Polymer Solar Cell Market Outlook:

Polymer Solar Cell Market size was valued at USD 1.62 billion in 2025 and is expected to reach USD 17.82 billion by 2035, expanding at around 27.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polymer solar cell is evaluated at USD 2.02 billion.

The polymer solar cell market is expanding primarily due to the increasing energy demand and the shift toward renewables. The massive use of conventional fossil fuels has led to severe resource depletion and contamination of the environment. Solar energy is unique since it is unrestricted by region and is ecologically friendly, boosting the polymer solar cell market. According to the International Energy Agency (IEA), the amount of energy obtained from renewable sources such as solar, wind, hydro, geothermal, and ocean waves increased by over 8% in 2022. This suggests that their share of the global energy supply increased by almost 0.4% to 5.5%. By 2028, 42% of global power will be from renewable sources, including solar and wind power.

Key Polymer Solar Cell Market Insights Summary:

Regional Highlights:

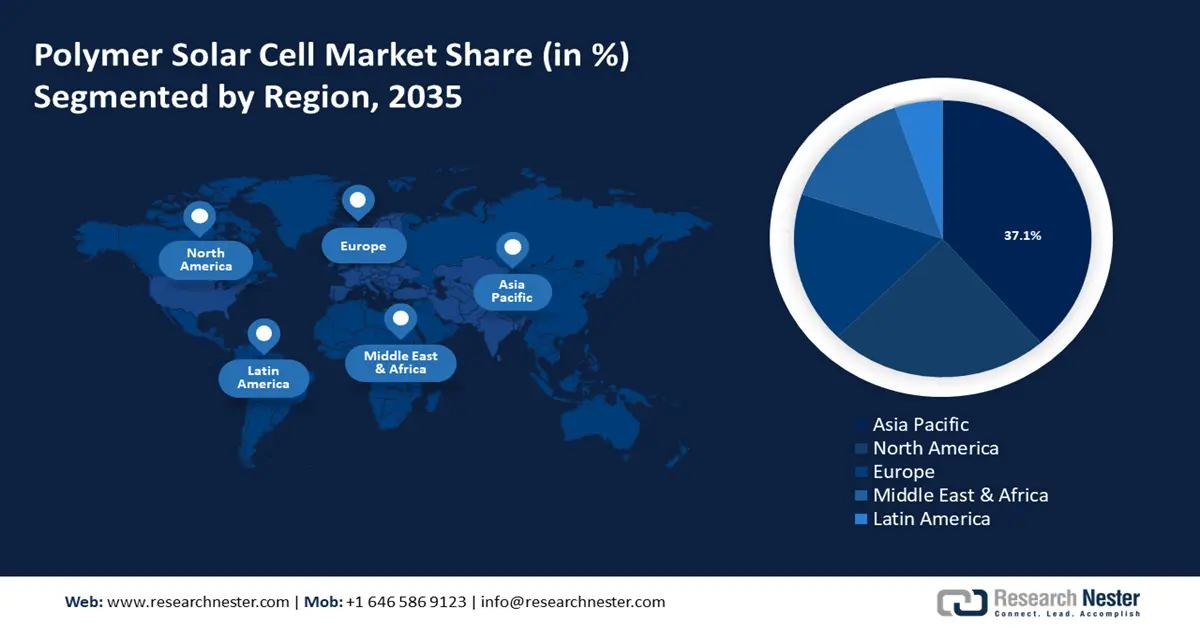

- Asia Pacific polymer solar cell market will account for 37.10% share by 2035, driven by strong manufacturing, technological advancements, and favorable government regulations, particularly in China, Japan, and South Korea.

- North America market will register significant growth during the forecast timeline, driven by increasing renewable energy projects, government incentives, and rising demand for sustainable energy solutions.

Segment Insights:

- The single layer segment in the polymer solar cell market is projected to hold a 37% share by 2035, driven by simplicity, affordability, and scalability compared to more complex designs.

Key Growth Trends:

- Expansion of the electrical industry

- Integration of graphene-based materials

Major Challenges:

- Low stability

- Increasing adoption of silicone solar cells

Key Players: InfinityPV, Epishine, Merck Group, Heliatek GmbH, NanoFlex Power Corporation, Brite Hellas S.A., Tata Power Solar Systems Limited, Pionis Energy Technologies LLC, JinkoSolar Holding Co., Ltd., Trina Solar Limited.

Global Polymer Solar Cell Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.62 billion

- 2026 Market Size: USD 2.02 billion

- Projected Market Size: USD 17.82 billion by 2035

- Growth Forecasts: 27.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Polymer Solar Cell Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of the electrical industry: The need for innovative and sustainable energy solutions is increasing along with the electrical sector, which creates a potential for polymer solar cells. The International Energy Agency (IEA) produced research in 2024 that states that global electricity consumption will increase more quickly over the next three years, averaging 3.4% yearly growth through 2026.

The development of smart grid technologies allows for better integration of decentralized energy sources such as polymer solar cells, enhancing their market potential. Moreover, the growth of the electric vehicle sector increases demand for lightweight, flexible solar solutions that can be used in vehicle design and charging infrastructure. - Integration of graphene-based materials: Graphene-based materials have been widely used for new energy conversion and storage devices, including supercapacitors, fuel cells, batteries, and solar cells, because of their exceptional electrical, optical, mechanical, and thermal capabilities. In particular, polymer solar cells find graphene materials to be particularly attractive due to their great transparency, conductivity, flexibility, and abundance.

Also, most recently, there has been a 20% decrease in solar ray reflectance in graphene-based solar cells, which presents a 20% improvement in potential efficiency. Currently, several graphene-based solar cell variations are under investigation, which is escalating the polymer solar cell market growth. - Increased efficiency in organic photovoltaic solar cells (OPVs): Higher efficiency rates make polymer solar cells more competitive with traditional solar technologies, driving more investment and adoption. Improved efficiency allows for greater versatility in applications, enabling polymer solar cells to be used in diverse settings, including building-integrated photovoltaics and portable devices. A low-cost/low-energy production process, tunable spectrum absorbance, flexibility, transparency, light weight, and other distinctive advantages characterize OPVs, a promising new PV technology. OPVs are quickly catching up to the performance of traditional PV technologies, with power conversion efficiency (PCE) of about 20% at the small-cell level.

Challenges

- Low stability: Compared to silicon-based solar cells, polymer solar cells presently have poorer efficiency and less stability over the long run, which limits their marketability and competitiveness.

- Increasing adoption of silicone solar cells: The best plastic devices have an efficiency of little more than 8%, whereas silicon solar panels can achieve up to 18%, which is one of the biggest disadvantages of using polymer photovoltaics. Furthermore, its ability to harvest solar radiation and convert it into electrical power has substantially improved. Moreover, silicon has no known toxicity and is stable, limiting the broad use of polymer solar cells.

Polymer Solar Cell Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

27.1% |

|

Base Year Market Size (2025) |

USD 1.62 billion |

|

Forecast Year Market Size (2035) |

USD 17.82 billion |

|

Regional Scope |

|

Polymer Solar Cell Market Segmentation:

Junction Type

The single layer segment is poised to capture 37% polymer solar cell market share by 2035 owing to its simplicity and affordability. Comparing single-layer polymer solar cells to more intricate designs such as bilayer, bulk heterojunction, and multi-junction cells, the former is simpler to produce and requires fewer ingredients and processing processes. Due to their increased scalability and reduced production costs, single-layer cells are now more widely available for use.

Also, recently, a power conversion efficiency (PCE) of more than 18% has been achieved by single-junction OSCs (which use a single layer as an active layer) that use narrow-band-gap small-molecule acceptors (SMAs) and wide-band-gap polymer donors (PDs) as their bulk heterojunction (BHJ) photoactive layers.

Application

The BIPV segment is expected to garner a notable size during the forecast period. The segment growth can be attributed to the polymer solar cells' flexibility and lightweight design making them perfect for incorporation into building materials including roofs, windows, and facades. This allows buildings to become energy-generating structures without sacrificing aesthetics. Polymer solar cells are now more durable and efficient because of advances in material science, which makes them more appealing for use in architectural applications. Furthermore, the environmental benefits of BIPV, including lower carbon footprints and energy savings, are consistent with the growing need for sustainable and green building practices.

Our in-depth analysis of the polymer solar cell market includes the following segments:

|

Junction Type |

|

|

Application |

|

|

Technique |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polymer Solar Cell Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 37.1% by 2035. The market expansion is due to its strong manufacturing base, technological improvements, and favorable government regulations. Countries such as China, Japan, and South Korea have established themselves as significant participants by investing heavily in R&D, which has accelerated innovation in polymer solar cell technology.

China has emerged as a significant hub for the production and commercialization of solar panels, owing to its low-cost manufacturing capabilities and broad supply network. According to a report released by the Oxford Institute of Energy Studies, China has long led the world in solar manufacturing. In 2020, China produced 67% of the world's solar PV modules and accounts for a sizable portion of worldwide PV cell and polysilicon output. Furthermore, the nation’s tremendous push for innovation and sustainability in the solar energy sector has strengthened its position as a market leader.

The growing population in India has increased the energy demand which is stimulating the demand for renewable sources such as solar energy. According to the United Nations Organization, the population of India reached 1.43 billion in April 2023, matching and eventually surpassing that of mainland China.

In South Korea, the growing demand for wearable solar electronics and electricity is escalating the growth of the polymer solar cell market. Stretchable solar cells that can withstand strain have drawn a lot of attention as a potential energy source since the demand for wearable electronics is growing rapidly. For instance, in January 2024, the world's best stretchable organic solar cell was unveiled by the KAIST research team from the Department of Chemical and Biomolecular Engineering (CBE). The team also revealed the creation of a new conductive polymer material that achieved high electrical performance and elasticity.

North America Market Insights

North America will encounter huge growth for the polymer solar cell market during the forecast period and will hold the second position owing to the rise in renewable energy projects throughout the region. Also, the number of renewable energy projects such as solar farms and installations has significantly increased.

The polymer solar cell market is expanding in the U.S. due to the need for sustainable energy solutions, the increasing knowledge of how traditional energy sources affect the environment, and government incentives encouraging the use of renewable energy. According to the U.S. Environmental Protection Agency, the Inflation Reduction Act, which was passed by Congress in 2022, established federal incentives for energy communities. These incentives include bonus tax credits for the installation of solar and wind power on brownfields, coal communities, and mining sites.

There is a growing demand in Canada for affordable, clean energy, and many manufacturers are prepared to increase their investments in solar cell technology. Since polymer solar cells don't generate hazardous waste, they offer a renewable energy source that is also environmentally beneficial.

Polymer Solar Cell Market Players:

- InfinityPV

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Epishine

- Merck Group

- Heliatek GmbH

- NanoFlex Power Corporation

- Brite Hellas S.A.

- Tata Power Solar Systems Limited

- Pionis Energy Technologies LLC

- JinkoSolar Holding Co., Ltd.

- Trina Solar Limited

The polymer solar cell market is a huge industry with established companies, cutting-edge startups, and technology suppliers.

Recent Developments

- In May 2024, Epishine, a Swedish energy impact company rethinking light capture with their market-leading printed organic solar cells, completed a private placement sponsored by Pareto Securities that raised SEK 69 million.

- In May 2023, Merck Group, a prominent scientific and technology corporation, made a significant step toward implementing its sustainability plan. The company entered into a 16-year, off-site, virtual power purchase agreement (VPPA) with Recurrent Energy for the Liberty County Solar project in Texas, United States.

- Report ID: 6459

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polymer Solar Cell Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.