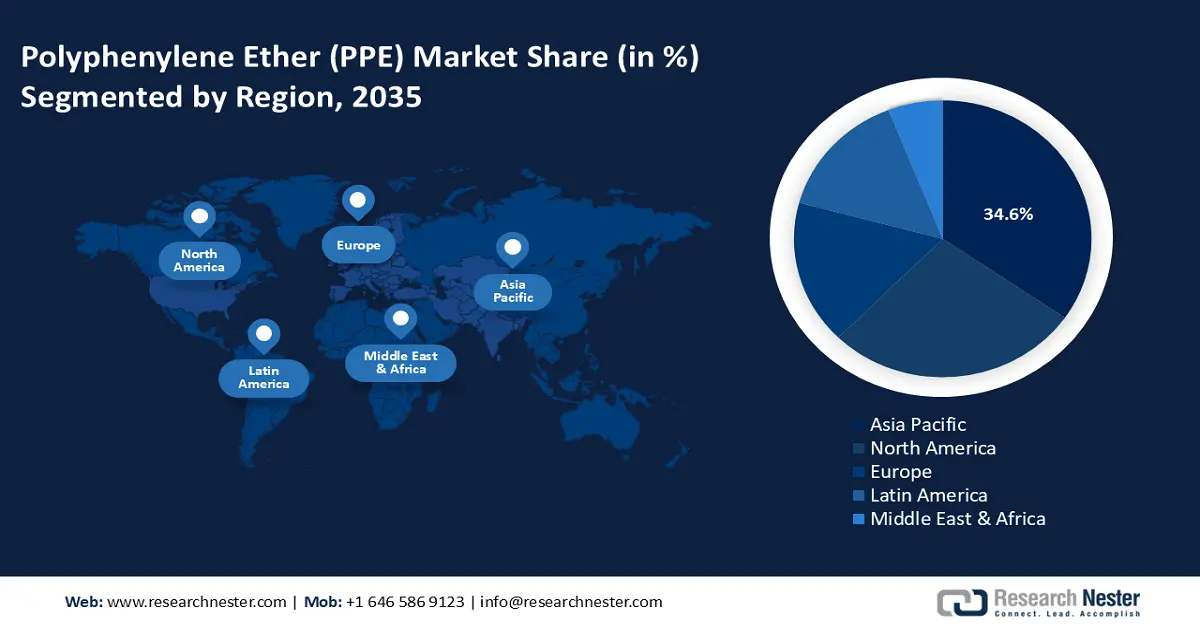

Polyphenylene Ether (PPE) Market - Regional Analysis

APAC Market Insights

Asia Pacific in polyphenylene ether market is anticipated to dominate over 34.6% revenue share by 2035. The market is expanding owing to the increased production of automobiles in the region. Automobile battery packs, sandwich composite cores, shock absorbers, and other components heavily rely on polyphenylene ether. Furthermore, the increasing use of electronic devices including laptops, smartphones, and power banks, and the growing number of vehicle manufacturing facilities in the region, particularly in Singapore and Thailand, will propel polyphenylene ether market growth. For instance, the Asia Pacific region's smartphone adoption rate increased from 64% in 2019 to 78% in 2023. It was predicted that over 90% of people in APAC would own a smartphone by 2030.

Furthermore, in 2024, the polyphenylene ether (PPE) market was experiencing a slowdown as the upstream cost support diminished. Furthermore, there was minimal international interest in buying new products, so inventory supplies were building up. During the aforementioned time frame, the supply and demand dynamic also showed minimal stability on a domestic level.

In China, expanding automotive and electronics will drive the growth of the polyphenylene ether market. According to reports, China produced 30.16 million motor vehicles in December 2023. Compared to the prior figure of 27.02 million units for December 2022, this is an increase, heightening the use of PPE for components like battery packs and shock absorbers due to its lightweight and durable properties. Moreover, the increasing adoption rate of EVs has bolstered the demand for PPE in manufacturing components such as connectors and housings in the nation.

Moreover, India's chemical industry is flourishing, due to easy access to abundant raw materials, a cost-effective workforce, and a series of organic developments that have taken place, escalating the polyphenylene ether market. The India Brand Equity Foundation (IBEF) reported that India is third in Asia and sixth globally in terms of chemical production, which accounts for 7% of the country's GDP. Currently valued at USD 220 billion, the Indian chemical sector is projected to grow to USD 300 billion by 2030 and USD 1 trillion by 2040. Even in a time of global instability, this industry continues to be a vibrant center of opportunity.

North America Market Insights

The North America polyphenylene ether market is expected to grow at a significant rate during the projected period. The market's expansion can be primarily ascribed to the growing use of electric, hybrid, and lightweight cars along with the expanding aerospace industry's applications in the region. Additionally, the region's polyphenylene ether (PPE) market is expanding due to the growing use of PPE in pump impellers, automotive composites, small appliance housings, and computer screens. According to the International Trade Administration, the U.S. aerospace industry continues to generate the largest trade balance (USD 77.6 billion in 2019) and the second-highest volume of exports (USD 148 billion). With aerospace exports growing at an average rate of 5.31% over the last ten years and the aerospace trade balance growing at an average rate of 4.64% since 2010, this dominant position has stayed the same for decades.

Furthermore, the polyphenylene ether’s pricing forecast experienced a state of near-stagnation as a result of the supply and demand equation operating at moderate levels and managing to achieve equilibrium. To balance the average demand dynamic of the American industries, the suppliers were careful to purchase adequate supplies. In conclusion, a buoyant and steady pricing performance was seen, with sporadic, small variations.

In the U.S., PPE contributes to reducing vehicle weight and enhancing fuel efficiency. According to the IEA, the U.S. sold more than 16 million light-duty vehicles (LDVs) in 2019. The average fuel consumption of new LDVs in the nation in 2019 was 8.6 liters of gasoline-equivalent (Lge/100 km), which is 20% more than the global average. Moreover, the growing use of PPE in producing medical devices and surgical equipment is further fueling the polyphenylene ether market growth.