Polyglycerol Market Outlook:

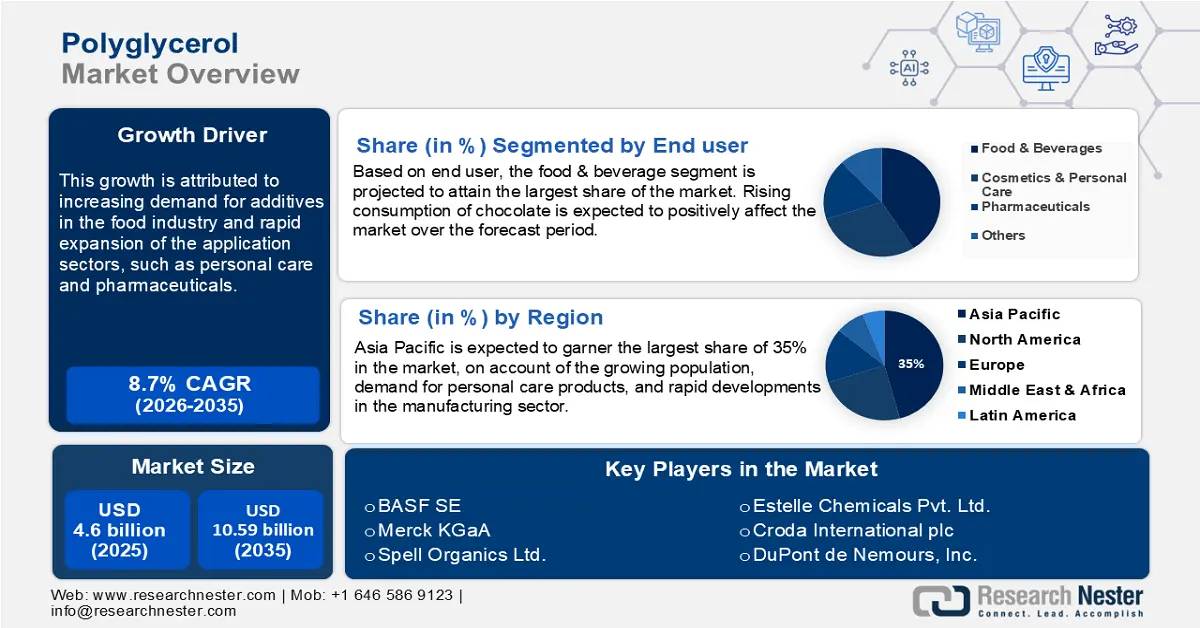

Polyglycerol Market size was valued at USD 4.6 billion in 2025 and is likely to cross USD 10.59 billion by 2035, registering more than 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polyglycerol is assessed at USD 4.96 billion.

Polyglycerol market is primarily driven by its use as an emulsifier in food and beverage products, typically sourced from palm oil, castor seeds, and soybeans. The palm oil sector experienced a growth of 3% in terms of production over the last ten years. The 2024-25 yield was 79.53 million metric tons, a 4% rise from 2023-24, which was 76.26 million metric tons. The weight of annual crude palm oil (CPO) trade fluctuated around 15 million tones for the past ten years, whereas refined palm oil has witnessed a steep surge to about 25 million tons in 2020. The export value and annual trade remained roughly USD 7 billion for CPO and USD 18 billion for refined palm oil.

2021 Overview of Gross Profit Distribution in the Palm Oil Chain (in USD billion).

|

|

Large plantations |

Refineries |

Oleo-Chemicals and food ingredient specialists |

FMCGs, Retailers |

|

Gross profit |

$7.0 |

$8.4 |

$2.5 |

$34.6 |

|

Gross profit share |

13.3% |

16.0% |

4.8% |

66% |

Source: Fern

Key Polyglycerol Market Insights Summary:

Regional Highlights:

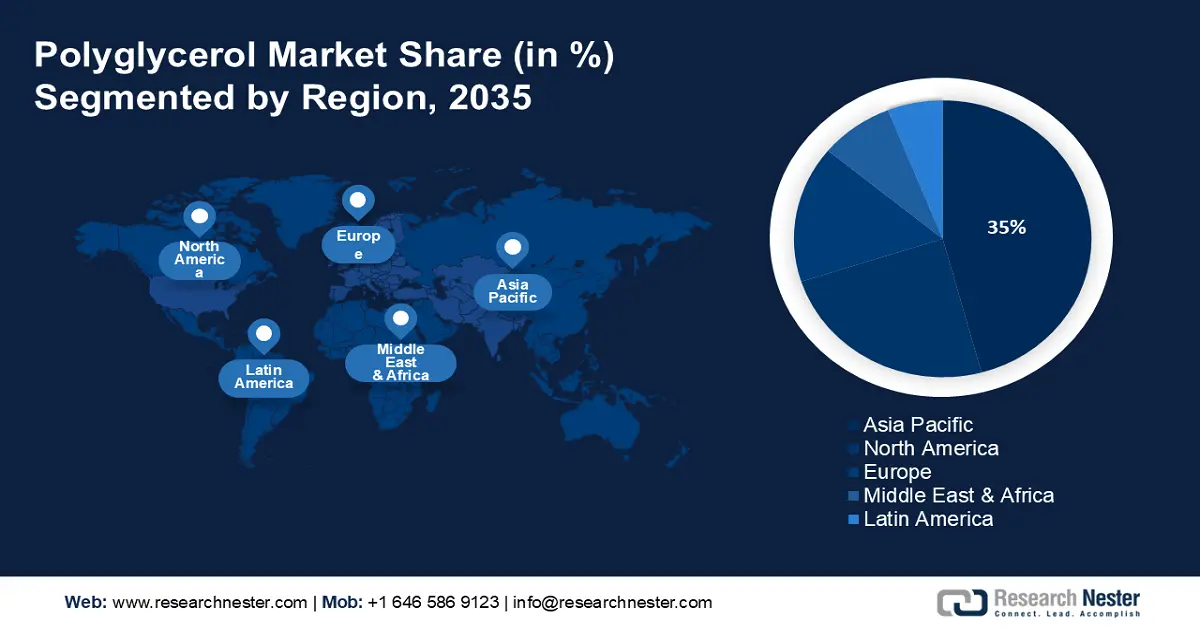

- Asia Pacific polyglycerol market will hold over 35% share by 2035, driven by robust raw material supply chain and food consumption.

Segment Insights:

- The pg-3 segment in the polyglycerol market is anticipated to secure the largest share by 2035, driven by vast applications in the personal care industry.

- The food & beverage segment in the polyglycerol market is anticipated to secure a significant share by 2035, fueled by widespread use in food production additives.

Key Growth Trends:

- Notable trade trajectory of soybeans and castor oil seeds

- Influence of the regulatory framework of the cosmetics industry on polyglycerol market

Major Challenges:

- Stability challenge of lipid-based excipients (LBEs)

Key Players: Merck KGaA, Taiyo Kagaku Co., Ltd., Estelle Chemicals Pvt. Ltd., BASF SE, Spell Organics Ltd., DuPont de Nemours, Inc., Spiga Nord S.p.A, Croda International Plc, Sakamoto Yakuhin Kogyo Co., Ltd.

Global Polyglycerol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.6 billion

- 2026 Market Size: USD 4.96 billion

- Projected Market Size: USD 10.59 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Polyglycerol Market Growth Drivers and Challenges:

Growth Drivers

- Notable trade trajectory of soybeans and castor oil seeds: The worldwide yield of soybean in 2024-25 was 276.9 million metric tons, with a ten year growth of 32%. The top suppliers were China (19.95 MMT), the U.S. (13.01 MMT), Brazil (11.2 MMT), Argentina (8.38 MMT), and the EU (2.89 MMT), as per the U.S. Department of Agriculture (USDA). Furthermore, castor oil seeds, another popular raw material held a global trade value of USD 32.5 million in 2023, emerging as the 4404th most supplied product. According to the OEC, castor oil seed exports surged by 55.5% between 2022 and 2023, i.e., from USD 20.9 million to USD 32.5 million.

- Influence of the regulatory framework of the cosmetics industry on polyglycerol market: The government emphasis on the listing and registration of cosmetic facilities and products have regulated the use of safe and effective emulsifiers and preservatives and emulsifiers, including polyglycerol esters. The 2022 Modernization of Cosmetics Regulation Act (MoCRA) is the most prominent regulatory development since the 1938 Federal Food, Drug, and Cosmetic (FD&C) Act. MoCRA was further updated in July 2024 to discontinue Cosmetic Direct listed products that are no longer on the market. The Cosmetic Ingredient Review of June 2023 conducted safety assessment of Diglycerin and Polyglycerin-3, -6, and -10 in skin products, in turn, improving market penetration.

Challenges

- Stability challenge of lipid-based excipients (LBEs): Polyglycerol has shown inefficacy for drug delivery and affects the stability of the pharmaceutical product. The unstable solid state of a number of polyglycerol moieties limits their preference for different pharmaceutical applications.

Polyglycerol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 4.6 billion |

|

Forecast Year Market Size (2035) |

USD 10.59 billion |

|

Regional Scope |

|

Polyglycerol Market Segmentation:

Product

PG-3 is estimated to gain the largest market share over the projected time frame. This can be attributed to the segment’s vast applications in the personal care and cosmetic industries. Moisturizers, foundation, anti-aging serums, lip gloss, and hair conditioners are all made with PG-3 in the personal care business. The personal care industry is growing rapidly on account of the higher inclination of the global population towards the use of cosmetic products for skin & hair care. For instance, considering the Europe cosmetic industry, with 841 small and medium-sized businesses (SMEs) in the cosmetics manufacturing sector, France leads all of Europe, followed by Italy with 736 SMEs.

End user Segment Analysis

The food & beverage segment is expected to garner a significant share in the forthcoming years, owing to its widespread use of polyglycerol-based emulsifiers, colorants, texture stabilizers, preservatives, and others, especially in food production. For instance, the U.S. processed foods exports market garnered a value of USD 38.84 billion in 2024, exhibiting a CAGR of 2.9% between 2015-24. The overall U.S. volume of processed foods product was 11.15 million metric tons in 2024.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

Product |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyglycerol Market Regional Analysis:

APAC Market Insights

Asia Pacific polyglycerol market is projected to hold the largest market share of 35% by the end of 2035, owing to the presence of a robust raw material supply chain. APAC had the top three producers of palm oil in 2024. Indonesia alone amounted to 46,500MT in terms of volume, underscoring 58% of the global yield in 2024. It was followed by Malaysia (19,200MT, 24%) and Thailand (3,700MT, 5%). Additionally, the market is further expected to witness noteworthy growth as a result of rising consumption of meat and junk food. The demand for meat is expected to grow by 30% by 2030, and by 2050, it is estimated to surpass 75% in the region.

China sales of personal care and beauty sector was USD 88 billion in 2021, a 10% spike from 2020. The country’s e-commerce platforms are highly influential in impacting global consumer behavior and trends. As per IEA, the e-commerce and social media platform Xiaohongshu, as of early 2023, has attracted more than 200 million users. China has a high number of patents filed and approved in the cosmetics sector, accounting for 86% (44 patents) published between 2013 and 2023.

Middle East and Africa Market Insights

The MEA polyglycerol market plays a prominent role in the global landscape, owing to its robust raw material supply chain. Nigeria, in terms of world production percentage, accounted for 2% in 2024, whereas the total yield was 1,500 MT. Cote d'Ivoire generated 600MT in the same period, making it the top nineth producer of palm oil.

Côte d’Ivoire’s five leading agro-industrial companies- UOC, PALMCI, Palmafrique, Codipalm, and Dekel Oil, account for approximately 60% of the country’s total processed palm oil output, highlighting the economic significance of the commodity. Other notable industry players include Awi, Adamafrique, Sania, Sarci, and the SIFCA Group. It is estimated that around 75% of Côte d’Ivoire’s manufactured palm oil meets national consumption demands for oilseeds, primarily for the manufacturing of food and industrial products. The remaining 25% is exported to neighboring countries, including Mali, Burkina Faso, Niger, Ghana, and Nigeria. This strategic distribution not only stabilizes the domestic market but also enhances and diversifies export markets, fostering regional economic integration and increasing revenue from exports.

Oil, Palm Kernel, Production-Supply-Distribution (PSD)

|

Oil, Palm Market |

2022-23 (Oct 2022) |

2023-24 (Oct 2023) |

2024-25 (Oct 2024) |

|

Area Planted (1000 HA) |

0 |

0 |

0 |

|

Area Harvested (1000 HA) |

300 |

300 |

300 |

|

Trees (1000 TREES) |

26900 |

26900 |

26900 |

|

Beginning Stocks (1000 MT) |

41 |

181 |

186 |

|

Production (1000 MT) |

600 |

600 |

600 |

|

MY Imports (1000 MT) |

59 |

70 |

80 |

|

Total Supply (1000 MT) |

700 |

851 |

866 |

|

MY Exports (1000 MT) |

234 |

375 |

380 |

|

Total Distribution (1000 MT) |

700 |

851 |

866 |

|

CY Imports (1000 MT) |

24 |

70 |

0 |

|

CY Exports (1000 MT) |

287 |

375 |

380 |

|

Yield (MT/HA) |

2 |

2 |

2 |

Source: USDA

Polyglycerol Market Players:

- Koninklijke DSM N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- Taiyo Kagaku Co., Ltd.

- Estelle Chemicals Pvt. Ltd.

- BASF SE

- Spell Organics Ltd.

- DuPont de Nemours, Inc.,

- Spiga Nord S.p.A

- Croda International Plc

- Sakamoto Yakuhin Kogyo Co., Ltd.

The market players are capitalizing on the widespread use of polyglycerol across food, cosmetics, and other heavy-duty industries. They are expanding their scope of operations with strategic initiatives such as product launches, reaching new geographies, acquisitions, and collaborations. Some of the prominent companies operating in the sector are:

Recent Developments

- In October 2024, BASF expanded its Personal Care business offerings of natural-based emulsifiers with the newly launched ingredient, EmulgadeVerde 10 OL, suitable for cold manufacturing processes, thus enabling cost, time and energy savings.

- Report ID: 4624

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyglycerol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.