Plug-in Hybrid Electric Vehicles Market Outlook:

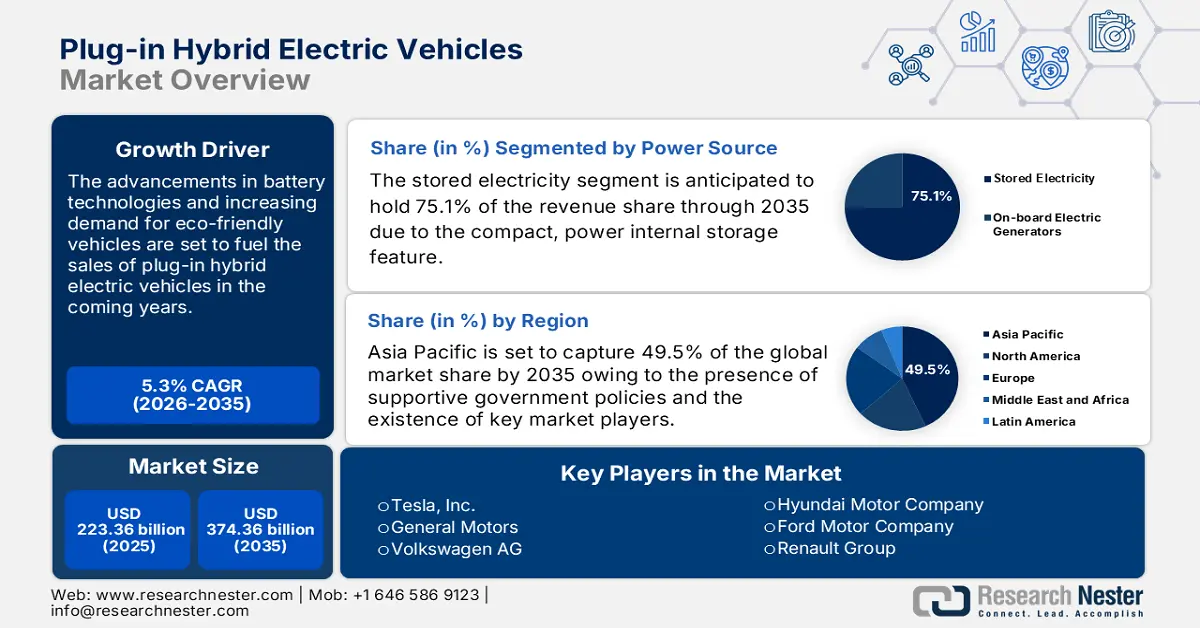

Plug-in Hybrid Electric Vehicles Market size was over USD 223.36 billion in 2025 and is poised to exceed USD 374.36 billion by 2035, growing at over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of plug-in hybrid electric vehicles is estimated at USD 234.01 billion.

Plug-in hybrid electric vehicles are gaining popularity worldwide owing to their ability to bridge the gap between conventional vehicles (gasoline-based) and electric vehicles (battery-based). The strict environmental regulations on carbon emissions and the sustainability trend are augmenting the sales of plug-in hybrid electric vehicles. As per the Research Nester study, hybrid electric vehicle ownership has surged over 17 million, globally. In addition, companies are investing in developing novel products, to lower emissions. For instance, in May 2023, Toyota Motor Corporation announced its all-new Prius PHEV model, Z grade with better performance and design.

Modern plug-in hybrid electric vehicles employed with regenerative brakes that convert kinetic energy to electric energy comply effectively with sustainability trends, mitigating carbon emissions. From the first developed gasoline electric vehicle ‘Lohner-Porsche’ in mid-1889 to current modern plug-in hybrid electric vehicles, the powertrain and engines have drastically evolved owing to continuous technological advancements by key market players.

Key Plug-in Hybrid Electric Vehicles Market Insights Summary:

Regional Highlights:

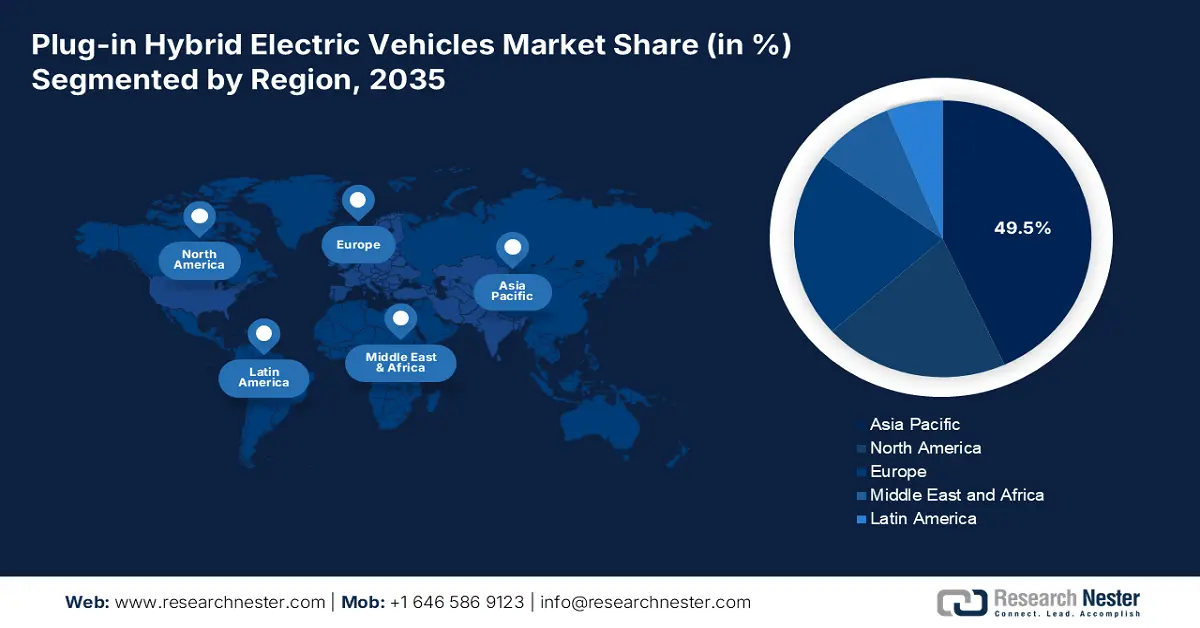

- Asia Pacific plug-in hybrid electric vehicles market will account for 49.50% share by 2035, driven by strong presence of automobile manufacturers and technological advancements.

Segment Insights:

- The passenger cars segment in the plug-in hybrid electric vehicles market is expected to see substantial growth till 2035, driven by the increasing popularity of hybrid electric vehicles for their energy-efficiency quality.

- The stored electricity segment in the plug-in hybrid electric vehicles market will hold a 75.10% share by 2026-2035, influenced by ongoing innovations in lithium-ion batteries boosting vehicle performance.

Key Growth Trends:

- Innovations in PHEV technology

- Increasing public investment in fast chargers

Major Challenges:

- Resistance to change

- High cost of alternative fuel vehicles

Key Players: Tesla, Inc., Mercedes-Benz Group AG, General Motors, Volkswagen AG, Dr. Ing. h.c. F. Porsche AG, Hyundai Motor Company, and Renault Group.

Global Plug-in Hybrid Electric Vehicles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 223.36 billion

- 2026 Market Size: USD 234.01 billion

- Projected Market Size: USD 374.36 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 18 September, 2025

Plug-in Hybrid Electric Vehicles Market Growth Drivers and Challenges:

Growth Drivers

- Innovations in PHEV technology: The ongoing advancements in PHEV technology are fueling the performance of vehicles and aiding in the mitigation of greenhouse gas emissions. Manufacturers are integrating advanced lightweight materials and vehicle-to-grid infrastructure to increase the fuel efficiency of vehicles. They are also using AI in designing the car model to minimize its overall expense, oil usage, and carbon emission. The advancements in battery energy density are one of the latest PHEV market trends. Modern batteries with energy storage and distribution capabilities aid in longer travel time, appealing to a wider consumer base.

- Increasing public investment in fast chargers: Supportive government policies on electric vehicle adoption and increasing public and private investments in advancing charging infrastructure are set to significantly boost the sales of plug-in hybrid electric vehicles in the coming years. Publicly reachable fast chargers enable longer journeys and mitigate the need to buy personal charging systems. According to a 2022 report by the International Energy Agency, China has the highest publicly 40% accessible charging units compared to other EV markets. Followed by China, Europe has a large number of public fast-charging units of around 50,000.

Challenges

- Resistance to change: The lack of adoption of hybrid vehicles due to misconceptions or resistance to change can hinder the plug-in hybrid electric vehicles (PHEV) market growth to some extent. Many developing economies are witnessing this, as most vehicle owners are hesitant to adopt modern automobile technology due to a lack of knowledge and false information available.

- High cost of alternative fuel vehicles: The high cost of PHEV compared to its gasoline counterpart is negatively influencing the overall market growth. Modern hybrid vehicles are integrated with next-gen technologies, and the development of these systems requires extensive investment in R&D, which increases the final costs. The complex charging infrastructure in some economies also contributes to low sales of plug-in hybrid electric vehicles.

Plug-in Hybrid Electric Vehicles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 223.36 billion |

|

Forecast Year Market Size (2035) |

USD 374.36 billion |

|

Regional Scope |

|

Plug-in Hybrid Electric Vehicles Market Segmentation:

Power Source Segment Analysis

Stored electricity segment is poised to hold over 75.1% plug-in hybrid electric vehicles market share by the end of 2035. Most plug-in hybrid electric vehicles use stored electricity from the connected batteries. Charging equipment or regenerative braking systems provide power to plug-in hybrid electric vehicles. Compared to fully electric models where the charging device is installed externally, PHEVs are powered by batteries. The ongoing innovations in batteries such as lithium-ion batteries are boosting the overall performance of vehicles. For instance, automotive lithium-ion battery sales increased by 65% to 550 GWh in 2022 from 330 GWh in 2021.

Vehicle Type Segment Analysis

By the end of 2035, passenger cars segment is estimated to capture around 87.5% plug-in hybrid electric vehicles market share, owing to the increasing popularity of hybrid electric vehicles for their energy-efficiency quality. The dual power source aspect is majorly contributing to the sales growth of plug-in hybrid electric passenger vehicles. In March 2024, JSW MG Motor announced its plan to launch new plug-in hybrid electric passenger vehicles in India.

Our in-depth analysis of the plug-in hybrid electric vehicles market includes the following segments

|

Power Source

|

|

|

Powertrain |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plug-in Hybrid Electric Vehicles Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is likely to dominate majority revenue share of 49.5% by 2035, owing to the strong presence of automobile manufacturers, rapid technological advancements in plug-in hybrid electric vehicles, and the increasing number of vehicle ownerships. Japan, China, and South Korea have a robust automotive manufacturing sector, which is directly increasing the sales of plug-in hybrid electric vehicles. The supportive government policies on electric vehicle adoption are also boosting the profits of PHEV manufacturers.

China is the fastest-growing economy in terms of population size, significantly influencing vehicle ownership rates in the country. The growing awareness of the benefits of electric vehicles is further contributing to the PHEV market growth. For instance, the International Energy Agency estimates that around 60% of new electric cars were registered in China in 2023.

Followed by China, India is also a lucrative marketplace for plug-in hybrid electric vehicle manufacturers owing to increasing public investments in EV charging infrastructure and auto component manufacturing. For instance, in August 2024, the India Brand Equity Foundation stated that the Ministry of Heavy Industries India approved around USD 96.13 billion for installing 7,432 public EV charging stations under the Phase-II of the FAME India scheme. Furthermore, the India EV market is anticipated to reach a valuation of USD 113.99 billion by 2029 and the EV battery sales are anticipated to be valued at USD 27.7 billion by 2028.

North America Market Insights

The North America plug-in hybrid electric vehicles market is estimated to expand at the fastest pace during the forecast period owing to rapid advancements in battery technology, easy availability of a wide range of plug-in hybrid vehicles and the presence of advanced charging infrastructure. The presence of early adopters in the region is also drastically fuelling the demand for PHEVs.

In U.S. the hybrid electric vehicle sales are estimated to increase at a rapid pace during the forecasted period. According to the U.S. Environmental Protection Agency, currently, there are more than 50EV and PHEV models available in the U.S. market and this number is expected to boost in the coming years. Also, as per the U.S. Office of Energy Efficiency & Renewable Energy analysis, the sales of hybrid electric vehicles increased by 53% in 2023.

In Canada, the strict regulations on carbon emissions and increasing investments in advanced charging infrastructure are fuelling the sales of plug-in hybrid electric vehicles. According to a report by the Canada Energy Regulator, around 25% of new plug-in hybrid electric vehicles were registered in the country in 2022.

Plug-in Hybrid Electric Vehicles Market Players:

- Mercedes-Benz Group AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- General Motors

- Volkswagen AG

- Audi AG

- Škoda Auto a.s.

- Dr. Ing. h.c. F. Porsche AG

- Hyundai Motor Company

- Renault Group

- Ford Motor Company

- BMW Group

Key players in the plug-in hybrid electric vehicles market are investing heavily in R&D to introduce next-gen models. They are also collaborating with other players and tech firms to expand their product portfolios and reach a wider consumer base. Manufacturers are also employing investment strategies to expand their presence in the high-potential economies. For instance, Hyundai Motor India proposed to invest USD 2.45 billion in Tamil Nadu to boost its electric vehicle production in the country.

Some of the key players include:

Recent Developments

- In May 2024, Mazda USA announced that its 2025 CX-70 and CX-70 Plug-in Hybrid (PHEV) models received the prestigious 2024 TOP SAFETY PICK award. The top factors due to which these PHEVs received awards are the presence of advanced safety systems and storing foundations.

- In March 2024, Hyundai Motor Company revealed its refreshed 2025 Tucson SUV at the New York International Auto Show. The updated 2025 Tucson compresses of latest features and is set to be available in a range of power series such as hybrid, plug-in hybrid, ICE, and XRT variants.

- Report ID: 6599

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.