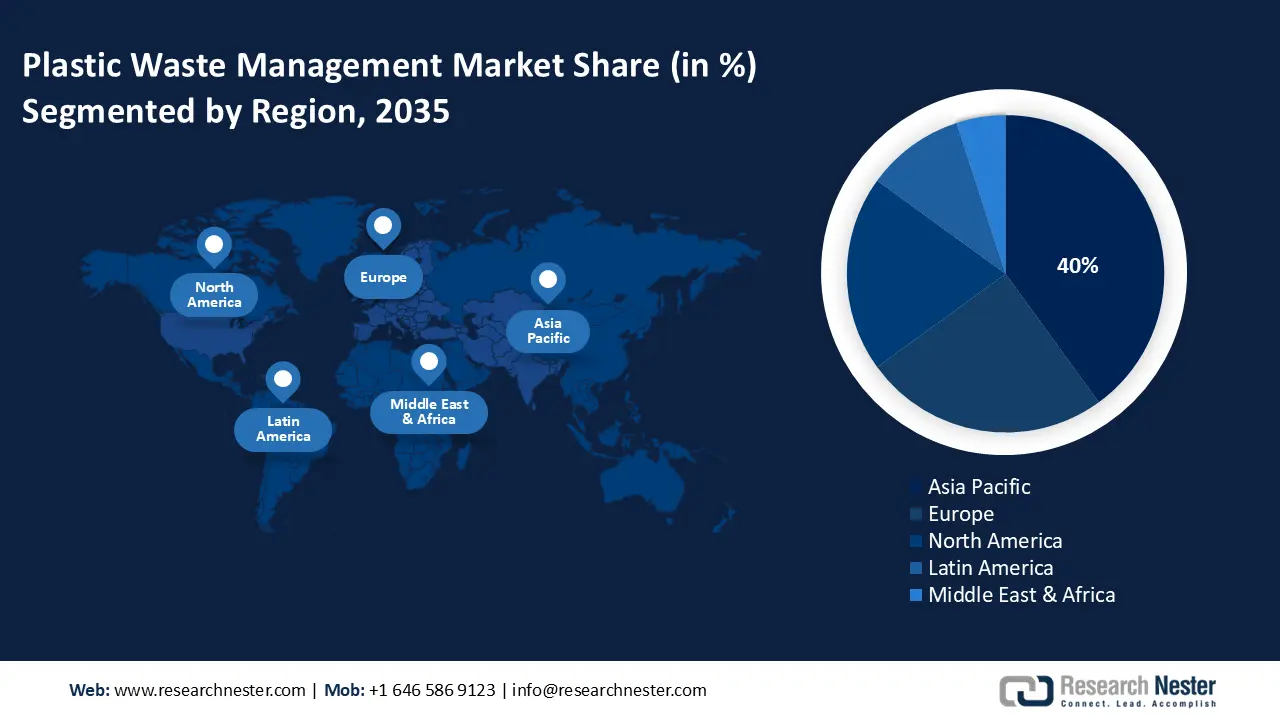

Plastic Waste Management Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific plastic waste management market is expected to hold 40% of the global revenue share by 2035, mainly driven by swift economic development, stringent environmental regulations, and increasing investments in sustainable technologies. China is at the forefront of this adoption, supported by substantial government incentives and industrial reforms. Meanwhile, Japan and South Korea are concentrating on advancements in green chemistry, whereas India and Malaysia are enhancing their infrastructure and regulatory frameworks to optimize waste processing. The growth of public-private partnerships and increased funding for research and development further strengthen the demand for waste management solutions throughout the region.

China is anticipated to maintain the largest revenue share in the Asia Pacific market, propelled by significant government investments in circular economy strategies and environmental reforms. A report by Earth.Org discloses that the country consumes at least 20% or one-fifth of the world’s plastics. It is also the biggest producer and exporter of single-use and new (virgin) plastics. This highlights that to reduce the carbon footprint, the country is implementing strict regulations on plastic use, which is indirectly increasing the demand for waste management solutions. The modernization of the industrial sector, along with rigorous pollution control regulations, also enhances the demand for sophisticated chemicals used in plastic waste management. Furthermore, government incentives aimed at promoting green manufacturing, coupled with a diverse industrial foundation, support market growth.

Europe Market Insights

Europe is anticipated to account for 30% of the worldwide plastic waste management market share through 2035, due to the stringent regulations implemented by the European Chemicals Agency (ECHA) and ambitious sustainability objectives outlined in the European Green Deal. The U.K., Germany, and France are at the forefront of demand growth, fueled by increasing investments in green chemistry and circular economy initiatives. The government funding and research and development efforts concentrated on advanced recycling and sustainable chemical production are also propelling the trade of plastic waste management solutions.

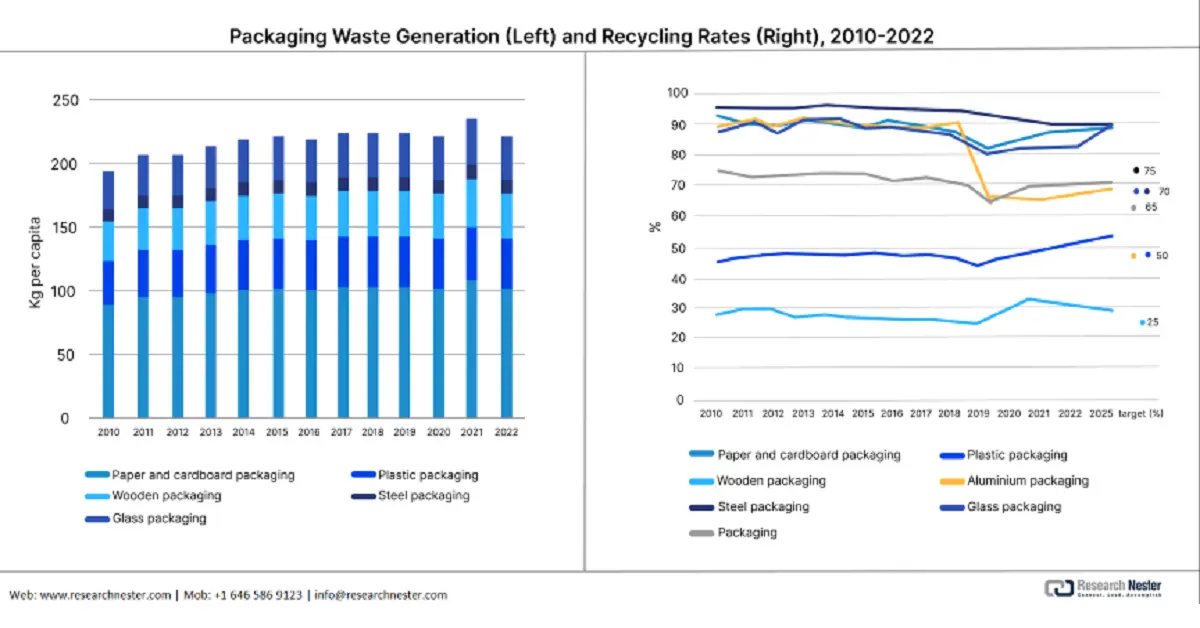

Germany is projected to hold the largest revenue share of the Europe market throughout the study period, driven by its strong chemical manufacturing sector, sophisticated recycling infrastructure, and governmental policies that encourage sustainable chemical development. The country’s prominence in the adoption of a circular economy and its rigorous environmental regulations are fundamental to this market leadership. The European Environment Agency (EEA) in its report revealed that the plastic packaging recycling rate expanded to over 50% in 2022. This is positively driving the sales of waste management solutions. The same source also estimated that in 2022, the country produced 227 kg of plastic waste per person, which is much higher than the average of 186 kg per person in the 27 EU countries. Overall, investing in Germany is likely to double the revenues of plastic waste management solution manufacturers.

Source: EEA

North America Market Insights

North America plastic waste management market is anticipated to increase at a CAGR of 6.3% from 2026 to 2035. This growth is attributed to the rigorous environmental regulations imposed by the EPA and heightened government investments in sustainable chemical initiatives. The advancements in chemical recycling technologies, along with federal grants aimed at promoting clean energy chemical production, are further accelerating the adoption of plastic waste management solutions. Additionally, demand is bolstered by industrial mandates regarding chemical waste disposal and strategies focused on the circular economy.

The U.S. leads the sales of plastic waste management technologies owing to the mounting regulatory pressure and corporate sustainability targets. The growing public concern over plastic pollution is expected to create a lucrative environment for plastic waste management solution producers. The U.S. Plastics Pact Inc. reports that in 2023, U.S. Pact Activators produced nearly 5.57 million metric tons of plastics. Also, about 33% of all plastic packaging in the country, by weight, was made by these Activators. Most plastic waste is led by the packaging sector, especially single-use plastics used for food, drinks, and online shopping. This makes packaging the main focus for collection and recycling efforts. Overall, the U.S. is the most investment-worthy market for key players.