Point-of-Care Glucose Testing Market Outlook:

Point-of-Care Glucose Testing Market size was over USD 3.42 billion in 2025 and is projected to reach USD 5.36 billion by 2035, growing at around 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of point-of-care glucose testing is evaluated at USD 3.56 billion.

The market has experienced impressive growth trends with the rising incidence of diabetes becoming a leading cause of death. For instance, in November 2024, it was unveiled by the WHO that, by 2022, 14% of adults over the age of 18 had diabetes, up from 7% in 1990. In 2022, more than half (59%) of adults aged 30 and older with diabetes did not take any medication to treat their condition. Hence, the number of people with diabetes increased from 200 million in 1990 to 830 million in 2022. In 2021, diabetes caused 1.6 million deaths, with individuals under 70 years old accounting for 47% of all diabetes-related deaths.

Furthermore, the technological innovations in testing devices, have improved in terms of ease of use, accuracy, and affordability, thereby increasing their adoption among healthcare professionals and patients. For instance, in January 2022, Roche unveiled the Cobas Pulse, a point-of-care blood glucose monitor designed for hospital staff. It is a mobile digital health solution that is the first of its kind in the industry for professional blood glucose management. Moreover, the increasing focus on decentralized healthcare and home care solutions has fueled interest in POC testing, with instant results and enhanced patient compliance.

The aging population, as well as an increase in lifestyle-related diseases, also adds to the increased attention to glucose monitoring as a vital component of chronic disease management. In addition, encouraging government policies to enhance access to healthcare and induce early diagnosis and care are driving market growth. For instance, in November 2023, the Department of Health and Social Care, the three CDC locations announced by the government will serve patients in London, Sussex, and Yorkshire, providing patients with more choices regarding where and how they receive care. The government opened 160 community diagnostic centers, facilitating faster access to potentially life-saving tests and examinations.

Key Point-of-Care Glucose Testing Market Insights Summary:

Regional Highlights:

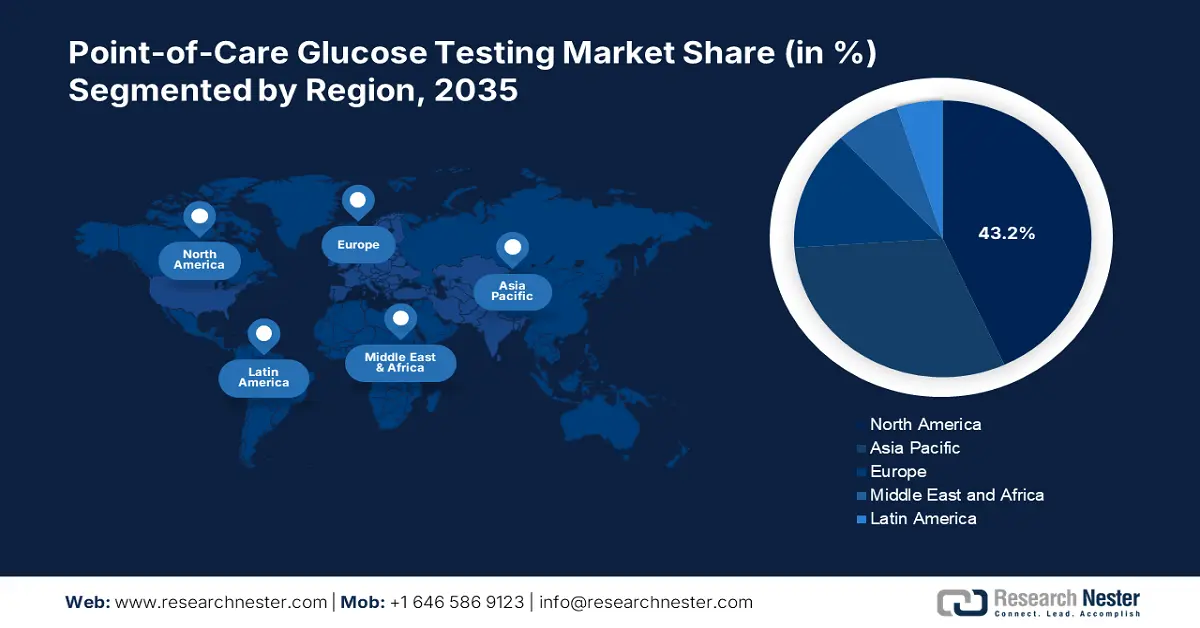

- North America's 43.2% share in the Point-of-Care Glucose Testing Market is fueled by research collaborations and automated insulin delivery system development, driving strong growth through 2026–2035.

- Asia Pacific’s Point-of-Care Glucose Testing Market is anticipated to grow fastest by 2035, supported by cost-effective innovation and favorable regulatory policies.

Segment Insights:

- The Type-2 Diabetes segment is anticipated to lead the market by 2035, driven by the increasing global prevalence of type-2 diabetes, boosting demand for quick and easy point-of-care glucose testing solutions.

- The Lancing Devices and Strips segment of the Point-of-Care Glucose Testing Market is projected to hold a 66.2% share by 2035, driven by their critical role in precise glucose measurement and advancements in lancing technology.

Key Growth Trends:

- Emergence of wearable technologies

- Increased investment in healthcare R&D

Major Challenges:

- Integration with electronic health records (EHR)

- Accuracy and reliability concerns

- Key Players: Acon Laboratories, Freestyle, One Touch, Accu-Chek, Dario, iHealth, and more.

Global Point-of-Care Glucose Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.42 billion

- 2026 Market Size: USD 3.56 billion

- Projected Market Size: USD 5.36 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Point-of-Care Glucose Testing Market Growth Drivers and Challenges:

Growth Drivers

- Emergence of wearable technologies: The introduction of wearable devices has contributed to making a substantial change in the market through continuous and non-invasive glucose monitoring capabilities. For Instance, in June 2024, Lingo and Libre Rio, consumer wearables based on continuous glucose monitoring technology, are two new over-the-counter continuous glucose monitoring (CGM) systems by Abbott. It received FDA approval and is specifically made to cater to distinct needs such as Type 2 diabetes ways to enhance their health and wellness. Therefore, wearable technology development is improving diabetes management and shaping the future of point-of-care testing in a more user-friendly and efficient way.

- Increased investment in healthcare R&D: The high spending is compelling companies to develop new testing tools and methods to enhance accuracy, minimize waste, and improve interaction within the point-of-care glucose testing market. It not only enhances the quality of point-of-care glucose testing but also spurs the uptake of sophisticated monitoring solutions, ultimately enhancing patient outcomes and healthcare delivery. For instance, in May 2024, the Scottish Government announced funding of USD 10.9 million for diabetes technology. This reflects a national commitment to provide closed-loop system technology to all children in Scotland and more adults with type 1 diabetes.

Challenges

- Integration with electronic health records (EHR): Market poses a significant challenge through the integration of the records into electronic health records (EHR). It generally leads to data fragmentation and disrupts integrated patient management. Healthcare providers employ multiple systems that are not compatible, and therefore it is hard to transfer and consolidate glucose monitoring data smoothly. It can contribute to clinical decision delays and deprive healthcare professionals of an integrated image of a patient's health state. Consequently, the complexity of standardizing data formats as well as meeting regulatory compliance can hinder the effective integration process.

- Accuracy and reliability concerns: A notable barrier in the point-of-care glucose testing industry is accurate and reliable results since variation in test outcomes can erode confidence in such quick diagnostic products. Device calibration, user manipulation, and ambient conditions can cause inconsistencies in blood glucose readings, leading to potentially inaccurate information for patients and medical professionals. Erroneous measurements can result in inappropriate treatment actions, compromising patient safety and therapeutic outcomes. In addition, a lack of consistency in protocols on various testing devices can amplify such problems, thus necessitating the importance of ensuring quality control for manufacturers and having strong validation protocols.

Point-of-Care Glucose Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 3.42 billion |

|

Forecast Year Market Size (2035) |

USD 5.36 billion |

|

Regional Scope |

|

Point-of-Care Glucose Testing Market Segmentation:

Product (Lancing Devices and Strips, Blood-Glucose Meter)

Lancing devices and strips segment is set to capture over 66.2% point-of-care glucose testing market share by 2035. Owing to their critical status in the sampling of blood, these products have become a component of the precise measuring of glucose. For instance, in January 2024, Medtronic plc announced that the MiniMed 780G system with Simplera Sync, a small, disposable CGM with a two-step streamlined insertion process that eliminates the need for fingersticks or overtape was approved with the CE Mark. This development demonstrates Medtronic's dedication to improving diabetes care through user-friendliness. With new advancements in lancing technology, this segment will continue to hold its top spot and play a substantial role in driving the overall growth of the market.

Application (Type-1 Diabetes, Type-2 Diabetes)

In the point-of-care glucose testing market, the type-2 diabetes segment has taken a leading edge reflecting growing rates of incidence worldwide. It owes much to increasing attention toward efficacious strategies of diabetes care aimed at managing outcomes and forestalling the associated complications of neglected blood glucose regulation. The need for easy, quick testing products among type-2 diabetes patients has promoted extensive use of point-of-care testing devices, which allow self-monitoring and timely clinical intervention. For instance, in January 2025, Stanford Medicine researchers created an artificial intelligence-based algorithm that can parse three of the four most prevalent subtypes of Type 2 diabetes using data from continuous blood glucose monitors.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Point-of-Care Glucose Testing Market Regional Analysis:

North America Market Statistics

North America point-of-care glucose testing market is anticipated to dominate revenue share of around 43.2% by the end of 2035, owing to the collaborative and strategic agreements between research institutions and companies to find breakthroughs in the management of diabetes. For instance, in January 2025, c announced that it had inked an agreement with the University of Virginia Center for Diabetes Technology (UVA). It is a multi-year collaboration agreement to further research and development of fully automated closed-loop insulin delivery systems.

The U.S. point-of-care glucose testing market is witnessing profitable growth attributable to advancements in technology that provide early and easy access to treatment. For instance, as per the American Diabetes Association, in 2021, 38.4 million Americans, or 11.6% of the population, had diabetes. Of the 38.4 million adults with diabetes, 29.7 million had a diagnosis, whereas 8.7 million did not. Hence, the main focus of the country is on advanced technology that can identify diagnostic details that would revolutionize the treatment of diabetes.

The market in Canada is significantly growing due to the supportive regulatory environment. For instance, in May 2024, according to a report by parliament's budget, the government of Canada introduced a bill, anticipated to increase federal spending by USD 1.3 billion over the following five years. This program will cover out-of-pocket costs for those with drug plan coverage and will cover 100% of the cost of diabetes and contraception medications for those without any plans.

Asia Pacific Market Analysis

The point-of-care glucose testing market in Asia Pacific is projected to be the fastest-growing market. To outperform the competitors, vendors in the region are working to provide cutting-edge point-of-care glucose testing products at affordable costs. The majority of people are becoming more aware of this new class of treatments. Moreover, it is projected that the introduction of advantageous regulatory policies to support PoC glucose diagnostics will accelerate market expansion.

The point-of-care glucose testing market in India is remarkably expanding, driven by expanding healthcare facilities that provide easy access and effective methodologies to treat the disease. For instance, in December 2024, India developed the first diabetes biobank, to support scientific research, the Madras Diabetes Research Foundation's (MDRF) biobank collects, prepares, stores, and disseminates biospecimens. The goal is to support cutting-edge diabetes research, based on variations, and associated conditions.

The market in China is gaining noteworthy traction owing to smooth approvals and aids for the development of novel drugs. For instance, in January 2025, Novo Nordisk announced that the U.S. FDA approved Ozempic, a drug for adults with type 2 diabetes and chronic kidney disease (CKD), to reduce the risk of kidney disease progression. The National Medical Products Administration (NMPA) of China approved Ozempic in 2024, an injection of 0.5 mg, 1 mg, or 2 mg is now the most commonly indicated glucagon-such as peptide-1 receptor agonist (GLP-1 RA) in its class.

Key Point-of-Care Glucose Testing Market Players:

- Dexcom

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott

- Roche

- Ascensia Diabetes Care

- LifeScan

- Medtronic

- Ypsomed

- Animas

- Insulet

- Bayer

- Nipro

- Terumo

- Arkray

- Acon Laboratories

- Freestyle

- One Touch

- Accu-Chek

- Dario

- iHealth

- FreeStyle Libre

The prominent players in the point-of-care glucose testing market are highly competitive. With the increasing demand for effective and precise glucose monitoring solutions, the competitive environment is likely to change, thereby promoting additional innovation and growth in the industry. For instance, in January 2024, Trinity Biotech (TRIB) completed the acquisition of Waveform Technologies' biosensor and Continuous Glucose Monitoring (CGM) assets valued at USD 12.5 million. Through this strategic acquisition, the company strengthened its position in the biosensor market and created cutting-edge diabetes care.

Here's the list of some key players:

Recent Developments

- In February 2025, Glucotrack, Inc. announced the successful completion of its first human clinical study, based on the real-time, continuous blood glucose monitor (CBGM) inserted into the subclavian vein.

- In July 2023, Ascensia Diabetes Care and Avricore Health announced a collaboration to integrate blood glucose monitoring into point-of-care testing. The goal of the partnership is to incorporate Avricore's HealthTab PCOT platform with the Contour Next-Gen and Contour Next One BGM systems.

- Report ID: 7185

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.