Plasma Therapy Market Outlook:

Plasma Therapy Market size was valued at USD 497.9 million in 2025 and is projected to reach USD 1.6 billion by the end of 2035, rising at a CAGR of 13.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of plasma therapy is estimated at USD 567.1 million.

There is an immense exposure for the worldwide market due to the accelerated adoption in terms of orthopedics, dermatology, and neurology applications. Also, the platelet-rich plasma (PRP) and convalescent plasma treatments are extensively utilized to harness the body’s natural healing capabilities. Therefore, the report published by the World Health Organization in July 2022 states that around 1.7 billion people across all nations suffer from musculoskeletal conditions, making them one of the leading causes of disability in almost 160 countries. Hence, the presence of this consumer base responsibly creates an optimistic market opportunity for the global pioneers involved in the field of plasma therapy.

Furthermore, on the regulatory front, the ecosystem for plasma-based therapies continues to emerge, wherein the governing bodies extensively prefer patient safety, efficacy, and quality in terms of clinical applications. This can be testified by the report from the U.S. FDA published in October 2023 that significantly outlined COVID-19 convalescent plasma parameters. It states that blood establishments must adhere to rigorous manufacturing standards, including specific labeling requirements (ISBT 128 format) and adverse event reporting protocols (21 CFR 606.170), hence building greater trust and standardization in plasma therapies, supporting wider clinical adoption.

Key Plasma Therapy Market Insights Summary:

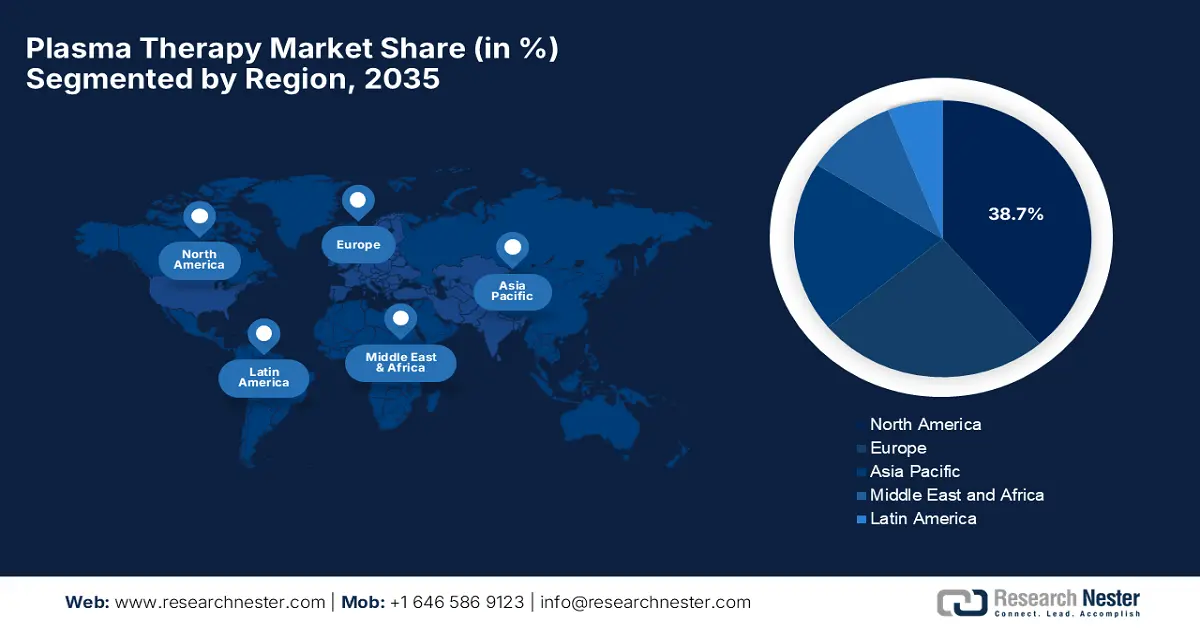

Regional Insights:

- North America is anticipated to command a 38.7% share of the plasma therapy market by 2035 due to the presence of leading manufacturers, strong R&D capabilities, and expanding patient awareness.

- Asia Pacific is set to witness the fastest growth in the forecast period 2026–2035 owing to rising disease prevalence, aging populations, and accelerated advancements in plasma processing technologies.

Segment Insights:

- The autologous segment in the plasma therapy market is projected to account for a 73.5% share by 2035 propelled by its safer profile using the patient’s own blood to avoid infection or immunogenic risks.

- The leukocyte-rich PRP segment is expected to secure a 45.5% share by 2035 stemming from its elevated immune cell and growth factor concentration that enhances tissue repair.

Key Growth Trends:

- Amplifying demand for non-invasive and regenerative procedures

- Wide range of applications

Major Challenges:

- Lack of standardization & clinical evidence

- Exacerbated treatment costs

Key Players: Grifols, Octapharma, Kedrion, Biotest, LFB Group, Green Cross Corp, Kamada, BPL, Sanquin, SK Plasma, Intas Pharmaceuticals, Baxalta, Bio Products Laboratory, PlasmaGen Biosciences.

Global Plasma Therapy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 497.9 million

- 2026 Market Size: USD 567.1 million

- Projected Market Size: USD 1.6 billion by 2035

- Growth Forecasts: 13.9%

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Brazil, United Arab Emirates, United Kingdom

Last updated on : 19 August, 2025

Plasma Therapy Market - Growth Drivers and Challenges

Growth Drivers

-

Amplifying demand for non-invasive and regenerative procedures: This rising demand is readily shaping the foundation of the market since it offers minimally invasive solutions for conditions such as tendon injuries, arthritis, and hair loss as well. As per a February 2023 Biomedicine & Pharmacotherapy article highlights myeloid-derived growth factor (Mydgf) is highlighted as a key blood-derived protein that promotes cardiac repair through angiogenesis. It also underscores the cardiovascular focus with plasma therapy's wound-healing applications through shared protein-mediated repair pathways, thereby making it suitable for standard market growth.

-

Wide range of applications: Since plasma therapy is widely recognized for its potential benefits in dermatology, orthopedics, and wound healing, the market is also evolving at a notable pace. In this context, the clinical study by the National Institute of Health in December 2023 found that the concept of Platelet-Rich Plasma (PRP) therapy has evolved significantly over the last few decades, with the crucial role of platelets in healing and tissue regeneration. It remarkably identifies growth factors like PDGF and VEGF, and the clinical use of PRP in surgeries and wound healing supports growing clinical adoption.

-

Cutting-edge technological breakthroughs: The aspect of ongoing technological advancements readily drives business in the worldwide market of plasma therapy. For instance, in March 2022, Terumo BCT notified that it had received the U.S. FDA’s approval for the Rika Plasma Donation System, which is particularly designed to enhance donor safety and reduce the collection time to below 35 minutes. Such innovations are highly essential to scale up collection efficiency, thereby meeting rising global therapeutic needs, hence denoting a positive market outlook.

Revenue Opportunity Snapshot for Key Plasma Therapy Manufacturers

|

Manufacturer |

Strategic Initiative |

Capacity / Investment |

Year |

|

Grifols |

Fractionation capacity expansion |

25-hectare biotechnology hub |

2025 |

|

Grifols |

Acquisition of U.S. collection centers |

1 million additional liters for fractionation |

2021 |

|

Takeda |

New manufacturing facility in Osaka |

Invest 100 billion JPY in a New Manufacturing Facility for Plasma-Derived Therapies in Japan |

2023 |

Sources: Grifols, Takeda

Challenges

-

Lack of standardization & clinical evidence: This creates a major hurdle for the market, creating skepticism among physicians and ultimately slowing down adoption. In this regard, the industry still lacks universally accepted treatment protocols, especially in terms of PRP concentration levels, applications, and patient selection procedures. On the other hand, certain administrative bodies consider plasma therapy as off-label label thereby limiting insurance coverage and clinical acceptance.

-

Exacerbated treatment costs: The aspect of expensive treatments mostly creates hesitation among patients from price-sensitive regions to leverage plasma therapy. Also, this is not often covered under insurance by both public and private entities, especially in terms of cosmetic procedures such as hair restoration or skin rejuvenation. Besides, the treatment cost can range from USD 500 to USD 2,500 per session, making it extremely challenging for a wider group of audience. Therefore, these high out-of-pocket costs, coupled with a lack of reimbursement, hinder market expansion.

Plasma Therapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.9% |

|

Base Year Market Size (2025) |

USD 497.9 million |

|

Forecast Year Market Size (2035) |

USD 1.6 billion |

|

Regional Scope |

|

Plasma Therapy Market Segmentation:

Source Segment Analysis

The autologous segment is poised to garner the largest share of 73.5% in the market during the discussed timeframe. The dominance in the segment originates from its safety profile that uses the patient’s blood, thereby reducing the risk of infections or any sort of immunogenic reactions. For instance, in April 2025, Kaya Clinic introduced India’s first-ever meta-cell plasma treatment for hair restoration with autologous exosomes, enabling very little discomfort and recovery. The procedure is accepted both by the U.S. FDA and CE, denoting a wider segment scope.

Type Segment Analysis

The leukocyte-rich PRP segment is expected to grow at a considerable rate, with a share of 45.5% in the market during the discussed time period. The higher concentration of immune cells and growth factors that enhance healing in various applications is the key factor behind this proprietorship. In this context National Institute of Health (NIH) in April 2024 published an article that states leukocyte-rich PRP contains elevated white blood cell levels that can enhance immune response and tissue repair, and the choice of selection relies on the patient-specific factors and clinical context, hence allowing a steady cash influx in the segment.

Application Segment Analysis

The orthopedics segment is projected to gain a significant market share of 40.6% in the market by the end of 2035. The rising prevalence of osteoarthritis and sports injuries across all nations solidifies this subtype as the primary choice fueling commercial success in the field. This can be evidenced by the study by the American Orthopedic Society for Sports Medicine in 2024, which found that PRP therapy is a safe treatment for knee osteoarthritis that alleviates the symptoms and improves patient outcomes. It also underscored that PRP releases key growth factors that promote tissue healing and may slow disease progression, thus suitable for standard market upliftment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Source |

|

|

Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plasma Therapy Market - Regional Analysis

North America Market Insights

North America is the dominant player in the global market, which is expected to capture the largest revenue share of 38.7% by the end of 2035. The existence of notable manufacturers, a robust R&D ecosystem, and increasing public awareness are the fueling factors behind the region’s proprietorship. Testifying such capabilities, the study by NIH in October 2023 surveyed 25 top hospitals in the U.S. and found that PRP injections are available in almost every healthcare facility, priced around USD 350 to USD 2,800 per injection average being USD 800. Further, as there is a broader scope, this growing visibility is attracting higher investments, hence, fostering a greater market expansion.

U.S. in the plasma therapy market is stepping towards domination in the regional dynamics on account of suitable reimbursement policies and the presence of skilled professionals. In this context, the data from the Centers for Medicare & Medicaid Services (CMS) in September 2024 revealed that it is enabling coverage for autologous platelet-rich plasma (PRP) therapy for patients who are encountering chronic non-healing diabetic, pressure, or venous wounds, and when administered within approved clinical research studies. Besides, these offerings are expected to expand wider adoption, thereby significantly supporting growth and innovation in this field.

Canada is also following regional growth in the plasma therapy market extensively attributed to the advancements in regenerative medicine and increasing demand for non-invasive treatments. There has been consistent support from both public and private administrative bodies, whether for reimbursements or product approvals, encouraging more players to operate in this field. In July 2024, CSL Behring declared that it received reimbursement recommendation from the Canadian Agency for Drugs and Technologies in Health (CADTH) for HEMGENIX (etranacogene dezaparvovec), the first gene therapy approved for hemophilia B treatment in the country, hence positively impacting market growth.

Clinical Trials Involving Allogeneic and Stem Cell-Based Therapies 2023

|

National Clinical Trial Number |

Derived from |

Phase |

Sponsor Country |

|

NCT03279081 |

Adult allogeneic expanded adipose |

Phase III |

U.S. |

|

NCT03549299 |

Allogeneic ABCB5-positive Limbal Stem Cells |

Phase I/II |

U.S. |

|

NCT02675556 |

Allogeneic Human Mesenchymal Stem Cells |

Phase I |

U.S. |

|

NCT03167203 |

hESC-derived Retinal Pigment Epithelial Cell |

Phase I/II |

U.S. |

|

NCT04356287 |

Human Umbilical Cord-derived Mesenchymal Stromal Cells |

Phase I/II |

Canada |

Source: NIH

APAC Market Insights

Asia Pacific in the plasma therapy market is set to showcase the fastest growth during the assessed tenure, i.e., 2026 to 2035. The region’s progress in this field is productively elevated by the rising disease prevalence, aging demographics, and expanded awareness of regenerative medicine. Besides, the region also benefits from vigorous advancements in plasma processing technologies and the existence of supportive administrative bodies encouraging R&D in this field. Furthermore, the prominent countries such as China, Japan, India, and Australia are witnessing higher demand for plasma-derived therapies, including immunoglobulins, clotting factors, hence fostering a profitable business environment.

China is reinforcing its dominance in the plasma therapy market, supporting increased market revenue owing to the heightened demand for plasma-derived products and evolving technologies in plasma sourcing and refinement. For instance, in July 2025, Apyx Medical Corporation announced the launch of Renuvion in the country, thereby introducing its helium plasma technology, which deliberately expanded the clinical adoption of plasma-based therapies in aesthetic and surgical procedures as well. The product received approval from the National Medical Products Administration, elevating the company’s progress in global market expansion.

India is evolving rapidly in the Asia Pacific’s plasma therapy market due to the presence of continuously expanding PRP applications in orthopedics, dermatology, and other chronic diseases. The country also benefits from supportive government policies that are constantly making efforts to bridge gaps in the healthcare sector. In this regard, the Ministry of Health and Family Welfare in January 2025 introduced a scheme called Ayushman Bharat Digital Mission (ABDM) to create a nationwide digital health ecosystem. This system consists of individual Health IDs for patients, helping integrate treatment tracking. Therefore, the implementation of such moves is expected to facilitate better treatment management.

Clinical Trials Involving Allogeneic and Stem Cell-Based Therapies 2023

|

NCT Number |

Derived from |

Phase |

Sponsor Country |

|

NCT04194671 |

Mesenchymal Stem Cells |

Phase I/II |

China |

|

NCT04464213 |

Human Placental Mesenchymal Stem Cells |

Phase I |

China |

|

NCT01809769 |

Autologous Adipose Tissue-Derived MSCs |

Phase I/IIa |

China |

|

NCT03225651 |

Autologous Bone Marrow Stem Cell |

Phase II |

Vietnam |

|

NCT02338271 |

Autologous Adipose-Derived Stem Cell |

Phase I |

Korea |

|

NCT02298023 |

Allogenic Adipose-derived Mesenchymal Stem Cells |

Phase II |

Korea |

Source: NIH

Europe Market Insights

Europe is showcasing notable growth in the plasma therapy market, effectively propelled by the rising demand for immunoglobulins, advancements in plasma-derived therapies, and expanding infrastructure for blood collection and fractionation. The prominent countries such as Germany, France, and Italy are the major contributors to this expected growth, owing to their supportive regulatory frameworks. For instance, in May 2023, Switzerland-based Regen Lab declared that it received CE certification under EU MDR 2017/745 for its PRP-based medical devices, including REGENKIT, CELLULAR MATRIX fig, and Arthrovisc. This certification displays the safety, quality, and performance of its autologous plasma solutions.

Germany holds a strong position in Europe’s plasma therapy market since the PRP treatments are widely adopted across the country’s vast geography. The country also benefits from its advanced healthcare infrastructure, strong R&D ecosystem, and high technological standards. Therefore, in May 2025, the country’s leading firm, called Viromed Medical AG, reported that scientists and medical researchers at Hannover Medical School represented the utilization of cold plasma for the treatment of ventilator-associated pneumonia, which showed extremely remarkable in vitro efficacy, 100% and safety results, hence benefiting the overall market growth in the country.

France has gained enhanced recognition in the regional plasma therapy market, readily facilitated by the increasing prevalence of musculoskeletal disorders and chronic wounds among the country’s aging demographics. In this context, Cerus Corporation in May 2025 declared that it received approval from the French National Agency for Medicines and Health Product Safety (ANSM) for its next-generation INTERCEPT illumination device. This system is especially designed to enhance operations and ergonomics in daily blood centers, which comprises touch screen navigation and intuitive software, allowing a steady cash influx in the country’s market.

FDA-Approved Plasma Therapy Devices (2024)

|

Device Name |

Manufacturer |

Indication |

Approval Year |

|

Healeon Float PRP |

Bimini Health Tech |

Autologous PRP preparation for bone graft handling |

2024 |

|

Illuminate PRP |

Gale Force Aesthetics |

Point-of-care PRP preparation for orthopedic applications |

2024 |

|

FG-001 PRP Device |

OrthoAscent |

PRP preparation for bone graft handling in orthopedic surgery |

2024 |

|

Arthrex Thrombinator |

Arthrex, Inc. |

Autologous serum/PRP preparation for bone defects |

2024 |

|

3C OrthoPatch |

Reapplix ApS |

PRP preparation for bone graft handling |

2024 |

|

Aeon ACKit |

Aeon Biotherapeutics |

Point-of-care PRP preparation for bone defects |

2024 |

|

Rika Plasma Donation |

Terumo BCT |

Automated source plasma collection |

2024 |

Source: U.S. FDA

Key Plasma Therapy Market Players:

- CSL Behring

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Grifols

- Octapharma

- Kedrion

- Biotest

- LFB Group

- Green Cross Corp

- Kamada

- BPL

- Sanquin

- SK Plasma

- Intas Pharmaceuticals

- Baxalta

- Bio Products Laboratory

- PlasmaGen Biosciences

The worldwide plasma therapy market is witnessing intensifying competition between the top pioneers, such as CSL Behring and Takeda, who are leveraging their extensive plasma collection networks and fractionation technologies. Meanwhile, the Japan-based players are concentrating on rare disease treatments and regenerative medicine. Besides, the emerging competition originates from players in emerging economies who are offering cost-effective alternatives. Furthermore, trends such as AI-driven plasma screening and mobile plasma collection are extensively propelling revenue in this field.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In July 2025, Henniker Plasma introduced its latest product called the Stratus Plasma Manufacturing Cell range, which is a completely integrated, turnkey solution that deliberately merges atmospheric plasma surface preparation with robotic automation to enhance various steps in the production processes.

- In December 2024, Niterra Ventures Company reported that it made an additional investment of USD 18 million in Germany-based Neoplas Med GmbH, marking the total grants to be USD 25 million. These provinces aim for global expansion of the kINPen MED, which is an argon cold plasma device that has been used in over 500,000 wound care treatments.

- In April 2020, CSL Behring, Takeda, Biotest, BPL, LFB, and Octapharma entered into a strategic alliance to develop a plasma-derived hyperimmune therapy for COVID-19, thereby accelerating the development and production of anti-SARS-CoV-2 polyclonal immunoglobulin using convalescent plasma.

- Report ID: 8007

- Published Date: Aug 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plasma Therapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.