Polyimide Coatings Market Outlook:

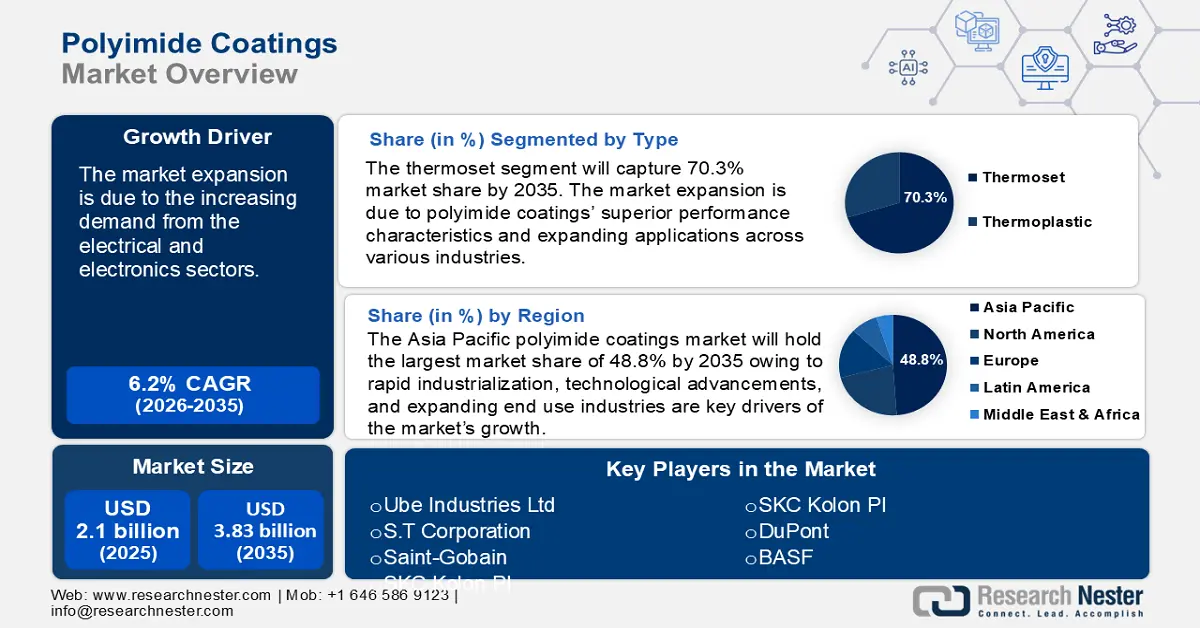

Polyimide Coatings Market size was over USD 2.1 billion in 2025 and is projected to reach USD 3.83 billion by 2035, growing at around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polyimide coatings is evaluated at USD 2.22 billion.

The polyimide coatings market expansion is due to the increasing demand from the electrical and electronics sectors. Polyimide coatings are highly valued in these industries for their exceptional thermal stability, chemical resistance, and electrical insulating properties, making them ideal for applications such as electronic components, circuit boards, flexible printed circuits, and electrical wires and cables. The proliferation of consumer electronics, smartphones, and automotive electronics has fueled this demand. Additionally, aerospace and defense industries significantly contribute to market growth. The need for materials that can withstand extreme environments has led to the adopting of polyimide coatings in aircraft components, missile systems, and other defense applications, owing to their outstanding heat resistance, flame retardancy, and mechanical properties.

The growing use of polyimide films across industries directly contributes to the polyimide coatings market, as coatings enhance the films’ properties and adapt them for various specialized applications. Advancements in producing thin, flexible, and high-performance polyimide films have broadened their application, requiring specialized coatings to enhance durability, conductivity, and environmental resistance. Leading manufacturers are scaling up their polyimide film production capabilities to meet growing demand across the electronics, automotive, and aerospace industries. This expansion creates a parallel need for high-performance polyimide coatings, which enhance film properties and functionality. PI Advanced Materials, formerly known as SKC Kolon PI, is a significant polyimide film manufacturer with an installed capacity of over 4500 tons in 2021. The company added 750 tons of capacity by the first half of 2022, followed by another 750 tons by the end of 2023. This increased the overall PI film capacity to 6000 tons by the end of 2023.

Further, polyimide exports are a crucial growth driver for the market, ensuring global availability and enabling manufacturers to meet increasing demand across diverse industries. From March 2023 to February 2024, 15,218 shipments of polyimide were exported worldwide (TTM). With 1,532 exporters and 1,591 buyers, these shipments represented a 48% increase over the previous 12 months. China, Vietnam, and South Korea are the top three exporters of polyimide worldwide. With 18,218 shipments, South Korea is the world's top exporter of polyimide, followed by China (8,235 shipments) and Vietnam (6,733 shipments).

Key Polyimide Coatings Market Insights Summary:

Regional Highlights:

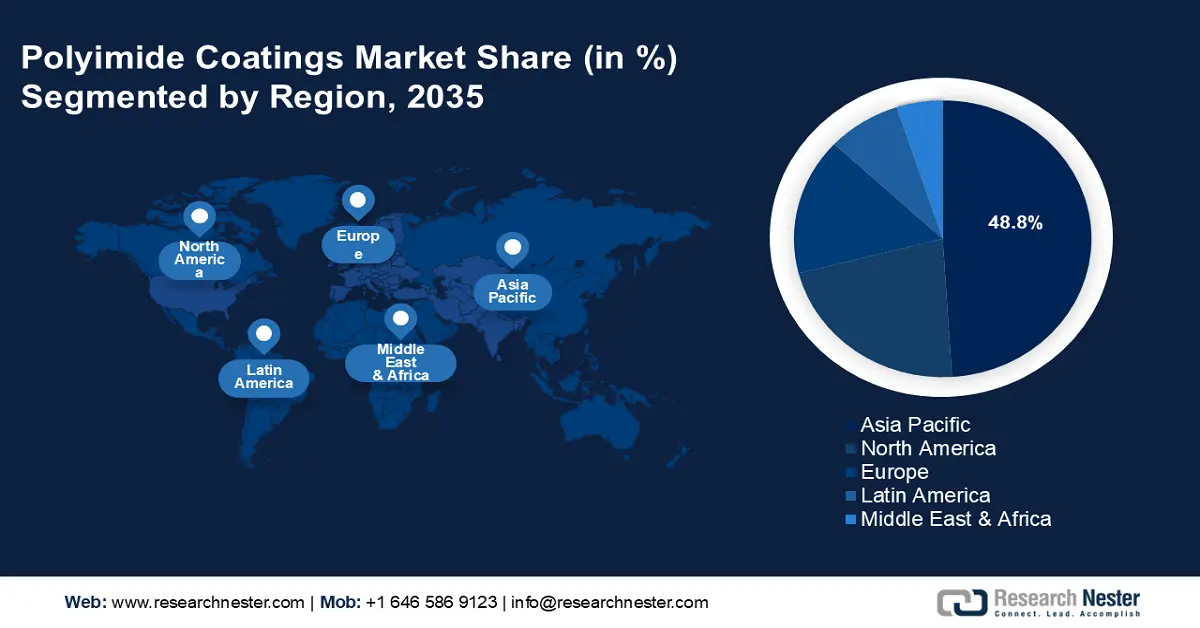

- Asia Pacific dominates the Polyimide Coatings Market with a 48.8% share, driven by rapid industrialization, technological advancements, and expanding end use industries, ensuring strong growth through 2035.

Segment Insights:

- Thermoset coatings segment are projected to hold a 70.3% share by 2035, driven by their superior thermal stability and mechanical performance.

- The Electronic Parts segment of the Polyimide Coatings Market is expected to expand through 2035, fueled by rising demand in semiconductors and advanced displays for high-performance coatings.

Key Growth Trends:

- Increased adoption in medical applications

- High-performance materials for harsh environments

Major Challenges:

- High production costs

- Limited raw material availability

- Key Players: Ube Industries Ltd, FLEXcon Company Inc, S.T Corporation, Saint-Gobain, DuPont, BASF.

Global Polyimide Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.1 billion

- 2026 Market Size: USD 2.22 billion

- Projected Market Size: USD 3.83 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, India, South Korea, Japan, Vietnam

Last updated on : 13 August, 2025

Polyimide Coatings Market Growth Drivers and Challenges:

Growth Drivers

- Increased adoption in medical applications: Polyimide coatings are essential in medical devices like catheters, guidewires, implants, and diagnostic equipment due to their durability, flexibility, and safety. Increasing surgical procedures and advancements in device design boost demand for polyimide-coated components. A 14-year retrospective study by the International Society of Aesthetic Plastic Surgery (ISAPS) conducted from 2010 to 2023, projected that more than 15.8 million surgical procedures were performed worldwide. Moreover, the popularity of wearable medical devices for health monitoring has surged, requiring polyimide coatings for biosensors and flexible circuits to ensure durability and reliability. Devices such as fitness trackers, smartwatches, and medical sensors increasingly rely on polyimide coatings for performance enhancement.

- High-performance materials for harsh environments: Polyimide coatings provide exceptional thermal stability, which makes them ideal for use in aerospace components exposed to high temperatures, pressure, and harsh chemicals. Polyimide coatings are used on engine components, wiring, and insulating materials in avionics systems to protect them from heat and environmental exposure. Coatings are used in spacecraft and satellite components to withstand extreme temperature variations in space.

Further, in the oil and gas industry, equipment is exposed to harsh conditions such as high temperatures, corrosive chemicals, and abrasive environments. Polyimide coatings are used to protect metal surfaces and enhance the performance and lifespan of drilling equipment, pipelines, and machinery. Polyimide coatings are applied to parts that are exposed to extreme temperatures and chemicals, providing insulation and corrosion protection. Coatings prevent degradation caused by exposure to chemicals and extreme environmental conditions.

Challenges

- High production costs: Polyimide coatings are expensive to manufacture due to the complex synthesis processes and the high cost of raw materials. This limits their affordability and adoption, especially in cost-sensitive industries. Small-scale manufacturers may struggle to compete due to high production expenses. Adoption is constrained in regions with limited budgets for advanced materials. Industries like consumer electronics and automotive face cost pressures, making it difficult to justify the use of polyimide coatings over cheaper alternatives.

- Limited raw material availability: Key raw ingredients required for polyimide manufacturing, such as aromatic dianhydrides and diamines, may be limited. This may cause supply chain interruptions and pricing volatility. Dependence on individual suppliers can result in inefficiencies. High raw material costs lead to higher product pricing and limited market penetration.

Polyimide Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 3.83 billion |

|

Regional Scope |

|

Polyimide Coatings Market Segmentation:

Type (Thermoset and Thermoplastic)

The thermoset segment is estimated to capture polyimide coatings market share of over 70.3% by 2035. The market expansion is due to polyimide coatings’ superior performance characteristics and expanding applications across various industries. Thermoset polyimide coatings are known for their excellent thermal stability, chemical resistance, and mechanical properties, making them ideal for demanding applications. Thermoset polyimide coatings can withstand extreme temperatures (up to 500 degrees) and resist degradation in harsh chemical environments, making them essential for industries with rigorous performance requirements.

Thermoset coatings are widely used in aerospace and defense for their ability to maintain structural integrity under extreme conditions. They are used in applications such as thermal insulation for engines and protective coatings for structural components. Investments in research and development, along with advancements in manufacturing processes, will further solidify thermoset polyimides’ position as a critical material in high-performance applications.

Application (Electronic Parts, Tubing, Electrical Insulation, Fiber Optic Cables, and Mechanical Parts)

The electronic parts segment in polyimide coatings market will garner a notable share in the forecast period. The segment growth is due to the rising demand in semiconductor manufacturing. Polyimide coatings are used for insulating and protecting semiconductor components, which are critical in devices like smartphones, computers, and IoT systems. Polyimide coatings are integral to manufacturing advanced displays, including OLED and AMOLED screens, which require heat-resistant and transparent materials for better performance.

Moreover, as electronic devices become smaller and more powerful, the need for coatings that provide insulation and thermal management in compact spaces increases. The rise of electric vehicles and renewable energy systems has driven demand for advanced electronic parts with polyimide coatings for thermal stability and electrical insulation.

Our in-depth analysis of the global polyimide coatings market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyimide Coatings Market Regional Analysis:

APAC Market Forecast

Asia Pacific in polyimide coatings market is poised to capture over 48.8% revenue share by 2035. The region’s rapid industrialization, technological advancements, and expanding end use industries are key drivers of the market’s growth. The production of electric and hybrid vehicles has spurred demand for polyimide coatings in motor insulation, wire coatings, and gaskets. Moreover, innovations such as water-based formulations and UV-curable polyimide coatings have expanded their applications across various industries.

China’s massive electronics production base drives significant demand with applications in printed circuit boards, flexible circuits, electronic components, wires, and cables. China is a global leader in vehicle production, the automotive industry is a major consumer. In 2021, China sold 3.3 million electric vehicles, representing a 154% increase from 2020. Additionally, the country is seeing emerging industries adopting polyimide coatings, with several key sectors showing significant growth. The introduction of flexible electronic devices is creating new opportunities for polyimide coatings. Wearables, sensors, and smart displays are driving demand for lightweight, flexible, and durable polyimide films.

Increased demand from semiconductor manufacturing and electric vehicle production is creating substantial pressure on the supply chain. China’s new energy vehicle (NEV) production surpassed 10 million units in 2024, boosting demand for specialized polyimide materials. The country’s GDP grew 4.8% year-on-year in the first three quarters of 2024, supporting manufacturing activity and material demand.

India’s polyimide coatings market is experiencing significant capacity expansion across multiple sectors. In May 2024, BASF India Limited announced plans to expand polyimide production capacity by over 40% in its Panoli and Thane facilities, signaling robust market potential for polyimide-related materials. Moreover, India has several government initiatives supporting the polyimide coatings market. For instance, the Make in India program encourages domestic manufacturing and reduces import dependency, and the Production-Linked Incentive (PLI) Scheme enhances the electronics manufacturing ecosystem, whereas the Modified Special Incentive Package Scheme (M-SIPS) offers a CAPEX subsidy of 15-20% for manufacturing investments.

North America Market Analysis

The North America polyimide coatings market is expected to hold a significant share in the forecast period. The market is poised for sustained growth, driven by expanding industrial sectors and a rising need for high-performance coatings. The region’s emphasis on technological development, research and development, and innovation further supports market expansion. The ongoing research and development efforts in the U.S. are leading to innovations in polyimide coating applications, enhancing performance and expanding their use across multiple industries. Canada’s electronics sector contributes to the demand for polyimide coatings, particularly in applications such as wire insulation, PCB, and semiconductor packaging.

Key Polyimide Coatings Market Players:

- Kaneka Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ube Industries Ltd

- FLEXcon Company Inc

- S.T Corporation

- Saint-Gobain

- DuPont

- BASF

- TAIMIDE

- SKC Kolon PI

The polyimide coatings market is highly competitive and driven by key players with strong global and regional presence. These companies focus on product innovation, strategic collaborations, and expanding their market reach. Additionally, increasing demand from sectors like electronics, automotive, aerospace, and renewable energy continues to create new opportunities for the players.

Recent Developments

- In October 2024, BASF introduced two new product variations within its polyamide value chain in Europe: Ultramid LowPCF (reduced CO2 footprint/Product Carbon Footprint, PCF) and Ultrami ZeroPCF (CO2 footprint of net zero greenhouse gas emissions). These products can decrease greenhouse gas emissions compared to traditional items. The precursor caprolactam and BASF's Ultramid B brand are available in ZeroPCF and LowPCF versions, while Ultramid C is available as a LowPCF alternative.

- In January 2020, BASF completed the acquisition of Solvay's polyamide (PA 6.6) business. The deal expands BASF's polyamide portfolio with innovative and well-known products including Technyl. This enables BASF to provide its clients with even better plastic engineering solutions.

- Report ID: 7060

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyimide Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.