Plastic Pipe Market Outlook:

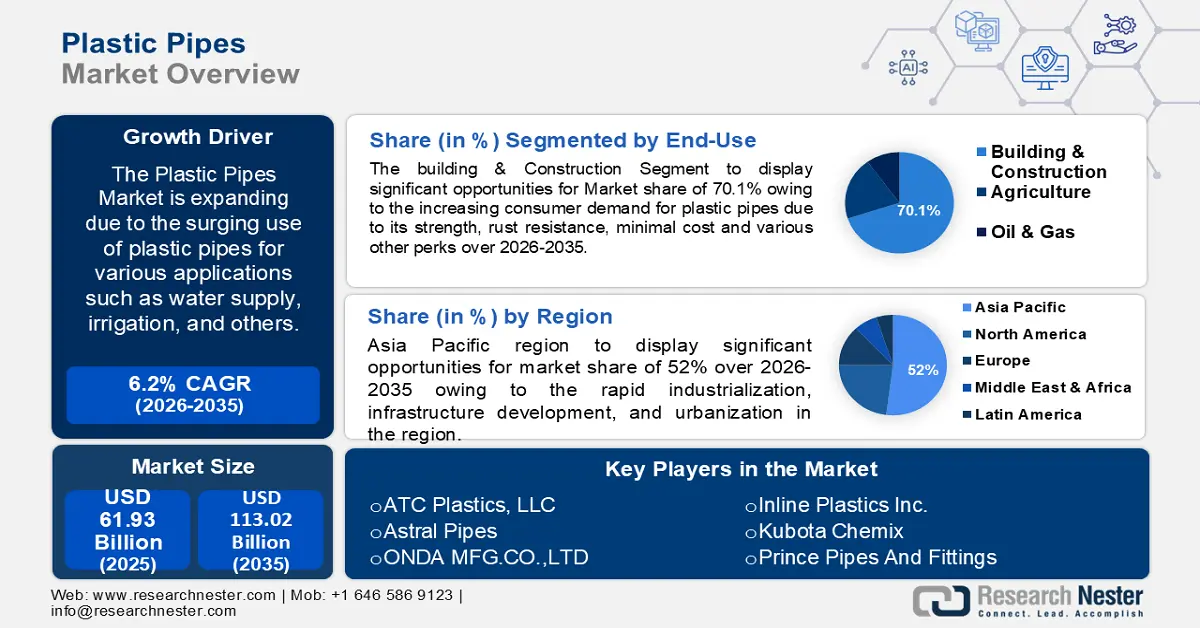

Plastic Pipe Market size was over USD 61.93 billion in 2025 and is poised to exceed USD 113.02 billion by 2035, growing at over 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of plastic pipe is estimated at USD 65.39 billion.

Widespread use of plastic pipes across industries such as oil & gas, construction, transportation, among several others, predominantly drives the market. A 2022 study by the Observatory of Economic Complexity stated the global trade of petroleum oils, and oils procured from bituminous minerals reached a total of USD 1.45 trillion in 2022. The DOT 2023 Gas Distribution Annual Report states that 55.4 million plastic services and roughly 840,550 miles of plastic mains were installed in the U.S. by the end of 2023. These statistics indicate a surge to 900.0000 services in 2022 from 34,952 miles of plastic pipe in 2021.

Miles of Plastic Main and Number of Plastic Services, through 2023

|

DOT/PHMSA Statistics for Year |

Total Miles of Plastic Main |

Approximate Miles of Plastic Service |

Approximate Total Miles of Plastic (Mains + Services) |

Total Number of Plastic Services |

|

2023 |

840,550 |

762,953 |

1,603,503 |

55.4 million |

|

2022 |

824,903 |

743,648 |

1,568,551 |

54.5 million |

|

2021 |

805,588 |

739,912 |

1,536,500 |

53.4 million |

|

2020 |

788,824 |

718,787 |

1,507,611 |

52.3 million |

|

2019 |

772,861 |

702,446 |

1,475,307 |

51.2 million |

Source: American Gas Association

Miles of Main and Number of Services for Various Types of Plastics, in 2023

|

Type of Plastic Material |

Miles of Main |

Number of Services |

|

ABS |

2,071 |

994 |

|

Polyethylene |

818,206 |

54,910,289 |

|

PVC |

19,815 |

53,077 |

|

Others |

458 |

466,351 |

Source: American Gas Association

Key Plastic Pipes Market Insights Summary:

Regional Highlights:

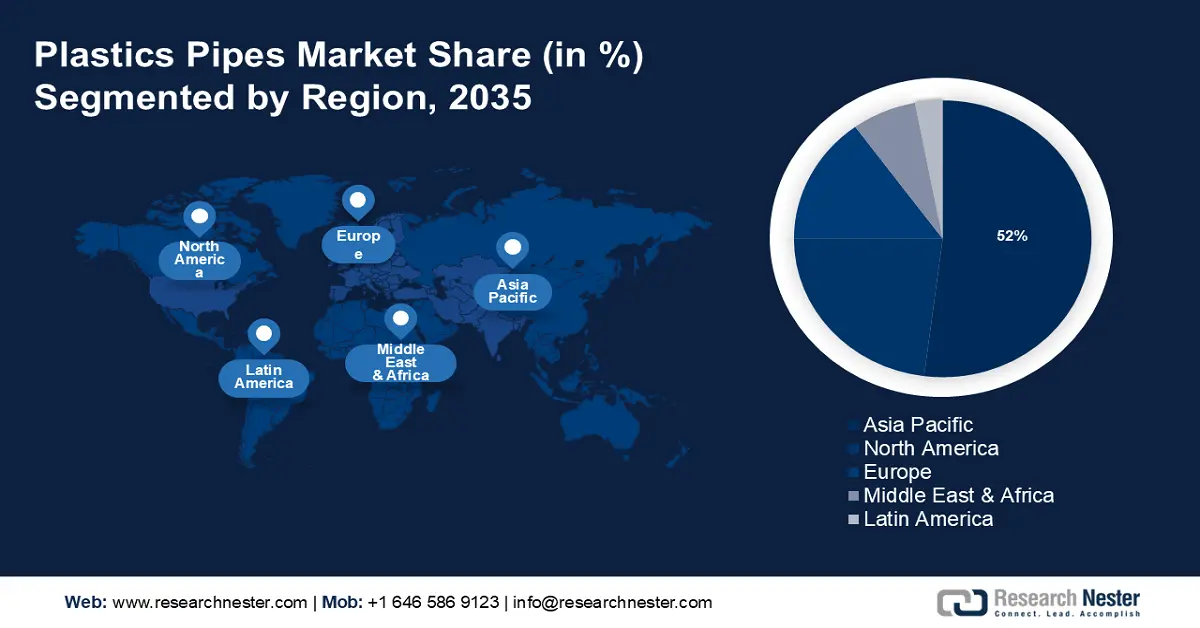

- The Asia Pacific plastic pipe market will dominate around 52% share by 2035, driven by rapid industrialization, infrastructure development, and urbanization.

- The North America market will account for 23% share by 2035, driven by strong infrastructure development, technological advances, and government mandates.

Segment Insights:

- The building & construction segment in the plastic pipe market is forecasted to achieve a 70.10% share by 2035, influenced by plastic pipes’ cost-efficiency, durability, and broad application in modern construction.

- The polyvinyl chloride segment in the plastic pipe market is projected to see substantial growth till 2035, driven by PVC’s resistance to corrosion and suitability across varied installation environments.

Key Growth Trends:

- Strong global trade

- Recyclability of plastics

Major Challenges:

- Environmental hazards

- Strict rules and regulations

Key Players: ATC Plastics, LLC, Formosa Plastics Corp, Astral Pipes, Prince Pipes and Fittings, Finolex Industries, Advanced Drainage Systems, Asahi/America Inc., Charlotte Pipe and Foundry Company, Westlake Pipe & Fittings, Kubota ChemiX, ONDA MFG.CO., LTD.

Global Plastic Pipes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 61.93 billion

- 2026 Market Size: USD 65.39 billion

- Projected Market Size: USD 113.02 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (52% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Plastic Pipe Market Growth Drivers and Challenges:

Growth Drivers

- Strong global trade: Plastic pipes are the 135th most traded item and in 2023 it held an overall trade value of USD 32.7 billion, representing 0.14% share. In terms of product complexity index (PCI), plastic pipes rank 522nd. The top five importers were the top importers the U.S. (USD 3.56 billion), Germany (USD 2.39 billion), Mexico (USD 1.76 billion), France (USD 1.51 billion), and China (USD 1.22 billion) in 2023. Whereas, the top five exporters comprised Germany (USD 4.79 billion), the U.S. (USD 3.97 billion), China (USD 3.93 billion), Italy (USD 2.02 billion), and Spain (USD 1.06 billion).

Growth (%) disaggregated by HS6 level, in 2023

|

Plastic Pipe Type |

Growth (%) |

|

Flexible plastic tube/hose not reinforced, with fitting |

55.4 |

|

Tube, pipe or hose, rigid, of PVC |

43.3 |

|

Fittings for plastic tube, pipe or hose |

43.3 |

|

Flexible plastic tube/hose not reinforced, no fitting |

22.7 |

|

Sausage casings of hardened protein, cellulose |

18.8 |

|

Tube, pipe or hose, rigid, of polyethylene |

17 |

|

Tube, pipe or hose, rigid of polypropylene |

12.9 |

|

Plastic tube, pipe or hose, flexible, mbp>27.6 MPa |

11.4 |

|

Other plastic tube, pipe or hose, flexible |

28.6 |

|

Other plastic tube, pipe or hose, rigid |

0.57 |

Source: OEC

- Recyclability of plastics: APP, PE, and PVC are the most common thermoplastics used to make pipes. They are easily reprocessed and recycled since they can be cut, remelted, and reformed. Off-cuts can be easily recycled into new pipes with a service life of over 100 years as they are 100% recyclable. For instance, in 2024, the MPA Skills Plumbing and Plastics Industry Pipe Association of Australia (PIPA), Vinidex, and Pipemakers collaboratively established a wide PVC and PE pipe and fitting recycling program in Washington. This is aimed to facilitate off-cut disposal of PVC and PE plastic pipes, diverting them from landfills and recycling them into new long-lasting pipes.

Challenges

- Environmental hazards: Extensive use of plastics accumulates in landfills and waterways. In 2021, the Food and Agriculture Organization of the United Nations (FAO) mentioned that 12.5 million tonnes of agricultural plastic products were used in 2019. Concerns about improper plastic waste disposal have impelled the adoption of more responsible models in agriculture, including sustainable and circular bioeconomy.

- Strict rules and regulations: Implementing stringent regulations regarding the utilization and disposal of plastics impedes market growth. The increasing awareness of plastic pollution and its environmental impact may lead to a widespread public nonacceptance of plastic products, thus deteriorating the market's growth.

Plastic Pipe Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 61.93 billion |

|

Forecast Year Market Size (2035) |

USD 113.02 billion |

|

Regional Scope |

|

Plastic Pipe Market Segmentation:

Material Segment Analysis

By 2035, polyvinyl chloride segment is set to dominate plastic pipe market share of over 55%. PVC pipes are known for their exceptional performance and extended lifespan. They offer resistance to corrosion, chemical degradation, and various other uses, ensuring reliable and consistent performance even in challenging environmental conditions. PVC pipes are suitable for above-ground and underground installations due to their ability to withstand elevated temperatures, fluctuations in pressure, and external forces. These sectors are crucial for global economic growth and contributed 29% of the economy in 2024.

Application Segment Analysis

The water supply segment is anticipated to dominate market share in the forthcoming years. Polymers like PVC, CPVC, PE, and PEX pipes are a popular choice in residential, commercial, and industrial infrastructures. These pipes are leak-proof and also are resistant to scaling and chemical reactions, extending the life of the plumbing system life compared to conventional metal pipes. Furthermore, companies are expanding their operations in different countries to cater to a wider customer base. For instance, in May 2024, Westlake Corporation announced its plan to build molecular-oriented polyvinyl chloride pipe plant at its manufacturing site in Wichita Falls, Texas.

End use Segment Analysis

In plastic pipe market, building & construction segment is projected to account for a revenue share of more than 70.1% by the end of 2035. Plastic pipes have widespread adoption in several building applications, including constructing residential, and commercial infrastructures, HVAC, plumbing, and drainage, due to their strength and rust resistance. Plastic pipes are a cost-effective alternative to traditional materials such as metal or concrete pipes. In 2022, 70% of the total polyvinyl chloride production in Europe was allocated to the manufacturing of windows, pipes, floors, roofing membranes, and other building items.

Our in-depth analysis of the global plastic pipe market includes the following segments

|

Material |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plastic Pipe Market Regional Analysis:

APAC Market Insights

Asia Pacific plastic pipe industry is poised to dominate majority revenue share of 52% by 2035. This is attributed to rapid industrialization, infrastructure development, and urbanization, predominantly in India, China, and Japan. In 2022, India imported 3.2 million metric tons of PVC from different sources, with the most significant increase in supplies coming from China, northeast Asia, and North America. The increase in PVC demand in India can be mostly attributed to the government's ongoing efforts to stimulate building and agricultural activities in the country. Both of these industries substantially depend on the supply of PVC pipes.

Population growth, increased building project investments, and government efforts to improve sanitation and water supply infrastructure are driving the China market demand. In addition, firms like China Lesso Group Holdings Limited, a plastic piping systems business generated USD 24,590 million, 79.6% of Group sales, with sustained performance. The Group altered its sales approach to market conditions and expanded its product line, increasing plastic pipe and pipe fitting sales by 10.6% to 2.647 million tons.

North America Market insights

By 2035, North America plastic pipe market is projected to dominate over 23% revenue share. This region is expected to dominate the plastic pipe industry owing to the strong infrastructure development, technological advances in plastic pipe manufacturing, a growing need for affordable and durable piping solutions, and mandate rules and regulations by the government, supporting the use of plastic pipe for a variety of applications. The region's strong economy and environmental focus drive plastic pipe use in buildings, water distribution, and industry. The growing investment in sewer, water, and transportation retrofitting and infrastructure development in Canada is expected to drive the market growth. In March 2024 Canada's plastic pipes exports accounted for up to USD 96.52 million and imports accounted for up to USD 116.2 million.

The U.S. plastic pipe industry is presently facing an unprecedented surge in imports and is significantly impacting domestic manufacturers and the corresponding employment. In 2022, imports reached 568 thousand metric tons, and in 2024 surpassed 571.1K. the cumulative U.S. PVC pipe imports during Q1 and Q2 2024 were over double the imports of Q1 and Q2 2023. The PVC pipe inbound trade stems majorly from a handful of suppliers. Colombia is by far the largest exporter, with 21.4 million pounds in Q1 and Q2 2024, followed by Dominican Republic (7.7 million pounds), and China (6.8 million pounds). These three countries were collectively ascribed for 66% of overall U.S. PVC pipe imports in 2024.

U.S. PVC Pipe Imports by Country (Jan-June 2024)

|

Country |

Import Quantity (in Million Lbs) |

|

Columbia |

21.4 |

|

Dominican Republic |

7.68 |

|

China |

6.84 |

|

Mexico |

1.28 |

|

India |

0.96 |

|

Others |

16.13 |

Source: CPA

Plastic Pipe Market Players:

- Inline Plastics Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ATC Plastics, LLC

- Formosa Plastics Corp

- Astral Pipes

- Prince Pipes and Fittings Ltd.

- Finolex Industries

- Advanced Drainage Systems

- Asahi/America Inc.

- Charlotte Pipe and Foundry Company

- Westlake Pipe & Fittings

The plastic pipe market is primarily controlled by prominent market players who are increasing their influence in the market through the implementation of various strategies. Pipelines are utilized to carry water, oil, or diesel projects over significant distances, taking into account the environmental effects. Some of the key players operating in the global plastic pipe market include:

Recent Developments

- In 2024, Inline Plastics announced the expansion of its popular Flip n' Mix tray collection by introducing two more options. These trays are intended to completely transform the way fresh toppings are packaged. They provide chefs the ability to be more creative in their culinary creations and raise the standards for how food is presented. The trays are designed to fit perfectly with the all-clear 7×7 squares, allowing for a complete view of the enticing contents inside from any angle.

- In June 2020, Prince Pipes and Fittings Limited launched the Prince Storefit Water Tanks. This new product is part of the company's initial collection of overhead water storage solutions and is available at six strategically positioned manufacturing plants throughout the country. They are widely utilized for installation in various places such as homes, offices, factories, commercial establishments, hospitals, schools, camps, and locations requiring big capacities for storing sanitary water.

- Report ID: 6266

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plastic Pipes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.