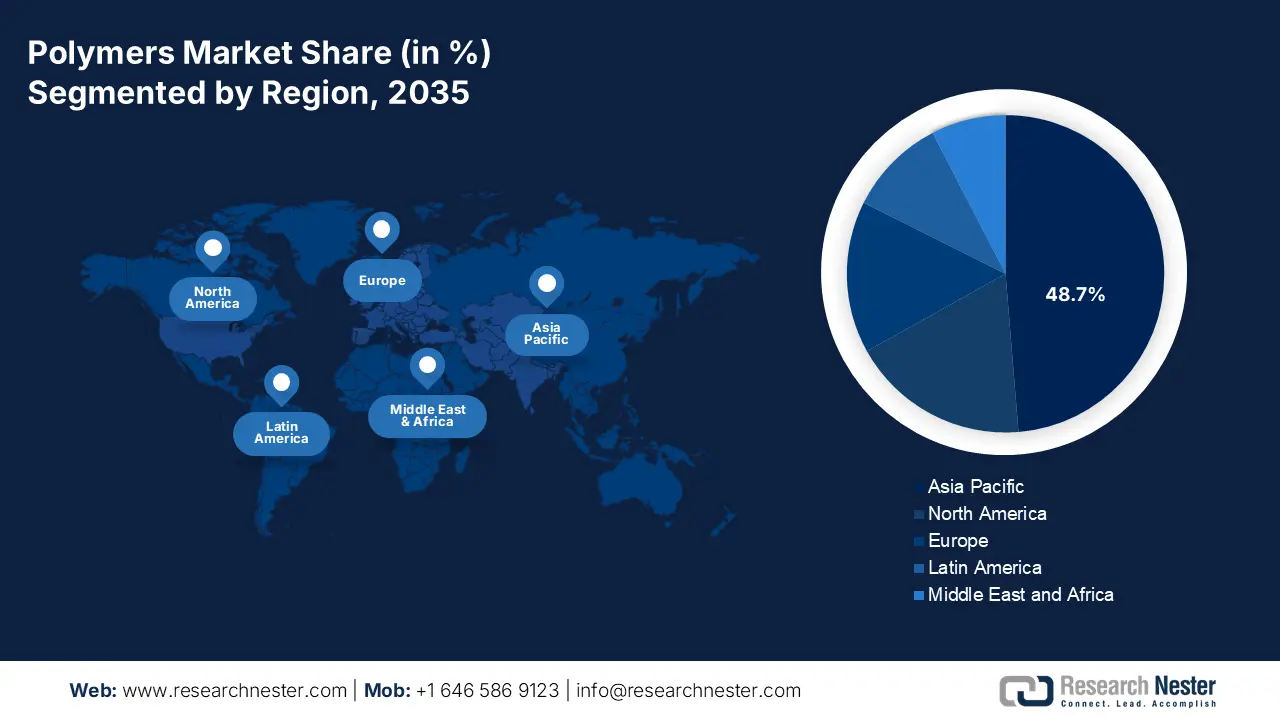

Polymers Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the polymers market is anticipated to account for the largest share of 48.7% by the end of 2035. The market’s upliftment in the region is highly driven by its huge manufacturing facilities, rapid urbanization, and extended middle-class consumption, especially in the automotive, construction, and packaging industries. China is the ultimate volume leader, while the market in India and Southeast Asia is also experiencing growth. According to a data report published by the Asia Development Bank (ADB) in 2024, the Innovative Finance Facility for Climate in Asia and the Pacific (IF-CAP) has been unveiled, which has contributed towards the administration for delivering USD 100 billion in climate finance. In addition, the ADB has also provided USD 30.8 billion in climate financing from domestic resources. In this regard, the three-year average share operations supported climate action, which has reached 79%, further surpassing the 75% target, all of which are catering to sustainability in the region.

China in the polymers market is growing significantly, owing to its dominance anchored by its massive domestic market, tactical government policies, and complete manufacturing ecosystem. While conventional sectors, such as construction and packaging, continue to remain core drivers, the market’s growth in the country is increasingly bolstered by high-value applications in consumer electronics, renewable energy, and electric vehicles. As stated in the June 2023 ADB Organization article, the average recycling rate is estimated to be 27% of standard plastics, while recycling rates for each type of plastic result in 28% for polyethylene, 30% for polypropylene, 27% for polyvinyl chloride, 26% for polystyrene, and 26% for acrylonitrile-butadiene-styrene. Besides, the overall recycling rates, based on these 5 plastic commodities, differ for different applications, which is also driving the market’s demand.

Plastic Commodities’ Recycling Rates for Different Applications in China (2023)

|

Application Type |

Recycling Rate |

|

Agriculture |

48% |

|

Transportation |

42% |

|

Building and Construction |

31% |

|

Others |

26% |

|

Electronics |

20% |

|

Packaging |

12% |

|

Commodity |

12% |

Source: ADB Organization

India in the polymers market is also growing due to the Make in India campaign that bolstered the domestic manufacturing, a burgeoning consumer goods market, and rapid infrastructure development. In addition, the government’s Production-Linked Incentive (PLI) scheme for allied sectors, such as electronics, textiles, and automotive, is indirectly developing huge pull-forces for polymers. Besides, as stated in the November 2025 IBEF Organization article, the plastic sector in the country has over 2,500 exporters and employs 4 million people, along with constituting 30,000 processing units. Moreover, the country’s government has the intention to level up the industry from Rs. 3,00,000 crore (USD 37.8 billion) to Rs. 10,00,000 crore (USD 126 billion) within 4 to 5 years. Therefore, with such development, there is a massive growth opportunity for the polymers market in the country.

Europe Market Insights

Europe in the polymers market is expected to emerge as the fastest-growing region during the forecast duration. The market’s development in the region is highly propelled by the shift towards a bio-based and circular economy, which is driven by strict regulatory frameworks. Besides, the region’s demand is underpinned by the presence of a robust automotive sector, especially for light weighting in electric vehicles, construction sectors, and innovative packaging requirements. According to an article published by the Europe Commission in July 2022, the regulatory body invested more than €1.8 billion in 17 large-scale advanced clean-tech projects. These projects have been selected to ensure long-lasting developments, denoting the availability of capital expenses exceeding €7.5 million. Therefore, with such generous funding provision for green projects, there is a huge growth opportunity for the market in the region.

Germany in the polymers market is gaining increased traction, owing to the presence of a strong manufacturing base, especially in the machinery and automotive industries, demanding high-performance engineering plastics. The market’s growth in the country is also increasingly propelled by its tactical approach towards a circular economy, which is supported by robust industrial and governmental partnerships. Besides, as per a report published by Circular Economy Europe in November 2024, the gross domestic product (GDP) in Berlin grew by 53%, reaching EUR 165 million in valuation. In addition, the GDP per capita increased by 39%, resulting in EUR 43,839, along with a surge in the national trend by 30%, leading to EUR 33,54 to EUR 43,480 as of 2022. Therefore, with continuous growth in Berlin, the market in the country is poised for increased exposure.

Poland in the polymers market is developing due to the rapid extension in developing manufacturing centers that can benefit lower operating expenses and significant regional cohesion funds, which are aimed at modernizing the industry. Besides, the Polish Chamber of Chemical Industry (PIPC) proactively promotes the Polish Deal for the Chemical Sector by aligning with the regional Green Deal. For instance, as stated in the December 2022 Europe Commission article, the organization has implemented the country’s operational programmes with Territorial Just Transition Plans (TJTPs), and these are valued at over €3.8 billion under the Just Transition Fund (JTF). The purpose of this is to readily support climate transition in the coal regions, including Łódzkie, Lower Silesia, Wielkopolska, Małopolska, and Silesia, thus denoting an optimistic outlook for the overall market in the country.

North America Market Insights

North America in the polymers market is expected to witness an uplift steadily by the end of the stipulated timeline. The market’s growth in the region is highly driven by the aspects of strategic pivot, innovation, and maturity towards sustainability. In addition, the strong demand from the automotive, construction, and packaging sectors is also fueling the market in the overall region. According to a report published by the Department of Energy in October 2024, the U.S. Environmental Protection Agency (EPA) has estimated that 600 million tons of demolition and construction waste, along with 292 million tons of municipal solid waste, have been generated in the U.S. This has readily increased the potential for circularity, which is creating a positive impact on the regional market. However, the utilization of recycled materials is one of the most suitable options for maintaining the value of materials within the economy.

Waste Statistics for Commodity Materials in Municipal Solid Waste (2024)

|

Material |

Embodied Energy (MJ/kg) |

Million Tons Recycled/Landfilled/ Incinerated |

Energy Savings from Recycled Material |

|

Aluminum |

210 |

0.6/2.6/0.5 |

95% |

|

Steel |

26.5 |

6.3/10.5/2.3 |

60% to 80% |

|

Glass |

10.5 |

3.0/10.5/2.3 |

30% |

|

Paper and Cardboard |

35 |

45.9/17.2/4.2 |

40% |

|

Plastics |

100 |

3.0/26.9/5.6 |

33% |

Source: Department of Energy

The polymers market in the U.S. is gaining increased exposure, owing to advancements in energy and manufacturing, recycling and environmental sustainability, along with green chemistry and chemical safety. As per an article published by the U.S. Department of Energy in July 2025, the body declared an overall USD 137 million for small-scale businesses across 30 states, pertaining to prioritizing clean energy and nuclear nonproliferation. Moreover, the Advanced Manufacturing Office (AMO) also offers support to development projects and small business research that can optimize material productivity, drive industrial decarbonization and competitiveness, and enhance energy efficiency. This organization has selected 10 projects with a funding provision of USD 10.8 million, as well as USD 700,000 from other organizations, to make advancements in manufacturing technologies.

The polymers market in Canada is also developing due to the existence of bio-based feedstock benefits, administrative push for circularity, and generous funding provision by the government. For instance, in February 2024, the Minister of Tourism and the Minister of Public Services and Procurement contributed USD 1.0 million for BOSK Bioproducts Inc., which is a small and medium-sized enterprise in Quebec. Therefore, with this fund, the organization is poised to produce polyhydroxyalkanoate (PHA), which is a notable component of REGEN, and through its 100% composite solution, BOSK has the intention to significantly diminish plastic waste. Besides, as stated in the November 2025 ISED Canada article, the Net Zero Accelerator (NZA) initiative is projected to contribute to the country’s global leadership strategies by reducing greenhouse gas emissions by 40% to 45% by the end of 2030, along with gaining net zero by the end of 2050, both of which are positively impacting the polymers market.