Plasma Pulse Technology Market Outlook:

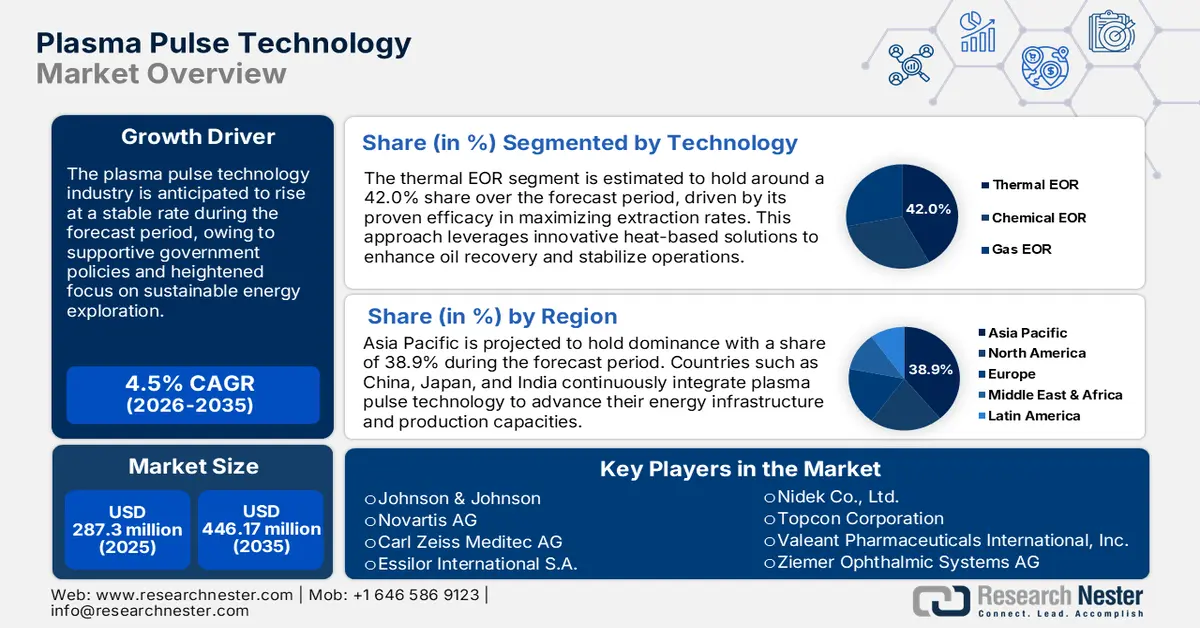

Plasma Pulse Technology Market size was over USD 287.3 million in 2025 and is anticipated to cross USD 446.17 million by 2035, growing at more than 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of plasma pulse technology is assessed at USD 298.94 million.

The plasma pulse technology market is on the rise as corporations work towards improving efficiency in the extraction of resources and in the manufacturing processes. The major industries, including mining, energy, and health care sectors, view this technology as a way to minimize the impact of their operations on the environment and enhance their efficiency. Growing support from government programs, as indicated by updated U.S. Department of Energy resources, reflects a broader acknowledgment of plasma applications in achieving cleaner operations. One recent development is from June 2023, when Ivanhoe Mines increased its stake in I-Pulse, a company that employs pulsed-power plasma for mineral exploration. This step is aimed at the more targeted identification of ores, lessening the disturbance to the habitats and demonstrating how plasma solutions can support a more environmentally friendly approach to resource extraction.

Another factor driving plasma pulse technology market expansion is the healthcare industry, where plasma pulse technology is revolutionizing tumor ablation and surgery. Researchers view a possibility for safer and more effective therapies, which is in line with the recent changes in the government guidelines on the use of precision medicine in the clinical setting. In May 2024, U.S. Medical Innovations received FDA clearance for the Canady Helios cold plasma ablation system for performing enhanced cancer surgeries with less tissue injury. Besides medical applications, plasma pulse processes can be used in high-precision material processing, which can be applied to various fields, including semiconductor processing and automotive manufacturing. Government sponsored research initiatives highlight the drive towards localized manufacturing upgrades by using plasma technologies.

Key Plasma Pulse Technology Market Insights Summary:

Regional Highlights:

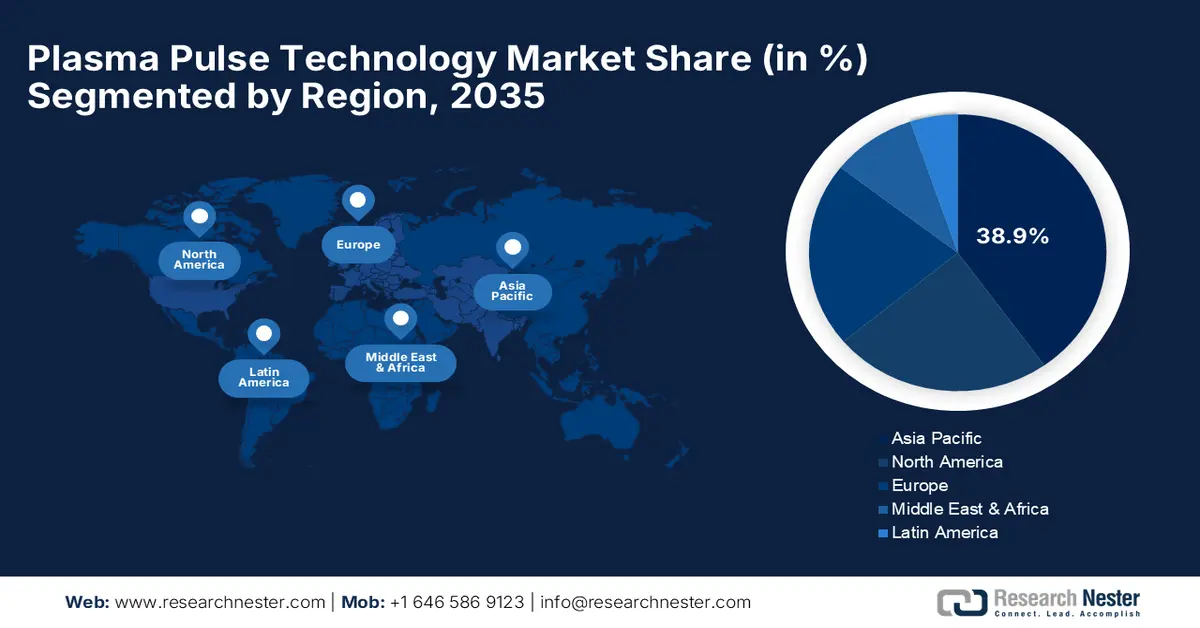

- By 2035, the Asia Pacific plasma pulse technology market is estimated to secure around 38.9% share, a trajectory strengthened by robust manufacturing bases and supportive government development initiatives.

- North America is anticipated to maintain a steady growth outlook through 2035, supported by its extensive industrial applications and strong research infrastructure.

Segment Insights:

- The Thermal EOR segment is projected to command over 42% share by 2035, bolstered as it enables more precise heat and pressure generation that enhances recovery in mature oil fields.

- The Onshore segment is set to witness a CAGR exceeding 5.5% through 2035, as its accessibility and existing infrastructure streamline plasma tool deployment for operators.

Key Growth Trends:

- Enhanced precision in semiconductor and electronics

- Increased emphasis on nuclear fusion and clean energy

Major Challenges:

- Regulatory compliance and ethical considerations

- Market awareness and public funding allocation

Key Players: Johnson & Johnson, Novartis AG, Carl Zeiss Meditec AG, Essilor International S.A., Nidek Co., Ltd., Topcon Corporation, Valeant Pharmaceuticals International, Inc., Ziemer Ophthalmic Systems AG, Halliburton Energy Services, Inc., Chevron Phillips Chemical Company LLC, ExxonMobil Corporation, Baker Hughes Company.

Global Plasma Pulse Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 287.3 million

- 2026 Market Size: USD 298.94 million

- Projected Market Size: USD 446.17 million by 2035

- Growth Forecasts: 4.5%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Indonesia, Mexico, United Arab Emirates

Last updated on : 3 December, 2025

Plasma Pulse Technology Market - Growth Drivers and Challenges

Growth Drivers

- Enhanced precision in semiconductor and electronics: The continuous drive toward the miniaturization of device structures is driving the adoption of plasma pulse technology in semiconductor manufacturing. Plasma etching and deposition enable fine patterning with feature sizes below 2 nm and accurate control of the material surface. One such instance can be traced back to July 2023, when Advanced Energy launched the eVerest RF generator, which supports dynamic multilevel power pulsing for atomic-scale processes. This advancement reveals that refined plasma solutions are necessary for the next generation of chip manufacturing. Furthermore, electronics manufacturers rely on plasma pulses to achieve uniform thickness of layers on sensors and other components used in smart gadgets. As electronics proceed with further development and enhancement of their functionality and complexity, stable and controllable plasma systems are the key to development.

- Increased emphasis on nuclear fusion and clean energy: Efforts by various countries to tap nuclear fusion for energy, which is almost inexhaustible, have increased the interest in plasma pulse technology. Modern scientific institutions use plasma control in containing and regulating the high energy reactions necessary for the generation of fusion power. In December 2023, the plasma physics lab at Cornell University became part of a DOE-funded Plasma Energy Research and Technology Coordination hub for improving plasma confinement techniques. This partnership highlights the focus on the major advancements that bring fusion power closer to becoming a reality. With governments providing more grants and funds for fusion research and development, there is a steady increase in the need for dependable plasma tools.

- Industrial innovation and public-private partnerships: The growth in mining, automotive, and aerospace industries requires new technologies that make production more efficient with minimum negative impacts on the environment. Plasma pulses enable precise treatments of the surface, fine welding, and thorough cleaning with relatively low chemical content. In August 2023, Princeton Plasma Physics Lab obtained several INFUSE grants for partnering with private companies in diagnostic work and plasma-material issues. This shows how partnerships facilitate the transition between innovations discovered in academia and the needs of the industries. The cooperation between governmental laboratories and companies helps to advance the commercialization of plasma solutions. As companies seek greater productivity and sustainability, plasma-based solutions emerge as the key plasma pulse technology market growth enabler.

Challenges

- Regulatory compliance and ethical considerations: While plasma pulse technology is used in a wide range of fields, including medical and donor testing, the differences in regulatory frameworks and standards of ethical behavior are more apparent in different countries. There are many rules and regulations that need to be adhered to in order to ensure that patients are not harmed, and the public is not let down. This includes data privacy, informed consent, and long-term consequences, which need cooperation between researchers, regulatory agencies, and clinicians.

- Market awareness and public funding allocation: Although its potential is widely acknowledged, plasma pulse technology still has problems in obtaining stable funding and gaining recognition in the market. Some public and private institutions may be reluctant to fund this relatively new area of study, which can slow down progress and adoption. Therefore, the promotion and demonstration of successful cases are important to increase financial backing and market credibility.

Plasma Pulse Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 287.3 million |

|

Forecast Year Market Size (2035) |

USD 446.17 million |

|

Regional Scope |

|

Plasma Pulse Technology Market Segmentation:

Technology Segment Analysis

Thermal EOR segment is predicted to capture over 42% plasma pulse technology market share by 2035. The method can produce heat and pressure more accurately than conventional methods, which makes it effective in enhancing recovery rates in mature oil fields. In addition, it sometimes minimizes the environmental implications of chemical additives. In April 2023, Terraplasma GmbH presented a cold plasma system for the treatment of PFAS in water, which proved that plasma processes are unique and highly efficient for contaminant degradation.

A major factor that continues to make thermal EOR popular is its versatility in different reservoirs, ranging from heavy oil sand to mature fields. The plasma pulses can also be adjusted in terms of temperature and intensity, making it possible for the operators to regulate the viscosity of the material. In October 2023, General Fusion reported on a new demonstration machine combining the magnetized target fusion with mechanical compression, indicating continued exploration of plasma concepts for power output.

Application Segment Analysis

Onshore segment in the plasma pulse technology market is poised to exhibit CAGR of over 5.5% till 2035. Some onshore locations are more accessible, which makes it possible for operators to bring in plasma equipment with fewer complications. This often leads to shorter project cycles and cost savings. Onshore fields also have existing infrastructure, which helps in the easy adoption of plasma tools in the traditional work setting. Another factor supporting onshore dominance is the versatility of applications other than energy, including waste management and soil cleanup.

Plasma pulses are also gaining adoption as they can help in vaporizing pollutants and decomposing hazardous compounds with higher efficiency as compared to purely chemical techniques. In February 2025, CSIRO of Australia unveiled a method of using plasma reactors to filter out PFAS from lithium-ion batteries that is likely to revolutionize the management of e-waste. Although it is not directly related to oil and gas, it has the same operational benefit, which is easily accessible onshore facilities for further testing and scaling.

Our in-depth analysis of the global plasma pulse technology market includes the following segments:

|

Technology |

|

|

Application |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plasma Pulse Technology Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific plasma pulse technology market is estimated to capture revenue share of around 38.9% by the end of 2035. This expansion is fostered by robust manufacturing industries and government initiatives for development. Manufacturers in the electronics, energy, and healthcare industries always look for plasma methods to increase production and minimize emissions. In March 2023, Supriya Lifescience partnered with Plasma Nutrition to develop better protein molecules using cold plasma technology, which is an indication of how the region is open to cross-industry innovations.

Players in China have been investing significantly in high-temperature plasma science, particularly in fusion and material applications. In August 2023, the HL-3 Tokamak achieved a first plasma current of 1MA, which indicates better energy confinement in the study of magnetic fusion. This accomplishment highlights China’s efforts to be at the forefront of the development of next-generation power technologies. In addition to fusion, manufacturers in China also employ plasma pulses in automotive coatings and electronics packaging, and other high-volume applications. Global cooperation with academic and international partners enhances plasma-based techniques and strengthens China’s presence on the international stage.

The increasing industrial diversification in India can be considered a positive sign to support plasma pulse initiatives in industries such as pharma and automobile components, and renewable energy. Local firms consider plasma sterilization of medical instruments and eco-friendly and efficient methods of processing textiles without chemicals. Although there is evidence of enhanced budgetary provisions at government websites for emerging technologies, the actual progress in R&D is gradual. There is a trend of fine tuning the regulation of plasma applications and its deployment to make it safer and more environmentally friendly.

North America Market Insights

North America plasma pulse technology market is expected to portray a steady CAGR during the forecast period. The industry continues to be a prime area for plasma pulse technology development due to its large industrial applications and strong research facilities. Businesses use plasma in the purification of crude oil, the enhancement of semiconductor manufacturing, and potential treatments. Policies that advocate the rational use of resources ensure that more capital is invested in research and development. In January 2025, Safe & Green Holdings enters into a Letter of Intent to acquire Olenox and Machfu to expand the digital network for modular smart construction. While not directly related to plasma pulses, this strategy highlights that companies are interested in comprehensive solutions that can be paired with other high-accuracy technologies.

The plasma industry in the U.S. has many plasma-related programs ranging from high-energy physics laboratories to manufacturing lines. Businesses utilize federal grants and state-led incentives to develop plasma pulse applications for various industries like advanced electronics and oncology. For instance, in February 2025, Sanofi decided to acquire DR-0201 from Dren Bio to strengthen its immunotherapy portfolio, showing that consolidation in the biotech industry continues to unfold, which frequently involves innovative treatment approaches, such as plasma-based platforms. Innovation is fostered through collaborations between academic institutions and startups in the U.S. through government-funded projects. This culture of public-private partnership ensures the continued leadership of the nation in plasma technology and the sharing of information between the two sectors.

Canada also supports the development of plasma pulse through incorporating this technology in its resource-based sectors as well as new age clean technologies. Provincial governments provide incentives towards new extraction and remediation methods that have less impact on ecology in the mining and energy sectors. In December 2023, ASML delivered the first High NA EUV lithography modules to Intel, indicating that North America was prepared to invest in advanced tools that might benefit from complementary plasma solutions in chip manufacturing.

Plasma Pulse Technology Market Players:

- Johnson & Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Carl Zeiss Meditec AG

- Essilor International S.A.

- Nidek Co., Ltd.

- Topcon Corporation

- Valeant Pharmaceuticals International, Inc.

- Ziemer Ophthalmic Systems AG

- Halliburton Energy Services, Inc,

- Chevron Phillips Chemical Company LLC

- ExxonMobil Corporation

The competition in the plasma pulse technology market comprises traditional energy companies, medical equipment manufacturers, and new entrants. Some of the prominent players in the market are Johnson & Johnson, Novartis AG, Carl Zeiss Meditec AG, Essilor International S.A., Nidek Co., Ltd., Topcon Corporation, Valeant Pharmaceuticals International, Inc., Ziemer Ophthalmic Systems AG, Halliburton Energy Services, Inc., Chevron Phillips Chemical Company LLC, ExxonMobil Corporation, Baker Hughes Company. These players concentrate on specific segments, from ophthalmology tools and equipment to oilfield services, where plasma pulses are more accurate and less invasive.

Most firms use acquisitions and joint ventures to strengthen differentiated competencies in hardware and software integration. In November 2023, Reveal Lasers purchased AgeJET to expand its skin rejuvenation portfolio to include cold plasma technology. This transaction shows that even segments such as medical aesthetics are discovering new applications for plasma pulses. The news also highlights the trend among some of the leading companies to diversify product offerings with acquisitions. Traditional industry players remain focused on niche technology development, while start-ups experiment with new approaches to water purification, nanocoating, and 3D printing.

Here are some leading players in the plasma pulse technology market:

Recent Developments

- In January 2025, Pulse Biosciences presented updates at the JPMorgan Healthcare Conference on its CellFX nanosecond pulsed field tech. The platform enables selective tissue treatment by disrupting cell membranes while sparing surrounding areas. It's targeting dermatology and oncology markets for early expansion. The company reaffirmed its pivot toward commercial deployments and clinical collaborations.

- In October 2024, SpiralWave unveiled plasma towers that convert atmospheric CO₂ into liquid fuels using pulsed plasma fields. The modular towers use plasma to break molecular bonds, reforming carbon into usable hydrocarbons. This approach offers a non-thermal, scalable path for carbon-to-fuel conversion.

- Report ID: 7432

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plasma Pulse Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.