Plastic Resin Market Outlook:

Plastic Resin Market size was over USD 907.2 billion in 2025 and is poised to exceed USD 1.42 trillion by 2035, growing at over 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of plastic resin is estimated at USD 944.76 billion.

Plastics and polymers comprise over 10% of a vehicle’s weight and are key substitutes for heavy steel and iron automobile components. Polyethylene, polyamides, polypropylene, and PVCs, along with other specialty polymers are the type of plastics used in the automotive industry. According to the U.S. Department of Energy, reducing 10% of automotive weight can influence improvement in fuel economy by about 6%-8%. More focus is on improving the additives for plastics by utilizing carbon-negative materials and decarbonizing the polymer materials used in the automotive industry.

Key Plastic Resins Market Insights Summary:

Regional Highlights:

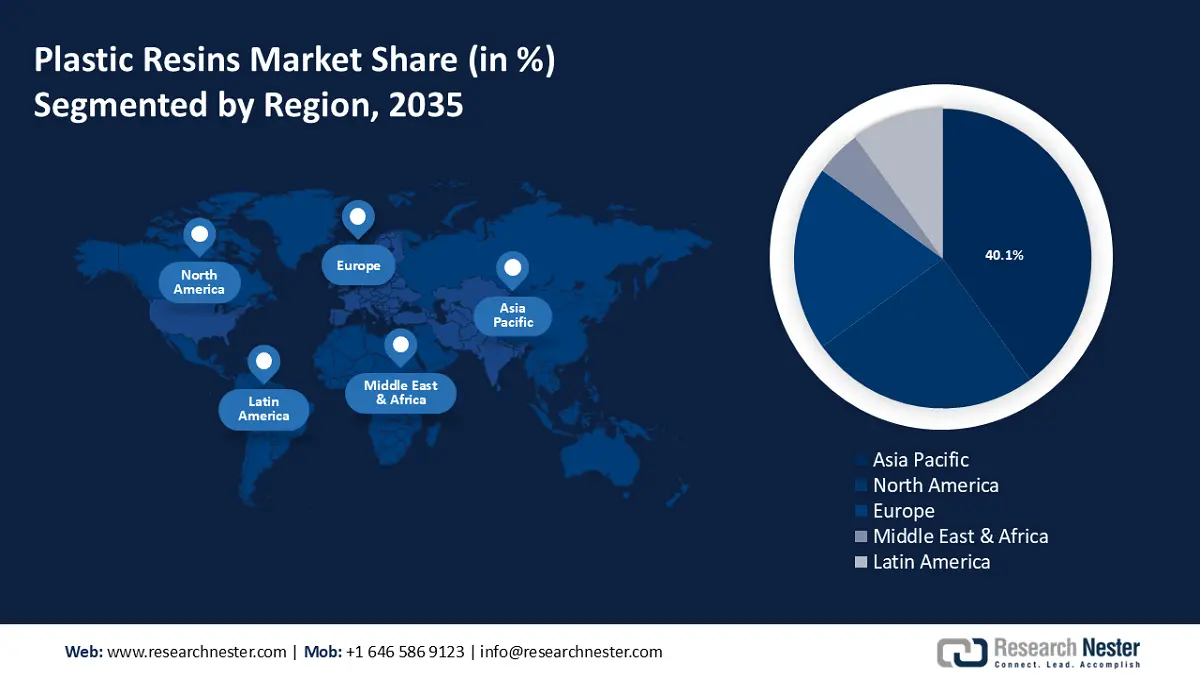

- The Asia Pacific plastic resin market will dominate around 40% share by 2035, driven by rising production of plastics and growing number of production plants in the region.

Segment Insights:

- The crystalline segment in the plastic resin market is anticipated to achieve significant growth till 2035, driven by growing demand in the packaging industry, especially fueled by e-commerce activities.

- The packaging segment in the plastic resin market is expected to achieve notable growth till 2035, driven by the increasing need for packaged foods and beverages, particularly in developed countries.

Key Growth Trends:

- Emergence of rotomolding, 3D printing, and thermoplastic resin in aerospace industry

- Government regulations to focus on the circularity of plastics

Major Challenges:

- Growing price of raw materials

Key Players: LyondellBasell Industries N.V., ExxonMobil Corporation, Dow Inc., SABIC, BASF SE, INEOS Group, Mitsubishi Chemical Corporation, Chevron Phillips Chemical Company LLC, Formosa Plastics Corporation, Covestro AG.

Global Plastic Resins Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 907.2 billion

- 2026 Market Size: USD 944.76 billion

- Projected Market Size: USD 1.42 trillion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Plastic Resin Market Growth Drivers and Challenges:

Growth Drivers

- Emergence of rotomolding, 3D printing, and thermoplastic resin in aerospace industry: The aerospace sector’s relentless pursuit of efficiency and enhanced performance is fostered by innovative, advanced, and nimble manufacturing techniques. However, manufacturing complexities and part weight can challenge this pursuit. The weight of each component has significance since every ounce of weight shaved off an aircraft adds to sustainability goals by optimizing fuel consumption. Thermoplastic resin have emerged as the key raw material used to produce lightweight parts for aircraft.

Two processes that leverage thermoplastic are additive manufacturing and rotational molding for component design and fabrication. A closer examination reveals its durability and potential applications within the aerospace industry. Additive manufacturing, also known as laser sintering and 3D printing, represents the epitome of component design innovation and is divergent from conventional manufacturing. In traditional machining of aluminum, 90% of the original metal piece is discarded for each finished product. On the contrary, 3D printing fabricates objects by stacking a 0.005-inch layer of material using a predefined computer-aided design (CAD) model, in turn, optimizing the use of raw materials.

Ductwork and several aerospace components rely on specific classes of polymers that exhibit the characteristics desired for abrasive environments and chemical exposure. These comprise polyamide 11 (nylon 11 and 12) and glass- and fiber-filled polymers, rendering preferred characteristics such as temperature and corrosion resistance, flame retardance, and ductility. Their lightweight nature facilitates fuel efficiencies and reduces carbon footprint. Rotomolded fuel tanks are a key alternative to fluorinated counterparts, in the wake of the decision to halt the production of fluorinated coatings for high-density polyethylene (HDPE) containers by the Environmental Protection Agency (EPA) owing to poly- and perfluoroalkyl substance (PFAS) contamination.

The inherent flexibility of rotomolded components allows the aircraft to withstand aerodynamic stress and vibrations during take-offs and landings. Rotomolded parts showcase the ability to flex and withstand an accidental drop. The aerospace sector is marked by continuous merger & acquisition (M&A) activities. In April 2023, Persico SpA acquired U.S.-based rotomolding service provider, Precision Mold Services Inc. Subsequently, a new rotomolding subsidiary was established in Blaine and proliferated Persico’s geographical expansion. - Government regulations to focus on the circularity of plastics: As of early 2023, four states in the U.S. passed laws promoting the use of post-consumer recycled (PCR) resin in packaging to stabilize recycled markets, provide an environment for end-market investment, and level the competitive playing field. There are broad-scale ongoing proposals under development in the European Union and Canada. The Association of Plastic Recyclers (APR) provides a PCR certification program for a robust and trusted recycling system.

CalRecycle adopted permanent policies to implement Assembly Bill 793, effective from January 2024. It caters to the accountability of the volume of post consumer recycled plastic and virgin plastic beverage containers sold in California and determines [PRC Section 14575(g)(3)(A)] by beverage manufacturers in the state.The circularity of plastic resin limits the use of disposable plastics and has the potential to alter the paradigm of manufacturing processes.

Plastic resin such as polyethylene and polypropylene are mandated compliance with Sections 311 and 312 of EPCRA and facilities that use hazardous chemicals as defined by the Occupational Safety and Health Act’s (OSHA) Hazardous Communication Standards (HCS). Some plastic resin are classified as combustible dust in Safety Data Sheets (SDS) by OSHA’s Combustible Dust National Emphasis Program (NEP). Onsite presence of polypropylene and polyethylene combustible dust requires the facility to maintain an SDS and is subject to EPCRA Sections 311 and 312. Stringent regulations have been put in place to streamline manufacturing and operations of heavy-duty industries. - Adoption of plastic resin in construction industry: Construction activities constitute one of the main sectors and activities with the biggest carbon footprints. Ongoing government efforts to structure a variety of standards, methods, and instruments that aim to control the industry's greenhouse gas emissions. Among these efforts are the creation of various grading systems, the notion of green buildings, and sustainable building materials. According to the American Chemistry Council, using plastic for building and construction conserved more than 465 trillion BTUs of energy compared to alternative materials. Therefore, the plastic resin market is predicted to expand.

- Rising demand for consumer electronics: Nearly every piece of electronics requires electricity to operate. However, it also increased the possibility of fatality. Hence, plastics are employed in many different applications in which their insulation qualities are required since they do not conduct electricity. Electric wiring is frequently insulated with PVC, and switches, light fixtures, and grips are composed of thermosets—which can tolerate high temperatures. Plastics are particularly appropriate for housings for equipment including food mixers, electric razors, and hair dryers as they shield users from the possibility of electric shock.

Challenges

- Growing price of raw materials: Plastic resin is made from hydrocarbon fuels, including sand, salt, coal, natural gas, and crude oil. However, all these resources on account of extensive use are getting depleted. Due to this, P.E. manufacturers compete intensely, maintaining tight margins in the resin market and exporting substantial volumes. Supply and demand gaps are also anticipated to maintain the fluctuation of plastic resin prices worldwide. The majority of raw materials are produced by petrochemical downstream processes. Climate change, political unpredictability, and mismatches in supply and demand all contribute to the unpredictability of crude oil prices. As a result, the plastic resin market is expected to be hindered over the forecast period.

Plastic Resin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 907.2 billion |

|

Forecast Year Market Size (2035) |

USD 1.42 trillion |

|

Regional Scope |

|

Plastic Resin Market Segmentation:

Product Segment Analysis

The crystalline segment in the plastic resin market is predicted to capture the highest revenue share of 61.1% during the forecast period. The main element influencing the segment growth is the growing demand for the packaging industry, which is further dominated by growing e-commerce activities. For instance, in Europe, the European Commission estimates that 70% of the population from 92% of internet users ordered products online in the year 2023. Hence, the demand for crystalline polymers is projected to rise since they are considered to be the most durable option and stay least affected by solvents.

Moreover, polyethylene, polypropylene, and epoxy resin are the three main types of resin in crystalline polymers. However, one of the major polymers that are commonly used globally is polyvinyl chloride. It is especially utilized building industry as an alternative to rubber for flooring applications and as insulation around electrical cables.

Application Segment Analysis

Packaging segment is set to capture over 34.3% plastic resin market share by 2035. The segment growth is poised to be driven by an increasing need for packaged foods and beverages, particularly in developed countries. Moreover, the rising working-class population is also forecasted to influence demand for packed food & beverages. Additionally, governments around the world have launched strict guidelines for the safe use of plastic materials in beverage and food applications, which is further expected to foster segment growth. Consequently, with the expanding segment, the market is also set to grow.

Our in-depth analysis of the plastic resin market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plastic Resin Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to hold largest revenue share of 40% by 2035. The growth of the market in this region is forecasted to be influenced by the rising production of plastics. For instance, in 2021, from close to 389 million tons of plastic produced globally over 51% of the plastics were manufactured in Asia Pacific. Also, the plastic production plants in the region are growing in number which is additionally estimated to encourage market expansion.

China market is expected to observe the largest growth in contrast to other nations in this region. This growth is set to be encouraged by the growing use of plastic in the manufacturing sector.

The market for plastics resin in India is also projected to rise over the forecast period. The country has a presence of prominent domestic players including Deep Masterbatch, Ms Metallization Pvt. Ltd., Technovaa Plastic Industries Private Limited, Sanvy Resin And Coatings Pvt. Ltd., and Aryan Composites Pvt. Ltd., among several others.

Additionally, the Japan market is also set to grow on account of the growing plastic resin demand in electronics and automotive sectors. Polycarbonate resin has widespread adoption in electronics as an electrical insulator. The resin also has applications in machinery and automotive machinery industries.

North America Market Insights

The North America plastic resin market is poised to have significant growth during the forecast period. The major factor driving the market expansion in this region is the increasing urban population. As predicted by the U.S. Census Bureau, the urban population in the U.S. increased by about 6.4% between the years 2010 to 2020. This is further projected to boost the construction activities additionally encouraging the plastic resin market expansion.

Additionally, the market in the U.S. is also estimated to rise over the projected timeframe. The stringent government regulations to curb greenhouse emissions have prompted manufacturers to use plastic resin component production. This trend is anticipated to drive market growth in the U.S. during the forecast period.

The Canada market expansion is ascribed to the presence of a robust end-to-end supply chain for EVs. The country is drawing international investment for EV component manufacturing, including Belgium’s Umicore which offered funding of USD 1.5 billion for a manufacturing facility in Ontario. The rising influx of investments is propelling growth of the market.

Plastic Resin Market Players:

- SABIC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik Industries AG

- Dow

- DuPont

- Celanese Corporation

- Eastman Chemical Company

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- LOTTE Chemical Corporation

- Avient Corporation

The plastic resin market is poised to rise on account of the surging number of key players in reducing carbon footprint. This is encouraging automobile manufacturers to invest in innovative technologies to optimize manufacturing processes. The emerging trend of sustainable transportation has fostered investment in EV component production.

Some of the major players in the market include:

Recent Developments

- April 14, 2022: SABIC succeeded in acquiring Clariant's 50% share in Scientific Design, a specialty company. Through this agreement, SABIC will become the sole owner of Scientific Design, the leading manufacturer of catalysts and licensor of high-performance process technologies.

- April 19, 2022: Evonik has doubled the manufacturing capacity for isobutene derivatives at its Marl facility by spending over USD 10 billion.

- Report ID: 6335

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plastic Resins Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.