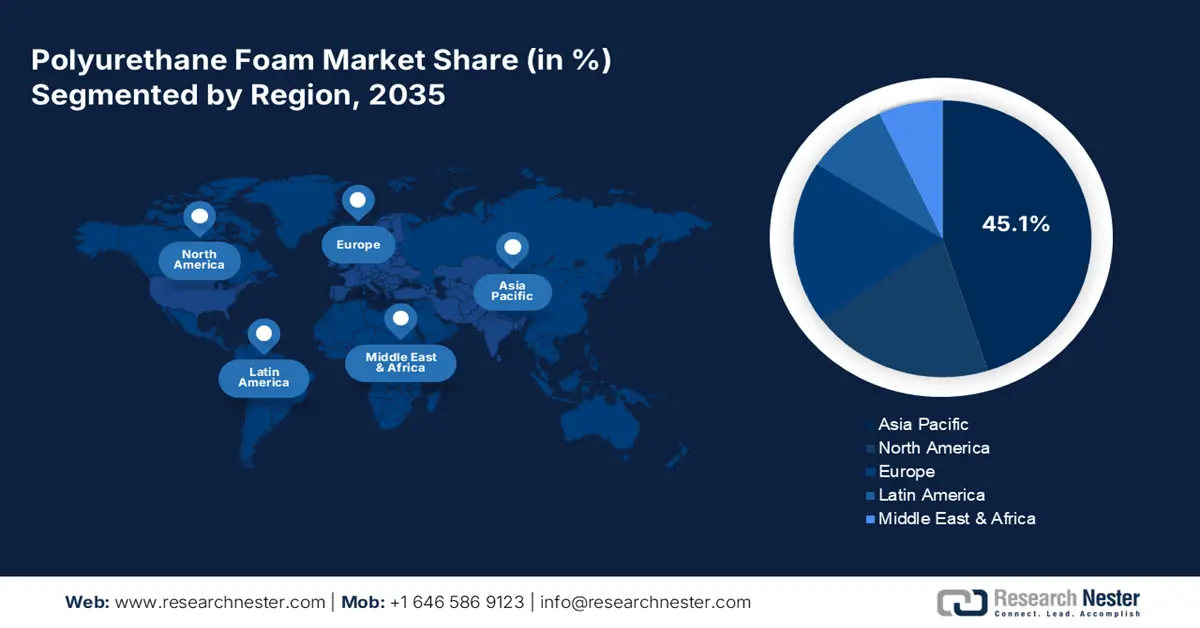

Polyurethane Foam Market - Regional Analysis

APAC Market Insights

The Asia Pacific polyurethane foam market is projected to capture 45.1% of the global revenue share through 2035. The swift rise in urbanization and industrialization is anticipated to fuel the consumption of polyurethane foams. The expanding automotive and home & office furniture markets are creating a profitable environment for both domestic and international players. The hefty public-private investments in the infrastructure sector are also driving the sales of polyurethane foams. China, India, Japan, and South Korea are some of the leading marketplaces in APAC.

The India polyurethane foam industry is poised to increase at the fastest CAGR from 2026 to 2035. The robust growth in the construction and automotive sectors is set to expand the profit margins of polyurethane foam manufacturers. The Indian Green Building Council reveals that nearly 5,820 green projects are certified & fully operational in the country. The government’s push for affordable housing and energy-efficient buildings is increasing the consumption of rigid PU foams.

North America Market Insights

The North America market is estimated to hold the second-largest revenue share throughout the study period. The furniture, bedding, and packaging industries are accelerating the production and commercialization of polyurethane foams. The robust rise in the new residential and commercial projects is also contributing to the increasing sales of PU foams. Furthermore, the sustainability trends are amplifying the demand for bio-based polyols and recyclable PU foams.

The U.S. polyurethane foam sector is anticipated to be driven by the high per-capita consumption and diversified end-use applications. The growing consumer demand for comfort and ergonomic furniture is likely to accelerate the consumption of polyurethane foams. Government incentives, building codes, and green initiatives are further emerging as key driving factors. In November 2024, the U.S. Green Building Council disclosed that there are over 547,000 LEED-certified residential units. This directly indicates the lucrativeness of the U.S. market for PU foam manufacturers.

Europe Market Insights

The Europe market is anticipated to expand at a robust pace between 2026 and 2035. The well-established automotive and furniture sectors are promoting the sales of polyurethane foams. The rigid PU foams are highly demanded by energy-efficient buildings and smart infrastructure projects in the EU. E-commerce growth is also contributing to the increasing demand for PU foam-based protective packaging solutions. The sales of polyurethane foams in Germany are set to be driven by their expanding applications in the automotive interiors and industrial cushioning sectors. The country’s high standards for comfort, safety, and ergonomics are further driving a high demand for medium- and high-density foams in residential and commercial furniture products. The mature construction industry is also accelerating the commercialization of PU foams.