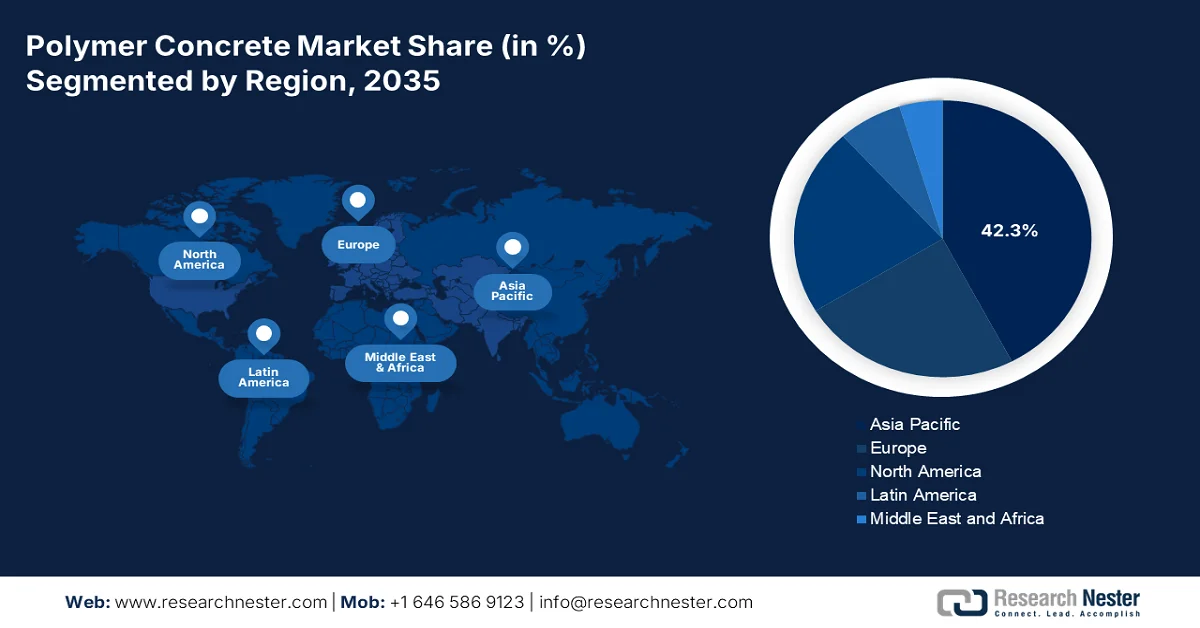

Polymer Concrete Market - Regional Analysis

APAC Market Insights

The Asia Pacific polymer concrete market is dominating and is poised to hold the regional revenue share of 42.3% by 2035. The dominance is due to the government-led infrastructure development, rapid urbanization, and urgent urban utility upgrades. The massive national initiatives create a sustained demand for durable, low-maintenance construction materials. A primary driver is the region’s focus on building new water treatment, industrial processing, and transportation infrastructure, where polymer concrete’s corrosion resistance and fast installations are vital. The trend is strongly toward using polymer concrete components to meet the aggressive project timelines. Moreover, stringent new environmental regulations aimed at controlling industrial pollution are also mandating the use of advanced containment and treatment systems, further embedding polymer concrete in public and private sector specifications.

The polymer concrete market in India is driven by the sustained central and state government investment in transportation, urban infrastructure, and water systems under multi-year public spending programs. According to the PIB January 2025 report, India’s national highway network expanded over 146,000 kilometers by 2023, with annual capital outlays exceeding a trillion, a portion of which is allocated to asset upgrading and rehabilitation. Moreover, the Current World Environment Journal has published a study on the management of urban water resources in July 2025. The study shows that nearly 145 lakh sewer connections and 39 lakh water tap connections were installed in the chosen 500 cities under the AMRUT Mission. These expansions increase the demand for corrosion resistant low maintenance construction materials. This further boosts the adoption of polymer concrete, creating a positive impact on the market.

The massive and continuous expansion of road, rail, and urban transport networks drives the sustained demand for the polymer concrete market in China. These concrete materials are durable, low-maintenance construction materials. As per the People’s Republic of China, October 2024 data, with 5.4 million kilometers of roads, 160,000 kilometers of railways, and over 10,000 kilometers of urban rail lines, there is an ongoing rehabilitation, expansion, and modernization of transport infrastructure. The rural road expansion, which is 4.6 million kilometers, and high urbanization further increase the requirements for drainage systems, cable trenches, platforms, and bridges, where corrosion resistance, high durability, and rapid installations are significant. the government backed modernization and urban mobility programs create a stable demand for polymer concrete and thus proliferate the market’s growth.

North America Market Insights

The polymer concrete market demand in North America is driven by the aging infrastructure renewal and stringent environmental regulations. The market growth is reliant on the regulation-driven compliance-focused industry with demand anchored in large-scale public infrastructure renewal and stringent environmental mandates. The critical need for durable, long-life repair materials in transportation and water systems is directly demanding the polymer concrete market. further the investments in the corrosion-resistant construction material for industrial and municipal wastewater infrastructure, making polymer concrete a specified material for containment and treatment projects. This creates a stable non-discretionary demand landscape where product specification is based on total lifecycle cost and regulatory adherence rather than initial price, with a pronounced trend toward prefabricated polymer concrete components for efficiency in both public works and heavy industry applications.

The U.S. polymer concrete market is strongly supported by the federal infrastructure spending mainly in transportation and water systems, where durability and lifecycle performance are procurement priorities. According to the U.S. Federal Highway Administration, January 2022 data, nearly 46,000 bridges in the U.S. are classified as in poor condition, driving the modernization-focused material demand. Besides, the U.S. Department of Transportation 2025 report depicts that the federal aid highway obligations and emergency relief funding totaling USD 72.3 billion are highly used in highway infrastructure program projects, bridge rehabilitation, drainage systems, and so on. These categories are the primary application areas for the polymer concrete, prioritizing durability, reduced maintenance frequency, and rapid construction timelines.

Federal Highway Administration Budget (2025)

|

Parameter |

Request |

Supplemental |

Total Budget |

|

FEDERAL-AID HIGHWAYS (OBLIM) |

62,114,171 |

|

62,114,171 |

|

Exempt Obligations |

602,577 |

|

602,577 |

|

Emergency Relief |

94,300 |

|

94,300 |

|

Highway Infrastructure Program |

|

9,454,400 |

9,454,400 |

|

Total |

62,811,048 |

9,454,400 |

72,265,448 |

Source: U.S. Department of Transportation 2025

The polymer concrete market in Canada is primarily supported by the sustained federal and provincial investment in transportation, water, and climate-resilient infrastructure. According to the Government of Canada, January 2025 data, under the Investing in Canada Infrastructure Program, USD 33 billion is delivered towards the funding for public transit, green infrastructure, and community infrastructure, with a part of the share allocated for the rehabilitation of roads, bridges, and municipal assets. Besides, the 2025 Association of Manitoba Municipalities data depicts that 60% of public infrastructure assets, many of which are aging and require corrosion-resistant and low-maintenance construction materials. Further, the federally supported programs create a stable demand for durable concrete solutions and support long-term polymer concrete adoption by prioritizing lifecycle performance over upfront construction costs.

Europe Market Insights

The polymer concrete market in Europe is expanding rapidly and is driven by the stringent EU-wide environmental regulations and significant funding for infrastructure cohesion and modernization. The core demand stems from the need to rehabilitate aging wastewater treatment plants and transportation networks to comply with the directives, such as the EU urban wastewater treatment directive, which is undergoing a major revision to enforce the higher standards. Further, the funding from the EU recovery and resilience facility prioritizes the green transition and digital infrastructure, creating direct opportunities for durable materials in public works. A key trend is the strong shift toward circular economy principles pushing manufacturers to develop formulations with higher recycled content and lower carbon footprints to meet both regulatory demands and public procurement criteria focused on sustainability.

The polymer concrete market in Germany is underpinned by the sustained federal investment in transport infrastructure renewal, municipal utilities, and climate-resilient construction under the federal transport infrastructure plan and related funding frameworks. The growth is further supported by the scale and continuous modernization of one of the world’s most extensive transport infrastructures. According to the Federal Ministry of Research, Technology, and Space report in July 2023, the country operates around 830,000 kilometers of road, including 13,000 kilometers of motorways, alongside 38,400 kilometers of rail networks, all of which require regular rehabilitation to maintain performance and safety standards. These rehabilitation-led programs prioritize durable, low-maintenance materials to reduce the lifecycle costs and traffic disruption across high-utilization corridors. This results in the adoption of polymer concrete in drainage systems, cable trenches, and precast transport components funded via federal and State budgets.

The UK polymer concrete market is supported by the sustained government investment in transport infrastructure, renewal of water utilities, and climate-resilient urban development. According to the Network Rail Center May 2023 report, the government has invested 44 billion euros in rail infrastructure, including the major programs such as Network Rail’s control period 7, which highlights the maintenance and renewal of existing assets rather than network expansion. Moreover, the report from National Highways, June 2022, depicts that the national highways manage and operate more than 4,500 miles of strategic road network, much of which requires ongoing rehabilitation to address asset aging and traffic growth. These publicly funded programs prioritize durable, low-maintenance materials, reinforcing stable demand for polymer concrete in rehabilitation-focused transport projects.