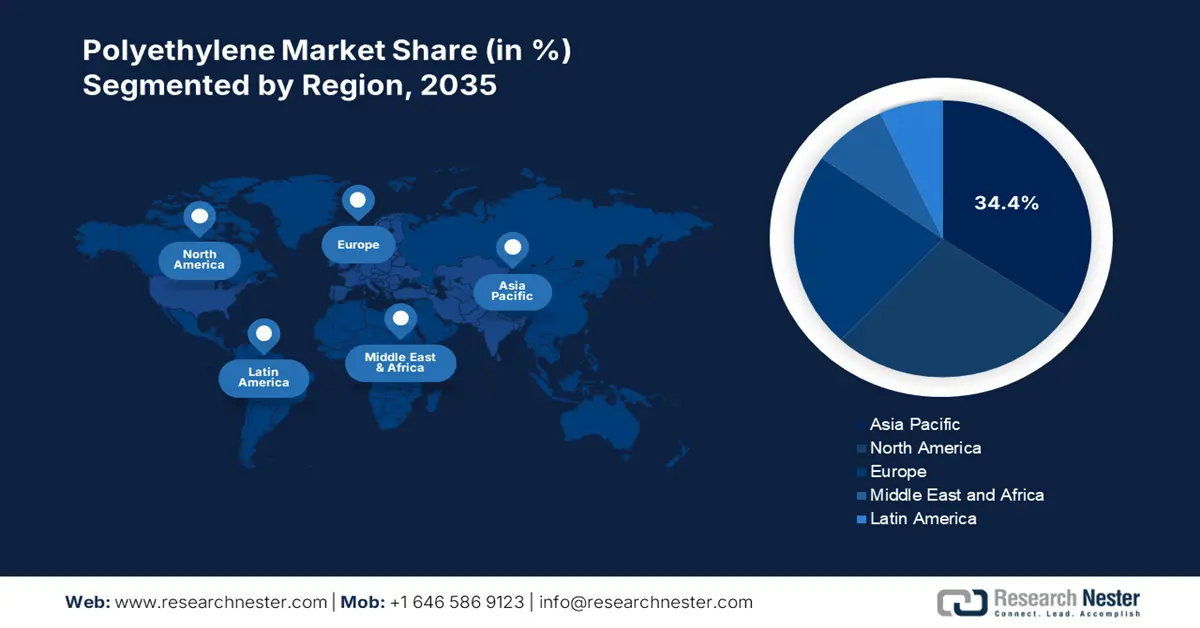

Polyethylene Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific polyethylene market is expected to hold 34.4% of the global revenue share by 2035, due to increasing demand from the packaging, construction, and automotive industries. The government infrastructure investment programs in India, China, Japan, South Korea, and Malaysia are also contributing to the growing sales of polyethylene. The expanding chemical production and export activities are further anticipated to propel the APAC market growth.

The market in India is poised to increase at the fastest CAGR between 2026 to 2035, owing to the booming e-commerce activities. The smart farming practices and high retail trade are creating high earning opportunities for polyethylene manufacturers. Packaging is another leading factor promoting the use of polyethylene in the majority of end use industries. The India Brand Equity Foundation (IBEF) reveals that, in January 2024, Mold-Tek Packaging Ltd, a rigid plastic packaging leader, opened 3 new factories in Tamil Nadu, Telangana, and Haryana. These new factories are set to add 5,500 tons to their production capacity each year, bringing the total to 54,000 tons by the end of the financial year 2025. Such rapid developments are directly amplifying the consumption of polyethylene in the country.

North America Market Insights

North America market is expected to capture 27.6% of the global revenue share through 2035, driven by solid demand growth from the packaging, construction, and automotive sectors. Ethane-based ethylene feedstock is backing the U.S. and Canada to export various polyethylene grades to other parts of the world. The food contact applications and e-commerce shipping materials widely use polyethylene. Construction and agriculture are other larger application areas of polyethylene in the region.

The U.S. polyethylene market is mainly driven by its expansive petrochemical base and consumer-driven economy. The chemical and oil & gas sectors are amplifying the sales of polyethylene in the country. The booming construction activities and increasing auto trade represent an investment-worthy environment for key players. WITS reveals that in 2023, the country exported nearly 3,341,890,000 Kg of polyethylene, having a specific gravity of <0.94, to the world. Overall, infrastructure upgrades and technological advancements are set to fuel the consumption of polyethylene in the country.

Europe Market Insights

The Europe market is projected to expand at the fastest CAGR from 2026 to 2035. The EU’s Single-Use Plastics Directive and targets for recycled content are expected to drive innovations in polyethylene. Modernization of the power grid and expansion of EV infrastructure are set to double the revenues of polyethylene manufacturers in the years ahead. The construction, automotive, and wire & cable enterprises are also contributing to the increasing sales of polyethylene grades in the region. Furthermore, Germany, France, Italy, Spain, and the U.K. are the most profitable marketplaces in the EU.

Germany leads the sales of polyethylene grades owing to its strong industrial base and advanced packaging sector. The leadership in sustainability initiatives is also set to fuel the demand for recyclable polyethylene products. The food, pharmaceuticals, and industrial packaging are boosting the consumption of polyethylene. The WITS study reveals that the country exported around 1,144,626.06 Kg of polyethylene having a specific gravity of<0.94 in 2023. This reflects that the country is one of the top exporters of polyethylene to the world.