SSD market forecasts the scope of application is set to increase in multiple enterprises by the end of 2035.

An emerging enterprise driving the demand for portable SSDs is the companies offering wedding services, and to keep pace with the surging demand from enterprises, industry leaders are investing to improve the time-to-market of their portable SSD solutions for professionals. A recent example is the launch of the flagship portable SSD T9 by Samsung in October 2023, specifically designed for end use by enterprises with a maximum capacity of 4TB storage.

The personal segment of the portable SSD market is set to expand its revenue share. With the rising disposable income in established economies, consumers investing in portable SSD solutions for personal use have increased. The growth in disposable income coincides with greater spending on leisure activities such as gaming, which remains a significant driver of portable SSD sales. For instance, the European Union (EU) reported that in the second quarter of 2024, household real income per capita increased by 0.4% in the heels of a 1.1% increase in the first quarter of the same year. Additionally, the U.S. Bureau of Economic Analysis reported that the disposable personal income in the country increased by USD 61.1 billion (0.3%) in November. Moreover, the rapid proliferation of home entertainment systems is a trend boosting the adoption of portable SSDs to store and transport large media collections.

Type (1 TB, 2 TB, 500 GB, Others)

The 1 TB segment of the portable SSD market is poised to hold a leading revenue share in the industry. The requirement for high-speed data transfer and durable storage solutions along with the expansion of applications are major factors contributing to the segment’s growth. The heightened adoption of cloud computing and big data analytics necessitates high-performance storage solutions, further fueling the demand for portable SSDs. Moreover, the largest application throughout the forecast period is expected to be for gaming with major players bolstering product releases to remain competitive. For instance, in June 2023, Asus, a major player in the market, released the TUF Gaming AS1000 portable 1TB SSD in the backdrop of growing demands from the gaming community.

Our in-depth analysis of the global portable SSD market includes the following segments:

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Portable SSD Market Regional Analysis:

North America Market Forecast

North America in portable SSD market is estimated to dominate around 36.7% revenue share by the end of 2035. The widespread adoption of digitalization in the region has led to a surge in data generation, necessitating robust storage solutions. The integration of advanced interfaces such as Thunderbolt 4 and USB 4 has improved data transfer speeds thereby bolstering consumer satisfaction rates. According to the U.S. Department of Commerce in 2023, 35% of organizations in the region operate with hybrid or fully remote workplaces, fueling corporate investments in portable SSDs for on-the-go datasets. Moreover, the U.S.-Mexico-Canda Agreement (USMCA) has improved cross-border tech trade for seamless supply chain integration for manufacturers.

The U.S. portable SSD market is a major market worldwide, underpinned by the robust growth of the tech sector and consumer enthusiasm for advanced electronics solutions. The U.S. Bureau of Economic Analysis reports a 4.2% year-over-year increase in spending for consumer electronics in 2023, bolstered by the demand for productivity tools for content creation and remote workers. The Consumer Technology Association (CTA) highlights heightened SSD adoption for gaming and 4K/8K media workflows, supported duly by the nationwide 5G network expansion. Moreover, federal initiatives such as the National Artificial Intelligence Initiative Act in 2023 spur enterprise demand for high-capacity storage to manage AI-driven workloads.

The Canada portable SSD market is set to expand during the stipulated timeline. The government-led digital transformation initiatives are driving the sector’s growth. In 2023, Statistics Canada reported that 27% of employees in Canada were working hybrid schedules, creating a sustained demand for portable SSDs in industries such as education and public administration. The USD 4 billion investment via the Canadian Digital Adoption Program has empowered small businesses to adopt advanced technologies while including secure storage solutions aligned with NIST guidelines. Furthermore, the Bank of Canada’s economic outlook report in 2023 highlights an increase in corporate IT budgets prioritizing cybersecurity upgrades, which in turn creates lucrative opportunities for the adoption of encrypted portable SSDs.

APAC Market Forecast:

The APAC portable SSD market is poised to account for the fastest growth. A significant factor APAC’s rapid growth curve is the digital transformation initiatives. The regional smart city projects, such as Digital India and Singapore’s Smart Nation, require high-speed storage for IoT applications. Moreover, the Asia-Pacific Economic Cooperation (APEC) reported a 19% YoY increase in cross-border data flows from 2021 to 2023 creating a favorable ecosystem for the adoption of portable SSDs for secure data mobility. Additional nationwide initiatives in thriving APAC economies, such as the Society 5.0 initiative of Japan and South Korea’s Digital New Deal are expected to further amplify the demand for low-latency storage solutions.

The China portable SSD market is characterized by strategic state-led innovation and investments in self-sufficiency. The Digital China initiative targets a 70% enterprise cloud adoption by 2025, which is poised to be a key trend supporting the portable SSD demand for hybrid IT architectures. Moreover, the Ministry of Industry and Information Technology reported a 31% increase in domestic SSD patent filings from 2021 to 2023 reflecting advancements in NAND flash technologies. Furthermore, the Belt and Road initiative is expected to drive export initiatives with portable SSDs manufactured in China gaining traction in the APAC markets.

The India portable SSD market is estimated to exhibit growth during the forecast period. The rising investments in public-private tech benefit the expansion of the market in India. Furthermore, the National Association of Software and Service Companies (NASSCOM) reports that data and AI can add around USD 500 billion to the country’s GDP by 2025, which is expected to create lucrative opportunities to provide on-the-go storage solutions. Moreover, SSDs are integral to the Jupiter Cloud Infrastructure for SMEs. Domestic schemes such as the Production-Linked Incentive (PLI) incentivize manufacturing in India, with key players set to leverage the benefits to reduce import dependency.

Key Portable SSD Market Players:

- Samsung Electronics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Western Digital

- Kingston Technology

- Seagate Technology

- Micron

- Toshiba

- ADATA

- Lexar

- Transcend Information Inc.

- Kioxia Corporation

The portable SSD market is projected to expand during the stipulated forecast period. Leading players are prioritizing R&D investments in high-speed interfaces such as Thunderbolt 4 and USB4. Partnerships with cloud service providers and OEMs assist in expanding product integration, while targeted marketing campaigns highlighting security features can bolster adoption rates in industries such as finance. Moreover, partnerships with local manufacturers to create localized hubs is poised to boost expansion in emerging markets.

Here are some key players in the portable SSD market:

Recent Developments

- In January 2025, CORSAIR released the EX400U USB4 External SSD. The portable SSD offers sequential read speeds of up to 4,000MB/sec and sequential write speeds of up to 3,600MB/sec.

- In November 2024, Western Digital announced the release of multiple flash storage solutions. The expanded portable SSD solutions include the SanDisk Extreme PRO with USB4 and the 8TB SanDisk Extreme Portable SSD for professionals and casual users respectively.

- Report ID: 7124

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Portable SSD Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.