Plasma Protein Therapeutics Market Outlook:

Plasma Protein Therapeutics Market size was valued at USD 31.87 billion in 2025 and is likely to cross USD 54.96 billion by 2035, expanding at more than 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of plasma protein therapeutics is assessed at USD 33.48 billion.

The plasma protein therapeutics market is expanding remarkably owing to the increasing focus of healthcare providers on the management of diverse health disorders. The growth is primarily spurred by an increased incidence of genetic and chronic conditions such as hemophilia, immunologic disorders, and liver disease, resulting in the need for plasma-derived therapies. For instance, in January 2025, researchers and associates from the Mayo Clinic Organization detailed the prevalence of autoimmune diseases in the U.S. in their study, which was published in the Journal of Clinical Investigation. According to it, an estimated 15 million people are thought to have one or more of the 105 autoimmune diseases.

In addition, advanced manufacturing process and technical developments improve security and efficiency, thus rendering wider accessibility and availability of the product. The growing popularity and credibility of personalized medicine has also made demand for innovative and customized therapeutic uses of plasma proteins. For instance, in November 2024, a group of researchers from Michigan State University with specialists from the Karolinska Institute and the University of California, Berkeley developed an innovative approach for the early detection of disease using blood proteins. It helps healthcare professionals streamline treatment plans and enhance patient outcomes.

Key Plasma Protein Therapeutics Market Insights Summary:

Regional Highlights:

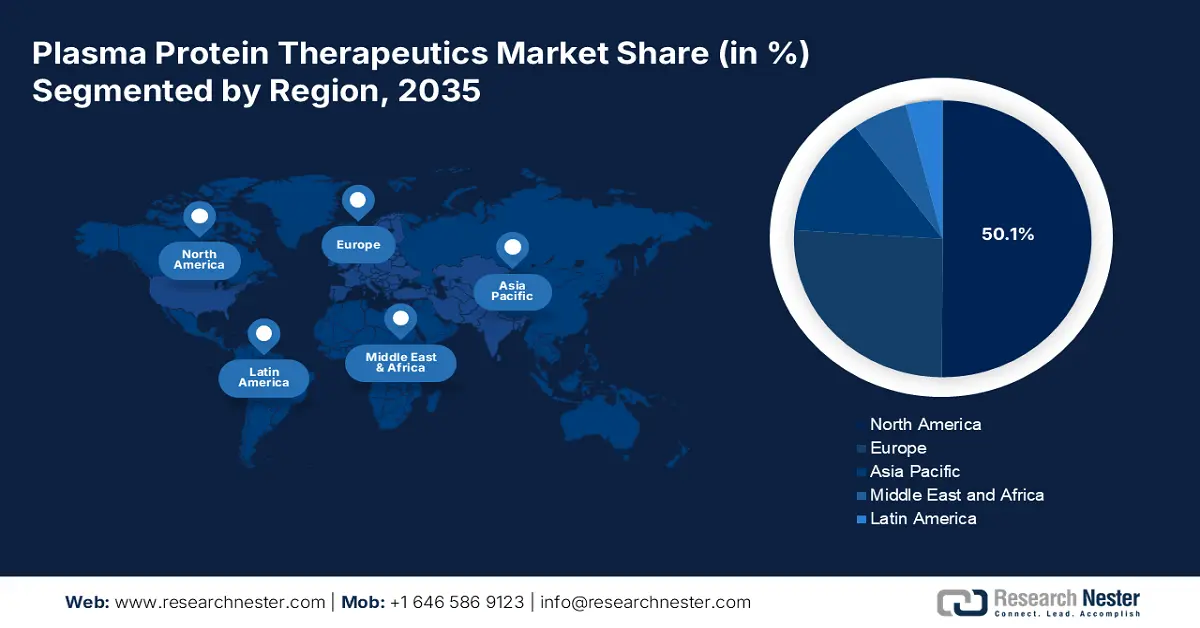

- North America dominates the Plasma Protein Therapeutics Market with a 50.1% share, driven by the presence of sophisticated healthcare infrastructure and robust innovation in plasma-derived drugs, bolstering its leadership through advanced therapeutic advancements by 2035.

- The Plasma Protein Therapeutics Market in Asia Pacific is projected to grow fastest by 2035, fueled by an unexpected surge in chronic and genetic diseases, alongside improved healthcare infrastructure.

Segment Insights:

- The Immunoglobulin segment is expected to capture 38.3% market share by 2035, fueled by the growing incidence of chronic diseases and advancements in immunoglobulin therapies.

Key Growth Trends:

- Supportive regulatory framework

- Increased research and development

Major Challenges:

- Competition from recombinant therapies

- Risk of contamination and safety

- Key Players: Kedrion S.p.A., Shire, Bio Products Laboratory (BPL), Kamada Ltd., and more.

Global Plasma Protein Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.87 billion

- 2026 Market Size: USD 33.48 billion

- Projected Market Size: USD 54.96 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (50.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Plasma Protein Therapeutics Market Growth Drivers and Challenges:

Growth Drivers

- Supportive regulatory framework: One of the pivotal driving forces for innovation in the plasma protein therapeutics market is an enabling regulatory environment. It builds conditions for safe, effective, and ethical standards for the collection and use of human plasma. For instance, in July 2022, a proposal for a Regulation on Standards of Quality and Safety of Substances of Human Origin (SoHO) for Human Application was prepared by the European Commission. The regulation completed the revision of the legal framework for blood, tissues, and cells in light of new scientific, technological, and societal developments by repealing the Blood Directive (2002/98/EC) and the Tissues and Cells Directive (2004/23/EC).

- Increased research and development: Advanced research and development (R&D) activity in the plasma protein therapeutics market propels innovation in the efficacy of plasma-derived treatments. It underpins the exploration of new applications and uses of plasma proteins to develop new therapies for all manner of genetic and chronic conditions. For instance, in December 2024, the Chinese Academy of Sciences' Hefei Institutes of Physical Science, demonstrated that low-dose Cold Atmospheric Plasma (CAP) therapy can successfully lower the growth of tumors. In addition, investment helps to discover applications of personalized medicine strategies establishing the pivotal position of plasma proteins in medicine.

Challenges

- Competition from recombinant therapies: The threat to the plasma protein therapeutic market posed by recombinant therapies is competition in the form of improvements in biotechnology potentially offering substitutes and surrogates for the well-established plasma-derived drugs. The challenge becomes more intense with greater price competition and the need for innovation from plasma protein product manufacturers. Though awareness of patients and clinicians alike is still increasing regarding such possibilities, the industry is being challenged to develop along axes of product differentiation, therapeutic effect, and overall value in an evolving environment.

- Risk of contamination and safety: The predominant concern in the plasma protein therapeutics market is safety concerns with far-reaching consequences for the integrity of both patient health as well as pharmaceuticals. Plasma collection and processing itself pose the inherent risk of transmitting disease pathogens such as bacteria and viruses that undermine the safety of plasma-based medicine. Furthermore, safety authorities require stringent processes of testing and screening to avoid these threats. These, however, if poorly conducted, result in disastrous consequences in the form of product recall, and loss of credibility, among others.

Plasma Protein Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 31.87 billion |

|

Forecast Year Market Size (2035) |

USD 54.96 billion |

|

Regional Scope |

|

Plasma Protein Therapeutics Market Segmentation:

Product Type (Immunoglobulin, Albumin, Plasma derived factor VIII)

Based on the product type, the immunoglobulin segment is poised to hold plasma protein therapeutics market share of over 38.3% by the end of 2035. The growing incidence of chronic disease, coupled with the greater appreciation for targeted treatment results in enhanced demand for immunoglobulin in pharmaceuticals. In addition, technological advances in products further enhance the safety and effectiveness of immunoglobulin drugs. For instance, in December 2023, the new intravenous immunoglobulin Yimmugo (IgG Next Generation) from Biotest AG was approved by the Paul-Ehrlich-Institute in Germany. Consequently, the segment will experience robust growth, due to the prominence of immunoglobulins in modern therapeutic practice.

End user (Hospitals, Others)

In the plasma protein therapeutics market, the hospital segment has taken a leading edge due to an increased patient population. Moreover, the spurring healthcare infrastructure expenses in developing the state-of-the-art infrastructure help to avail the advanced facilities for better treatment efficacy. For instance, in December 2024, the Centers for Medicare and Medicaid Services unveiled that U.S. healthcare spending grew 7.5% in 2023, reaching USD 4.9 trillion or USD 14,570 per person, accounting for 17.6%. With continued demand growth for plasma protein therapies, the combined role of hospitals in the provision of such essential therapies is going to be maintained, and thus solidify its position in modern healthcare systems.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plasma Protein Therapeutics Market Regional Analysis:

North America Market Statistics

North America in plasma protein therapeutics market is expected to dominate around 50.1% revenue share by the end of 2035, due to the presence of sophisticated healthcare infrastructure with the robust push for innovation of plasma-derived drugs. Moreover, research interests of pharmaceutical and biotech firms in the region spur breakthroughs and market thrusts for new therapeutic applications, and it is a business of a pioneering sector that meets the subtle needs of the patients of rare and chronic diseases.

The U.S. plasma protein therapeutics market has an environment characterized by its established and extensive regulatory system. Apart from facilitating high-pressure clinical trials and expeditious approval of breakthrough therapy, such a system is also prospective to facilitate unparalleled research and development spending. For instance, in February 2025, Medexus Pharmaceuticals announced that GRAFAPEXTM (treosulfan) for injection had completed the regulatory review process with the US FDA. In addition to this, Medexus established a wholesale acquisition cost of USD 3,050 per 5-gram vial and USD 610 per 1-gram vial for GRAFAPEXTM in the country.

Canada is becoming an important player in the plasma protein therapeutics market with its rising focus on public health and safety. The robust healthcare infrastructure and favorable regulatory environment in Canada also put it in an optimal position for plasma protein therapy. For instance, in June 2023, Grifols and Canadian Blood Services inked a historic long-term agreement in September 2022, to improve Canada's self-sufficiency in immunoglobulin (Ig) therapies. It provides high-quality plasma products, raising consumer trust and enabling therapeutic opportunities to increase for patients.

Asia Pacific Market Analysis

The plasma protein therapeutics market in Asia Pacific is projected to be the fastest-growing market during the stipulated timeframe. It is increasingly becoming a key driver due to an unexpected surge in cases of chronic and genetic diseases. A change in the burden of healthcare increased growth in healthcare infrastructure and increased awareness of plasma-derived therapies are stimulating demand for novel therapies. Furthermore, government initiatives favoring increased donation of plasma and blood are also contributing to the resilience of this market to increase further here.

The plasma protein therapeutics market in India assumes a prominent role complemented by a remarkable increase in investment and focus on regulatory reforms to enable the production of novel plasma-derived therapies. For instance, in April 2024, Plasmagen Biosciences Pvt. Ltd. continued its strong commitment to support plasma protein products in the pipeline, taking into account guidelines suggested by the Eight Road Ventures.

Regulatory Status of Plasma-derived Therapeutic Products by Company:

|

Facilities/ Instruments |

Amount (In USD billion) |

Ratings |

Rating Action |

|

Long-term bank facilities |

2.59 |

CARE BBB-Stable |

Reaffirmed

|

|

Short-term bank facilities |

0.23 |

CARE A3 |

Reaffirmed |

Source: Care Edge Ratings

The plasma protein therapeutics market in China is exponentially rising due to enforced government initiatives to expand the number of the nation's blood donation centers and plasma fractionation sites. For instance, in the August 2021 NLM article, it was unveiled that according to data from the People's Republic of China's National Health Commission website, there were 257 apheresis plasma stations in China in 2019. As China develops further and strengthens the regulatory framework, the plasma protein therapeutics market is bound to change dramatically.

Key Plasma Protein Therapeutics Market Players:

- CSL Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Grifols S.A.

- Takeda Pharmaceutical Company Limited

- Octapharma AG

- Biotest AG

- Kedrion S.p.A.

- Shire

- Bio Products Laboratory (BPL)

- Kamada Ltd.

- China Biologic Products Holdings, Inc.

- Octapharma Plasma, Inc.

- Sanquin

- LFB S.A.

- ADMA Biologics, Inc.

- Bioverativ

The prominent players in the plasma protein therapeutics market leverage their networks and expertise to increase the volume and value of therapeutics from plasma. Through product diversification, these firms take advantage of the rising demand for high-value treatments, thereby propelling industry growth and embedded market leadership positions. For instance, in April 2021, Grifols closed the USD 55.2 million purchase of seven U.S. plasma donation centers from Kedrion. Regulatory clearances have been obtained for the operation, which will be funded entirely by Grifols' funds.

Here's the list of some key players:

Recent Developments

- In November 2024, Roche announced the acquisition of Poseida Therapeutics, Inc. The goal of this acquisition is to create commercially available CAR-T cell therapies to treat patients with hematological malignancies.

- In March 2024, AstraZeneca revealed that it had finalized a deal to buy Amolyt Pharma. With the significant addition of eneboparatide (AZP-3601), a Phase III investigational therapeutic peptide with a novel mechanism of action intended to meet important therapeutic goals for hypoparathyroidism.

- Report ID: 7259

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plasma Protein Therapeutics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.