Polymer Coated Fabrics Market - Growth Drivers and Challenges

Growth Drivers

- Growing demand from the automotive industry: Polymer-coated fabrics are increasingly utilized in automotive applications such as seat covers, airbags, convertible tops, and interior linings. This is due to their durability, resistance to wear and tear, and aesthetic attractiveness. With a 1,480-crore investment, the National Technical Textile Mission (NTTM) seeks to establish India as a major player in the global technical textile market while simultaneously growing the domestic market. Additionally, electric vehicle (EV) manufacturers are implementing lightweight and durable materials to help increase efficiency, thus allowing for a further expansion of coated fabric usage throughout the global automotive industry.

- Rising construction and infrastructure projects: The polymer coated fabrics market size in India was Rs. 226.80 crores in 2019–20, and based on an anticipated 10% compound annual growth rate, the high-rise construction sector is forecast to drive the market's size in 2024–2025 to Rs. 365.27 crores. Global consumption in 2019–20 was approximately USD 334 million, and by 2024–2025, it is predicted to increase at a CAGR of 5% to reach USD 425.92 million. The construction industry is a significant driver of demand for polymer coated fabrics used in awnings and canopies, roofing membranes, and architectural tensile structures, as these fabrics provide weather resistance, UV protection, and flexibility of structure. The demand for coated fabrics is anticipated to grow with increasing investments in smart cities, urban housing, and commercial infrastructure development. The increasing emphasis on both sustainable and lightweight building materials continues to accelerate, which further aids in the adoption of polymer coated fabrics on today's modern construction projects and strengthens market growth.

- Expansion in healthcare and medical applications: Polymer coated fabrics are heavily utilized in medical mattresses, surgical gowns, hospital furniture, as well as protective coverings. According to ASSOCHAM and Velocity, India's medical waste production is expected to reach 775.5 tons per day by 2022, with a compound annual growth rate of almost 7%. This is because polymer coated fabric is waterproof and easy to clean, and provides excellent antibacterial properties. The demand for coated fabrics in the medical sector is increasing due to the rise of infections, as well as the growing concern about hygiene standards when it comes to healthcare facilities. Additionally, with rising budgets on healthcare infrastructure and increased demand for durable and protective materials to be used in hospitals and clinics, the issue of coated fabric is a critical piece of the medical sector.

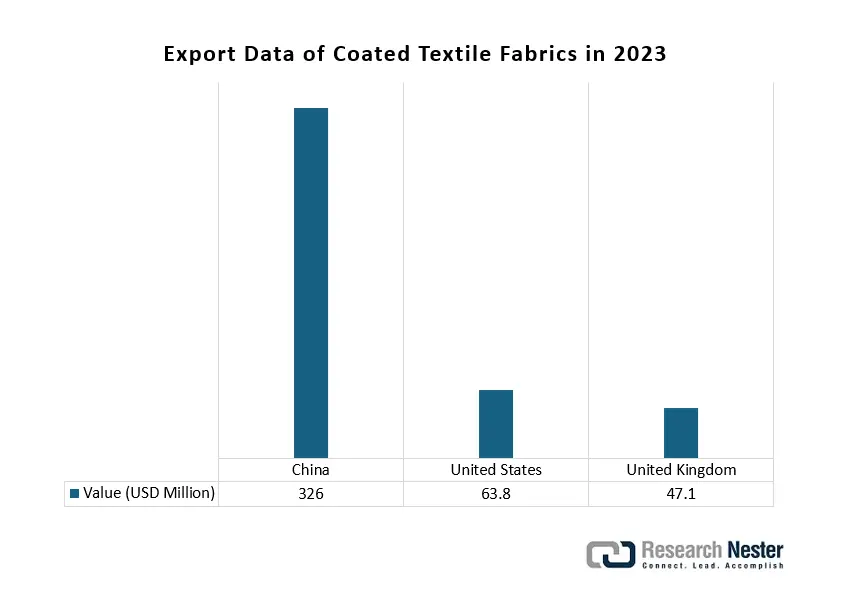

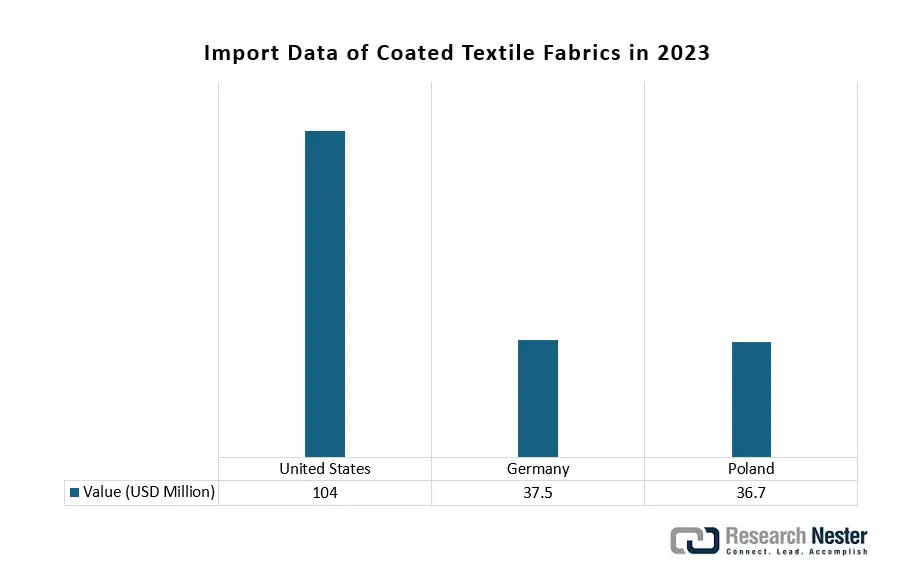

1. Emerging Trade Dynamics in Coated Textile Fabric

The global trade in coated textile fabrics is a significant catalyst for growth in the polymer-coated fabric market, as demand rises for durable, functional materials across sectors like automotive, construction, and protective gear. International supply chains facilitate the exchange of advanced coating technologies and specialty polymers, enabling manufacturers to enhance attributes such as waterproofing, flame resistance, and structural resilience. This cross-border collaboration not only expands material accessibility but also accelerates innovation in sustainable and high-performance coated textiles. As a result, trade dynamics are pivotal in shaping the development and adoption of next-generation polymer-coated fabrics worldwide.

Source: OEC

Source: OEC

2. Polyurethane Trade Dynamics in Polymer Coated Fabric

Polyurethane is a vital component of polymer-coated fabrics, providing flexibility, durability, abrasion resistance, and water repellence. The properties of polyurethane offer comfort, aesthetics, and long-term functionality, with it essential for automotive applications such as seat covers, air bags, convertible tops, and interior linings. Global polyurethane trade revenues were $7.45 billion in 2023, down 17.7% from 2022 when revenues reached $9.05 billion, with a 5-year annualized decline rate of 0.48%.

Import & Export Data of Polyurethane in 2023

|

Exporters |

Value (USD Million) |

Importers |

Value (USD Million) |

|

Germany |

1,620 |

China |

720 |

|

China |

944 |

United States |

446 |

|

United States |

781 |

Germany |

446 |

Source: OEC

Challenges

- Price changes caused by limitations in raw material supply: The ups and downs of petrochemical prices, driven by geopolitical issues, throw a wrench in the usual pricing strategies. The 2022 conflict between Russia and Ukraine led to a surge in natural gas prices throughout Europe, which subsequently increased the costs of polymer raw materials and narrowed profit margins for suppliers of polymer-coated fabrics.

- Delays in market entry due to lengthy regulatory approval processes: In 2022, new safety regulations in China pushed back the approval and market introduction of chemicals for polymer-coated fabrics by six months, negatively impacting supplier revenues and slowing down the adoption of new solutions. Polymer

Polymer Coated Fabrics Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 25.05 billion |

|

Forecast Year Market Size (2035) |

USD 40.37 billion |

|

Regional Scope |

|