Global Plastic Injection Molding Machine Market

- An Outline of the Global Plastic Injection Molding Machine Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Comparative Analysis of the Current Technologies

- Up-Coming Technologies

- Growth Outlook

- Pricing Benchmarking

- SWOT

- Supply Chain

- Root Cause Analysis

- Regional Demand

- Recent News

- Machine Type Overview

- Customer Requirements

- Plastic Injection Molding Machine Demand Among Different End User

- Comparative Positioning

- Competitive Landscape

- Competitive Model

- Company Market Share

- Business Profile of Key Enterprise

- ARBURG GmbH + Co KG

- ENGEL AUSTRIA GmbH

- Haitian International Holdings Limited

- Husky Technologies

- KraussMaffei Group GmbH

- Milacron, LLC

- NISSEI PLASTIC INDUSTRIAL CO., LTD.

- Sumitomo Heavy Industries, Ltd.

- The Japan Steel Works, Ltd.

- Toyo Machinery & Metal Co., Ltd.

- YIZUMI

- Global Plastic Injection Molding Machine Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- Global Plastic Injection Molding Machine Market Segmentation Analysis (2019-2037)

- By Machine Type

- Hydraulic, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Electric, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Hybrid, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- By Clamping Force

- Upto 200 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- 200-500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- Above 500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- By Automation Level

- Manual, Market Value (USD Million), and CAGR, 2019-2037F

- Semi-Automatic, Value (USD Million), and CAGR, 2019-2037F

- Fully Automatic, Value (USD Million), and CAGR, 2019-2037F

- By End User

- Automotive, Market Value (USD Million), and CAGR, 2019-2037F

- Construction, Market Value (USD Million), and CAGR, 2019-2037F

- Consumer Goods, Market Value (USD Million), and CAGR, 2019-2037F

- Electronics, Market Value (USD Million), and CAGR, 2019-2037F

- Medical, Market Value (USD Million), and CAGR, 2019-2037F

- Packaging, Market Value (USD Million), and CAGR, 2019-2037F

- By Region

- North America, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Europe, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Asia Pacific Excluding Japan, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Japan, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Latin America, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Middle East and Africa, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- By Machine Type

- Cross Analysis of Type w.r.t. End User (USD Million), 2019-2037

- North America Plastic Injection Molding Machine Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- North America Plastic Injection Molding Machine Market Segmentation Analysis (2019-2037)

- By Machine Type

- Hydraulic, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Electric, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Hybrid, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- By Clamping Force

- Upto 200 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- 200-500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- Above 500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- By Automation Level

- Manual, Market Value (USD Million), and CAGR, 2019-2037F

- Semi-Automatic, Value (USD Million), and CAGR, 2019-2037F

- Fully Automatic, Value (USD Million), and CAGR, 2019-2037F

- By End User

- Automotive, Market Value (USD Million), and CAGR, 2019-2037F

- Construction, Market Value (USD Million), and CAGR, 2019-2037F

- Consumer Goods, Market Value (USD Million), and CAGR, 2019-2037F

- Electronics, Market Value (USD Million), and CAGR, 2019-2037F

- Medical, Market Value (USD Million), and CAGR, 2019-2037F

- Packaging, Market Value (USD Million), and CAGR, 2019-2037F

- By Country

- U.S., Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Canada, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- By Machine Type

- Cross Analysis of Type w.r.t. End User (USD Million), 2019-2037

- Europe Plastic Injection Molding Machine Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- Europe Plastic Injection Molding Machine Market Segmentation Analysis (2019-2037)

- By Machine Type

- Hydraulic, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Electric, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Hybrid, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- By Clamping Force

- Upto 200 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- 200-500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- Above 500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- By Automation Level

- Manual, Market Value (USD Million), and CAGR, 2019-2037F

- Semi-Automatic, Value (USD Million), and CAGR, 2019-2037F

- Fully Automatic, Value (USD Million), and CAGR, 2019-2037F

- By End User

- Automotive, Market Value (USD Million), and CAGR, 2019-2037F

- Construction, Market Value (USD Million), and CAGR, 2019-2037F

- Consumer Goods, Market Value (USD Million), and CAGR, 2019-2037F

- Electronics, Market Value (USD Million), and CAGR, 2019-2037F

- Medical, Market Value (USD Million), and CAGR, 2019-2037F

- Packaging, Market Value (USD Million), and CAGR, 2019-2037F

- By Country

- UK, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Germany, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- France, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Italy, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Spain, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Russia, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- BENELUX, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Poland, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Rest of Europe, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- By Machine Type

- Cross Analysis of Type w.r.t. End User (USD Million), 2019-2037

- Asia Pacific Excluding Japan Plastic Injection Molding Machine Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- Asia Pacific Excluding Japan Plastic Injection Molding Machine Market Segmentation Analysis (2019-2037)

- By Machine Type

- Hydraulic, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Electric, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Hybrid, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- By Clamping Force

- Upto 200 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- 200-500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- Above 500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- By Automation Level

- Manual, Market Value (USD Million), and CAGR, 2019-2037F

- Semi-Automatic, Value (USD Million), and CAGR, 2019-2037F

- Fully Automatic, Value (USD Million), and CAGR, 2019-2037F

- By End User

- Automotive, Market Value (USD Million), and CAGR, 2019-2037F

- Construction, Market Value (USD Million), and CAGR, 2019-2037F

- Consumer Goods, Market Value (USD Million), and CAGR, 2019-2037F

- Electronics, Market Value (USD Million), and CAGR, 2019-2037F

- Medical, Market Value (USD Million), and CAGR, 2019-2037F

- Packaging, Market Value (USD Million), and CAGR, 2019-2037F

- By Country

- China, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- India, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- South Korea, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Australia, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Indonesia, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Malaysia, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Vietnam, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Thailand, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Singapore, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- New Zealand, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Rest of APEJ, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- By Machine Type

- Cross Analysis of Type w.r.t. End User (USD Million), 2019-2037

- Japan Plastic Injection Molding Machine Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- Japan Plastic Injection Molding Machine Market Segmentation Analysis (2019-2037)

- By Machine Type

- Hydraulic, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Electric, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Hybrid, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- By Clamping Force

- Upto 200 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- 200-500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- Above 500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- By Automation Level

- Manual, Market Value (USD Million), and CAGR, 2019-2037F

- Semi-Automatic, Value (USD Million), and CAGR, 2019-2037F

- Fully Automatic, Value (USD Million), and CAGR, 2019-2037F

- By End User

- Automotive, Market Value (USD Million), and CAGR, 2019-2037F

- Construction, Market Value (USD Million), and CAGR, 2019-2037F

- Consumer Goods, Market Value (USD Million), and CAGR, 2019-2037F

- Electronics, Market Value (USD Million), and CAGR, 2019-2037F

- Medical, Market Value (USD Million), and CAGR, 2019-2037F

- Packaging, Market Value (USD Million), and CAGR, 2019-2037F

- By Machine Type

- Latin America Plastic Injection Molding Machine Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- Latin America Plastic Injection Molding Machine Market Segmentation Analysis (2019-2037)

- By Machine Type

- Hydraulic, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Electric, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Hybrid, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- By Clamping Force

- Upto 200 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- 200-500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- Above 500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- By Automation Level

- Manual, Market Value (USD Million), and CAGR, 2019-2037F

- Semi-Automatic, Value (USD Million), and CAGR, 2019-2037F

- Fully Automatic, Value (USD Million), and CAGR, 2019-2037F

- By End User

- Automotive, Market Value (USD Million), and CAGR, 2019-2037F

- Construction, Market Value (USD Million), and CAGR, 2019-2037F

- Consumer Goods, Market Value (USD Million), and CAGR, 2019-2037F

- Electronics, Market Value (USD Million), and CAGR, 2019-2037F

- Medical, Market Value (USD Million), and CAGR, 2019-2037F

- Packaging, Market Value (USD Million), and CAGR, 2019-2037F

- By Country

- Brazil, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Argentina, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Mexico, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- Rest of Latin America, Market Value (USD Million), Volume (Units), and CAGR, 2019-2037F

- By Machine Type

- Cross Analysis of Type w.r.t. End User (USD Million), 2019-2037

- Middle East & Africa Plastic Injection Molding Machine Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- Middle East & Africa Plastic Injection Molding Machine Market Segmentation Analysis (2019-2037)

- By Machine Type

- Hydraulic, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Electric, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- Hybrid, Market Value (USD Million), Volume (Units) and CAGR, 2019-2037F

- By Clamping Force

- Upto 200 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- 200-500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- Above 500 Tons, Market Value (USD Million), and CAGR, 2019-2037F

- By Automation Level

- Manual, Market Value (USD Million), and CAGR, 2019-2037F

- Semi-Automatic, Value (USD Million), and CAGR, 2019-2037F

- Fully Automatic, Value (USD Million), and CAGR, 2019-2037F

- By End User

- Automotive, Market Value (USD Million), and CAGR, 2019-2037F

- Construction, Market Value (USD Million), and CAGR, 2019-2037F

- Consumer Goods, Market Value (USD Million), and CAGR, 2019-2037F

- Electronics, Market Value (USD Million), and CAGR, 2019-2037F

- Medical, Market Value (USD Million), and CAGR, 2019-2037F

- Packaging, Market Value (USD Million), and CAGR, 2019-2037F

- By Country

- GCC, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2019-2037F

- Israel, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2019-2037F

- South Africa, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2019-2037F

- Rest of Middle East & Africa, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2019-2037F

- By Machine Type

- Cross Analysis of Type w.r.t. End User (USD Million), 2019-2037

- About Research Nester

Plastic Injection Molding Machine Market Outlook:

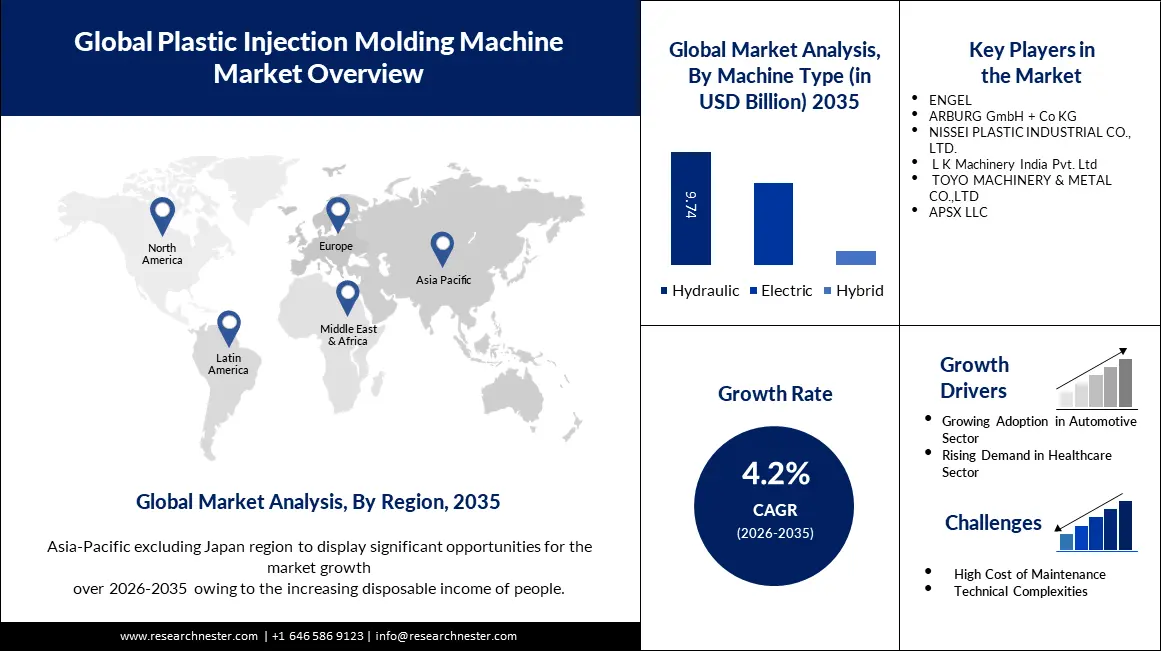

Plastic Injection Molding Machine Market size was over USD 12.4 billion in 2025 and is projected to reach USD 18.71 billion by 2035, witnessing around 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of plastic injection molding machine is evaluated at USD 12.87 billion.

The plastic injection molding machine market is expected to record significant growth due to increasing demand from the healthcare, automotive, consumer products, and packaging industries. As industries strive to deliver higher production rates while remaining environmentally responsible, manufacturers are paying more attention to energy-efficient production, automation, and precision molding as the defining strategies. In February 2025, Mack Molding revealed a plan to invest USD 3 million in automation and additional equipment for productivity enhancement and production capacity. This initiative aims to meet the increasing application of precision and micro molding across different industries. The investment also shows how manufacturing firms require modern equipment to sustain competitive advantage in complex manufacturing processes that require customization, faster production rates, and quality assurance.

Global sustainability goals and the requirement for smart manufacturing systems are influencing plastic injection molding machine market opportunities further. In October 2024, Milacron launched its new all-electric injection molding machine with monosandwich technology. The eQ180 allows for the use of post-consumer recycled (PCR) material to manufacture multi-layer parts, enhancing resource-efficient manufacturing. This innovative technology is consistent with circular economy principles, providing an avenue for manufacturers to embrace environmentalism while ensuring product quality. Such innovations are helping to define the transition to integrated systems, where the performance of the machine is linked with a reduction in the impact on the environment.

Key Plastic Injection Molding Machine Market Insights Summary:

Regional Highlights:

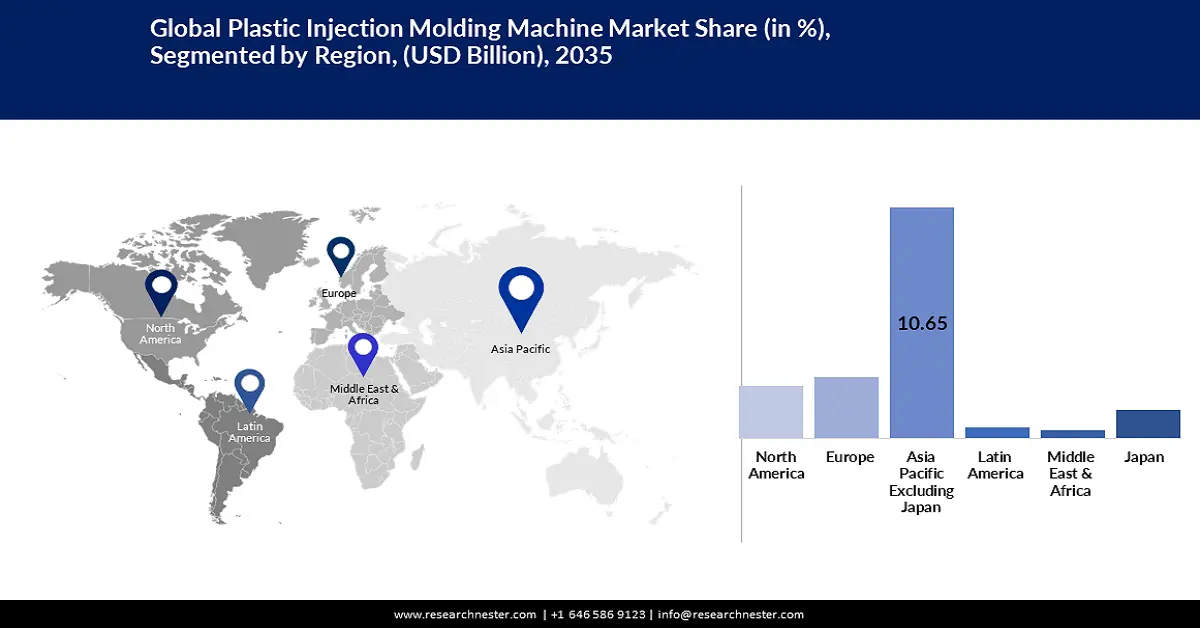

- Asia Pacific is predicted to hold a 59.4% share by 2035, impelled by industrialization, rising consumer demand, and government support for manufacturing - plastic injection molding machine market.

- North America is projected to achieve significant growth by 2035, fueled by domestic manufacturing expansion, reshoring of supply chains, and adoption of advanced automation technologies.

Segment Insights:

- Electric segment is projected to account for over 51.9% share by 2035, driven by increasing adoption in industries requiring energy efficiency and precise process control - plastic injection molding machine market.

- 200-500 tons clamping force segment is expected to hold around 57.7% share by 2035, owing to its versatility in mid-range applications across automotive, packaging, and medical device sectors.

Key Growth Trends:

- Shift toward lightweight automotive components

- Medical device and healthcare sector expansion

Major Challenges:

- Environmental regulations and pressure on conventional plastics

- Fragmented supply chain and skilled labor deficit

Key Players: ARBURG GmbH + Co KG, ENGEL AUSTRIA GmbH, Haitian International Holdings Limited, Husky Technologies, KraussMaffei Group GmbH, Milacron, LLC, NISSEI PLASTIC INDUSTRIAL CO., LTD., Sumitomo Heavy Industries, Ltd., The Japan Steel Works, Ltd., Toyo Machinery & Metal Co., Ltd., YIZUMI.

Global Plastic Injection Molding Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.4 billion

- 2026 Market Size: USD 12.87 billion

- Projected Market Size: USD 18.71 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (59.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, Germany, United States, Japan, Italy

- Emerging Countries: India, South Korea, Mexico, Brazil, Turkey

Last updated on : 17 September, 2025

Plastic Injection Molding Machine Market Growth Drivers and Challenges:

Growth Drivers

- Shift toward lightweight automotive components: Automotive OEMs continue to use plastics in their products in an effort to reduce the weight of vehicles and increase fuel economy. The U.S. Department of Energy explains that for every 10% decrease in vehicle weight, the fuel economy increases by 6% to 8%. With the rising call for sustainability in electric vehicle manufacturing, original equipment manufacturers are placing their bets on more sophisticated molding machines that can deliver lightweight yet sturdy parts. In December 2024, the Pittsfield Plastics Engineering company laid down a plan for a USD 1 million investment to develop large-part injection molding. The company has also upgraded its manufacturing capabilities through the acquisition of robotics, large-tonnage molding systems, and auxiliary equipment and has positioned its infrastructure for high-volume and weight-conscious plastic injection molding machine markets such as automotive interiors and structures.

- Medical device and healthcare sector expansion: Micro and precision molding solutions are quickly becoming indispensable to the medical manufacturing landscape. As more disposable products are used in medical applications, diagnostics components, and even advanced drug delivery systems, molding machine technology is advancing to meet higher tolerances and cleanroom environments. In November 2024, Viant acquired Knightsbridge Plastics, a California-based company, to combine micro-molding with its medical device design and manufacturing. This capability strengthens Viant’s capacity to manufacture intricate micro components and niche plastic components, as well as broadens the company’s network of centers of excellence worldwide.

- Technological advancements in sustainable molding systems: Innovation is one of the main drivers that contribute to the growth of sustainable and intelligent molding machines. In May 2024, Husky Technologies introduced the next-generation HyPET 6e platform, which combines innovation with reliable technology to set new benchmarks in molding sustainability. The platform increases PET preform molding productivity, which helps manufacturers optimize the use of materials and decrease carbon footprint. This development demonstrates how sustainability and digitalization are becoming integrated to transform machine architecture. As more manufacturers embrace eco-friendly materials and closed-loop production, equipment providers with versatile, high-performance systems are securing a large slice of the value proposition.

Challenges

- Environmental regulations and pressure on conventional plastics: There is a growing demand from governments and institutions for the plastics industry to shift from using polymers derived from fossil fuels. In 2025, the United Nations Environment Assembly, the World Wide Fund for Nature (WWF), and other international organizations will be working on an International Plastics Treaty that will set sustainable production standards and promote the use of biodegradable plastics. As much as this will spur innovation, it is a problem for the molding machine manufacturers who have to fashion the equipment to handle new materials. In order to efficiently process the new generation of polymers, which include systems capable of accepting other resins and biodegradable feedstocks, there is a need for research and development and reconfiguration of the supply chain.

- Fragmented supply chain and skilled labor deficit: Manufacturers are also experiencing elongated and complex supply chain issues and a lack of skilled technical workforce, especially in emerging plastic injection molding machine markets and the reshoring nations. In December 2024, Jalex Futures Ltd purchased SGH Moulds, a plastic injection molding company in the medical, industrial, and automotive industries. Although such acquisitions strengthen regional presence, their implementation is contingent upon workforce preparedness and component performance. The absence of this network can result in an erratic delivery of materials that can slow down production schedules and limit plastic injection molding machine market adaptability.

Plastic Injection Molding Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 12.4 billion |

|

Forecast Year Market Size (2035) |

USD 18.71 billion |

|

Regional Scope |

|

Plastic Injection Molding Machine Market Segmentation:

Machine Type Segment Analysis

Electric segment is expected to hold over 51.9% plastic injection molding machine market share by the end of 2035, as electric machines consume less energy, have a shorter cycle time, and provide better process control. These machines are being adopted in industries such as electronics, healthcare, and consumer goods industries, where accuracy and hygiene are paramount. In February 2024, ARBURG extended its electric series by launching the ALLROUNDER 720 E GOLDEN ELECTRIC with a clamping force of 2,800 kN. This trend supports the transition to full electric platforms that deliver greater returns on investment, require less maintenance, and can be easily integrated into Industry 4.0 environments.

Demand for electric molding solutions continues to rise as manufacturers seek to achieve high throughput rates and ever-higher environmental regulations while maintaining precision and variability. Electric machines also offer modularity and flexibility in terms of scale, which means they can be adjusted easily depending on the level of production. Their operational reliability, low noise, and emissions make them suitable for high-volume, environmentally friendly production processes. The upsurge in the adoption of electric micro-molding systems adds to this segment’s market dominance.

Clamping Force Segment Analysis

By the end of 2035, 200–500 tons clamping force segment is set to capture around 57.7% plastic injection molding machine market share, due to its applicability in mid-range applications. This segment targets specific markets such as packaging, automotive interiors, and medical device housing. In November 2024, YIZUMI released the sixth-generation A6 series injection molding machines with high energy efficiency and smart production. There are a number of advantages associated with these machines including the versatility of the machines and the ability to inject at a much higher rate. This segment remains popular due to its applicability to both electric and hybrid vehicles, offering superior performance with minimal space consumption. They are crucial in achieving production agility needs as well as cost-efficient manufacturing objectives.

Our in-depth analysis of the global plastic injection molding machine market includes the following segments:

|

Machine Type |

|

|

Clamping Force |

|

|

Automation Level |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plastic Injection Molding Machine Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific plastic injection molding machine market is predicted to account for revenue share of around 59.4% by 2035, owing to industrialization, consumer demand, and manufacturing support from the government. In January 2025, YIZUMI and KUKA Robotics formed a strategic partnership for the advancement of smart manufacturing and robotic automation. The partnership will integrate artificial intelligence in controlling the machinery with the use of flexible production platforms. Such partnerships are likely to mark a new era of intelligent, high-precision molding machines designed for mass production across Asia.

The plastic injection molding machine market in China remains on an upward trajectory and is in sync with the country’s manufacturing recovery. Industrial production increased by 6.7% YoY in April 2024, showing the beginning of production recovery. YIZUMI, with the support of KUKA’s automation solutions, is strengthening China’s position as a leader in advanced molding equipment. The electronics industry and electric vehicle segment of the country are driving the need for advanced, high-speed molding systems with the capability to manage complex part shapes and challenging cycle time specifications.

India is poised to become a significant molding hub with the help of international collaborations and internal changes. In December 2024, Electronica Plastic Machines signed a Memorandum of Understanding with ENGEL Group to jointly work on designing suitable molding technologies for the Indian plastic injection molding machine market. ENGEL’s technology transfer and capital investment focus on enhancing the overall manufacturing capacity of India. Such collaboration means an increased focus on precision molding, first-line autonomy, and export-oriented competitiveness, the dynamics that are likely to propel India plastic injection molding machine industry growth.

North America Market Insights

North America region is projected to register substantial growth through 2035, due to the growth of domestic manufacturing, the return of supply chains, and increasing automation. In January 2025, Markdom, began a new production facility worth USD 19 million in the U.S., which improved regionalization and local capacity. The investment will help to locate high-output molding closer to its end-use plastic injection molding machine markets and reduce reliance on imports. These investments show how molding is set to benefit from capacity expansion, infrastructure improvement, and qualified workforce availability in North America.

The U.S. remains a hub of technological advancement in high-performance molding solutions through the support of regulatory frameworks and digital technology. In March 2024, Stork IMM increased its service capacity in North America to provide more support after the sales of its machines and to ensure the machines’ efficiency. This reflects an increase in the need for application-specific performance support in high-speed molding systems, which the facility enhances by providing parts and technical support. This regional strategy confirms the transition of the U.S. plastic injection molding machine market from a product-based market to a market that focuses on long-term equipment partnerships and performance-based services.

The plastic injection molding machine industry in Canada is experiencing expansion due to the implementation of sustainability standards and the integration of new technologies. Businesses are focusing on energy-saving equipment and technologies and the use of robots to sustain themselves in the international plastic injection molding machine market. Measures by regional governments to promote the adoption of clean technology add to the pressure on molding operations to transition to electric or hybrid solutions. Cross-border partnerships and logistics integration are making Canada a strategic partner for high-volume precision manufacturing throughout North America.

Plastic Injection Molding Machine Market Players:

- ARBURG GmbH + Co KG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ENGEL AUSTRIA GmbH

- Haitian International Holdings Limited

- Husky Technologies

- KraussMaffei Group GmbH

- Milacron, LLC

- NISSEI PLASTIC INDUSTRIAL CO., LTD.

- Sumitomo Heavy Industries, Ltd.

- The Japan Steel Works, Ltd.

- Toyo Machinery & Metal Co., Ltd.

- YIZUMI

The market is highly competitive due to innovation, the expansion of the product portfolio, and the establishment of regional production facilities. Some of the prominent players in the market are ARBURG GmbH + Co KG, ENGEL AUSTRIA GmbH, Haitian International Holdings Limited, Husky Technologies, KraussMaffei Group GmbH, Milacron LLC, NISSEI PLASTIC INDUSTRIAL CO., LTD., Sumitomo Heavy Industries Ltd., The Japan Steel Works Ltd., Toyo Machinery & Metal Co., Ltd., and YIZUMI. These companies are focusing on utilizing high-efficiency machines, digital twin technologies, and modularity for scalable applications.

In January 2025, ENGEL expanded the victory electric series under the famous triumph machines, tie-bar-less, with the e-motion TL platform. This product reorganization further strengthens ENGEL’s electric, hybrid, and hydraulic solutions for the diversified production needs of its clients. The move also aligns with changes in the industry to offer more flexible machine designs and fewer options for customers, which gives clients optimal, efficient, and sustainable production technologies.

Here are some leading companies in the plastic injection molding machine market:

Recent Developments

- In January 2025, NISSEI PLASTIC INDUSTRIAL CO., LTD. announced a global expansion of its production network, with a major milestone reached in the U.S. The company's industrial expansion project in Texas was fully completed, and operations at the new facility officially commenced in February 2025. This development significantly boosts NISSEI’s regional production capacity and service responsiveness in North America.

- In June 2024, Arburg announced plans to expand its injection molding machine manufacturing in both Asia and North America. The move aims to localize production and reduce lead times across high-demand regional markets. By strengthening supply chain resilience, Arburg is positioning itself closer to strategic customer hubs. The expansion illustrates rising global demand for flexible, localized machine manufacturing.

- In May 2024, KUKA Robotics named ENGEL as a system partner, combining automation solutions with injection molding machinery. The partnership will integrate KUKA robotics into ENGEL’s molding platforms to boost automation, efficiency, and smart manufacturing. This collaboration enhances turnkey solutions for high-volume, precision molding operations. It signals increasing convergence between robotics and molding technology.

- Report ID: 6007

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.