Portable Battery Market Outlook:

Portable Battery Market size was over USD 17.51 billion in 2025 and is poised to exceed USD 45.83 billion by 2035, growing at over 10.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of portable battery is estimated at USD 19.1 billion.

The widespread adoption of smartphones, laptops, tablets, and wearable devices is driving the demand for portable batteries. As per the World Economic Forum, in 2022, there were about USD 8.58 billion active mobile subscriptions globally. These devices rely on efficient, long-lasting batteries to enhance user experience, leading to consistent growth in the portable battery market.

Furthermore, the rising popularity of electric vehicles (EVs) is a significant driver for the industry, especially in relation to EV charging stations, power storage, and backup systems. As per the International Energy Agency, in 2023, about one out of every five vehicles sold was electric. In 2023, sales of electric cars approached 14 million, with the United States, Europe, and China accounting for 95% of these sales. As the demand for EVs continues to grow, so does the need for reliable and efficient charging infrastructure. Portable batteries play a crucial role in providing power solutions for charging stations, enabling energy storage for off-grid locations, and supporting backup systems during power outages. This trend drives the overall demand for advanced portable battery solutions across various sectors.

Key Portable Battery Market Insights Summary:

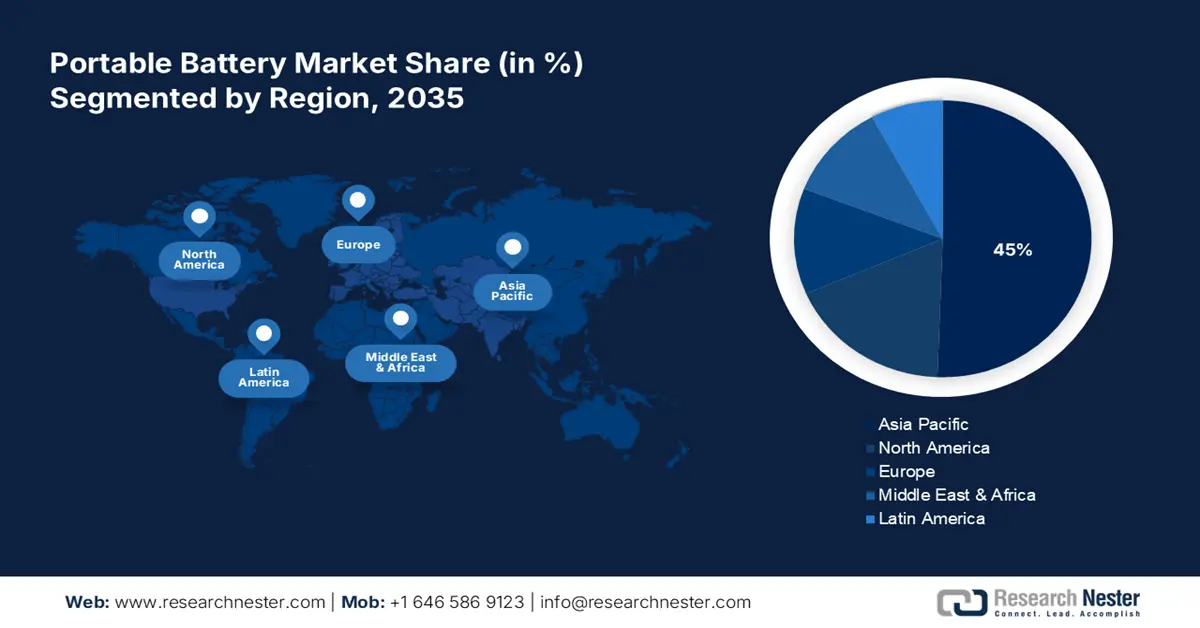

Regional Highlights:

- Asia Pacific dominates the Portable Battery Market with a 45% share, driven by rapid adoption of smartphones across the region, particularly in India and Southeast Asia, fostering growth through 2026–2035.

Segment Insights:

- The Smartphone segment is forecasted to dominate the market by 2035, driven by increasing smartphone usage and advancements in battery performance.

- The Lithium-ion Polymer segment is anticipated to achieve over 43.5% share from 2026-2035, driven by demand for lightweight, compact, and fast-charging batteries.

Key Growth Trends:

- Expanding renewable energy storage

- Rising trend in IoT devices

Major Challenges:

- Limited battery life and efficiency

- Environmental concerns and recycling issues

- Key Players: Acer Inc., Dell Inc., Tesla, Inc., Alcatel-Lucent.

Global Portable Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.51 billion

- 2026 Market Size: USD 19.1 billion

- Projected Market Size: USD 45.83 billion by 2035

- Growth Forecasts: 10.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Portable Battery Market Growth Drivers and Challenges:

Growth Drivers

- Expanding renewable energy storage: The growing focus on renewable energy solutions, such as solar and wind power, is driving the portable energy storage system. Furthermore, renewable energy share in power is expected to reach 94% in Europe, and 78% in the U.S. by 2050. This will in turn increase the demand for portable batteries. These portable batteries allow for the efficient storage and use of renewable energy, particularly in off-grid or remote locations where access to a stable power grid may be limited. By enabling energy storage during periods of high production, portable batteries make renewable energy more accessible and reliable, further fueling market growth and adoption.

- Rising trend in IoT devices: The proliferation of Internet of Things (IoT) devices, including smart home systems, wearables, and connected appliances, is creating significant demand for portable batteries. According to the World Economic Forum, globally, 42 billion IoT-connected devices are anticipated by 2025. As IoT adoption continues to rise, these devices require compact, efficient, rechargeable, and long-lasting power sources to ensure consistent performance. The need for reliable portable batteries is growing rapidly as more devices become interconnected and integrated into daily life.

Challenges

- Limited battery life and efficiency: One of the main challenges for portable batteries is their limited lifespan and efficiency. Over time, battery capacity degrades, leading to shorter usage periods and reduced performance. Users expect longer-lasting batteries, especially in high-demand applications like smartphones, EVs, and IoT devices, putting pressure on manufacturers to improve battery longevity.

- Environmental concerns and recycling issues: Portable batteries, particularly lithium-ion batteries, pose environmental concerns due to their chemical composition. Improper disposal can lead to environmental pollution. Additionally, the lack of efficient recycling systems for used batteries remains a significant challenge. As demand grows, addressing the environmental impact of battery production and disposal is becoming increasingly important.

Portable Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.1% |

|

Base Year Market Size (2025) |

USD 17.51 billion |

|

Forecast Year Market Size (2035) |

USD 45.83 billion |

|

Regional Scope |

|

Portable Battery Market Segmentation:

Technology (Lithium-ion Polymer, Lead Acid, Nickel Metal Hydride, Nickel Cadmium, Others)

By 2035, lithium-ion polymer segment is estimated to capture over 43.5% portable battery market share. The segment is growing due to its advantage of being lightweight, compact, and flexible, making it ideal for use in portable electronic devices, wearables, and electric vehicles. Lithium-ion polymer batteries offer higher energy densities and faster charging times compared to traditional lithium-ion batteries. In addition to not containing hazardous lead or cadmium, Li-ion batteries have a low self-discharge rate of only 1.5% to 2% per month. Their ability to be molded into various shapes allows for better integration in space-constrained applications, driving their increasing demand.

Application (Tablets, Automotive, Smartphones, Others)

In terms of application, the smartphone segment is expected to hold the majority of market share in the global portable battery market. With the growing reliance on smartphones for communication, entertainment, and work, the demand for efficient and long-lasting portable batteries has surged. Approximately 91% of people in the US own a smartphone. Increasing smartphone penetration, especially in developing regions, coupled with advancements in high-performance batteries to support energy-intensive features like gaming and 5G connectivity, drives this segment’s dominance in the market.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Application |

|

|

Battery Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Portable Battery Market Regional Analysis:

APAC Market Statistics

APAC in portable battery market is poised to account for more than 45% revenue share by the end of 2035. The rapid adoption of smartphones across the region with an adoption rate of around 94% by 2030, particularly in India and Southeast Asia, is a key driver. With increasing digitalization and mobile internet usage, the demand for portable batteries, including power banks and internal device batteries, is soaring.

India is anticipated to register a considerable share during the forecast period in the APAC region. Government incentives for EV production and infrastructure development further contribute to this growth. In 2023, there were 15.29 million registered electric vehicles in India, up from 1.3 million in 2018. Additionally, the e-commerce boom has made portable batteries more accessible, while the increasing adoption of gadgets like tablets, laptops, and wearables supports market growth. These devices rely on compact, efficient, and long-lasting power solutions, fueling the portable battery market.

China is a prominent player in the AAPC industry. The country’s renewable energy adoption promotes the use of portable batteries for energy storage in off-grid solar and wind systems. Government incentives and policies encourage innovation and investment in portable battery solutions. The country has a booming consumer electronics industry that drives the demand for portable batteries. With high smartphone, laptop, and wearable device adoption, the need for compact, efficient, and durable batteries is rising, supporting market growth. China is a major mobile phone manufacturer, exporter, and consumer. It manufactured 1.47 billion mobile phones in 2020, thus propelling the market for portable batteries.

North America Market Analysis

The portable battery market in North America is predicted to generate notable revenue by the end of 2035. Industry reports highlight that U.S. EV adoption is significantly supporting the demand for portable batteries used in charging infrastructure, mobile solutions, and energy storage. In Q2 2024, around three-quarters of EVs sold in the U.S. were manufactured in North America. This demand is further supported by government incentives and regulations that encourage the adoption of EVs.

The U.S. market is projected to witness significant growth due to the increasing adoption of smartphones, laptops, tablets, and wearable devices. For instance, 13 million more Americans used the Internet in 2023 than in 2021, according to new NTIA data. These devices require efficient, rechargeable batteries to support advanced functionalities and extended usage, boosting market demand. Moreover, innovation in battery technologies, such as lithium-ion and solid-state batteries, enhances energy density, safety, and longevity, making portable batteries more reliable and adaptable to diverse applications.

Canada pushes toward electrification and sustainable transportation, boosting the demand for portable batteries, particularly for EV charging infrastructure and energy storage systems. Government incentives for EV adoption and growing public awareness of sustainability drive this trend. A USD 14.9 million federal investment for 20 initiatives aimed at promoting zero-emission vehicle (ZEV) regulations and rules, infrastructure, and education throughout Canada. Additionally, the country invests in solar and wind energy projects fueling the need for portable batteries for energy storage and utilization of renewable energy in remote and off-grid areas, aligning with clean energy goals.

Key Portable Battery Market Players:

- Siemens

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Acer Inc.

- Dell Inc.

- Tesla, Inc.

- Alcatel-Lucent

- Advanced Battery Systems, Inc.

- TotalEnergies S.E.

- Nikon Corporation

- Sharp Electronics Corporation

A variety of well-known brands, up-and-coming companies, and niche manufacturers make up the dynamic competitive landscape of the global portable battery market. One important component of competition is innovation. For instance, in September 2024, EcoFlow, a prominent supplier of portable power and renewable energy solutions, introduced four new product lines to satisfy a wide range of consumer needs. Well-known companies in the sector use strategies like mergers and acquisitions, strategic alliances, and product innovation to improve their market position.

Recent Developments

- In June 2024, TotalEnergies subsidiary Saft introduced the first commercially available rechargeable batteries with ATEX certification. They are intended to power portable tools and equipment in the mining, oil and gas, defense, and agricultural sectors, among others.

- In October 2022, a Memorandum of Understanding was signed by Siemens and Automotive Cells Company (ACC) to form a new strategic alliance. Siemens will be ACC's preferred supplier for automation, digitization, and electrification technology. This will allow ACC to increase production while optimizing plant and energy efficiency.

- Report ID: 6801

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Portable Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.