Polyethylene Copolymer Market Outlook:

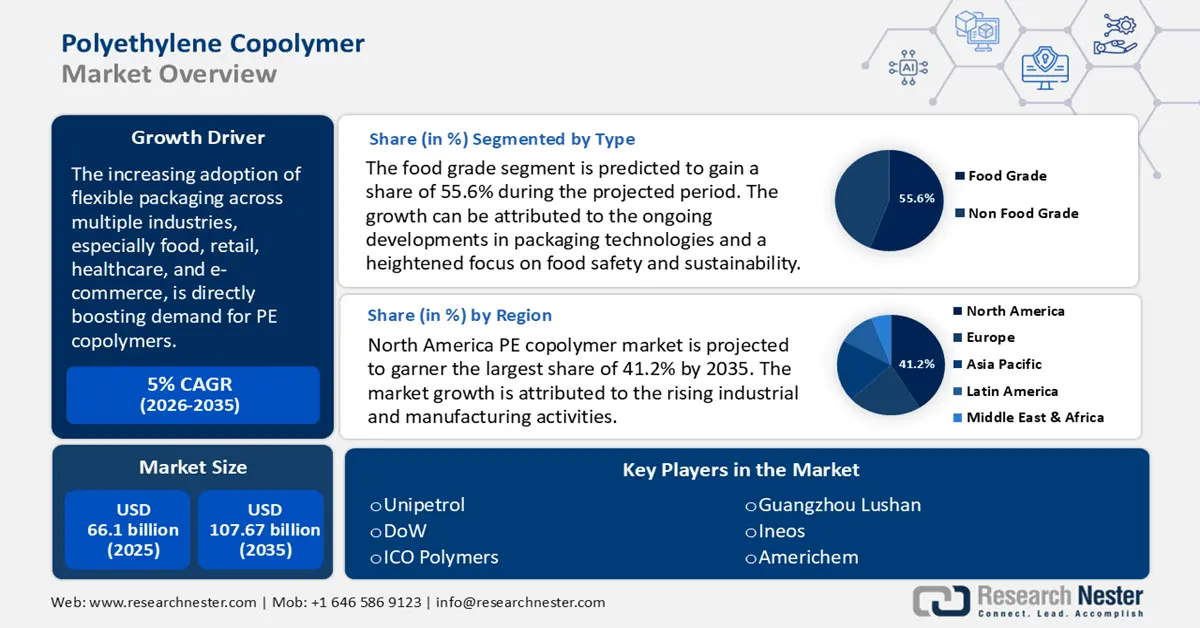

Polyethylene Copolymer Market size was over USD 66.1 billion in 2025 and is anticipated to cross USD 107.67 billion by 2035, growing at more than 5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polyethylene copolymer is assessed at USD 69.07 billion.

The increasing adoption of flexible packaging across multiple industries, especially food, retail, healthcare, and e-commerce, is directly boosting demand for polyethylene copolymers. polyethylene copolymers, such as ethylene-vinyl acetate (EVA) and ethylene-butene copolymers, are widely used in food packaging films, pouches, and wraps. Their flexibility, moisture resistance, and sealing properties help extend shelf life and improve packaging integrity. The rise in processed and convenience foods is fueling demand for high-performance packaging materials.

The rapid expansion of e-commerce has increased the demand for durable and lightweight protective packaging. polyethylene copolymers are used in bubble wraps, mailers, and stretch films, ensuring product safety during shipping. Moreover, many companies are replacing traditional plastics with recyclable polyethylene copolymers to meet sustainability goals. Innovations in bio-based PR copolymers and recyclable multilayer films are gaining traction.

Further, the continuous expansion of polyethylene (PE) production is a direct catalyst for PE copolymer market growth. Major petrochemical companies are continuously increasing PE production capacity to meet growing global demand. Countries like China and the U.S. are investing in new PE plants, supporting the availability of raw materials for polyethylene copolymer production. Global polyethylene production capacity continues to rise rapidly, reaching 157.02 million tons per year in 2023.

|

Region |

Polyethylene Production Capacity in 2023 (million tons per year) |

|

Asia Pacific |

57.1 |

|

North America |

33.82 |

|

Middle East |

28.52 |

|

Russia |

9.16 |

|

Africa |

4.7 |

Key Polyethylene Copolymer Market Insights Summary:

Regional Insights:

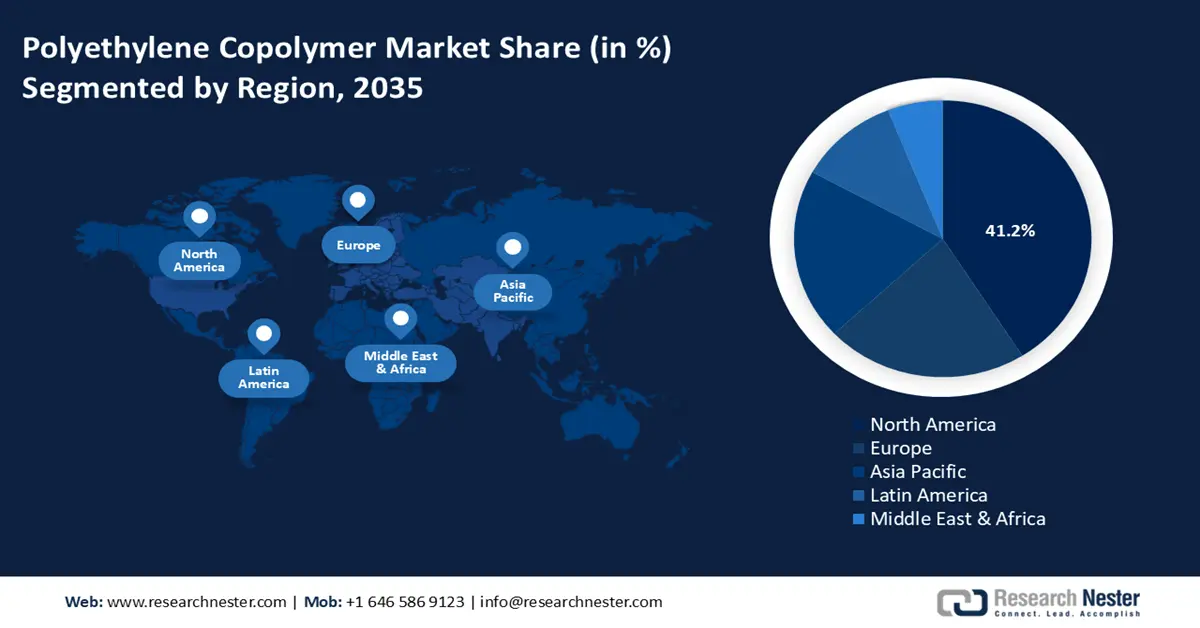

- North America is anticipated to command nearly 41.2% share by 2035 in the polyethylene copolymer market, stemming from expanding industrial and manufacturing activities.

- Europe is set to advance at a notable pace through 2035, underpinned by its strong manufacturing base and rising adoption of eco-friendly ethylene copolymer solutions.

Segment Insights:

- The food grade segment is projected to secure over 55.6% share by 2035 in the polyethylene copolymer market, propelled by ongoing developments in packaging technologies and heightened focus on food safety and sustainability.

- The package segment is expected to exhibit notable expansion by 2035, supported by its moisture-resistant characteristics that help preserve product freshness.

Key Growth Trends:

- Rising demand for bio based polyethylene copolymers

- Rising technological advancements

Major Challenges:

- Competition from substitutes

- Market saturation in mature economies

Key Players: Horda, Unipetrol, Dow, ICO Polymers, Guangzhou Lushan, Ineos, Americhem, ExxonMobil, Ferro, MOL Group, LyondellBasell, Univation Technologies LLC.

Global Polyethylene Copolymer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 66.1 billion

- 2026 Market Size: USD 69.07 billion

- Projected Market Size: USD 107.67 billion by 2035

- Growth Forecasts: 5%

Key Regional Dynamics:

- Largest Region: North America (41.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, Vietnam

Last updated on : 3 December, 2025

Polyethylene Copolymer Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for bio-based polyethylene copolymers: Rising awareness about plastic pollution and carbon footprint reduction is pushing industries toward eco-friendly materials. Bio-based polyethylene copolymers, derived from renewable sources, help reduce reliance on fossil fuels and lower greenhouse gas emissions. Many global brands are committing to using recyclable and biodegradable materials, driving demand for bio-based alternatives.

Governments worldwide are implementing strict plastic waste regulations, promoting the use of bio-based and compostable plastics. Policies encouraging recyclable and bio-based polymers are forcing companies to shift towards sustainable polyethylene copolymers. Many countries are introducing plastic bans and extended producer responsibility (EPR) programs, accelerating the adoption of bio-based packaging. According to a poll of over 23,000 adults conducted by Ipsos in partnership with the Plastic Free Foundation and World Wide Fund for Nature (WWF), across 34 surveyed countries, a global average of 70% of citizens support the establishment of global regulations for governments to combat plastic waste.

Additionally, major chemical manufacturers like Braskem, Dow, Sabic, and BASF are investing in bio-based polyethylene copolymer production. Brazil, Europe, and North America are leading in bio-based PE capacity expansion, with sugarcane-based ethylene plants becoming a key source. Partnerships between biotech companies and petrochemical giants are further boosting production and market penetration. - Rising technological advancements: The development of high-performance polyethylene copolymers, such as metallocene-based polyethylene copolymers, offer superior strength, flexibility, and clarity compared to traditional PE copolymers. These are widely used in flexible packaging, film, and medical applications. New polymerization techniques allow better impact resistance, heat tolerance, and tensile strength.

Moreover, advancements in polymerization technologies that include controlled polymerization techniques enable the production of customized PE copolymer structures for specialized applications. It helps improve processibility and performance in industries like electronics, healthcare, and coatings. The introduction of single-site catalysts like metallocene has led to more uniform molecular product quality.

Additionally, advanced copolymers with self-repairing and shape-memory properties are finding applications in medical devices and electronics. Antimicrobial & Barrier-enhanced copolymers are used in food packaging and healthcare to improve hygiene the rising demand for antimicrobial copolymers, especially those incorporating chitosan, is driving the growth of the market. Chitosan is a byproduct of seafood processing, making it an affordable alternative to synthetic antimicrobial agents. The pricing of chitosan varies significantly based on factors such as purity, molecular weight, degree of deacetylation, and intended application.

Component Pricing of Chitosan

|

Manufacturer |

Product Description |

Quantity |

Price |

Year |

|

Biosynth Carbosynth |

Chitosan - Molecular weight 190,000-310,000 |

2kg |

USD 300 |

2021 |

|

Biosynth Carbosynth |

Chitosan oligomer - Molecular weight <=3000 |

2kg |

USD 310 |

2021 |

|

Biosynth Carbosynth |

Chitosan |

1kg |

USD 154 |

2021 |

|

AK Scientific |

Chitosan |

5g |

USD 14 |

2021 |

|

AK Scientific |

Chitosan |

100g |

USD 82 |

2021 |

|

Alfa Aesar |

Chitosan, 85% deacetylated |

250g |

USD 190 |

2023 |

|

Alfa Aesar |

Chitosan, 85% deacetylated |

500g |

USD 237 |

2023

|

|

American Custom Chemicals Corporation |

CHITOSAN 95.00% |

10g |

USD 1125.56 |

2021 |

Challenges

- Competition from substitutes: Bioplastics like polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based plastics are gaining traction due to sustainability concerns and government regulations. Polypropylene is often used as a substitute due to its similar properties but lower cost and better heat resistance. Further, polyvinyl chloride is preferred in applications like pipes and cables due to its higher durability and chemical resistance. Moreover, polycarbonate, polyamide, and polyether ether ketone outperform PE copolymers in high-performance applications such as automotive and electronics. These materials offer better mechanical strength, thermal resistance, and durability, making them a preferred choice despite higher costs.

To overcome this competition, copolymer manufacturers need to focus on sustainable alternatives, advanced recycling technologies, and high-performance formulations to maintain PE copolymer market relevance. - Market saturation in mature economies: polyethylene copolymers have been widely used in industries like packaging, automotive, and construction for decades. The polyethylene copolymer market has reached a maturity phase, with limited opportunities for new applications or rapid growth. Low population growth and economic stagnation in regions like Europe and Japan reduce demand for consumer goods, packaging, and construction materials that use polyethylene copolymers. Unlike emerging economies with expanding industrial sectors, mature economies have stable but slow-growing industries.

Opportunities to overcome market saturation include diversifying into emerging economies where demand is rising due to industrialization and focusing on niche markets like high-tech, medical devices, and aerospace, where sophisticated copolymers can provide distinct advantages.

Polyethylene Copolymer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 66.1 billion |

|

Forecast Year Market Size (2035) |

USD 107.67 billion |

|

Regional Scope |

|

Polyethylene Copolymer Market Segmentation:

Type Segment Analysis

Food grade segment is predicted to capture polyethylene copolymer market share of over 55.6% by 2035. The growth can be attributed to the ongoing developments in packaging technologies and a heightened focus on food safety and sustainability. These copolymers are extensively utilized in packaging applications such as films, bags, pouches, and containers due to their flexibility, durability, and effective barrier properties, which are essential for maintaining the quality of packaged food products.

The increasing demand for safe and sustainable packaging solutions in the food and beverage industry is a key factor propelling the growth of the food grade polyethylene copolymer segment. By 2025, over 40% of companies plan to adopt innovative and sustainable packaging techniques as they pivot towards a circular economy. Additionally, the rise of e-commerce and the growing popularity of ready-to-eat food products have further amplified the need for high-quality food grade packaging materials.

Application Segment Analysis

The package segment in polyethylene copolymer market is witnessing substantial growth during the assessed period. PE packaging is commonly used to protect fresh fruits, frozen items, and liquids due to its moisture resistance and ability to preserve freshness. High-density polyethylene (HDPE) is often used for milk containers, while low-density polyethylene (LDPE) is favored for squeezable bottles and film wraps. A 2021 study evaluated the life cycle of milk packaging used in Canada, including LDPE 4 L milk bags, HDPE 2 L and 4 L bottles, and polymer-coated paperboard (PCPB) 1 L and 2 L cartons. Milk bags were shown to have the lowest environmental impact (in terms of greenhouse gas emissions) due to their relatively low weight when compared to other containers. While this finding is important for material and product selection, the study used a simplified examination of material movements in used milk containers.

Further, the medical sector relies on PE packaging for its hygienic and protective properties, making it suitable for medicinal containers, syringes, and sterile wraps. PE packaging provides a lightweight and sturdy method to safeguard products during transportation. Anti-static polyethylene bags are used to protect sensitive electronic components from electrostatic discharge. Additionally, polyethylene copolymers are adaptable to various processing methods like injection molding and blow molding, making them suitable for automotive parts, household items, and industrial components. Their flexibility and impact resistance are beneficial in producing bottles and containers.

Our in-depth analysis of the global polyethylene copolymer market includes the following segments

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyethylene Copolymer Market - Regional Analysis

North America Market Insights

North America polyethylene copolymer market is projected to capture revenue share of around 41.2% by the end of 2035. The market growth is attributed to the rising industrial and manufacturing activities. Several industries in the region are the largest consumers of polyethylene copolymers, including packaging, automotive, electrical, and electronics. The construction industry is also a major consumer, using HDPE in pipes, fittings, and sheets. Construction activities in the U.S. and Canada are expected to further drive the growth of the HDPE market in the region.

In the U.S. and Canada, the polyethylene copolymer market is poised for continued growth, supported by advancements in sustainable materials and the ongoing development of applications across key industries. Continuous innovation and adaptation to environmental regulations will be crucial for companies aiming to maintain a competitive edge in this evolving PE copolymer market. Moreover, companies are investing in research and development to create innovative, eco-friendly polyethylene copolymer solutions to meet growing market demands.

Europe Market Insights

Europe's polyethylene copolymer market is expected to grow at a significant rate during the projected period. Europe’s well-developed manufacturing sector, especially in Germany, France, and Italy, drives the market. These countries host major ethylene copolymer producers and converters. Germany dominates the Europe polypropylene market owing to the rising growth in the automotive industry. A strong emphasis on innovation, product development, and environmental stewardship has led to the adoption of eco-friendly ethylene copolymer-based products. In January 2024, GRDF in France utilized bio-based high-density polyethylene to build a sustainable gas pipeline. Further, the increasing demand for plastic products from the automotive industry boosts polyethylene copolymer market revenue in the region.

Increasing environmental consciousness is shaping the industry, with manufacturers focusing on sustainable production methods and recycled PET initiatives. The region’s substantial investments in recycling infrastructure support market growth. Further, a shift towards circular economy principles has led to innovations in polyethylene terephthalate PET manufacturing processes.

Polyethylene Copolymer Market Players:

- Horda

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Unipetrol

- DoW

- ICO Polymers

- Guangzhou Lushan

- Ineos

- Americhem

- ExxonMobil

- Ferro

- MOL Group

- LyondellBasell

- Univation Technologies, LLC

Leading players are adopting advanced polymerization techniques and catalyst technologies to enhance the properties of polyethylene copolymers. These innovations allow for the production of high-performance materials with improved mechanical properties, resistance to environmental factors, and better processibility. Companies are also focusing on cost-effective and energy-efficient production methods, which enable them to meet the growing demand while maintaining profitability.

Recent Developments

- In June 2024, Univation Technologies, LLC announced the launch of its latest licensed technology platform, UNIGILITY Tubular High-Pressure PE Process Technology, which enables the production of both low-density polyethylene (LDPE) and ethylene-vinyl acetate (EVA) copolymer resins.

- In February 2023, LyondellBasell, a global chemical industry leader, and KIRKBI A/S, the LEGO brand's family-owned holding and investment firm, announced an agreement to invest in APK, which specializes in a novel solvent-based recycling technique for low-density polyethylene (LDPE).

- Report ID: 7183

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyethylene Copolymer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.