Plastic Pigments Market - Historic Data (2019-2024), Global Trends 2025, Growth Forecasts 2037

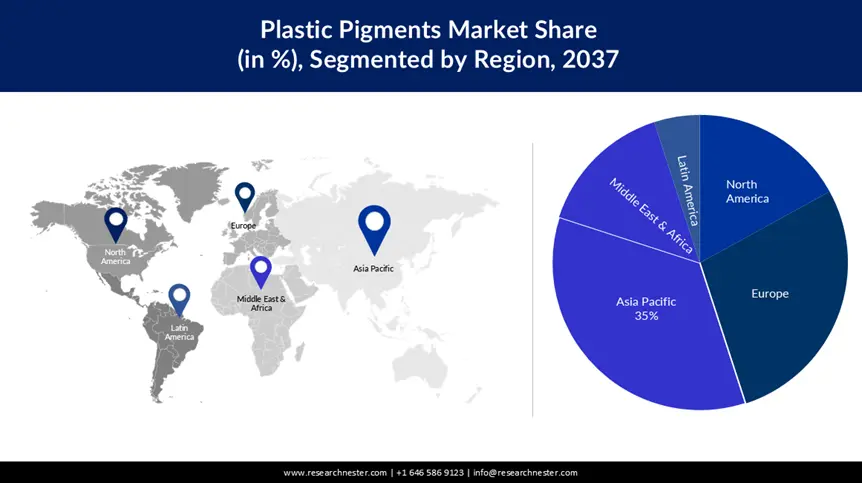

Plastic Pigments Market in 2025 is estimated at USD 15.11 billion. The global Market size was over USD 14.12 billion in 2024 and is anticipated to witness a CAGR of around 8.8%, crossing USD 42.27 billion revenue by 2037. Asia Pacific is expected to achieve USD 14.79 billion by 2037, driven by increasing construction activities and large-scale projects like “Smart City” in China and India.

The expansion of the plastic industry is the driving force behind the growth. Plastic's versatility has prompted the population to produce more plastic, which is expected to fuel market growth. Plastic pigments are organic or inorganic particles that are added to the polymer base to give the finished product a specific color or functional advantage. For instance, the most widely used inorganic pigment in the plastics industry is titanium dioxide, which is also known as the best white pigment in the world. Furthermore, owing to its superior physical characteristics, it is commonly used in coatings and plastics.

The rising packaging industry across the globe is believed to fuel market growth. Owing to the expansion of the packaging industry, the demand for plastic pigments also increases since producers require more pigments to produce colored plastic packaging. Besides this, plastic pigments are also used in the creation of personalized packaging.

Plastic Pigments Market: Growth Drivers and Challenges

Growth Drivers

- Growing Demand for Consumer Goods - A significant amount of color masterbatch is used in consumer goods made of plastic to improve their functional and aesthetic qualities, owing to its benefits, including its affordability, availability, and versatility. In addition, every consumer product these days needs to be packaged, so packaging suppliers are also focusing on employing attractive and brilliant colors when creating packaging items which have resulted in the expanding use of inorganic plastic pigments to make eye-catching packaging materials.

- Rising Adoption of New Technologies - The use of new technologies in the plastic pigment industry allows manufacturers to improve the properties of applications. The new ultra-thin-pigment technology provides new color shades such as CopperGlow, GoldenWhite, and GoldenShine by combining gold, copper, and silver, resulting in color saturation. These colors are now available in printing ink, coatings, and plastics.

In addition, with environmental safety in mind, technologies that spread less pollution are being used. In the United States, the Environmental Protection Agency's National Emissions Standard for Hazardous Air Pollution (NESHAP) established guidelines for the use of VOCs, and as a result, automotive paint manufacturers are shifting their technologies from solvent-borne to waterborne and powder coating technologies. When compared to solvent-borne technologies, these technologies emit fewer VOCs.

Challenges

- Adverse Effect on Humans and Environment- The whole world is aware of the fact that plastics are not suitable for humans as well as for the environment. Plastic pigments contain dangerous chemicals such as volatile organic compounds, and heavy metals, and exposure to these chemicals may lead to various health issues. These pigments can also negatively impact the environment by causing pollution. Therefore, several regulations and recycling initiatives are followed which can decrease the adverse effects of plastic pigments on humans and the environment.

- Rising Awareness About Plastic Waste

- Stringent Rules by Government for Environmental Protection

Plastic Pigments Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

8.8% |

|

Base Year Market Size (2024) |

USD 14.12 billion |

|

Forecast Year Market Size (2037) |

USD 42.27 billion |

|

Regional Scope |

|

Plastic Pigments Segmentation

Type (Organic, Inorganic)

The organic segment in the plastic pigments market is set to garner a notable share shortly driven by a wide range of benefits offered by the organic type of plastic pigments. The azo-type pigments make up more than 60% of all organic pigments, and their cooler spectrum roughly resembles that of cadmium, and they outperform inorganic ones by producing brighter, glossier hues at lower percentages to provide a wide variety of colors and performance for plastics. Paints, rubber products, inks, plastic goods, and coated printing sizes are all colored using organic pigments, owing to their most popular properties such as high tinting strength and excellent shade.

Further, in most end-user industries people generally prefer to use organic type over inorganic type owing to its benefits and also the organic one is environment friendly. The organic compound majorly consists of carbon and metallic compounds.

End-Use Industry (Packaging, Consumer Goods, Building & Construction, Automotive)

The automotive segment in the plastic pigments market is estimated to gain a robust market share in the coming years owing to the increasing demand and production of vehicles. Particles added to the polymer foundation for functional purposes are called plastic pigments, which are often used in vehicle coatings due to the benefits they bring such as improved thermal stability, greater degrees of outdoor durability, color fastness, and chemical resistance.

Moreover, these pigments are more in demand in the automobile industry since they are anti-corrosive and glossy, and can be used for several applications as these pigments enable the creation of high chromatic strengths and unique color journey effects. According to the Organization of Motor Vehicle Manufacturers, the global production of vehicles was 80,145,988 units in 2021. This is a rise from 77,711,725 units in 2020.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plastic Pigments Industry Regional Synopsis

APAC Market Forecast

Asia Pacific industry is estimated to dominate majority revenue share of 35% by 2037, impelled by increasing construction activities. For instance, a variety of construction projects such as “Smart City” or “Housing for All” are taking place in China, India, and other parts of Asia Pacific. These projects often require plastic pigments to color a wide range of plastic materials used in these projects.

Plastic pigments enhance the visual appeal of buildings and help in achieving vibrant colors in flooring, laminates, and furniture. The Indian construction sector is anticipated to expand gradually and is anticipated to reach over USD 1 trillion by 2025.

European Market Analysis

The Europe plastic pigments market is estimated to be the second largest, during the forecast timeframe led by the rising need for the product from the textile sector. For instance, the demand for synthetic fibers, which are commonly employed in the textile industry, is extremely high in European nations including France and Germany. During the manufacturing process, these synthetic fibers are colored using plastic pigments, which has led to an increase in demand in the region.

Companies Dominating the Plastic Pigments Landscape

- Clariant International Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ferro Corporation

- Heubach GmbH

- Huntsman International LLC

- The Chemours Company LLC

- LANXESS

- Cabot Corporation

- DIC Corporation

- Tronox Holding plc

- BASF

Recent Developments

- Clariant International Ltd has entered into a partnership with Lintech International, LLC to solely distribute its pigments for the plastics, coating, and printing ink markets across the entire United States of America.

- BASF has planned to increase production capacities for isoindoline yellow pigments by around 70%, as the demand for high-performance pigments grows.

- Report ID: 4428

- Published Date: May 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plastic Pigments Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert