Plastic Contract Manufacturing Market Outlook:

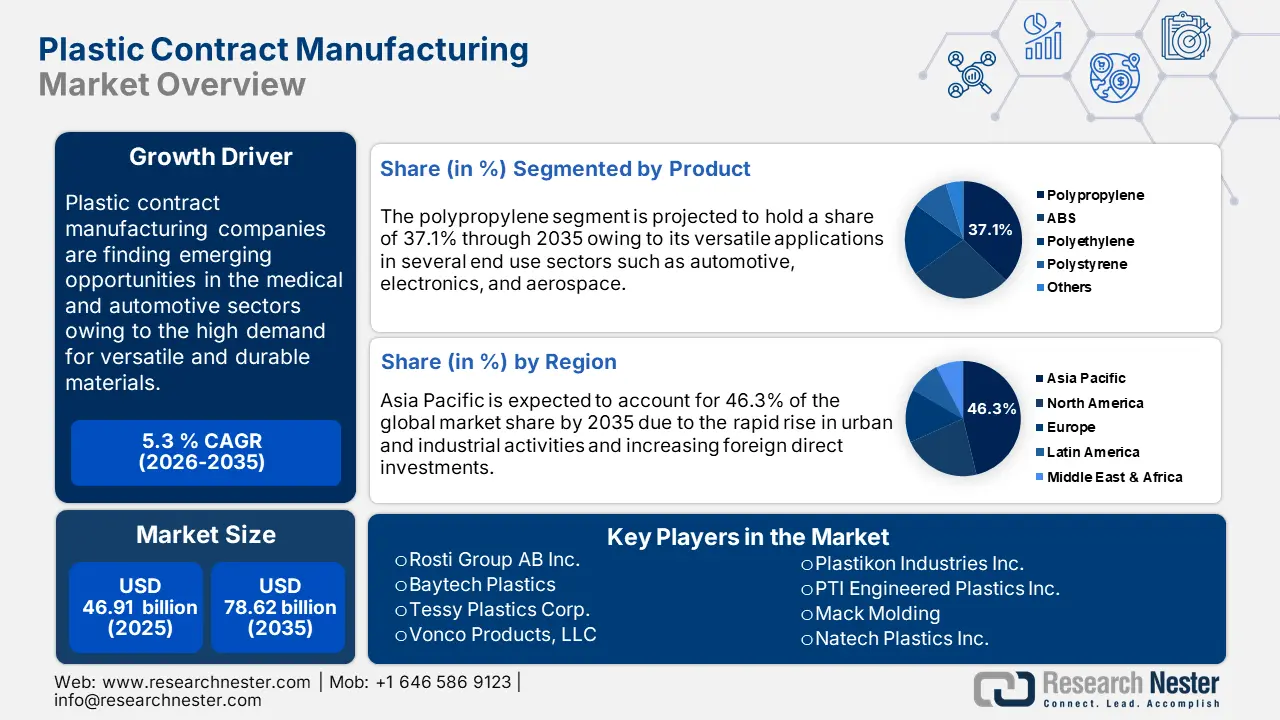

Plastic Contract Manufacturing Market size was valued at USD 46.91 billion in 2025 and is expected to reach USD 78.62 billion by 2035, expanding at around 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of plastic contract manufacturing is evaluated at USD 49.15 billion.

Asia Pacific, Latin America, and Middle East & Africa are emerging as the most opportunistic marketplaces for plastic contract manufacturing companies owing to rapid industrial and urban activities. The United Nations Environment Program (UNEP) states that over 400 million tonnes of plastic waste is generated, annually across the world. This highlights the boasting use of plastic products. The increasing innovations in materials and substances are uplifting the demand for plastic components creating a favorable environment for contract manufacturers. The development of high-performance plastics with specialized properties is opening profitable opportunities for leading companies in niche markets such as aerospace, defense, consumer goods, and medical devices.

The significant rise in e-commerce activities is also fueling the use of plastics for packaging purposes. The consistent boom in online shopping activities and fueling demand for innovative packaging materials is poised to propel the applications of plastics in food and beverages, cosmetics, pharmaceuticals, and consumer electronics. For instance, the International Trade Administration (ITA), the global B2B e-commerce market is estimated to reach a valuation of USD 36.0 trillion by 2026. Asia Pacific is set to capture a dominating market share in the coming years followed by Latin America and the Middle East. India ranks first with a CAGR of 14.1% followed by Brazil (14.0%) and Argentina (13.6%).

Key Plastic Contract Manufacturing Market Insights Summary:

Regional Highlights:

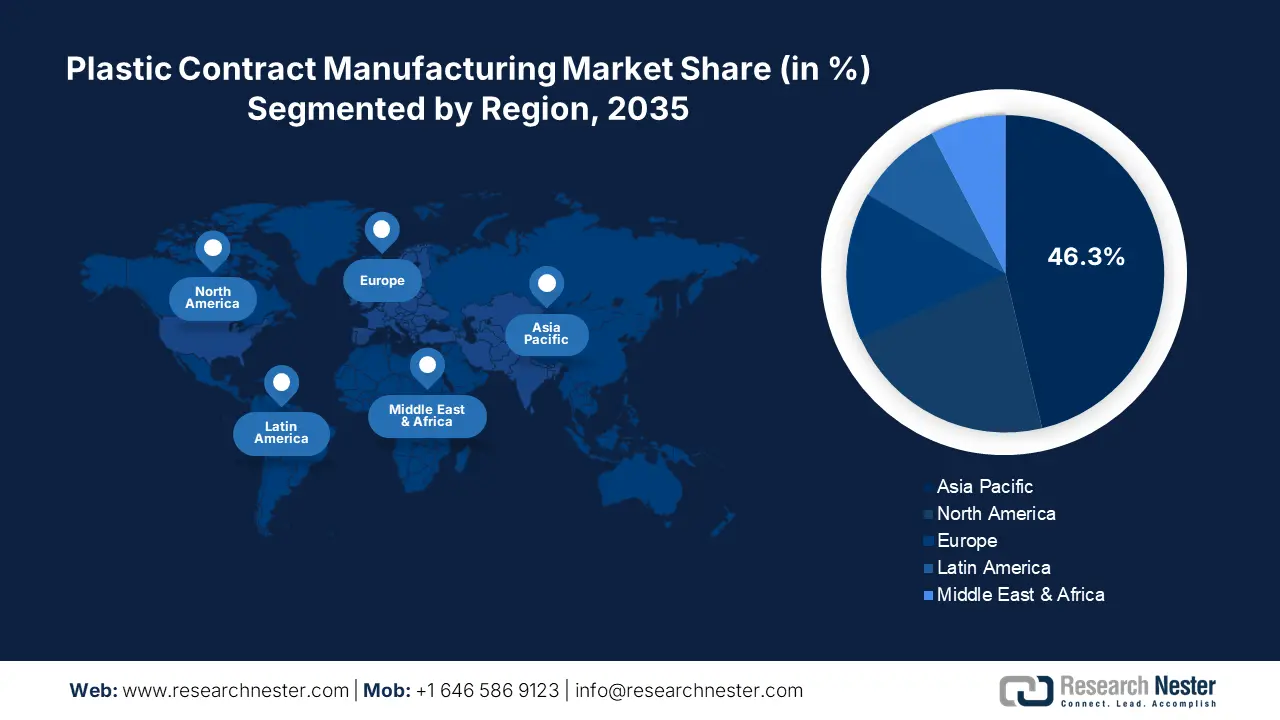

- Asia Pacific holds a 46.3% share in the plastic contract manufacturing market, fueled by urban and industrial growth, favorable investment policies, and rising plastic production in China and India, positioning it for significant growth through 2035.

- North America's Plastic Contract Manufacturing Market is projected to achieve the fastest CAGR by 2035, attributed to increasing demand from chemical, automotive, and aerospace sectors, along with bio-based plastic innovation.

Segment Insights:

- The Consumer Goods & Appliances segment is anticipated to hold a 28.3% share by 2035, driven by increasing consumption of recyclable plastics in smart devices and appliances.

- The Polypropylene segment of the Plastic Contract Manufacturing Market is forecasted to hold a 37.1% share by 2035, propelled by its versatility and lightweight properties in electronics, automotive, and packaging industries.

Key Growth Trends:

- Wide applications in automobile manufacturing

- Medical sector offering high growth opportunities

Major Challenges:

- Strict regulations and environmental concerns

- High competitiveness

Key Players: Rosti Group AB Inc., Baytech Plastics, Tessy Plastics Corp., and Vonco Products, LLC.

Global Plastic Contract Manufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 46.91 billion

- 2026 Market Size: USD 49.15 billion

- Projected Market Size: USD 78.62 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 13 August, 2025

Plastic Contract Manufacturing Market Growth Drivers and Challenges:

Growth Drivers

- Wide applications in automobile manufacturing: The increasing demand for lightweight and durable materials in the automotive sector to enhance fuel efficiency is expected to drive sales of plastic components. Dashboards, bumpers, and some engine components are manufactured using high-performance plastics. For instance, the American Chemical Council (ACC) reveals that in 2023, an average vehicle was compressing 426 pounds of plastics and polymer composites. The majority of modern car interiors are made of polymers and plastics such as instrument panels, sound control fabrics, and dash & door panels.

|

Plastics & Polymer Composites in an Average Automobile (lbs./vehicle) |

|||

|

Product |

2021 |

2022 |

2023 |

|

Polypropylene |

97 |

97 |

100 |

|

Polyurethane Foam |

82 |

84 |

85 |

|

Nylon |

40 |

42 |

45 |

|

High-Density Polyethylene (HDPE) |

33 |

33 |

33 |

|

Polyvinyl Chloride (PVC) |

31 |

31 |

32 |

|

Acrylonitrile Butadiene Styrene (ABS) |

21 |

21 |

24 |

|

Polycarbonate |

19 |

20 |

22 |

|

Phenolic Resins |

15 |

15 |

17 |

|

Polyvinyl Butyral |

7 |

7 |

7 |

|

Polybutylene Terephthalate (PBT) |

6 |

6 |

5 |

|

Polymethyl Methacrylate (PMMA) |

5 |

5 |

5 |

|

Polyacetal Resins |

10 |

9 |

8 |

|

Other Plastic |

40 |

40 |

43 |

|

Plastics & Polymer Composites Total |

406 |

410 |

426 |

Source: American Chemical Council

- Medical sector offering high growth opportunities: Plastics are finding high applications in the medical sector particularly, in disposable items, medical packaging, and components of medical devices such as syringes, infusion pumps, and diagnostic equipment. The booming need for advanced and innovative plastics is poised to uplift the revenue shares of market players.

Challenges

-

Strict regulations and environmental concerns: Strict environmental regulations are poised to hamper the plastic contract manufacturing market growth in the coming years. Plastic disposal and recycling issues are posing a major challenge to the revenue growth of key players. Furthermore, the increasing push towards mitigation of single-use plastics to reduce environmental impact is leading to low sales of plastic products. Thus, the implementation of strict regulations and environmental concerns are hampering the profitability of plastic contract manufacturing companies.

-

High competitiveness: Plastic contract manufacturing is a highly competitive market owing to the strong presence of industry giants and the increasing emergence of new companies. This competitiveness is leading to price wars, reduced profit margins, and pressure to maintain market position. To overcome these issues, market players are investing heavily in new product launches to attract a wider consumer base.

Plastic Contract Manufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 46.91 billion |

|

Forecast Year Market Size (2035) |

USD 78.62 billion |

|

Regional Scope |

|

Plastic Contract Manufacturing Market Segmentation:

Application (Medical, Aerospace & Defense, Automotive, Consumer Goods & Appliances, Others)

In plastic contract manufacturing market, consumer goods & appliances segment is set to capture revenue share of over 28.3% by 2035. Smart devices such as smartphones, laptops, TVs, wearables, and household appliances s are manufactured using lightweight, durable, and cost-effective plastic materials. The sales of consumer goods and appliances are directly fueling the consumption of plastics. For instance, the European Environmental Agency (EEA) estimates that 74% of plastic is used for non-packaging purposes such as consumer electronics, furniture, textiles, and construction in the EU. Furthermore, the ACC study reveals that increasing at a CAGR of 12.4%, the global electronic plastic recycling market is expected to reach USD 20 billion by 2030. This underscores the significant rise in the use of plastic in consumer goods & appliances.

Product (Polypropylene, Acrylonitrile Butadiene Styrene (ABS), Polyethylene, Polystyrene, Others)

By 2035, polypropylene segment is set to dominate plastic contract manufacturing market share of over 37.1%. Its lightweight and versatility, particularly in fabrication, are majorly fueling its sales. Also, its emerging image as the steel of the plastic industry is further uplifting polypropylene demand. Several end use industries such as electronics, automotive, packaging, and medical are also backing the increasing consumption of polypropylene. For instance, the report by the Observatory of Economic Complexity (OEC) states that in 2023, the total trade of polypropylene stood at USD 25.1 billion. The export and import trade was mainly concentrated in Saudi Arabia (USD 4.7 billion) and China (USD 2.65 billion), respectively.

Our in-depth analysis of the global plastic contract manufacturing market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plastic Contract Manufacturing Market Regional Analysis:

Asia Pacific Market Forecast

The Asia Pacific plastic contract manufacturing market is poised to hold 46.3% of the global revenue share through 2035. The swift urban and industrial activities are backing the sales of plastic products. Favorable investment policies are attracting a majority of companies to expand their production operations in the region. China and India are emerging as the most lucrative marketplaces for plastic contract manufacturing companies. Japan and South Korea owing to advanced manufacturing technologies are leading the plastic production. Overall, manufacturers targeting Asia Pacific are estimated to double their revenue shares in the coming years.

China has a vast and strong presence of chemical manufacturing companies, which act as the major supporter of plastic raw material production such as polystyrene, polypropylene, and polyethylene. For instance, the study by World Integrated Trade Solution (WITS) underscores that in 2023, nearly USD 286.23 million worth of polystyrene export trade was calculated, globally. The country is also a leading producer of automobiles especially electric vehicles (EV), which is augmenting the demand for automotive plastics. For instance, the International Energy Agency (IEA) estimated that China being the leader in EV production, calculated 1.9 million electric car sales in the first quarter of 2024.

The supportive government policies and increasing foreign investments are set to uplift India's plastic contract manufacturing market growth in the coming years. High production of raw materials is boosting the country’s position in the export trade. For instance, the WITS report estimates that in 2023, the country exported around 41,060,000 Kg of polystyrene, worldwide. The rising innovations in packaging materials are projected to drive sales of plastics during the foreseeable period. The India Brand Equity Foundation (IBEF) evaluates that with an anticipated annual growth rate of 22% to 25%, the country is expected to become a hub for packaging solutions in the years ahead.

North America Market Statistics

The North America plastic contract manufacturing market is estimated to increase at the fastest CAGR between 2025 to 2035. The existence of leading chemical, automobile, packaging, and aerospace & defense companies is backing the overall sales of plastics. The fueling demand for innovative materials and substances is anticipated to propel the plastic trade activities in the region. Furthermore, the environmental regulations and climatic commitments are opening opportunities for bio-based and recyclable plastic producers. The increasing construction and automobile production activities in both the U.S. and Canada are further set to amplify the production of plastics.

In the U.S., plastic manufacturers are finding high opportunities in the automotive, aerospace and defense, and medic sectors. These industries are highly demanding innovative materials and substances, which are set to fuel plastic consumption. For instance, the report by the National Highway Traffic Safety Administration (NHTSA) discloses that the use of thermoplastics and thermosets has increased by 150 Kg today from 30 Kg in 1970. A mid-sized vehicle holds around 10% to 12% of plastics in weight. Today, owing to lightweight, durability, and versatility plastics account for 50.0% of the new car’s material volume.

The swiftly expanding automotive market is foreseen to increase plastic demand in Canada in the coming years. To achieve fuel efficiency and lower vehicle weight, many automakers are investing in polystyrene, polypropylene, and ABS products. The rising vehicle production and registrations are explaining the profitability rate for automotive plastic producers. For instance, the Statistique Canada states that in 2022, the total number of road motor vehicles crossed 26.0 million and the registration of new motor vehicles totaled 483,287 in Q3’24.

Key Plastic Contract Manufacturing Market Players:

- McClarin Plastics LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- EVCO Plastics

- C&J Industries

- Genesis Plastics Welding

- Plastikon Industries Inc.

- PTI Engineered Plastics Inc.

- Mack Molding

- Natech Plastics Inc.

- Rosti Group AB Inc.

- Baytech Plastics

- Tessy Plastics Corp.

- Vonco Products, LLC

The plastic contract manufacturing market is highly saturated owing to the strong presence of gigantic players and the increasing emergence of new companies. To uplift their market position and stand apart from the crowd, new companies are employing innovation and innovative product launch strategies. Leading companies are introducing advanced products as well as adopting regional expansion, mergers and acquisitions, partnership & collaboration, and R&D marketing tactics to maximize their reach and revenue shares.

Some of the key players include in plastic contract manufacturing market:

Recent Developments

- In January 2025, Tessy Plastics Corp. announced that it secured the Plastics News, Sustained Excellence Award for 2025. This achievement explains Tessy’s commitment to innovation, quality, and exceptional service in the plastic contract manufacturing field.

- In March 2023, Vonco Products, LLC announced the successful acquisition of Genesis Plastics Welding. This move by Vonco is creating a Midwest plastics powerhouse and expanding its plastic contract manufacturing capabilities and services for healthcare and consumer markets.

- Report ID: 7236

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.