Polyethylene Market Outlook:

Polyethylene Market size was estimated at USD 117.8 billion in 2025 and is expected to surpass USD 193.7 billion by the end of 2035, rising at a CAGR of 5.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of polyethylene is estimated at USD 123.8 billion.

Low-cost natural gas feed and related ethane availability in the main producing areas remain the main engine of expansion in the polyethylene industry. Underpinning polyethylene production, the U.S. Energy Information Administration (EIA) data shows that the exports of ethane and ethane-based petrochemicals reached 21.6 million metric tons (MMmt) in 2023, due to high domestic production. Meanwhile, the Federal Reserve Bank of St. Louis reveals that the Import Price Index for plastic materials peaked at 174.7 in April 2025, mirroring the fall in feedstock-induced cost. Furthermore, according to the World Trade Integrated Solution (WITS) in 2023, Saudi Arabia led the exports of polyethylene, having a specific gravity of <0.94, which was further followed by the U.S. and the European Union. This reflects that demand for polyethylene is high due to the strong user base across the world.

|

Polyethylene having a specific gravity of <0.94, Exports 2023 |

|

|

Saudi Arabia |

3,170,580,000 Kg |

|

U.S. |

3,341,890,000 Kg |

|

European Union |

1,021,060,000 Kg |

|

Netherlands |

839,022,000 Kg |

|

Belgium |

826,946,000 Kg |

Source: World Trade Integrated Solution (WITS)

Key Polyethylene Market Insights Summary:

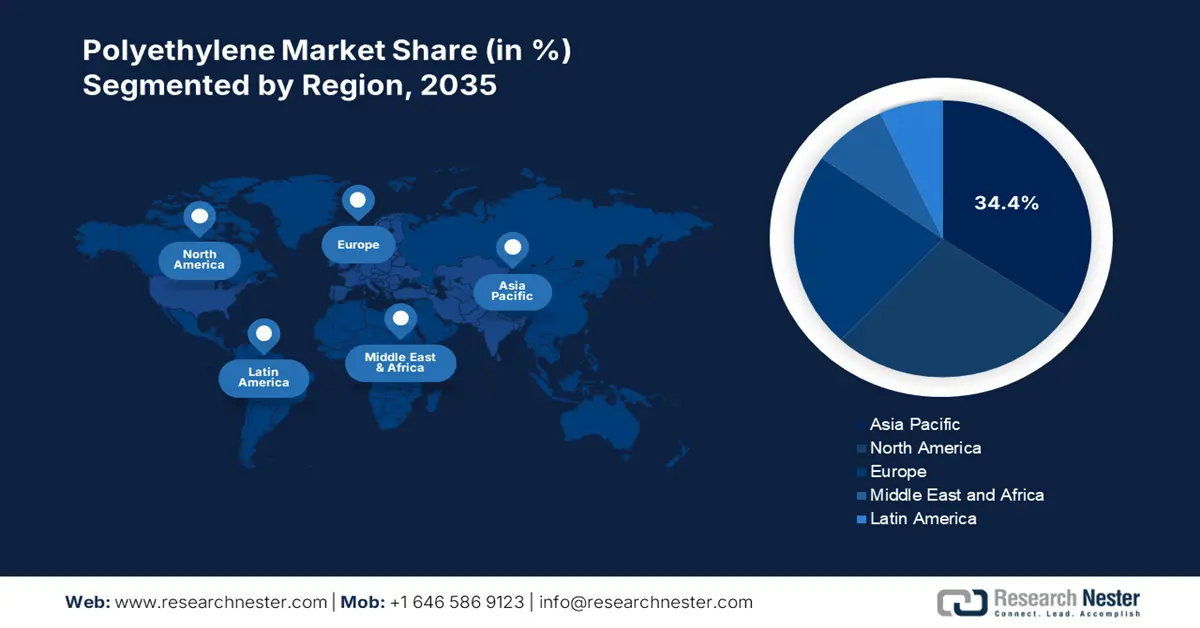

By 2035, the Asia Pacific market is projected to capture 34.4% of the global share, fueled by rising demand across packaging, construction, and automotive industries, particularly in the High-Density Polyethylene (HDPE) segment.

North America is forecasted to secure 27.6% of the market share, with its value anticipated to surpass by 2035 due to strong demand from packaging, construction, and automotive applications.

The Europe market is projected to expand at the fastest CAGR from 2026 to 2035.

The packaging segment is expected to dominate with a market share of 45.4% by 2035, emerging as the leading application area during the forecast period.

The High-Density Polyethylene (HDPE) segment is set to register the highest growth by 2035, holding a 39.7% share, attributed to its superior tensile strength, extensive chemical resistance, and cost efficiency.

Key Growth Trends:

- Growth in the packaging industry

- Expansion in agricultural applications

- Shift toward recyclable and bio-based polyethylene

Key Players:

- ExxonMobil Chemical Company, SABIC (Saudi Basic Industries Corporation), LyondellBasell Industries N.V., Dow Chemical Company, Mitsui Chemicals, Inc., Sinopec (China Petroleum & Chemical Corp), LG Chem Ltd., Reliance Industries Limited, INEOS Group Limited, Borealis AG, Lotte Chemical Corporation, Petronas Chemicals Group Berhad.

Global Polyethylene Market Forecast and Regional Outlook:

2025 Market Size: USD 117.8 billion

2026 Market Size: USD 123.8 billion

Projected Market Size: USD 193.7 billion by 2035

Growth Forecasts: 5.1% CAGR (2026-2035)

Largest Region: Asia Pacific

Fastest Growing Region: Asia Pacific

Last updated on : 28 August, 2025

Polyethylene Market - Growth Drivers and Challenges

Growth Drivers

- Growth in the packaging industry: The report by the World Packaging Organization (WPO) reveals that the global flexible plastic packaging market is poised to reach USD 315.5 billion by the end of 2027. The supply of groceries, drugs, and vegetables & meat through both offline and online channels is increasing the application of flexible plastic packaging materials. High-Density Polyethylene (HDPE) and Low-Density Polyethylene (LDPE) are utilized for flexible packaging, shrink films, and rigid containers. The sustained rise of e-commerce trade, which reached USD 27 trillion in 2022 and is projected to increase at a high pace in the years ahead, is also boosting the demand for lightweight and durable polyethylene items for use in food, consumer goods, and healthcare packaging.

- Expansion in agricultural applications: The demand for polyethylene is increasing in agricultural films, greenhouse cover films, irrigation pipes, and mulch films, among many other uses. The smart farming practices are also fueling the adoption of agri films. The Food and Agriculture Organization (FAO) estimates that global food production is likely to increase by over 60% by 2050. The increase in the agricultural films made of LDPE and LLDPE has the potential for farmers to maximize their crop yield using moisture-retaining films and weed checker films and meet the food demand. For example, according to the Ministry of Agriculture, from 2015 to 2024, 83.46 lakh hectares of land in India have been equipped with micro irrigation under the PDMC program. Such initiatives are likely to ensure a consistent demand for agritech solutions, including polyethylene films.

- Shift toward recyclable and bio-based polyethylene: The strict environmental regulations and sustainability trends are expected to fuel the demand for recyclable polyethylene products in the years ahead. The increasing plastic waste and carbon emissions are driving innovations in polyethylene production. The WPO estimates that the global biodegradable plastics market is likely to cross USD 23.3 billion by 2026. Lower carbon footprint and enhanced composability are key growth drivers for bioplastic sales. Furthermore, consumer awareness and corporate sustainability pledges are pushing polyethylene producers to introduce recyclable and bio-based solutions to attract an eco-friendly consumer base.

Challenges

- Volatility in raw material prices: Polyethylene prices are extremely sensitive to changes in crude oil and natural gas, which are the primary feedstocks. As noted by the U.S. Energy Information Administration (EIA), Brent crude was at a USD 83/b average for 2023, down from USD101/b in 2022, thus affecting the pricing of ethylene and margins for polyethylene. Rapid changes in feedstock pricing completely change supply contracts and profit-making options, especially in regions such as Asia and Europe, where naphtha-based production reigns dominant. Rapid changes complicate planning for PE manufacturers in pricing and investing over longer timeframes.

- Rising competition from alternative materials: The polyethylene manufacturers are facing strong competition from alternative material producers. Biodegradable polymers, paper-based packaging, and advanced composites are some of the leading alternatives in the market. They all act as a vital substitute in packaging. The sustainability pressures are increasing innovation costs and hampering the sales of conventional polyethylene.

Polyethylene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 117.8 billion |

|

Forecast Year Market Size (2035) |

USD 193.7 billion |

|

Regional Scope |

|

Polyethylene Market Segmentation:

Application Segment Analysis

The packaging segment is estimated to capture 45.4% of the global market share during the projected period. Flexible and rigid polyethylene are both integral parts of plastics packaging, which makes up nearly one-third of plastic usage. The use of polyethylene in packaging solutions is mainly driven by its versatility, cost-effectiveness, and performance. PE grades such as LDPE, LLDPE, and HDPE are widely used across flexible and rigid packaging formats, which drives the segmental growth. According to the Reusable Packaging Association, the global packaging market surpassed USD 1.1 trillion in 2023. The growing demand for lightweight, durable, and low-cost materials in packaging is accelerating polyethylene consumption.

Type Segment Analysis

The high-density polyethylene (HDPE) segment is anticipated to account for 39.7% of the global market share through 2035, mainly due to its excellent tensile strength and the widest chemical resistance range. The HDPE plastic has been consistently adding new capacity to keep-up with demand across several uses such as it is used for pipes (water piping), detergent bottles, and grocery bags. The American Chemistry Council also reports that HDPE is being increasingly utilized in construction and industrial packaging. Such observations are creating a profitable environment for high-density polyethylene companies.

End user Segment Analysis

The electronics segment is expected to hold a dominating share of the global market. The polyethylene is widely used in wire & cable insulation, protective housings, and component packaging. The versatile role of polyethylene is fueling its application in the electronics sector. For instance, the Observatory of Economic Complexity (OEC) reveals that the global trade of electrical machinery and electronics was calculated at USD 3.3 trillion in 2023. The rising trade of electronics products directly reflects a positive influence on the sales of polyethylene.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyethylene Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific polyethylene market is expected to hold 34.4% of the global revenue share by 2035, due to increasing demand from the packaging, construction, and automotive industries. The government infrastructure investment programs in India, China, Japan, South Korea, and Malaysia are also contributing to the growing sales of polyethylene. The expanding chemical production and export activities are further anticipated to propel the APAC market growth.

The market in India is poised to increase at the fastest CAGR between 2026 to 2035, owing to the booming e-commerce activities. The smart farming practices and high retail trade are creating high earning opportunities for polyethylene manufacturers. Packaging is another leading factor promoting the use of polyethylene in the majority of end use industries. The India Brand Equity Foundation (IBEF) reveals that, in January 2024, Mold-Tek Packaging Ltd, a rigid plastic packaging leader, opened 3 new factories in Tamil Nadu, Telangana, and Haryana. These new factories are set to add 5,500 tons to their production capacity each year, bringing the total to 54,000 tons by the end of the financial year 2025. Such rapid developments are directly amplifying the consumption of polyethylene in the country.

North America Market Insights

North America market is expected to capture 27.6% of the global revenue share through 2035, driven by solid demand growth from the packaging, construction, and automotive sectors. Ethane-based ethylene feedstock is backing the U.S. and Canada to export various polyethylene grades to other parts of the world. The food contact applications and e-commerce shipping materials widely use polyethylene. Construction and agriculture are other larger application areas of polyethylene in the region.

The U.S. polyethylene market is mainly driven by its expansive petrochemical base and consumer-driven economy. The chemical and oil & gas sectors are amplifying the sales of polyethylene in the country. The booming construction activities and increasing auto trade represent an investment-worthy environment for key players. WITS reveals that in 2023, the country exported nearly 3,341,890,000 Kg of polyethylene, having a specific gravity of <0.94, to the world. Overall, infrastructure upgrades and technological advancements are set to fuel the consumption of polyethylene in the country.

Europe Market Insights

The Europe market is projected to expand at the fastest CAGR from 2026 to 2035. The EU’s Single-Use Plastics Directive and targets for recycled content are expected to drive innovations in polyethylene. Modernization of the power grid and expansion of EV infrastructure are set to double the revenues of polyethylene manufacturers in the years ahead. The construction, automotive, and wire & cable enterprises are also contributing to the increasing sales of polyethylene grades in the region. Furthermore, Germany, France, Italy, Spain, and the U.K. are the most profitable marketplaces in the EU.

Germany leads the sales of polyethylene grades owing to its strong industrial base and advanced packaging sector. The leadership in sustainability initiatives is also set to fuel the demand for recyclable polyethylene products. The food, pharmaceuticals, and industrial packaging are boosting the consumption of polyethylene. The WITS study reveals that the country exported around 1,144,626.06 Kg of polyethylene having a specific gravity of<0.94 in 2023. This reflects that the country is one of the top exporters of polyethylene to the world.

Key Polyethylene Market Players:

- ExxonMobil Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SABIC (Saudi Basic Industries Corporation)

- LyondellBasell Industries N.V.

- Dow Chemical Company

- Mitsui Chemicals, Inc.

- Sinopec (China Petroleum & Chemical Corp)

- LG Chem Ltd.

- Reliance Industries Limited

- INEOS Group Limited

- Borealis AG

- Lotte Chemical Corporation

- Petronas Chemicals Group Berhad

- Sumitomo Chemical Co., Ltd.

- Prime Polymer Co., Ltd.

- Tosoh Corporation

The global polyethylene market is marked by fierce competition between large chemical manufacturers. North America, Asia, and Europe are major markets and host some players in the polyethylene value chain. The leaders include ExxonMobil, Dow, SABIC, and LyondellBasell, who dominate primarily through capacity expansions, advancements in recycling, and partnership strategies with vertical players. Asian companies such as Sinopec and LG Chem concentrate on cost leadership, warranties, and technologies. Japanese companies, including Mitsui Chemicals and Sumitomo Chemical, are focused on quality innovations and supply reliability. Strategic actions generally include constructing new circular plastics manufacturing, investing in bio-based PE, and vertical integration.

Here is a list of key players operating in the global market:

Recent Developments

- In November 2024, BASF introduced Easiplas, a new high-density polyethylene (HDPE) brand, from its integrated Zhanjiang site in China. This new brand is set to make top-quality, easy-to-use plastics that are simple to process.

- In June 2024, Dow introduced two new REVOLOOP recycled plastics resins. This launch is a big step for Dow in promoting recycling and turning waste into something useful.

- Report ID: 439

- Published Date: Aug 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyethylene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.