Polyvinyl Alcohol Fiber Market Outlook:

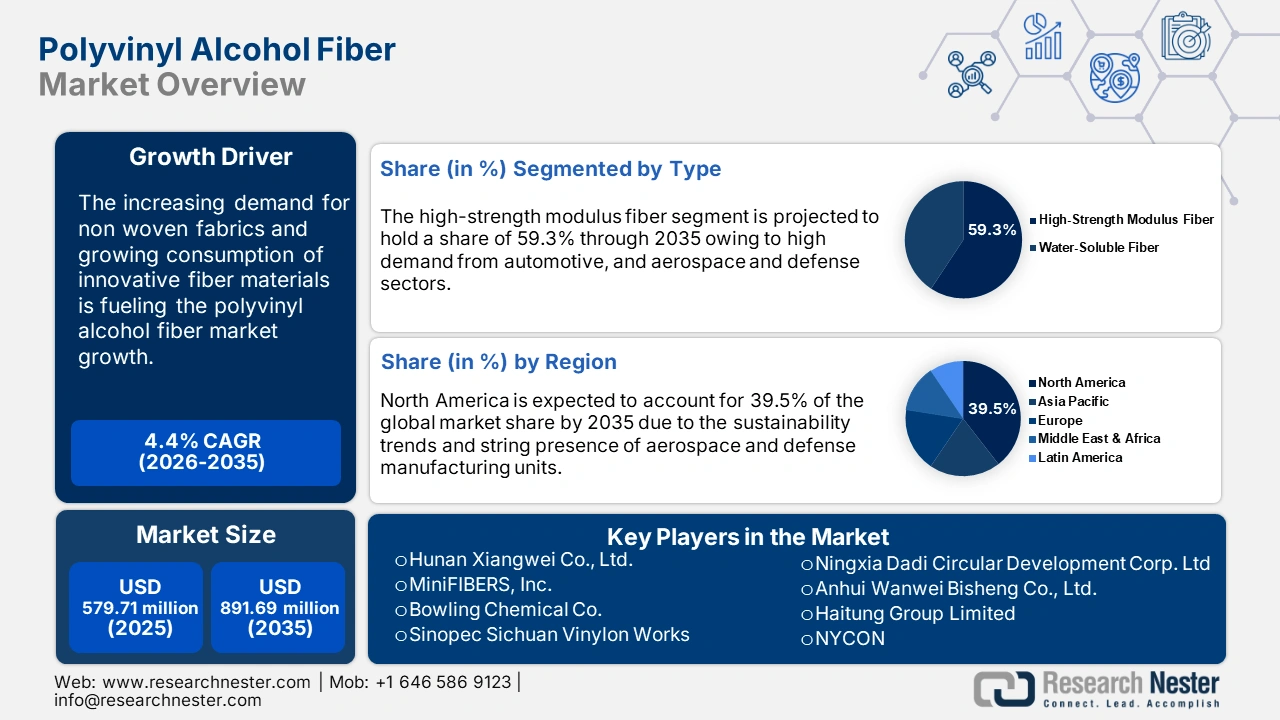

Polyvinyl Alcohol Fiber Market size was valued at USD 579.71 million in 2025 and is expected to reach USD 891.69 million by 2035, registering around 4.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polyvinyl alcohol fiber is evaluated at USD 602.67 million.

Strict regulations and a global push toward sustainability are augmenting the sales of polyvinyl alcohol (PVA) fibers. The increasing popularity of biodegradable and eco-friendly materials is also backing the consumption of polyvinyl alcohol fibers across several end use industries such as construction, textiles, paper, and packaging. Continuous research and development activities are leading to the development of improved polyvinyl alcohol fibers. Advancements in production technologies are estimated to uplift the polyvinyl alcohol fiber market growth in the coming years. The rising urban and industrial activities in the developing regions are amplifying the sales of polyvinyl alcohol fibers. Manufacturers are set to find significant scope in the high-potential economies in the years ahead.

|

Polyvinyl Alcohols |

|||

|

Country |

Export Value in USD Million |

Country |

Import Value in USD Million |

|

China |

733 |

Germany |

207 |

|

Chinese Taipei |

351 |

Netherlands |

193 |

|

Japan |

242 |

U.S. |

183 |

|

Germany |

229 |

Belgium |

147 |

|

U.S. |

209 |

India |

144 |

Source: OEC World

The report by the Observatory of Economic Complexity (OEC) states that in 2022, the global trade of polyvinyl alcohol stood at USD 2.17 billion, representing the 1413th position as the most traded global product. The polyvinyl alcohol trade expanded at a significant CAGR of 36.0% between 2021 and 2022. The export trade of polyvinyl alcohol was mostly dominated by the Asian countries. The market concentration amounted to 3.04 using Shannon Entropy, explaining the export dominance of 8 countries. Gross product exports growth totaled USD 34.1 billion in China, in 2022.

Key Polyvinyl Alcohol Fiber Market Insights Summary:

Regional Highlights:

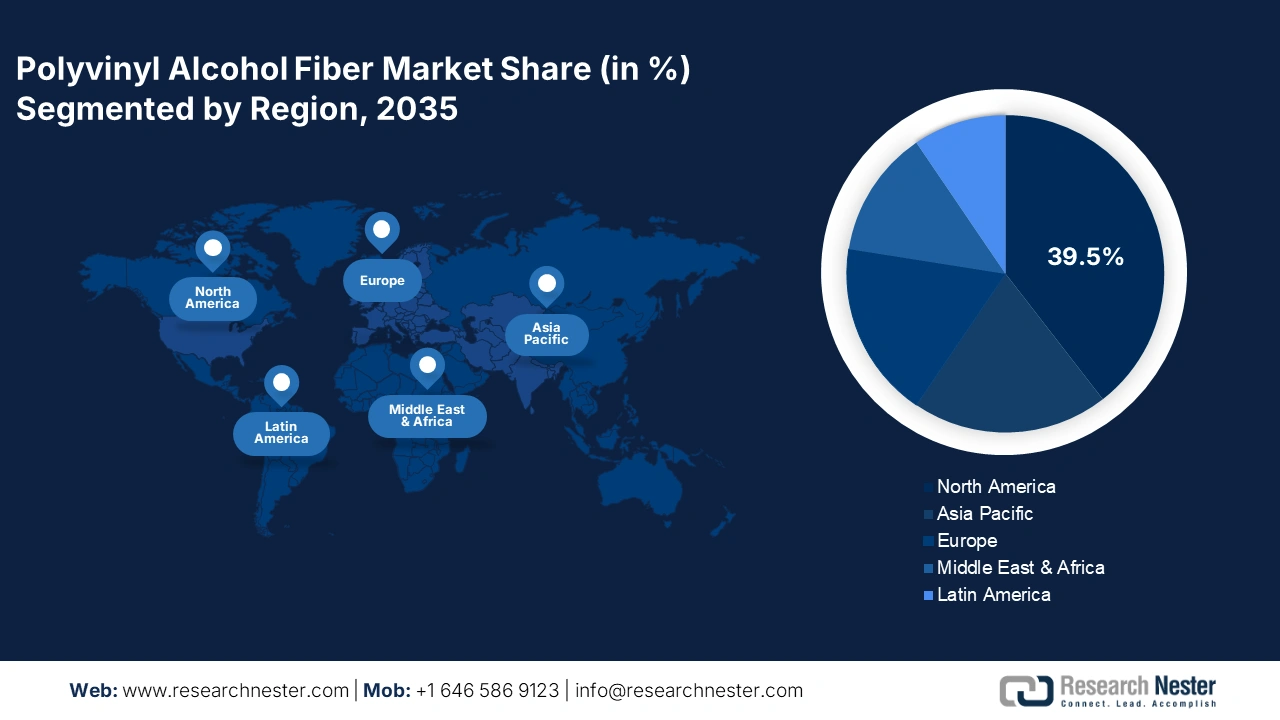

- North America polyvinyl alcohol fiber market will account for 39.50% share by 2035, fueled by innovations in medical fabrics and automotive sector advancements.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, fueled by the booming textile industry and supportive government policies.

Segment Insights:

- The high-strength modulus fiber segment in the polyvinyl alcohol fiber market is projected to achieve significant growth till 2035, fueled by its lightweight and durable characteristics ideal for aerospace and automotive.

- The construction segment in the polyvinyl alcohol fiber market is expected to secure a dominant share by 2035, driven by increased use of PVA fibers in infrastructure and composite material reinforcement.

Key Growth Trends:

- Growing popularity of nonwoven fabrics

- Rise in the textile sector

Major Challenges:

- Growing popularity of nonwoven fabrics

- Rise in the textile sector

Key Players: Inner Mongolia Shuangxin Environment-Friendly Material Co., Ltd., Ningxia Dadi Circular Development Corp. Ltd, Anhui Wanwei Bisheng Co., Ltd., and Haitung Group Limited.

Global Polyvinyl Alcohol Fiber Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 579.71 million

- 2026 Market Size: USD 602.67 million

- Projected Market Size: USD 891.69 million by 2035

- Growth Forecasts: 4.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Polyvinyl Alcohol Fiber Market Growth Drivers and Challenges:

Growth Drivers

- Growing popularity of nonwoven fabrics: Nonwoven fabrics widely used in hygiene, medical, and filtration products are major drivers of the polyvinyl alcohol fiber market growth. Polyvinyl alcohol fiber is the main material used in the production of nonwoven fabrics owing to its ability to create fabric more soft, durable, and lightweight. Thus, the growth in the nonwoven fabrics trade directly propels the sales of polyvinyl alcohol fibers. For instance, the OEC study reveals that the nonwoven textile trade was calculated at USD 18.4 billion in 2022, holding the 238th position as the most traded product worldwide. China and the U.S. are the leading exporters and importers of nonwoven textiles.

|

Nonwoven Textiles |

|||

|

Country |

Export Value in USD Million |

Country |

Import Value in USD Million |

|

China |

4050 |

U.S. |

1870 |

|

Germany |

2120 |

Germany |

1300 |

|

U.S. |

1920 |

China |

917 |

|

Italy |

1370 |

Japan |

816 |

|

Japan |

943 |

Poland |

727 |

Source: OEC World

- Rise in the textile sector: The textile companies are leading consumers of PVA fibers, particularly for the production of industrial clothing. Innovations in textile industries are driving high demand for water-soluble and biodegradable fibers such as polyvinyl alcohol fiber. Furthermore, the Textile Exchange Organization study reveals that the fiber production per person worldwide expanded from 8.3 kgs in 1975 to 14.6 kgs in 2022. Furthermore, the sustainability trend is anticipated to offer lucrative opportunities for polyvinyl alcohol fiber manufacturers in the textile industry.

Challenges

- Limited awareness among some end users: Polyvinyl alcohol fiber’s limited awareness and adoption in some manufacturing industries are limiting its sales growth. The prime reasons hindering polyvinyl alcohol fiber adoption are resistance to change and experimentation with new technologies. Small-scale companies and those in price-sensitive markets often hesitate to invest in new technologies owing to a lack of knowledge of their benefits and high costs.

- Competition from alternatives: The easy availability of alternatives such as polylactic acid, nylon, polypropylene, cotton, and hemp is hampering the polyvinyl alcohol fiber market growth. The cost-effectiveness and similar benefits offered by these solutions often create challenges for polyvinyl alcohol fiber manufacturers. Thus, high competition from alternative solutions is expected to constrain the revenue growth of key players to some extent.

Polyvinyl Alcohol Fiber Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 579.71 million |

|

Forecast Year Market Size (2035) |

USD 891.69 million |

|

Regional Scope |

|

Polyvinyl Alcohol Fiber Market Segmentation:

Type Segment Analysis

The high-strength modulus fiber segment is poised to capture over 59.3% polyvinyl alcohol fiber market share by 2035. These types of fibers are finding high applications in aerospace & defense, automotive, and infrastructure development sectors. High-strength modulus fiber with its lightweight and ability to withstand extreme conditions such as temperature, pressures, and impacts are boosting the sales growth. The swift hike in automotive ownerships is fueling the demand for high-strength modulus fibers across the world. The necessary strength-to-weight ratio offered by high-strength modulus fibers makes them ideal for use in aircraft and automobile components and systems, further contributing to the overall polyvinyl alcohol fiber market growth.

Application Segment Analysis

The construction segment is projected to account for a dominating polyvinyl alcohol fiber market share throughout the forecast period. In the construction sector, versatile and superior-strength fibers such as PVA are increasingly being used to reinforce concentrate and other composite materials. The growth in infrastructure development projects including bridges, roads, and high-rise buildings positively contributes to the polyvinyl alcohol fiber sales. For instance, the International Finance Corporation (IFC) states that in FY24 it invested around USD 8.9 billion in infrastructure projects. Furthermore, in January 2025, IFC entered into a strategic partnership with ACCIONA to enhance sustainable infrastructure projects across high-potential markets. Such developments in the construction segment are opening lucrative doors for polyvinyl alcohol fiber producers.

Our in-depth analysis of the global polyvinyl alcohol fiber market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyvinyl Alcohol Fiber Market Regional Analysis:

North America Market Insights

North America polyvinyl alcohol fiber market is anticipated to capture revenue share of over 39.5% by 2035. Innovations in medical fabric materials, the expanding automotive sector, and the integration of superior materials in fishing products including ropes and nets are set to boost the revenues of polyvinyl alcohol fiber manufacturers. Developments in the paper industry are also driving the sales of polyvinyl alcohol fibers in both the U.S. and Canada.

In the U.S., the continuous innovations in aerospace and defense component manufacturing are anticipated to fuel the adoption of polyvinyl alcohol fibers. Investments in this sector are backing the adoption of polyvinyl alcohol fiber materials. For instance, the Aerospace Industries Association (AAA) revealed that the U.S. aerospace and defense exports increased by 21.0% between 2022 to 2023, totaling USD 135.9 billion, owing to the increasing demand for American-made products.

In Canada, strict environmental regulations and sustainability trends are expected to propel the adoption of polyvinyl alcohol fibers. The shift towards biodegradable and water-soluble materials in the paper and packaging sector is also augmenting the sales of polyvinyl alcohol fibers. The Canadians’ focus on reducing plastic waste is propelling the use of polyvinyl alcohol fiber materials for packaging purposes. Consistent innovations in these sectors are set to boost the revenues of polyvinyl alcohol fiber producers in the coming years.

Asia Pacific Market Insights

The Asia Pacific polyvinyl alcohol fiber market is foreseen to increase at the fastest CAGR throughout the study period. The boasting textile industry, high fishing culture, and booming construction activities are set to propel the sales of polyvinyl alcohol fibers in the coming years. India, China, South Korea, and Japan are high-earning marketplaces for polyvinyl alcohol fiber manufacturers. Supportive government policies and the strong presence of chemical producers are augmenting the PVA fiber trade in the region.

China being forefront of innovations is creating lucrative opportunities for superior material manufacturers including those who produce PVA fibers. The high demand for innovative materials in the construction sector is fueling the sales of polyvinyl alcohol fibers. The growth in the construction and infra-upgrade projects is expected to increase the demand for polyvinyl alcohol fibers. For instance, the International Trade Administration (ITA) states that China being the largest construction sector invested around USD 4.2 trillion in new infrastructure during its 14th Five-Year Plan period (2021-2025).

India’s rapidly expanding chemical industry backed by supportive government and foreign direct investment (FDI) policies is expected to fuel the sales of polyvinyl alcohol fibers. The India Brand Equity Foundation (IBEF) report states that the chemical industry in the country is set to reach USD1.0 trillion by 2040. Around USD 23.13 million is allotted to the Ministry of Chemical and Petrochemical under the interim budget 2024-25.

Polyvinyl Alcohol Fiber Market Players:

- Hunan Xiangwei Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- MiniFIBERS, Inc.

- Bowling Chemical Co.

- Sinopec Sichuan Vinylon Works

- NYCON

- Inner Mongolia Shuangxin Environment-Friendly Material Co., Ltd.

- Ningxia Dadi Circular Development Corp. Ltd

- Anhui Wanwei Bisheng Co., Ltd.

- Haitung Group Limited

Key players in the polyvinyl alcohol fiber market are employing several organic and inorganic strategies to earn high profits and reach a wider consumer base. New product launches and technological innovations are prime marketing tactics aiding manufacturers to stand out in the crowded landscape. To increase their market reach, the companies are also entering into strategic partnerships and collaborations. Furthermore, to earn untapped opportunities, industry giants are adopting regional expansion strategies.

Some of the key players include in polyvinyl alcohol fiber market:

Recent Developments

- In May 2024, Anhui Wanwei Bisheng Co., Ltd. revealed the introduction of a new polyvinyl alcohol (PVA) product. With superior performance, the product is finding high applications in the construction, textile, paper, and packaging industries.

- In January 2024, Haitung Group Limited declared the launch of a new polyvinyl alcohol product, PVA BP17A. Through this launch, the company sets a step ahead toward becoming a leader in the global petrochemical market.

- Report ID: 7026

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyvinyl Alcohol Fiber Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.