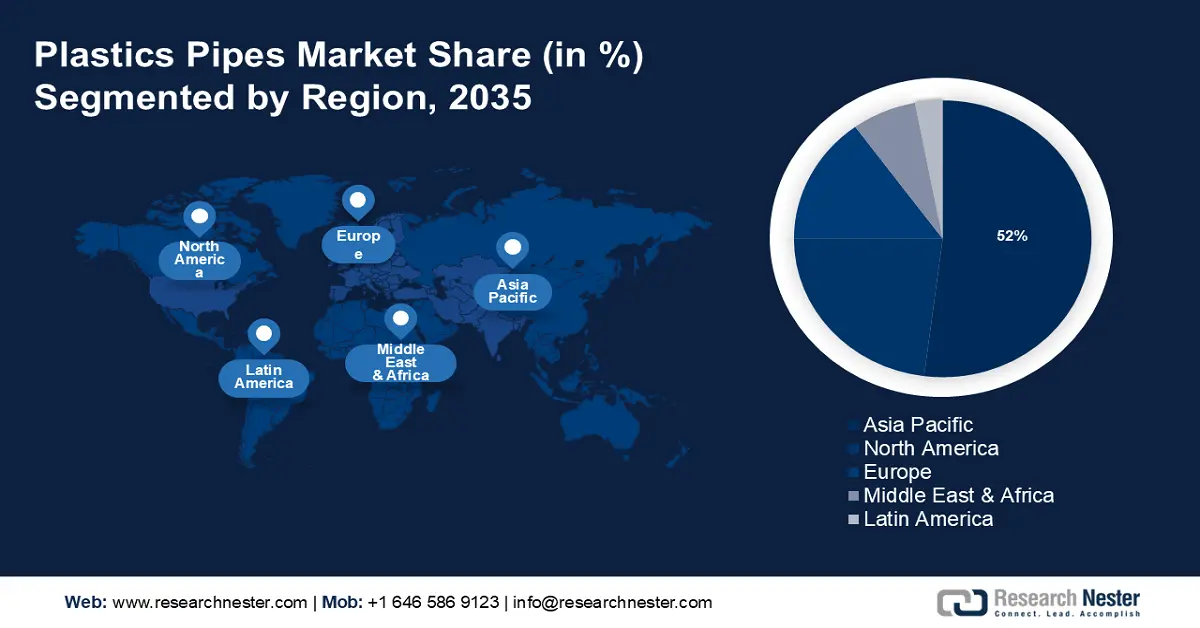

Plastic Pipe Market Regional Analysis:

APAC Market Insights

Asia Pacific plastic pipe industry is poised to dominate majority revenue share of 52% by 2035. This is attributed to rapid industrialization, infrastructure development, and urbanization, predominantly in India, China, and Japan. In 2022, India imported 3.2 million metric tons of PVC from different sources, with the most significant increase in supplies coming from China, northeast Asia, and North America. The increase in PVC demand in India can be mostly attributed to the government's ongoing efforts to stimulate building and agricultural activities in the country. Both of these industries substantially depend on the supply of PVC pipes.

Population growth, increased building project investments, and government efforts to improve sanitation and water supply infrastructure are driving the China market demand. In addition, firms like China Lesso Group Holdings Limited, a plastic piping systems business generated USD 24,590 million, 79.6% of Group sales, with sustained performance. The Group altered its sales approach to market conditions and expanded its product line, increasing plastic pipe and pipe fitting sales by 10.6% to 2.647 million tons.

North America Market insights

By 2035, North America plastic pipe market is projected to dominate over 23% revenue share. This region is expected to dominate the plastic pipe industry owing to the strong infrastructure development, technological advances in plastic pipe manufacturing, a growing need for affordable and durable piping solutions, and mandate rules and regulations by the government, supporting the use of plastic pipe for a variety of applications. The region's strong economy and environmental focus drive plastic pipe use in buildings, water distribution, and industry. The growing investment in sewer, water, and transportation retrofitting and infrastructure development in Canada is expected to drive the market growth. In March 2024 Canada's plastic pipes exports accounted for up to USD 96.52 million and imports accounted for up to USD 116.2 million.

The U.S. plastic pipe industry is presently facing an unprecedented surge in imports and is significantly impacting domestic manufacturers and the corresponding employment. In 2022, imports reached 568 thousand metric tons, and in 2024 surpassed 571.1K. the cumulative U.S. PVC pipe imports during Q1 and Q2 2024 were over double the imports of Q1 and Q2 2023. The PVC pipe inbound trade stems majorly from a handful of suppliers. Colombia is by far the largest exporter, with 21.4 million pounds in Q1 and Q2 2024, followed by Dominican Republic (7.7 million pounds), and China (6.8 million pounds). These three countries were collectively ascribed for 66% of overall U.S. PVC pipe imports in 2024.

U.S. PVC Pipe Imports by Country (Jan-June 2024)

|

Country |

Import Quantity (in Million Lbs) |

|

Columbia |

21.4 |

|

Dominican Republic |

7.68 |

|

China |

6.84 |

|

Mexico |

1.28 |

|

India |

0.96 |

|

Others |

16.13 |

Source: CPA