Pneumatic Components Market Outlook:

Pneumatic Components Market size was over USD 16.57 billion in 2025 and is poised to exceed USD 27.77 billion by 2035, growing at over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pneumatic components is estimated at USD 17.36 billion.

The pneumatic components market is growing significantly as the global trading of pneumatic components is expanding. As manufacturers increasingly source components from international suppliers to leverage cost advantages and access advanced technologies, this interconnectedness fosters broadening market reach. In 2022, according to the Observatory of Economic Complexity, hydraulic and pneumatic automatic controls ranked as the world's 128th most traded product. The exports between 2021 and 2022 increased by 9.46%, from USD 2.3 billion to USD 2.51 billion with top exporters such as Germany with USD 1.28 billion, France with USD 296 million, the U.S. with USD 146 million. The top importers were the U.S. with USD 196 million and Germany with USD 145 million.

In addition, the expansion of manufacturing and industrial infrastructure propels the market growth. China experienced a noticeable surge in its manufacturing sector with industrial production which rose by 4.6% in 2023, according to the data released by the National Bureau of Statistics. Further, enhancements in pneumatic technology are improving system capabilities and reliability, in turn stimulating demand. These dynamics, combined with a growth in emphasis on sustainability practices by favoring energy-efficient solutions, position the pneumatic components market for robust growth in an increasingly competitive global landscape.

Key Pneumatic Components Market Insights Summary:

Regional Highlights:

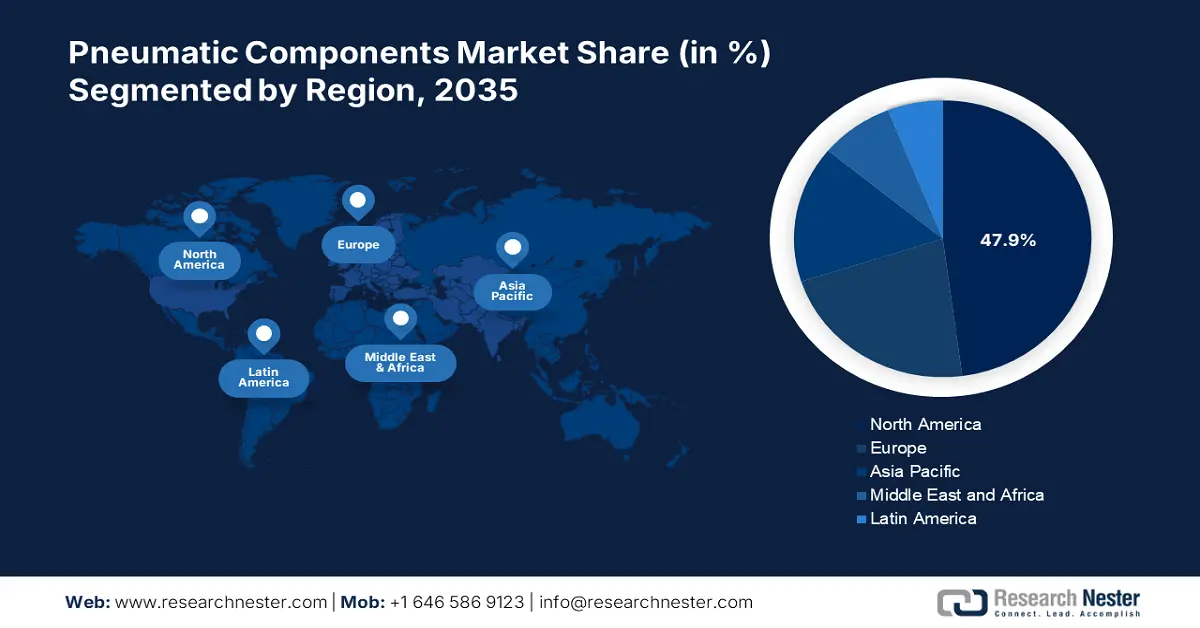

- North America commands a 47.9% share in the pneumatic components market, driven by the popularity of smart pneumatics through 2026–2035.

Segment Insights:

- The Machinery segment is expected to dominate with a 68.10% share by 2035, propelled by wide utilization across industrial applications and automation.

- The Pneumatic Valves segment is poised for substantial growth from 2026-2035, fueled by high demand in manufacturing due to precise control in pneumatic systems.

Key Growth Trends:

- Increasing automation in pneumatic components

- Rising R&D activities

Major Challenges:

- High initial costs

- Maintenance and downtime

- Key Players: Norgren, Inc. (IMI, PIC), Airtac International Group, JELPC (Ningbo Jiaerling Pneumatic Machinery Co., Ltd.), Fenghua Yaguang Pneumatic Element Co, Ltd., Camozzi Group, and more.

Global Pneumatic Components Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.57 billion

- 2026 Market Size: USD 17.36 billion

- Projected Market Size: USD 27.77 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 13 August, 2025

Pneumatic Components Market Growth Drivers and Challenges:

Growth Drivers

- Increasing automation in pneumatic components: Automation in the pneumatic components market is revolutionizing the way industrial operations are undertaken, as manufacturers increasingly depend on pneumatic systems to achieve greater efficiency and precision. This is driven by a growing need for reliable, responsive control in automated processes wherein pneumatic components such as actuators and valves are considered crucial. For instance, in March 2024, Chicago Pneumatic introduced the new series of CP8609 eBlueTork battery-operated heavy-duty torque wrenches. These eBlueTork wrenches are designed to speedily and accurately replace tires in large commercial vehicles such as trucks, buses, and waste collection.

In addition, pneumatic parts last longer and require minimal maintenance compared to electromotive parts. Since they are relatively simple, pneumatic components are suitable for less complex automatic control systems. When under stress, pneumatic system parts do not overheat. For instance, in August 2023, during the first half of the year 2023, KSB Group launched its new generation of pneumatic 90° quarter-turn actuators. Double-acting and single-acting pneumatic actuators belonging to type series ACTAIR EVO and DYNACTAIR EVO will be available for the actuation of any quarter-turn valves of butterfly, ball, and plug types. - Rising R&D activities: In the pneumatic components market R&D activities are increasing and creating huge innovation that is improving the performance of pneumatic systems. This has increased investment in R&D in terms of fostering advanced materials, more efficient designs, and smart technologies that increase the reliability and functionality of pneumatic components. For instance, in November 2023, SMC announced it to invest USD 265 million through 2026. This investment is an effort to establish a round-the-clock model at its sites, seeking to halve the time needed for product development.

In addition, the growing demand of industries seeking efficiency and sustainability places pneumatic systems at the forefront of modern manufacturing solutions with the integration of IoT and automation technologies. This compels manufacturers and researchers to advance their processes. For instance, in May 2022, MIT researchers developed a new manufacturing technique that may be less expensive for soft pneumatic actuators. MIT researchers have developed a new method of manufacturing soft pneumatic actuators.

Challenges

- High initial costs: One of the major challenges encountered in the pneumatic components market is high initial cost, as it usually chases away small and medium-sized enterprises from adopting this system. Although pneumatics solutions can offer a long-term cost saving and efficiency advantage, high front-end investment in quality components and installation can be prohibitively expensive. This may potentially limit market penetration and restrain the shift to automation for cost-sensitive industries, thus manufacturers if do not probe into the demanding strategies they might not reduce their entry costs and support the wider adoption of pneumatics technologies.

- Maintenance and downtime: A major challenge in the pneumatic components market is the maintenance and downtime of components. The pneumatics system can only depend on proper upkeep and rapid repairs. These include some frequent problems that cause operations to stop due to leaks in the air, wear out of parts, and a need for lubrication among others. These service demands can discourage potential users, particularly in industries where uptime is considered the most important. Hence, developing sturdier and self-monitoring pneumatics solutions that have as low maintenance requirements as possible as well as enhance system reliability seems complicated.

Pneumatic Components Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 16.57 billion |

|

Forecast Year Market Size (2035) |

USD 27.77 billion |

|

Regional Scope |

|

Pneumatic Components Market Segmentation:

Application (Machinery, Electronics, Chemical Industry, Others)

By 2035, machinery segment is expected to capture over 68.1% pneumatic components market share. Wide utilization of pneumatic systems across various industrial applications increases demand. This supremacy can be accredited to the effectiveness and accuracy brought by pneumatic parts towards the machinery that can have fast and dependable operations. For instance, in April 2024, Bosch Rexroth declared SMC Deutschland as the first in the line of pneumatic suppliers that boosts its ctrlX World partner network. This allows the integrators and machine builders to attain the ability to link actuators and sensors for use cases in pneumatic through EtherCAT and IO-Link into its automation systems using ctrlX. Therefore, optimizing production, its usage, and dependency in machinery segments for pneumatic systems is set to rise.

Type (Air Treatment Components, Pneumatic Valves, Pneumatic Cylinders)

Based on type, the pneumatic valves segment is expected to garner the major share in the pneumatic components market by the end of 2035. Owing to its controlling flow and direction within a compressed air pneumatic system it is preferred in the market. It ensures the precise working of actuators hence, they are in high demand across the world mainly in various manufacturing industries such as automobiles and packaging. According to the statistics of the Observatory of Economic Complexity, valves for pneumatic transmissions were the world's 276th most traded product in 2022 with exports rising by 0.85% from USD 13.3 billion to USD 13.5 billion. In addition, the top exporters were Germany with USD 3.58 billion, and the U.S. with USD 1.58 billion. The U.S. and Germany were among the top importers with USD 1.83 billion, and USD 1.48 billion worth of imports, respectively.

Our in-depth analysis of the global pneumatic components market includes the following segments:

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pneumatic Components Market Regional Analysis:

North America Market Statistics

By 2035, North America pneumatic components market is likely to dominate over 47.9% share. Smart pneumatics are becoming increasingly popular in the region because they require less maintenance. They last longer and offer higher performance than other forms of pneumatics. In addition, smart pneumatic valves and smart pneumatic actuators are among the popular forms of smart pneumatics which is driving market demand. This trend is beneficial for the overall dependability of operations.

The U.S. pneumatic components market is growing exponentially owing to the growing demand in the automotive industry. It focuses on improving the efficiency of the production lines and reduces energy consumption. For instance, in October 2022, Parker Hannifin launched the Bestobell high-performance cryogenic valve line. These valves are used in applications for the handling, storage, and treatment of ultra-low temperature liquefied gases. Hence, such upgrades and changes in components help the market to thrive.

Canada pneumatic components market is likely to witness substantial growth during the forecast period. This growth is attributable to the innovations and developments in pneumatic components. For instance, in October 2021, AERZEN's energy-efficient composite control system opened up new areas of application. It offers new features and a better visualization of the composite operation of different compressed air assemblies.

Europe Market Analysis

The pneumatic components market in Europe is gaining traction and is expected to witness lucrative growth during the forecast timeline. The adoption of Industry 4.0 technologies has increased over time, and so is the demand for automation in several industries. In addition, the government also encourages manufacturers through their initiatives, plans, new legislations, and compulsions to develop smart manufacturing technologies to implement the same.

Germany pneumatic components market is experiencing robust growth due to the strategic moves that key players within the country are making. These moves aim to enhance operability and efficiency for their products to remain highly competitive in the promptly changing ecosystem to meet the growing needs. For instance, in January 2023, Festo launched its ambitious global pneumatic essentials initiative. It strives to streamline ordering, ensure immediate shipping of pneumatic parts that will be available in stock, and design less cumbersome parts for machines.

Smart pneumatics systems are increasingly being adopted in the U.K. due to increased awareness of predictive maintenance. For instance, in September 2024, Camozzi Automation enhances its Air Treatment range. The new Pressure Booster Series BPA, with a 2:1 pressure ratio, increases outlet pressure up to 20 bar. It works automatically when needed to generate a constant pressure increase with its mechanical design guaranteeing quick and easy mounting, owing to its small size and light weight.

Key Pneumatic Components Market Players:

- Bosch Rexroth AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Festo SE & Co. KG OMEGA Engineering (Spectris PLC)

- Norgren, Inc. (IMI, PIC)

- Airtac International Group

- JELPC (Ningbo Jiaerling Pneumatic Machinery Co., Ltd.)

- Fenghua Yaguang Pneumatic Element Co, Ltd.

- Camozzi Group

- Zhaoqing Fangda Pneumatic Co. Ltd.

- Wuxi Huatong Pneumatic Manufacture Co. Ltd.

- CNSNS

- Easun Pneumatic Science

Market players in the pneumatic components market are engaged in several strategic moves to increase their global presence. Significant market activities such as new product launches at low cost and enhanced features assist companies in sustaining the dynamic environment of the market. For instance, in May 2022, Emerson declared that its AVENTICS series advanced valve (AV) valve system with advanced electronic system (AES) Profinet and Ethernet/IP is now available with preinstalled Open Platform Communications Unified Architecture (OPC UA) functionality. The AES can help users solve interoperability challenges and access data more easily while the integration of the digital twin can improve productivity and efficiency.

Here's the list of some key players:

Recent Developments

- In April 2024, Festo collaborated with Phoenix Contact in incorporating PLCnext technology from Phoenix in the networking and end device catalog to provide customers who demand connectivity in their electric and pneumatic systems with advanced automation products.

- In December 2022, Emerson introduced the ASCO Series 209 proportional flow control valves. In a specially designed, compact construction, these offer the ideal combination of accuracy, pressure ratings, flow characteristics, and energy efficiency.

- In October 2022, The pneumatic system of Boilermaker Special VII was upgraded by SMC Corporation of America. In preparation, the company launched its EX600-W Wireless Valve System, which allows for the wireless monitoring and control of pneumatic systems.

- Report ID: 6921

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pneumatic Components Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.