Portable Energy Storage System Market Outlook:

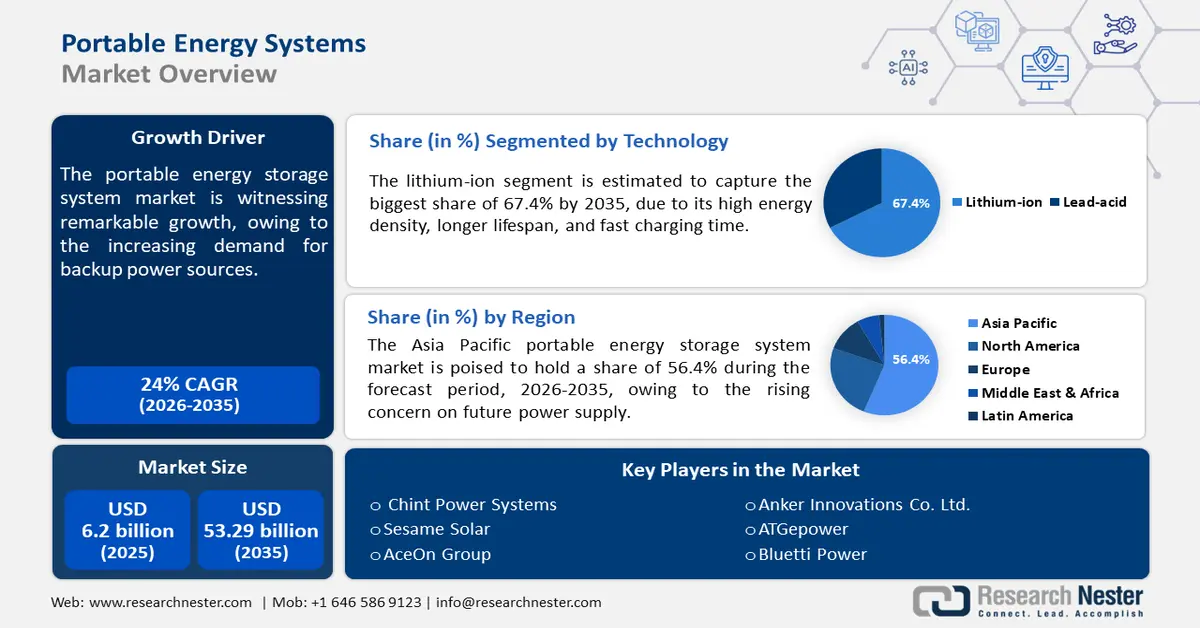

Portable Energy Storage System Market size was over USD 6.2 billion in 2025 and is projected to reach USD 53.29 billion by 2035, witnessing around 24% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of portable energy storage system is evaluated at USD 7.54 billion.

Portable devices serve consumers with mobility and cost-effective solutions for emergency backup power sources. Additionally, these power-grid devices are actively contributing to the reduction of CO2 emissions. The inclusion of battery power storage systems in governmental clean energy projects is driving the portable energy storage system market to grow exceptionally. In March 2024, the Ministry of Power sanctioned funding of USD 449.1 million for the implementation of VGF for the development of Battery Energy Storage Systems. Additionally, in September 2024, an investment of USD 25 million by the Government of Queensland attracted international private funding of USD 40 million to help build the battery industry.

Key Portable Energy Storage System Market Insights Summary:

Regional Highlights:

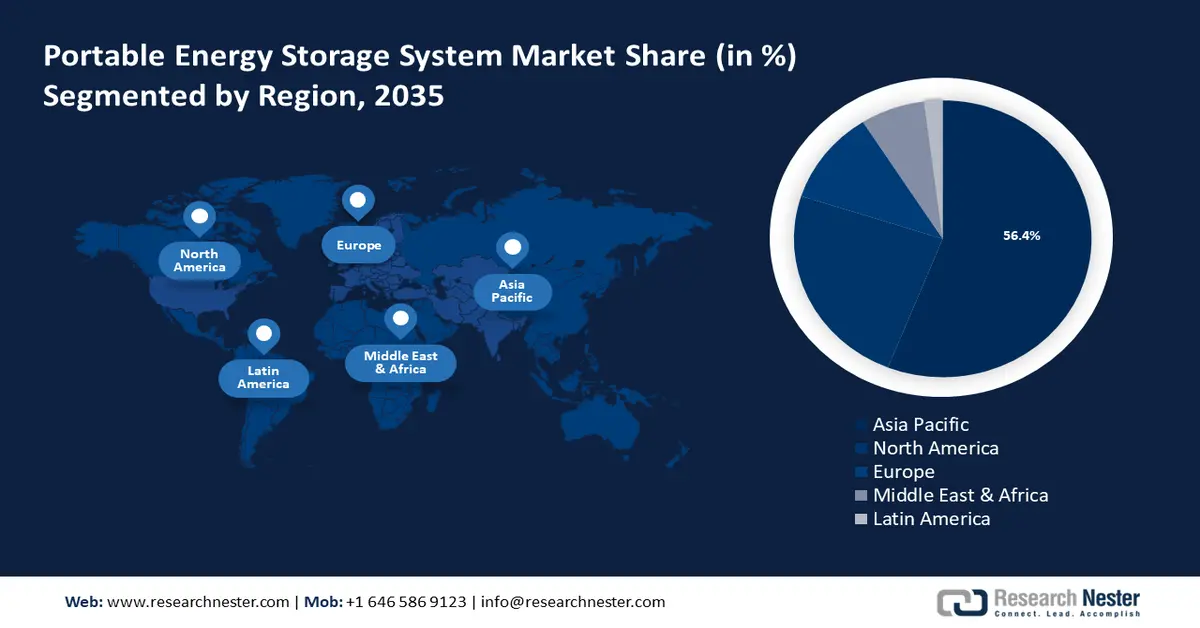

- Asia Pacific leads the Portable Energy Storage System Market with a 56.4% share, propelled by rising concerns about future power supply and high population demands, ensuring strong growth through 2026–2035.

- North America's Portable Energy Storage System Market is poised for growth by 2035, driven by the high demand for mobile power solutions in consumer electronics.

Segment Insights:

- The Lithium-ion segment is set for substantial growth from 2026-2035, driven by its high energy density, longer lifespan, fast charging, and compact design.

Key Growth Trends:

- Acceleration in renewable electricity deployment

- Supportive governmental regulations for energy storage

Major Challenges:

- Lack of established standardization

- Expensive maintenance

- Key Players: Chint Power Systems, Sesame Solar, AceOn Group, Anker Innovations Co., Ltd., ATGepower, Bluetti Power, Shenzhen Segre Electronics Co. Ltd., Zhejiang Xili New Energy Co. Ltd., Jiangsu Senji New Energy Technology Co. Ltd., Jiangxi Deti Intelligent Power Co. Ltd., Jntech Renewable Energy Co. Ltd, AMPIN Energy Transition Private Limited, UNIDO.

Global Portable Energy Storage System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.2 billion

- 2026 Market Size: USD 7.54 billion

- Projected Market Size: USD 53.29 billion by 2035

- Growth Forecasts: 24% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (56.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 14 August, 2025

Portable Energy Storage System Market Growth Drivers and Challenges:

Growth Drivers

- Acceleration in renewable electricity deployment: Renewable energy is now necessary to replace exhausting conventional power sources, implying an efficient energy storage system requirement. According to a report published by the International Energy Agency, in July 2023, around 3700 GW of new renewable capacity is anticipated to come online over the 2023‑2028 period. It is predicted to be driven by supporting policies from as many as 130 countries worldwide. It is further stated that renewable energy sources will account for 42% of the global electricity generation share, by 2028. This data indicates the massive increment in power generation, which will demand various options of storage for future consumption, boosting the portable energy storage system market size.

- Supportive governmental regulations for energy storage: The increased global population is draining conventional power fuels, which needs to be compensated through energy storage. According to an ISGF report on ESS Roadmap of India 2019-2032, the cumulative demand of ESS by 2032 is estimated to be over 2700 GWh, demanding the set-up of giga-scale battery manufacturing plants in the country. Government bodies are now showing concern by setting regulations on consumption for reserving residual energy to secure an un-cut power supply in the future.

According to FERC Order 841, in February 2018, RTOs and ISOs were directed to develop tariffs to integrate electric storage into all-electric markets, resulting in the wider use of electric storage. Additionally, the Ministry of Power in India also commenced the Electricity (Amendment) Rules, 2022, stating that the energy storage systems shall be considered as a part of the power system, as defined under clause (50) of section 2 of the Act. - Swelling demand for power backup: The energy storage systems are majorly used to operate household or industrial electronic goods in the absence of a traditional power grid. Additionally, portable electricity sources are a perfect option for traveling in remote areas, where rural electrification is rarely available. Its sustainable off-grid application has made a remarkable rise in the portable energy storage system market. Furthermore, the urge has also reached off-beat construction sites to retain a consistent power flow through the tools and machinery, creating a wider range of market spread.

Challenges

- Lack of established standardization: Uncertainty in usage safety and the absence of accurate monitoring are some of the major setbacks in the market. The operational limitations of these devices do not fall under any industrial standard, restraining the development process. Furthermore, the device’s compatibility is compromised without uniform standards. As technologies may not align with the new specifications, companies may refrain from investing in innovation. Additionally, the absence of standard protocols is also causing restrictions on portable energy storage system market growth.

- Expensive maintenance: The deficient lifespan of the batteries causes expensive maintenance due to costly and time-consuming replacement. The manufacturing technology needs to be upgraded to compete with other alternative storage systems. Specific parts such as lithium for the batteries are raising the cost of the overall device. Additionally, the complexity of the device may require trained professionals to repair it, further driving up the expense.

Portable Energy Storage System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24% |

|

Base Year Market Size (2025) |

USD 6.2 billion |

|

Forecast Year Market Size (2035) |

USD 53.29 billion |

|

Regional Scope |

|

Portable Energy Storage System Market Segmentation:

Technology (Lithium-Ion, Lead-Acid)

Lithium-ion segment is estimated to hold over 67.4% portable energy storage system market share by the end of 2035. Its high energy density, longer lifespan, and fast charging time are some of the major preferable points, making it the first choice for users worldwide. Additionally, its customizable technology has allowed companies to uphold their product quality with enhanced safety, temperature monitoring, and cost-effectiveness. With a compact design, the lithium-ion category is captivating noticeable investments in the market. In May 2024, one of the leading companies in India, Maxvolt Energy raised USD 1.5 billion for the development of fast-charging lithium-ion batteries.

The lead-based portable energy storage systems are also in demand for their variation and potential for future development. The advanced devices consist of intelligent battery management, allowing them to perform with increased energy density at a low investment cost. Furthermore, lead-acid batteries could be integrated into hybrid systems in combination with other high-power storage devices to maximize benefits. Lead-based energy storage is availing an affordable option for the investors in the market, further capturing the focus of leading companies.

Application (Outdoor, Emergency)

Portable energy storage systems have a wide range of applications but outdoor usage is growing rapidly. The increased demand for electric vehicles has inflated the requirement for efficient and cost-effective power sources. Developing countries such as China, Japan, and India, have emphasized the market size by implementing EVs in commercial transportation. Frequent events of natural disasters are also encouraging consumers to acquire emergency power backup. Further extending the portable energy storage system market significantly. With consumer-specific developments in these devices, companies are introducing new technologies to enhance their portfolio.

In the present scenario, natural disasters are more frequent than past years. Countries such as Japan and India face massive power damage each year due to these events, which subsequently increases the demand for emergency power backup systems. Many companies are launching inventive devices, featuring AC current supply and efficient storage capacity at the same time. Public authorities are also considering these systems effective for long-duration power-cut. Travelers are also preferring these tools in emergency for their portability and compact design, which are easy to carry.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Application |

|

|

Capacity |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Portable Energy Storage System Market Regional Analysis:

APAC Market Statistics

The Asia Pacific portable energy storage system market is poised to hold a share of 56.4% during the forecast period, 2026-2035, owing to the rising concern on future power supply. The high population and recent developments are conjugately penetrating the demand for sustainable sources of electricity. Initiatives taken by governing authorities are inspiring foremost companies to participate in the advancement of this industry.

With the largest population in the world, India is now governing the campaign to implement alternative energy sources. According to an article published by Invest India, in August 2024, India secured 4th position in global renewable energy installed capacity. It further adds, that 21 government projects have already been sanctioned, creating an investment opportunity of USD 4.8 billion. The massive amount of generated energy is proposed to be stored for future consumption, emphasizing the market size of portable energy storage systems. An IESA article published in April 2021 states, that the market of India is expected to be USD 2.1 billion in 2019 and forecasts a CAGR of 8% by 2027.

China market is also predicted to encounter immense growth during the forecast period, 2026-2035, driven by the increase in EV integration. Companies are heavily investing in acquiring large-scale battery plants for efficient supply. Awareness of carbon emissions is also dragging the attention of market leaders for larger investments. In 2023, UNIDO called out for a global exhibition, showcasing 315 innovations of clean energy solutions from 60 countries. Such actions have intrigued the market of power-grid solutions to grow bigger.

North America Market Analysis

The North America portable energy storage system market is also expected to experience significant growth in upcoming years. Mobile power solutions are in high demand to empower the larger market of consumer electronics. The region’s diverse geography encourages campers and educational excursions to participate in outdoor activities. Further stimulating the market to enlarge with increased demand. Major players of this market are also investing to introduce newest technologies for a sustainable and carbon-emission-free power source.

The U.S. market has also shown remarkable growth in recent years and is estimated to garner greater developments in this sector. Technological support and a sophisticated economy have helped in the smooth integration of electricity preservers into consumption. According to an article published by NASA, in January 2024, The Edwards Sanborn Solar and Energy Storage project incorporates the highest capacity solar farm in the United States with the largest battery storage system in the world. Increased interest in constructing such large-scale storage facilities shows a bigger investment scope in this industry.

Canada is also augmenting the market with several large-scale battery storage system projects and shows greater opportunity for investment in the future. Energy storage development has helped this country build new-generation assets and promote clean power sources. An article published by Energy Storage Canada in 2024 states, that there are four installed energy storage facilities in Canada, situated in Ontario, Alberta, Saskatchewan & PEI. Additionally, there are more projects to be slotted, further raising the portable energy storage system market statistics.

Key Portable Energy Storage System Market Players:

- Chint Power Systems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sesame Solar

- AceOn Group

- Anker Innovations Co. Ltd.

- ATGepower

- Bluetti Power

- Shenzhen Segre Electronics Co. Ltd.

- Zhejiang Xili New Energy Co. Ltd.

- Jiangsu Senji New Energy Technology Co. Ltd.

- Jiangxi Deti Intelligent Power Co. Ltd.

- Jntech Renewable Energy Co. Ltd

- AMPIN Energy Transition Private Limited

- UNIDO

The market's key players are now focusing on the development of portable energy storage systems to offer competitive options for consumers. They are partnering with other participants and in neighboring countries to expand their product line and portfolio. In April 2024, JLR partnered with energy storage start‑up, Allye Energy, to create a novel Battery Energy Storage System (BESS) to provide zero emissions power on the go. Further, they developed a new portable Battery Energy Storage System (BESS) using second‑life Range Rover and Range Rover Sport PHEV batteries. The market reach of advanced devices is setting parameters to beat their positions.

Some of these leading players include:

Recent Developments

- In September 2024, Grenergy acquired 1GW solar, including a 1 GW energized line from Repsol and Ibereólica to expand Oasis de Atacama, the world's largest battery project.

- In September 2023, Sesame Solar launched the world's first 100% renewably powered Mobile Nanogrids, which not only can generate energy through atmospheric water generators but also can be used as a portable energy storage system.

- In December 2022, Faradian Limited announced the successful installation of the first Faradion’s sodium-ion battery at a trail site in Yarra Valley in New South Wales, Australia, showcasing the development after the acquisition.

- In December 2021, Reliance New Energy Solar Ltd. acquired a 100% share of Faradion Limited to use its patented sodium-ion battery technology, offering next-generation, high-density, mobile, safe, sustainable, and low-cost energy storage solutions.

- Report ID: 6516

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.