Polyphenylene Ether (PPE) Market Outlook:

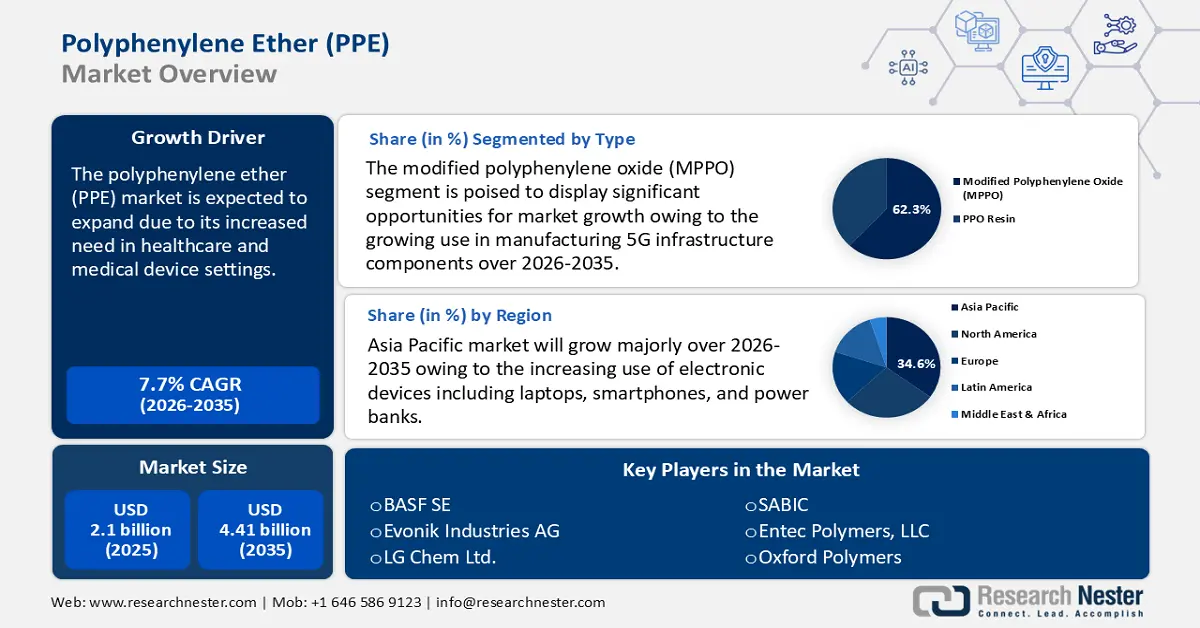

Polyphenylene Ether (PPE) Market size was over USD 2.1 billion in 2025 and is projected to reach USD 4.41 billion by 2035, witnessing around 7.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polyphenylene ether (PPE) is assessed at USD 2.25 billion.

The polyphenylene ether market will thrive owing to its increased need in healthcare and medical device settings. Due to its high degree of flexibility, modified polyphenylene ether (MPPE) is becoming popular. This has led to the widespread adoption of portable medical devices in developed and emerging nations. Hospitals and healthcare facilities strive to build low-noise medical for a better environment.

Furthermore, the growing aging population is promoting home care environments with better use of portable medical equipment. The World Health Organization (WHO) has projected that the population of individuals aged 60 years and older is anticipated to double to 2.1 billion by the year 2050. Additionally, between 2020 and 2050, the demographic of individuals aged 80 and above is expected to experience a threefold increase, reaching a total of 426 million. Also, major manufacturers in the U.S., China, Germany, and Mexico develop advanced medical devices, including portable medical devices, and trade them to meet the global demand.

|

Country |

Export Value of Medical Devices (in USD) |

Country |

Import Value of Medical Devices (in USD) |

|

U.S. |

33.3 Billion |

U.S. |

34.7 Billion |

|

Germany |

17.6 Billion |

Netherlands |

12.9 Billion |

|

Mexico |

14.1 Billion |

Germany |

11.4 Billion |

|

China |

12.0 Billion |

China |

10.1 Billion |

|

Netherlands |

11.5 Billion |

Japan |

6.58 Billion |

Source: OEC

According to the Observatory of Economic Complexity (OEC), with a total trade of USD 157 billion in 2022, medical instruments ranked as the 17th most traded product globally. Medical instrument exports increased by 4.22% between 2021 and 2022, from USD 151 billion to USD 157 billion. commerce in Medical Instruments constitute 0.66% of total world commerce. According to the Product Complexity Index (PCI), Medical Instruments is ranked 211th.

Key Polyphenylene Ether (PPE) Market Insights Summary:

Regional Highlights:

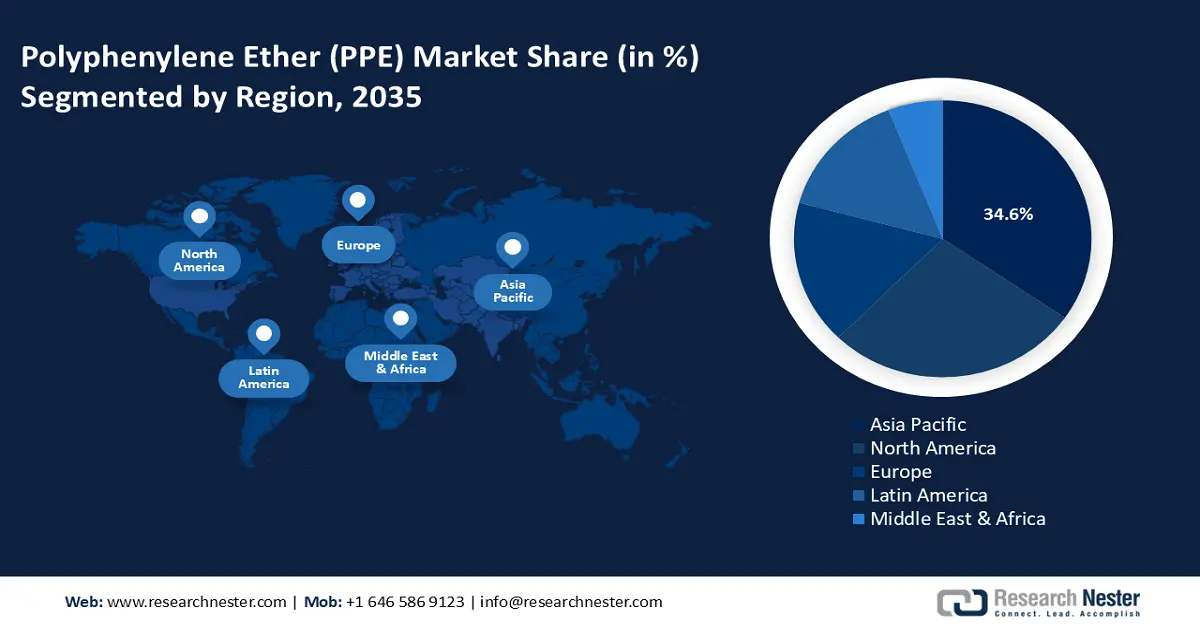

- By 2035, Asia Pacific is expected to command over 34.6% revenue share in the polyphenylene ether (PPE) market, underpinned by increased automobile production in the region.

- Across 2026-2035, North America is projected to expand at a notable pace, stemming from the growing use of electric, hybrid, and lightweight cars.

Segment Insights:

- By 2035, the modified polyphenylene oxide (MPPO) segment in the polyphenylene ether (PPE) market is projected to secure over 62.3% share, propelled by increasing demand for household appliances and electrical gadgets.

- Through 2026-2035, the automotive parts segment is anticipated to capture a substantial share, supported by the increasing demand and production of EVs and other automobiles.

Key Growth Trends:

- Growing application in end use industries

- Recent advances in upcycling PPE waste products

Major Challenges:

- Availability of alternatives

- Environmental concerns and stringent laws

Key Players: BASF SE, Evonik Industries AG, Entec Polymers, LLC, LyondellBasell Industries Holdings B.V., Oxford Polymers, Polyplastics Co., Ltd., SABIC, LG Chem Ltd., ROMIRA GmbH, Ashley Polymers.

Global Polyphenylene Ether (PPE) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.1 billion

- 2026 Market Size: USD 2.25 billion

- Projected Market Size: USD 4.41 billion by 2035

- Growth Forecasts: 7.7%

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 21 November, 2025

Polyphenylene Ether (PPE) Market - Growth Drivers and Challenges

Growth Drivers

- Growing application in end use industries: The increasing use of thermoplastic in housing units, where it is used to manufacture necessary components such as sockets, connectors, circuits, and insulators, will propel the growth of the polyphenylene ether market. PPE is renowned for its superior electrical insulating qualities and tolerance to high temperatures. Due to these characteristics’ builders of residential or commercial space are extensively employing PPE in their construction activities.

Also, PPE consumption will be driven by the growing population, the increasing need for safe housing, and the expansion of commercial and industrial spaces. Moreover, the surging number of manufacturers in the EV sector, the positive consumer response to hybrid and electric vehicles, and the excellent regional government initiatives to encourage the adoption of EVs for private and public transportation will accelerate the demand for PPE. For instance, a multi-government policy group called the Electric Vehicles Initiative (EVI) is tasked with hastening the global rollout and uptake of electric vehicles. To assist the EVI member nations in this endeavor, the IEA serves as Coordinator. Canada, Chile, China, Finland, France, Germany, India, Japan, the Netherlands, New Zealand, Norway, Poland, Portugal, Sweden, the United Kingdom, and the United States are among the sixteen participating in EVI.

- Recent advances in upcycling PPE waste products: Industrial polyphenylene ether production produces dimethyl phenol (DMP) oligomers as a byproduct, which greatly adds to the environmental burden of PPE use. Through Friedel-Crafts alkylation with p-dichloroxylene as an external crosslink agent, researchers identified a novel method for upcycling waste-derived DMP into hyper-crosslinked porous polymer networks. With a maximum BET surface area of 740 m2/g, the resultant hypercrosslinked porous polymers demonstrated an adsorption capacity of 5.9 weight percent for CO2 and 0.85 weight percent for H2. It was determined that the rigidity of the aromatic network structure was responsible for the form stability of micro- and mesopores. The findings suggest new possibilities for upcycling DMP-waste components for uses like carbon capture, which can lessen the adverse environmental effects of producing and using PPE and related engineering polymers.

Challenges

- Availability of alternatives: The companies in the polyphenylene ether market that operate in the chemical and materials sector are seeking new ways to innovate and create copolymers that will not only satisfy the competitive end-user demand but also aim for future expansion. As a result, new high-performance alternatives to PPE, typically treated as a copolymer, have been developed. Therefore, the introduction of alternative materials will hinder the expansion of the polyphenylene ether market.

- Environmental concerns and stringent laws: The widespread usage of various types of plastic is the root cause of the environmental issues, of which polyphenylene ether is one aspect. Recently many efforts have been made to raise public awareness of plastic and its derivatives, increasing pressure on manufacturers to build sustainable substitutes. Future survival may be increasingly challenging for PPE-producing companies unless they can find better solutions to address PPE-led environmental contamination. Furthermore, the extensive regulatory framework surrounding PPE use will make operations much more difficult.

Polyphenylene Ether (PPE) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 4.41 billion |

|

Regional Scope |

|

Polyphenylene Ether (PPE) Market Segmentation:

Type Segment Analysis

Modified polyphenylene oxide (MPPO) segment is likely to hold more than 62.3% polyphenylene ether market share by 2035. A substance known as modified polyphenylene oxide (MPPO) is composed of polystyrene and PPO. These materials include a range of mechanical properties and physical attributes, including good electrical qualities, low moisture absorption levels, and resilience to heat and chemicals. Thus, the increasing demand for household appliances and electrical gadgets is responsible for the segment growth.

The growing usage of MPPO in manufacturing 5G infrastructure components is one of the most noteworthy trends. The need for materials with superior electrical insulation and heat resistance will increase as the world prepares for the global rollout of 5G technology. By the end of 2030, 5G coverage is expected to reach about 85% of the world's population outside of China's mainland. Therefore, the increasing 5G subscriptions worldwide will escalate the market.

Application Segment Analysis

The automotive parts segment in polyphenylene ether (PPE) market will garner a significant share during the assessed period. The segment growth can be attributed to the increasing demand and production of EVs and other automobiles. The International Energy Agency (IEA) revealed that sales of electric vehicles approached 14 million in 2023. From about 4% in 2020 to 18% in 2023, electric automobiles now account for a larger portion of overall sales. Due to its lightweight nature, polyphenylene ether boasts remarkable strength, making it an excellent option for manufacturing various automotive components. This includes critical parts such as ignition systems, hybrid car inverters, electrical connectors, and lighting systems, among others. Moreover, globally, people's rising disposable income and rising car sales will fuel PPE market segment expansion.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyphenylene Ether (PPE) Market - Regional Analysis

APAC Market Insights

Asia Pacific in polyphenylene ether market is anticipated to dominate over 34.6% revenue share by 2035. The market is expanding owing to the increased production of automobiles in the region. Automobile battery packs, sandwich composite cores, shock absorbers, and other components heavily rely on polyphenylene ether. Furthermore, the increasing use of electronic devices including laptops, smartphones, and power banks, and the growing number of vehicle manufacturing facilities in the region, particularly in Singapore and Thailand, will propel polyphenylene ether market growth. For instance, the Asia Pacific region's smartphone adoption rate increased from 64% in 2019 to 78% in 2023. It was predicted that over 90% of people in APAC would own a smartphone by 2030.

Furthermore, in 2024, the polyphenylene ether (PPE) market was experiencing a slowdown as the upstream cost support diminished. Furthermore, there was minimal international interest in buying new products, so inventory supplies were building up. During the aforementioned time frame, the supply and demand dynamic also showed minimal stability on a domestic level.

In China, expanding automotive and electronics will drive the growth of the polyphenylene ether market. According to reports, China produced 30.16 million motor vehicles in December 2023. Compared to the prior figure of 27.02 million units for December 2022, this is an increase, heightening the use of PPE for components like battery packs and shock absorbers due to its lightweight and durable properties. Moreover, the increasing adoption rate of EVs has bolstered the demand for PPE in manufacturing components such as connectors and housings in the nation.

Moreover, India's chemical industry is flourishing, due to easy access to abundant raw materials, a cost-effective workforce, and a series of organic developments that have taken place, escalating the polyphenylene ether market. The India Brand Equity Foundation (IBEF) reported that India is third in Asia and sixth globally in terms of chemical production, which accounts for 7% of the country's GDP. Currently valued at USD 220 billion, the Indian chemical sector is projected to grow to USD 300 billion by 2030 and USD 1 trillion by 2040. Even in a time of global instability, this industry continues to be a vibrant center of opportunity.

North America Market Insights

The North America polyphenylene ether market is expected to grow at a significant rate during the projected period. The market's expansion can be primarily ascribed to the growing use of electric, hybrid, and lightweight cars along with the expanding aerospace industry's applications in the region. Additionally, the region's polyphenylene ether (PPE) market is expanding due to the growing use of PPE in pump impellers, automotive composites, small appliance housings, and computer screens. According to the International Trade Administration, the U.S. aerospace industry continues to generate the largest trade balance (USD 77.6 billion in 2019) and the second-highest volume of exports (USD 148 billion). With aerospace exports growing at an average rate of 5.31% over the last ten years and the aerospace trade balance growing at an average rate of 4.64% since 2010, this dominant position has stayed the same for decades.

Furthermore, the polyphenylene ether’s pricing forecast experienced a state of near-stagnation as a result of the supply and demand equation operating at moderate levels and managing to achieve equilibrium. To balance the average demand dynamic of the American industries, the suppliers were careful to purchase adequate supplies. In conclusion, a buoyant and steady pricing performance was seen, with sporadic, small variations.

In the U.S., PPE contributes to reducing vehicle weight and enhancing fuel efficiency. According to the IEA, the U.S. sold more than 16 million light-duty vehicles (LDVs) in 2019. The average fuel consumption of new LDVs in the nation in 2019 was 8.6 liters of gasoline-equivalent (Lge/100 km), which is 20% more than the global average. Moreover, the growing use of PPE in producing medical devices and surgical equipment is further fueling the polyphenylene ether market growth.

Polyphenylene Ether (PPE) Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik Industries AG

- Entec Polymers, LLC

- LyondellBasell Industries Holdings B.V.

- Oxford Polymers

- Polyplastics Co., Ltd.

- SABIC

- LG Chem Ltd.

- ROMIRA GmbH

- Ashley Polymers

The polyphenylene ether (PPE) market is defined by the existence of well-established competitors who compete based on technological breakthroughs, product quality, and innovation. Key market players frequently use strategic moves like mergers, acquisitions, and expansions to increase their PPE market presence and effectively fulfill the growing demand.

Recent Developments

- In July 2023, SABIC, a global leader in the chemical industry, unveiled its new PCR-based NORYL resin technology, made with 25% or more post-consumer recycled (PCR) content. This technology aims to provide alternative, sustainable material options to clients.

- In October 2021, LyondellBasell announced that it is currently producing polypropylene (PP) and polyethylene (PE) on a commercial scale with measurable and certified C14 sustainable content from renewable feedstock.

- Report ID: 4075

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyphenylene Ether (PPE) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.