Portable Medical Ventilator Market Outlook:

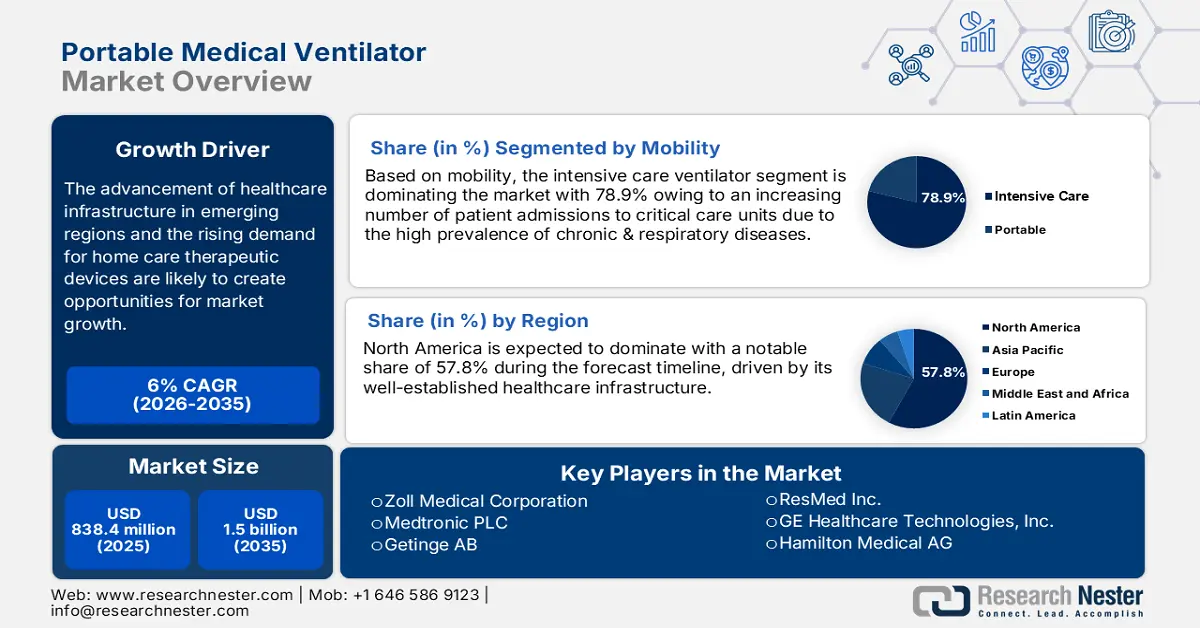

Portable Medical Ventilator Market size was valued at USD 838.4 million in 2025 and is expected to reach USD 1.5 billion by 2035, expanding at around 6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of portable medical ventilator is assessed at USD 883.67 million.

The portable medical ventilator market, indeed, has grown manifold in the last couple of years owing to the rapid healthcare technology advancement and emergency preparedness. With global healthcare systems seeking to improve the quality of patient care and extend the reach of life-saving treatments, demand for portable ventilators. For instance, in March 2022, IIT Hyderabad developed a low-cost, portable, and IoT-based ventilator with lithium-ion battery power. Moreover, this portable ventilator was initiated to be marketed for commercial purposes.

Apart from this, technological advancements that have made ventilators highly portable, user-friendly, and economical also promote this market further. For instance, in March 2023, Superior Sensor Technology announced proprietary pressure sensor technology. It enables improved ventilator response time and eliminates system noise of ventilators and high-flow oxygen equipment to reduce patient-ventilator dyssynchrony. Some of the other significant contributors to the demand for portable ventilators include investments in healthcare infrastructure by the government, especially in emerging economies, increasing emphasis on disaster response, and patient transport. All these factors combined underpin a robust market outlook for portable medical ventilators as critical components in modern respiratory care.

Key Portable Medical Ventilator Market Insights Summary:

Regional Highlights:

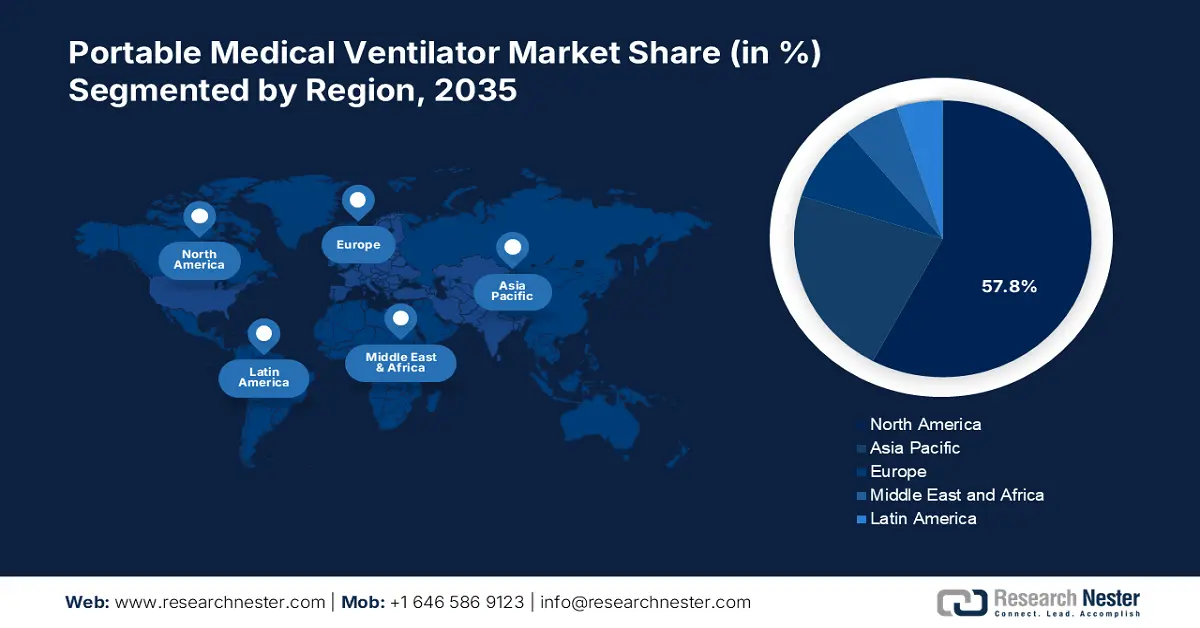

- North America's 57.8% share in the Portable Medical Ventilator Market is driven by tremendous technological advancements and increasing demand for home care, solidifying its dominance through 2026–2035.

- Asia Pacific's portable medical ventilator market is set for rapid expansion through 2026–2035, propelled by increasing affordability of medical devices and disaster preparedness focus.

Segment Insights:

- The Intensive Care segment is forecasted to achieve over 78.9% share by 2035, propelled by growing adoption across various healthcare settings.

- The Invasive Ventilators segment of the Portable Medical Ventilator Market is anticipated to dominate the market by 2035, driven by their capability to deliver high levels of ventilatory support.

Key Growth Trends:

- Rising prevalence of respiratory disease

- Government initiatives and healthcare infrastructure investments

Major Challenges:

- Battery life and power supply

- Limited availability in rural and underserved areas

- Key Players: Hamilton Medical AG, Fisher & Paykel Healthcare Limited, Zoll Medical Corporation, ResMed Inc., VYAIRE Medical Inc.

Global Portable Medical Ventilator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 838.4 million

- 2026 Market Size: USD 883.67 million

- Projected Market Size: USD 1.5 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (57.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 14 August, 2025

Portable Medical Ventilator Market Growth Drivers and Challenges:

Growth Drivers

- Rising prevalence of respiratory disease: The growing incidences of respiratory diseases, coupled with an aging population, pollution, and lifestyle changes, raise the demand for devices for respiratory support. For instance, in October 2024, it was published that due to growing air pollution, the incidences of respiratory disease in patients have risen to 10-15%. These mobile ventilators provide mobility and ease in longer-term care and emergency cases. The rising burden of respiratory diseases demands easier access to and higher efficiency in ventilatory support, which, in turn, accelerates the growth of the portable ventilator market.

- Government initiatives and healthcare infrastructure investments: Most governments worldwide realized the need to strengthen health systems, especially in light of the COVID-19 pandemic and the rising burden of chronic respiratory diseases. For instance, in July 2020, Advanced Medtech and Seeds Capital invested USD 10 million in ABM Respiratory Care’s series A round. This investment aimed at bringing telehealth ventilators and other significant devices to patients. Thus, funding for medical technologies such as portable ventilators has skyrocketed. Investments are designed to help improve access to care, boost disaster preparedness, and ensure better delivery of healthcare in general to underserved populations and in resource-poor areas.

Challenges

- Battery life and power supply: The significant challenge to the growth of the portable medical ventilator market is battery life and power supply. Portable medical ventilators largely function on continuous and reliable power sources for effective working. With unreliable access to power sources, this problem is aggravated in remote and emergency environments that can cause interruptions in ventilation and patient safety. These challenges will contribute to the restrictions on the reliability and applicability of portable ventilators in certain healthcare facilities thus restricting growth in the market.

- Limited availability in rural and underserved areas: The unprivileged areas lack the healthcare infrastructure, resources, and personnel to fully deploy and maintain such devices. Logistical challenges combined with the economic constraints of distributing high-tech medical equipment in rural areas limit access to portable ventilators. This limitation restricts the scale of market size as often, such areas greatly require affordable and accessible medical solutions, which have been restricted from acquiring life-saving technologies. Subsequently, the advancement of portable ventilator markets is hindered, especially for the low-income and rural regions whose disparities in healthcare are most highlighted.

Portable Medical Ventilator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 838.4 million |

|

Forecast Year Market Size (2035) |

USD 1.5 billion |

|

Regional Scope |

|

Portable Medical Ventilator Market Segmentation:

Mobility (Intensive care, Portable)

The intensive care segment is expected to hold portable medical ventilator market share of over 78.9% by the end of 2035, owing to the growing adoption across various healthcare settings. Intensive care ventilators are specifically designed to provide high-performance advanced respiratory support to critically ill patients, making them indispensable in emergency medical services where rapid intervention is required. For instance, in June 2021, ISRO developed Prana. It is a portable, low-cost critical care ventilator that uses an Ambu (Artificial Manual Breathing Unit) bag that is automatically compressed. Thus, intensive care ventilator is expected to gain momentum forward as it progresses through technological up-gradation and rising interest in emergency and critical care solutions.

Interface (Invasive, Non-invasive)

The invasive ventilators segment is projected to dominate the portable medical ventilators market attributable to their capability of delivering high levels of ventilatory support. In addition, it renders better control over parameters such as pressure, volume, and oxygenation. For instance, in July 2024, Noccarc received a much sought-after Bureau of Indian Standards (BIS) Certification IS 13450: Part 2: SEC 12:2023 certification for its much-acclaimed Made-in-India ICU Ventilator, Noccarc V730i. The Noccarc V730i includes modes of invasive and non-invasive ventilation along with revolutionary remote monitoring features via mobile phones, thus making critical care completely seamless and efficient.

Our in-depth analysis of the market includes the following segments:

|

Mobility |

|

|

Product |

|

|

Interface |

|

|

Age Group Mode |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Portable Medical Ventilator Market Regional Analysis:

North America Market Statistics

By 2035, North America portable medical ventilator market is predicted to account for around 57.8% revenue share. The region boasts tremendous technological advancements in which companies focus more on compact user-friendly ventilators with smart features that include remote monitoring and data analytics. This is also instrumental to the increasing demand for home care as portable ventilators find a huge demand for patients requiring long-term respiratory support outside of the clinical environment.

Well-established healthcare infrastructure and favorable reimbursement policies in the U.S. raise the ante for market growth. More innovation into fast-tracking advanced ventilator solutions in the market has been spurred by regulatory agencies, such as the FDA, through the simplification and hastening of the review of medical device approval. For instance, in November 2023, an umbrella (Emergency Use Authorization (EUA)) issued by the FDA permits the emergency use of specific ventilators, ventilator tubing connectors, ventilator accessories, and anesthesia gas machines.

In Canada, health emergencies require prior preparedness due to the increased awareness brought about by the COVID-19 pandemic, and the increasing demand for portable ventilators as an essential disaster response and preparedness component. For instance, in April 2020, Ventilators for Canadians partnered with Baylis Medical, to produce ventilators for hospitals all over the country. With the recent announcement of the Government of Canada's support for firms that produce essential medical supplies, Baylis can contribute to the care of patients affected by the COVID-19 virus.

Asia Pacific Market Analysis

Asia Pacific is the most rapidly growing region in the portable medical ventilator market, driven by the trend of increasing affordability of medical devices. The capabilities and skills of local manufacturers have made these devices accessible and innovative in urban and rural regions. In addition, the growing focus on disaster preparedness is driving the market to develop and equip itself with the latest and most efficient solutions to meet the demand consistently.

The primary growth driver for the portable medical ventilator market in China is that the country is increasing in popularity amongst patients, traveling from nearby regions to get advanced medical treatment. Consequently, local manufacturers have mitigated their costs for these medical devices to make them reach wider regions. For instance, in April 2020, as the world's demand for life-saving devices soared due to the coronavirus pandemic, China ventilator manufacturers worked consistently to increase supply. Thus, became one of the largest suppliers at that time.

The market in India is evolving at a steady pace as it embraces inventions in existing technologies to combat the growing instances of respiratory diseases. The breakthrough of studies and research allow the players in the market to remain competitive and offer reliable solutions in the portable medical ventilators market. For instance, in September 2021, Noccarc, a Pune-based startup, installed more than 3000 of its flagship V310 ventilators in more than 500 hospitals nationwide.

Key Portable Medical Ventilator Market Players:

- Schiller AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hamilton Medical AG

- Koninklijke Philips N.V.

- GE Healthcare Technologies, Inc.

- Medtronic PLC

- Getinge AB

- ResMed Inc.

- Zoll Medical Corporation

- VYAIRE Medical, Inc.

- Dragerwerk AG & Co., KGaA

- Fisher & Paykel Healthcare Limited

The top-notch key players in the portable medical ventilator market are stimulated to manufacture innovative and effective solutions for delivering better and timely patient care. In addition, the growing geriatric population tends to seek home care settings with portable ventilators. Moreover, the preterm birth of children also pushes the demand for players to develop inventive devices.

Here’s the list of some key players:

Recent Developments

- In April 2024, WEINMANN Emergency declared to announce new functions and features of MEDUVENT Standard, the state-of-the-art turbine ventilator at the RETTmobil trade fair in May 2024. It extends its applications to support the work of EMS field providers perfectly.

- In December 2023, Hamilton Medical introduced the VenTrainer App, the newest state-of-the-art solution for medical professionals. This app is specially designed to ease the use of mechanical ventilators in emergency medical services and critical care.

- Report ID: 6710

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Portable Medical Ventilator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.