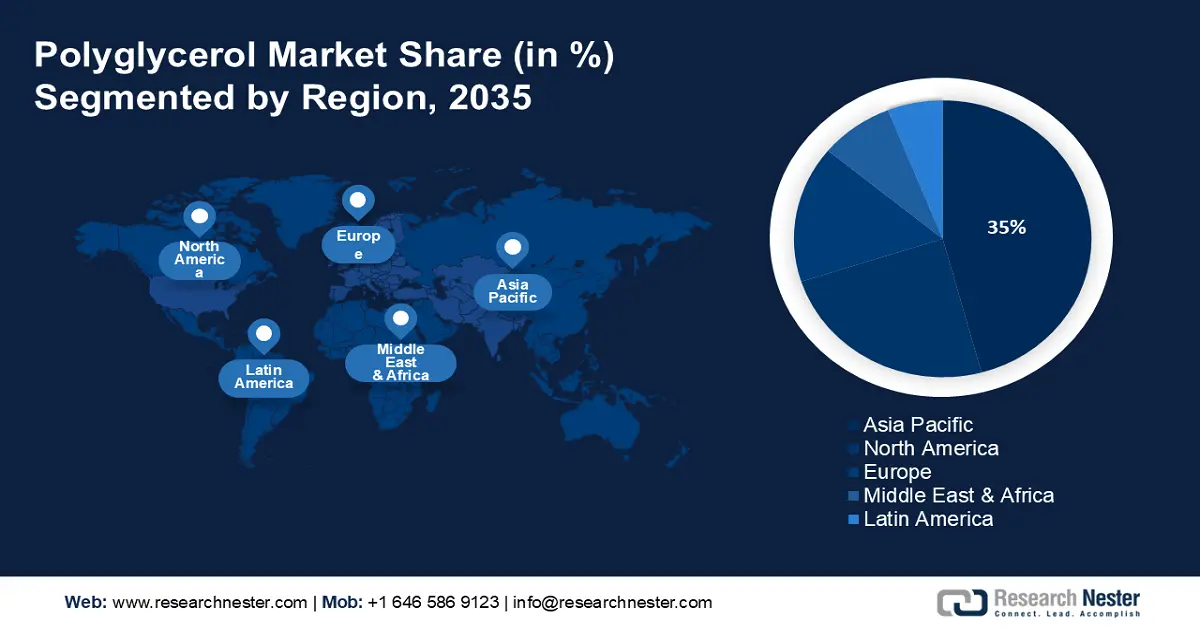

Polyglycerol Market Regional Analysis:

APAC Market Insights

Asia Pacific polyglycerol market is projected to hold the largest market share of 35% by the end of 2035, owing to the presence of a robust raw material supply chain. APAC had the top three producers of palm oil in 2024. Indonesia alone amounted to 46,500MT in terms of volume, underscoring 58% of the global yield in 2024. It was followed by Malaysia (19,200MT, 24%) and Thailand (3,700MT, 5%). Additionally, the market is further expected to witness noteworthy growth as a result of rising consumption of meat and junk food. The demand for meat is expected to grow by 30% by 2030, and by 2050, it is estimated to surpass 75% in the region.

China sales of personal care and beauty sector was USD 88 billion in 2021, a 10% spike from 2020. The country’s e-commerce platforms are highly influential in impacting global consumer behavior and trends. As per IEA, the e-commerce and social media platform Xiaohongshu, as of early 2023, has attracted more than 200 million users. China has a high number of patents filed and approved in the cosmetics sector, accounting for 86% (44 patents) published between 2013 and 2023.

Middle East and Africa Market Insights

The MEA polyglycerol market plays a prominent role in the global landscape, owing to its robust raw material supply chain. Nigeria, in terms of world production percentage, accounted for 2% in 2024, whereas the total yield was 1,500 MT. Cote d'Ivoire generated 600MT in the same period, making it the top nineth producer of palm oil.

Côte d’Ivoire’s five leading agro-industrial companies- UOC, PALMCI, Palmafrique, Codipalm, and Dekel Oil, account for approximately 60% of the country’s total processed palm oil output, highlighting the economic significance of the commodity. Other notable industry players include Awi, Adamafrique, Sania, Sarci, and the SIFCA Group. It is estimated that around 75% of Côte d’Ivoire’s manufactured palm oil meets national consumption demands for oilseeds, primarily for the manufacturing of food and industrial products. The remaining 25% is exported to neighboring countries, including Mali, Burkina Faso, Niger, Ghana, and Nigeria. This strategic distribution not only stabilizes the domestic market but also enhances and diversifies export markets, fostering regional economic integration and increasing revenue from exports.

Oil, Palm Kernel, Production-Supply-Distribution (PSD)

|

Oil, Palm Market |

2022-23 (Oct 2022) |

2023-24 (Oct 2023) |

2024-25 (Oct 2024) |

|

Area Planted (1000 HA) |

0 |

0 |

0 |

|

Area Harvested (1000 HA) |

300 |

300 |

300 |

|

Trees (1000 TREES) |

26900 |

26900 |

26900 |

|

Beginning Stocks (1000 MT) |

41 |

181 |

186 |

|

Production (1000 MT) |

600 |

600 |

600 |

|

MY Imports (1000 MT) |

59 |

70 |

80 |

|

Total Supply (1000 MT) |

700 |

851 |

866 |

|

MY Exports (1000 MT) |

234 |

375 |

380 |

|

Total Distribution (1000 MT) |

700 |

851 |

866 |

|

CY Imports (1000 MT) |

24 |

70 |

0 |

|

CY Exports (1000 MT) |

287 |

375 |

380 |

|

Yield (MT/HA) |

2 |

2 |

2 |

Source: USDA