Polymerization Catalysts Market Outlook:

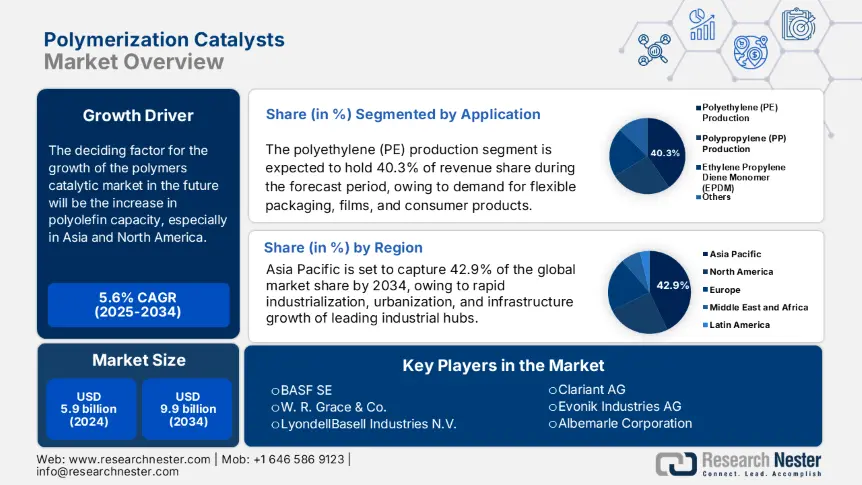

Polymerization Catalysts Market size was valued at USD 5.9 billion in 2024 and is projected to reach USD 9.9 billion by the end of 2034, rising at a CAGR of 5.6% during the forecast period, from, 2025 to 2034. In 2025, the industry size of polymerization catalysts is estimated at USD 6.2 billion.

The deciding factor for the growth of the polymerization catalysts market in the future will be the increase in polyolefin capacity, especially in Asia and North America. The increase in U.S. exports of primary olefins reached $705 million in 2016, up to $913 million (+29.7%), confirming this trend for catalysts due to the low-cost feedstock that supported petrochemical investment in the U.S. and increased exports. Expenditure on the metallocene catalyst skills, with manufacturing costs around $10781 per kg unit. R&D of catalytic, catalytic systems funded by government programs, particularly DOE catalytic upgrading programs, has done well to address decreasing costs and improving performance to the $3.1/gallon gasoline equivalent ($3.1).

The supply chain for raw materials has the following issues related to the supply chains for titanium and chromium compounds. Titanium relies on U.S. and South African import resources, and chromium is well supported by U.S. and European producers. Germany is the largest global exporter of metallic sulfates (837M kg in exports in 2021), and the US was second (268 M kg in imports) was given that these metal sulfates included catalyst precursors. The trend to increase catalyst production lines aligns with expected growth in existing and new physical ethylene/polypropylene plants, where there is more than 60 Mt/year, worldwide capacity for polypropylene. Between 2016 and 2017, the U.S. general import of inorganic chemicals increased from $8.18 billion in 2016 to $9.33 billion (+14.2%). The assembly lines for the catalyst polymer systems will be nested within the petrochemical facilities to facilitate integration and logistics.