Polystyrene Market Outlook:

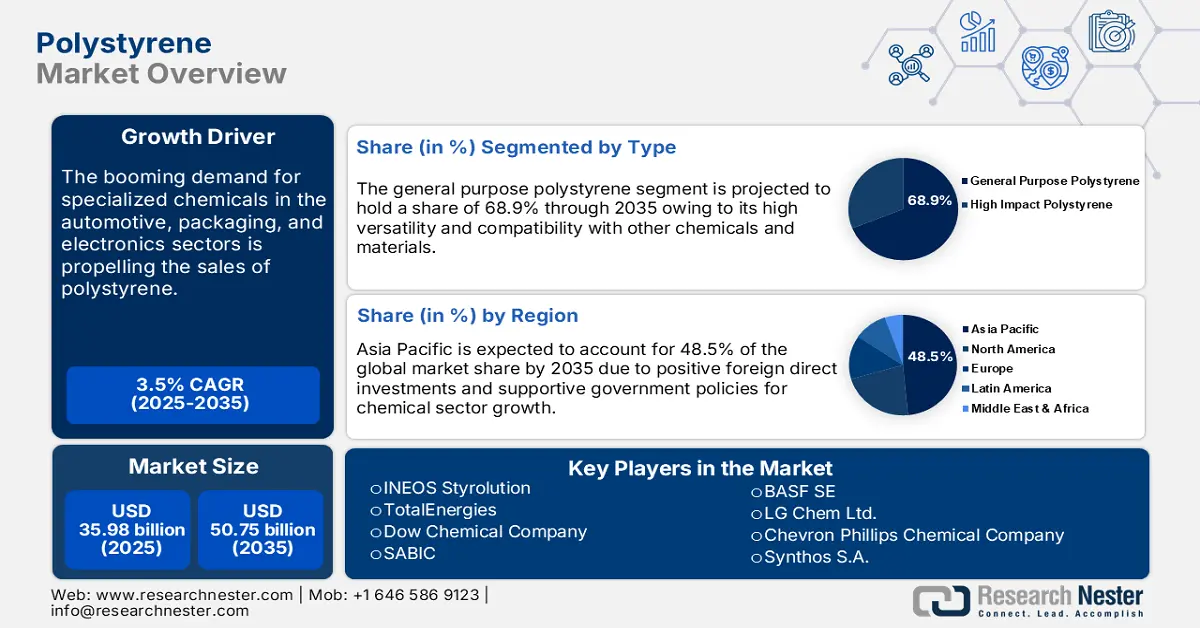

Polystyrene Market size was valued at USD 35.98 billion in 2025 and is set to exceed USD 50.75 billion by 2035, expanding at over 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polystyrene is estimated at USD 37.11 billion.

Polystyrene's superior compatibility and versatility are pushing its adoption in several end use industries. Automotive companies are making wide use of polystyrene to enhance energy efficiency and product performance through lightweight materials and chemicals. Increasing demand for specialized chemicals in the manufacturing of car parts, casings, appliances, and other electronic products is fueling the consumption of polystyrene. The growing popularity of electric vehicles (EVs) and consistent innovations in component production are generating lucrative opportunities for polystyrene manufacturers.

|

Majority of Automotive Industry Giants Estimates Sales and Revenue to Remain Steady or Surpass Over the Coming Years |

||

|

Manufacturer |

Distributor |

Retailer/Distributor |

|

88% |

87% |

82% |

Source: SEMA

The International Energy Agency (IEA) estimates that EVs are gaining widespread popularity, and more than 1 in 5 cars registered are electric, globally. An estimated 17 million electric cars were sold in 2024 across the world, a 25% hike compared to the previous year, with a dominance of China, Europe, and the U.S. Furthermore, the Specialty Equipment Market Association (SEMA) points out that nearly 55% of the automotive aftermarket manufacturers estimated a positive market growth in 2024. With an upward trend, the specialized automotive market crossed USD 52.0 billion in FY2023. The continuous growth in truck registrations is benefitting the manufacturers and aftermarket product and service providers. These statistics highlight that the consistent positive mounting trend in the automotive sector is poised to augment the revenue growth of polystyrene producers in the coming years.

Key Polystyrene Market Insights Summary:

Regional Highlights:

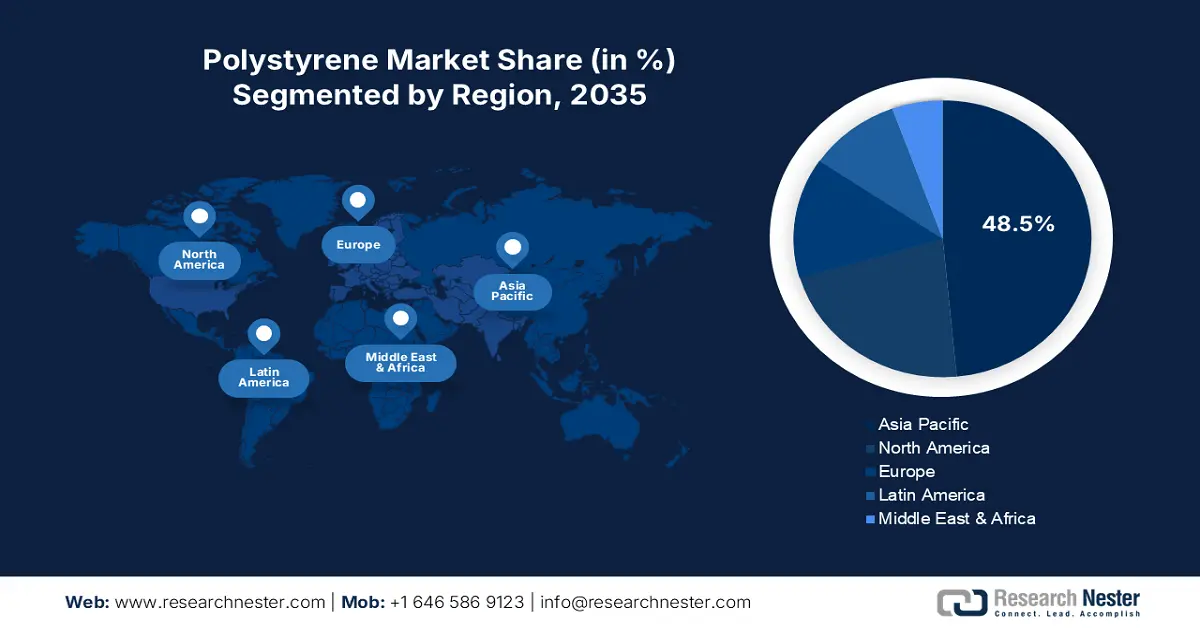

- Asia Pacific commands the Polystyrene Market with a 48.5% share, propelled by FDI policies, government support, and strong presence of end-use industries, driving robust growth through 2026–2035.

- North America's Polystyrene Market is expected to see robust growth over 2026–2035, driven by innovations in automotive and packaging sectors and booming construction industry.

Segment Insights:

- The Packaging segment is expected to achieve a 38.8% share by 2035, influenced by the importance of protective covering and innovations in packaging solutions.

- The General Purpose Polystyrene (GPPS) segment of the Polystyrene Market is forecasted to hold more than 68.9% share by 2035, driven by its versatility and growing applications.

Key Growth Trends:

- Rising applications in construction and buildings

- Electrical and electronics high-growth marketplace for polystyrene producers

Major Challenges:

- Environmental concerns leading to strict regulations

- Presence of alternatives a major drawback

- Key Players: INEOS Styrolution, Total Energies, Dow Chemical Company, SABIC, and BASF SE.

Global Polystyrene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 35.98 billion

- 2026 Market Size: USD 37.11 billion

- Projected Market Size: USD 50.75 billion by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, India, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Polystyrene Market Growth Drivers and Challenges:

Growth Drivers

-

Rising applications in construction and buildings: The construction industry is backing the sales of polystyrene, particularly expanded polystyrene (EPS). The prime factor promoting the consumption of polystyrene is its superiority, lightweight, and versatility in replacing soil or concrete. The increasing shift towards the adoption of specialized and innovative chemicals and materials in construction applications is set to push the demand for polystyrene and its derivates. For instance, the Federal Reserve Bank of St. Louis revealed that the producer price index of polystyrene foam product manufacturing in building and construction was 225.373 in December 2024. The rapid investments in residential structures both in developed and developing countries due to migration and urbanization booms are creating a profitable space for polystyrene producers.

-

Electrical and electronics high-growth marketplace for polystyrene producers: The rising demand for advanced electronics and electrical products is propelling the sales of polystyrene. The fueling use of innovative chemicals and materials in consumer electronics such as smartphones, laptops, and smart appliances is offering substantial growth to polystyrene manufacturers. Innovations in electrical switches, wire protective coatings, and cases are driving the consumption of polystyrene owing to its insulating properties.

Challenges

-

Environmental concerns leading to strict regulations: The non-biodegradable nature of polystyrene, particularly its derivates, creates significant waste management and disposal challenges. Polystyrene is often recorded across shorelines and landfills, leading to pollution. This is further leading to the implementation of strict regulations and bans. These factors lower the polystyrene market potential for products, discouraging the entry of new companies and reducing revenues for existing players.

-

Presence of alternatives a major drawback: The growing competition from alternative chemicals such as bioplastics, polyethylene terephthalate (PET), and polypropylene is challenging the revenue growth of polystyrene manufacturers. The similar properties and applications are appealing end users to invest in them and on the other hand limiting the consumption of polystyrene. Thus, the growing popularity of alternatives is anticipated to hinder the overall polystyrene market growth to some extent in the coming years.

Polystyrene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 35.98 billion |

|

Forecast Year Market Size (2035) |

USD 50.75 billion |

|

Regional Scope |

|

Polystyrene Market Segmentation:

Application (Packaging, Building & Construction, Automotive, Electrical & Electronics, Agriculture, Household Leisure & Sports, Others)

The packaging segment is likely to capture polystyrene market share of around 38.8% by the end of 2035. Packaging has become one of the vital parts of any business, such as e-commerce, food & beverages, automotive components, electronics, and homecare. The importance of protective covering and continuous innovations are propelling the consumption of specialized chemicals and materials, including polystyrene. Food and beverage packaging is one of the leading consumers of polystyrene. The high trade of food and beverages directly augments the packaging material sales and, ultimately, the consumption of polystyrene.

Type (General Purpose Polystyrene (GPPS), High Impact Polystyrene (HIPS))

In polystyrene market, general purpose polystyrene (GPPS) segment is projected to hold revenue share of more than 68.9% by 2035. The versatility of general purpose polystyrene is primarily contributing to its sales growth. GPPS manufacturers are finding lucrative opportunities in the electronics and electrical sectors. The booming demand for housing, casing, and other components is fueling the demand for lightweight and durable general purpose polystyrene. GPPS is also finding high applications in disposable cups, toys, and other household items. The consistent demand for these products from the middle-class earning demographic is anticipated to positively influence the consumption of general purpose polystyrene in the coming years.

Our in-depth analysis of the global polystyrene market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polystyrene Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific polystyrene market is likely to account for revenue share of more than 48.5% by the end of 2035. The positive foreign direct investment policies (FDI), government support for chemical production, and the strong presence of end use industries in the region are augmenting the sales of polystyrene and its derivatives. The expansion of international chemical manufacturing capacities and high spending in R&D are leading to the production and commercialization of advanced polystyrene solutions. China and India are high-growth markets for polystyrene producers, while Japan and South Korea are leading the innovation race.

In China, the rapid growth in the expansion of chemical plants owing to increasing international demand is set to create profitable opportunities for polystyrene companies. The report by the World Integrated Trade Solution (WITS) states that around USD 286.23 million worth of polystyrene was exported to the world, in 2023. The continuous growth in the automotive sector is further fueling the consumption of polystyrene. The IEA study states that China is the largest producer of electric vehicles across the world and in Q1’24 around 1.9 million electric cars were sold in the country.

India’s positive FDI policies and government support are backing the production of organic and inorganic chemicals, including polystyrene. For instance, the WITS study estimates that nearly 41,060,000 Kg of polystyrene was exported by India in 2023. Furthermore, the India Brand Equity Foundation (IBEF) states that between Q2-Q3 of FY 2024, the organic and inorganic chemical export trade totaled USD 14.09 billion. FDI inflows in the chemicals industry were calculated at USD 22.70 billion between April 2000 and June 2024. The swift rise in the packaging industry is also anticipated to drive the sales of polystyrene in the coming years. India is becoming a hub for packaging solutions backed by an estimated annual growth rate of 22 to 25%.

North America Market Statistics

The North America polystyrene market is expected to increase at a robust pace between 2025 to 2035. The strong presence of chemical companies, innovations in the automotive sector, high demand for specialized materials in packaging, and fueling agrochemical production are propelling the sales of polystyrene in the region. The booming construction and infrastructure development activities in both the U.S. and Canada are further augmenting the consumption of polystyrene and its derivatives.

In the U.S., the increasing development in agrochemical manufacturing is anticipated to drive the sales of polystyrene in the coming years. For instance, the Federal Reserve Bank of St. Louis estimated that the producer price index by industry of pesticide and other agriculture chemical manufacturing amounted to 197.833 in December 2024. The boasting construction industry is also opening profitable doors for polystyrene companies. The U.S. Census Bureau disclosed that the construction spending totaled USD 2192.2 billion in December 2024. The rise in residential and commercial structures in the country is representing a high demand for polystyrene foam products.

Canada’s expanding automotive sector is forecast to fuel the consumption of polystyrene in the coming years. The industry giants are focused on the use of specialized chemicals and materials to achieve energy efficiency by mitigating vehicle weight. The increasing registrations and supply of vehicles are reflecting a high demand for polystyrene. For instance, the Statistique Canada study disclosed that the total number of road motor vehicles surpassed 26.0 million in 2022 and nearly 483,287 new motor vehicles were registered in the third quarter of 2024.

Key Polystyrene Market Players:

- INEOS Styrolution

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TotalEnergies

- Dow Chemical Company

- SABIC

- BASF SE

- LG Chem Ltd.

- Chevron Phillips Chemical Company

- Synthos S.A.

- Versalis S.p.A.

- Formosa Chemicals & Fibre Corp.

- Trinseo

- Nova Chemicals Corporation

- Chi Mei Corporation

- Supreme Petrochem Ltd.

- Americas Styrenics LLC

The global polystyrene market is characterized by the presence of gigantic players and the increasing emergence of new companies. Leading companies are employing several organic and inorganic strategies such as new product launches, technological innovations, mergers & acquisitions, strategic collaborations & partnerships, and regional expansions to earn high profits and reach a wider customer base. Start-ups are investing heavily in research and development activities to introduce innovative solutions and stand out in the competitive landscape. By forming strategic collaborations, key players are introducing next-gen solutions and expanding their market reach.

Some of the key players include in polystyrene market:

Recent Developments

- In January 2025, the Plastics Industry Association (PLASTICS) announced the formation of the Polystyrene Recycling Alliance (PSRA), marking a significant step toward improving polystyrene recycling across the U.S. This collaboration is a move towards polystyrene sustainability and spreading awareness among Americans to recycle a wide variety of polystyrene items.

- In December 2024, INEOS Styrolution announced the launch of the first yoghurt cup in a supermarket containing mechanical recycling of polystyrene at food contact quality. Such innovations are significantly aiding the companies to align with the circular economy trend.

- Report ID: 7148

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polystyrene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.